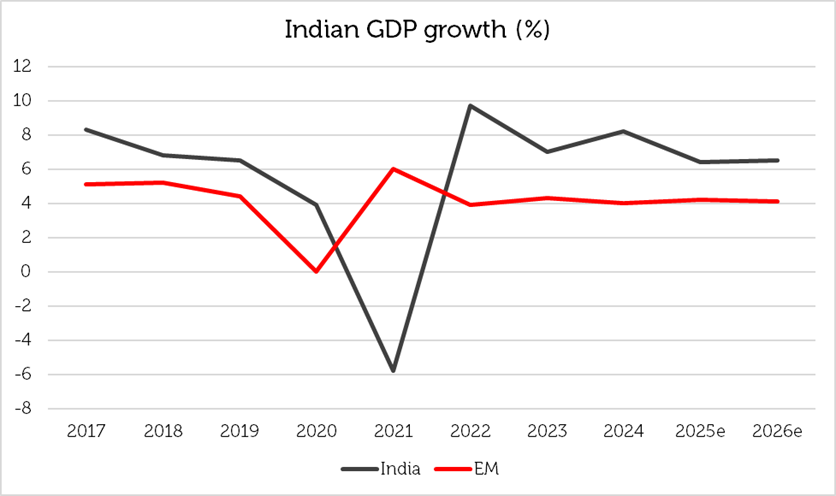

India might be the biggest growth story in emerging markets; the world’s most populous country has demonstrated better economic performance than the rest of the emerging market universe since the mid-teens, with GDP growth averaging over 5.5% annually since 2017.

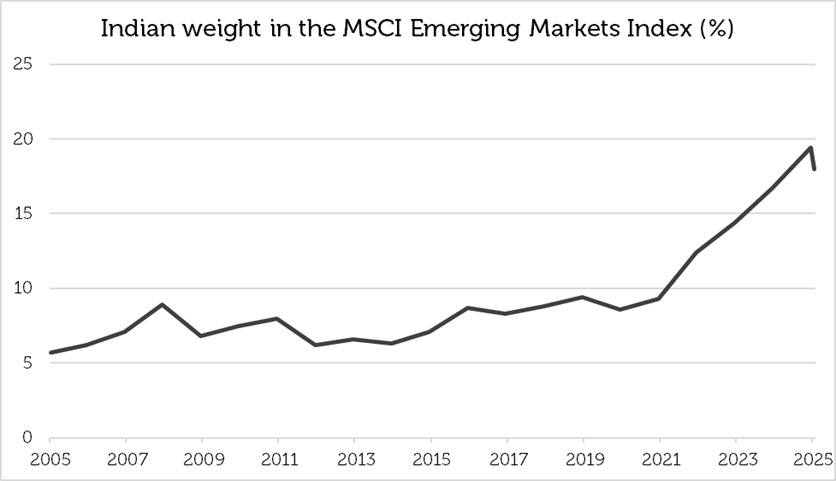

Strong economic growth and a great variety of investment opportunities have caused the weight of India to triple in the MSCI Emerging Markets Index since 2005. Its current weight of 18.4% makes India the third largest country in the benchmark, behind China and Taiwan [1].

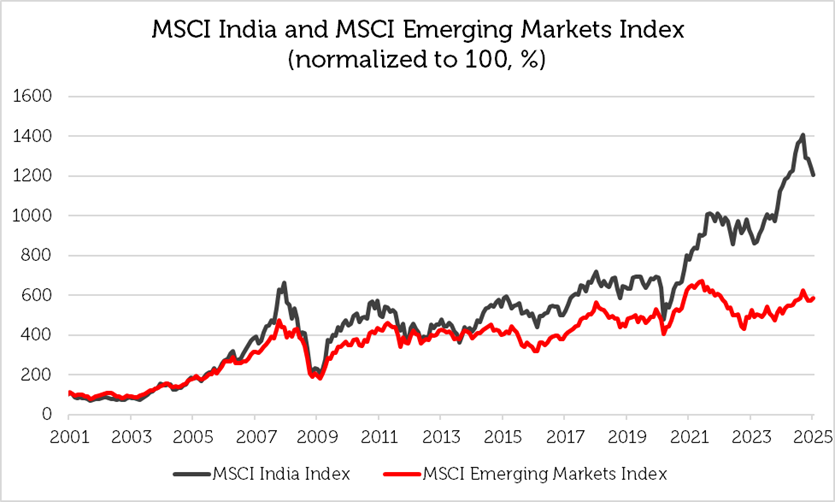

The MSCI India Index has outperformed the MSCI Emerging Markets Index since inception on 1st January 1993, compounding at the rate of 8.7% per annum compared to the 6.4% annual return of the broader global emerging market universe [2]. Performance has been especially strong since the recovery from the COVID-19 pandemic at the beginning of this decade.

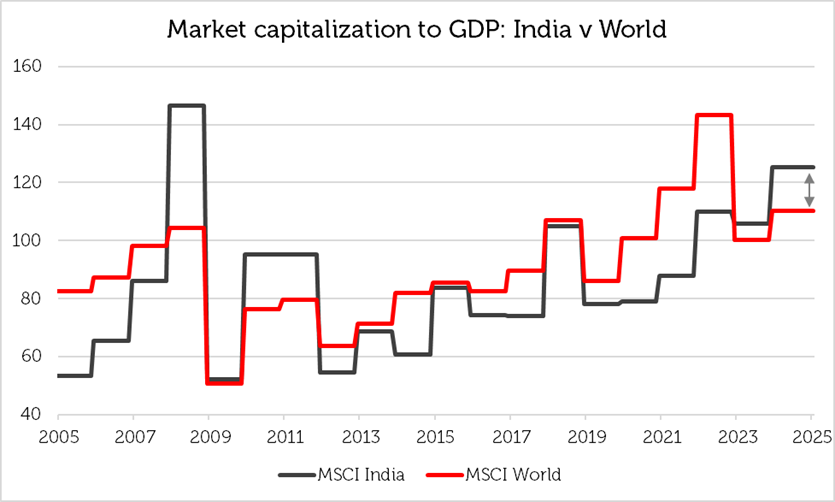

Most of India’s outperformance has occurred since the market surpassed its 2008 new year high in early 2021. As a result, India’s market capitalization to GDP – the “Buffett Indicator” – now exceeds 100% and suggests a rich valuation and possibly more modest forward returns. However, investor interest in the market has significantly increased.

What drives performance?

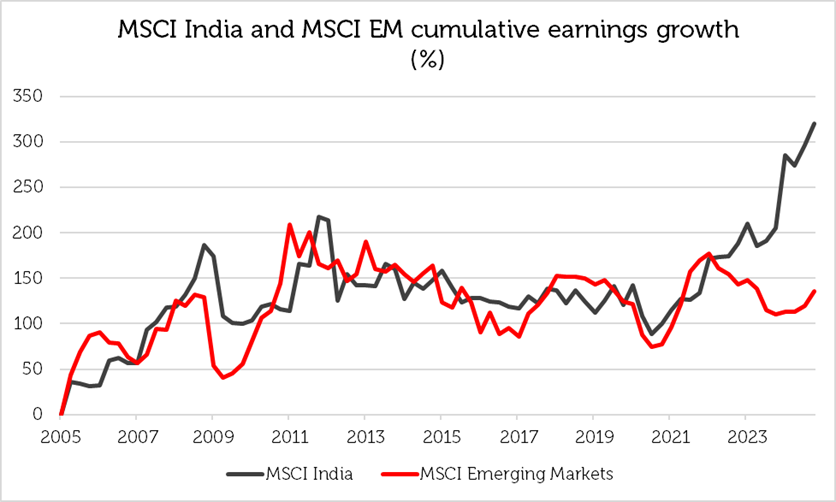

The most important contributor to equity returns is earnings growth. Earnings in local currency have compounded at about 12% per annum for the past 20 years, which equates to 8% in USD terms. This is twice as good as the 4% EPS growth rate of the MSCI Emerging Markets Index over the same period. Such superior performance has attracted investors to the Indian market, but there are concerns over valuation.

What is the right valuation for the growth rate?

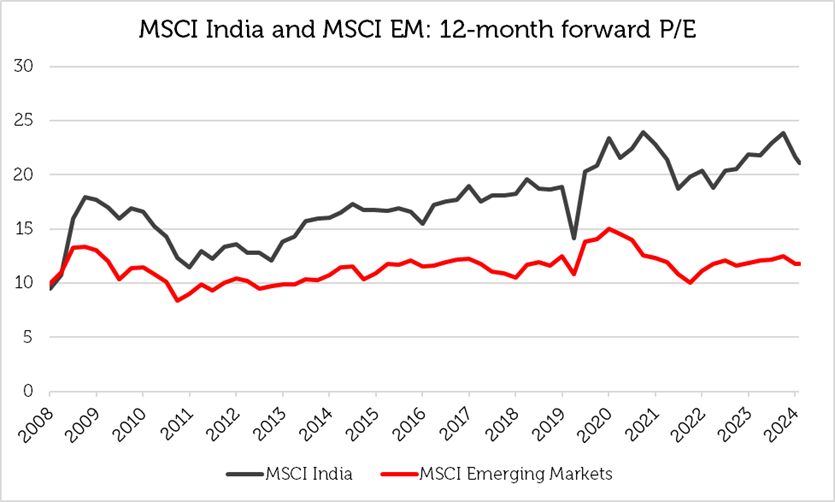

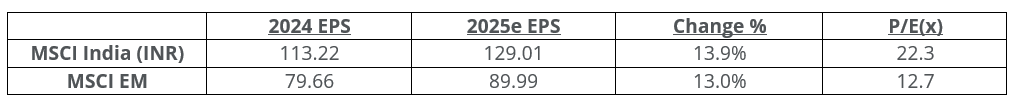

The main investment hurdle to overcome in India is its relatively high valuation, for the market does not generally offer growth at a reasonable price. Looking at the P/E ratio, the MSCI India Index is valued at 22.3 times forward earnings, a 17% premium to the long run average of 19 times and a 75% premium to the MSCI Emerging Market Index P/E of 12.7 times forward earnings.

Not only is India the most expensive equity market in EM, but it is also valued almost at par with the MSCI US Index, which trades at a forward P/E ratio of 23.4 [3]. Such high valuations compared both to history and to other markets give rise to concern over the strength of likely returns in the medium term.

As noted earlier, the historical growth rate of corporate earnings in India has been 12% in local currency terms. The 13.9% estimated local currency growth rate for 2025 is less than 1% higher than the broader emerging market expected growth rate, which means that investors must pay a premium multiple for an almost identical rate of earnings growth in the rest of the emerging markets universe.

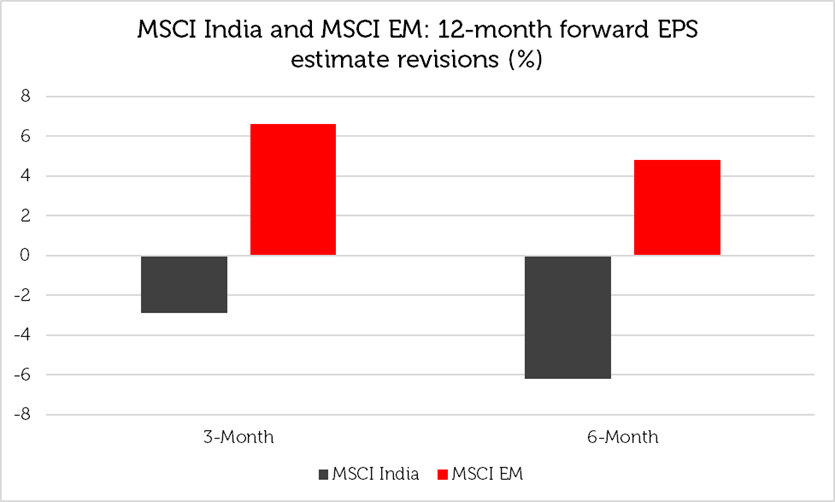

Indian earnings expectations have declined over the past three and six-months, while the broader MSCI Emerging Markets Index has seen earnings forecasts increase. The 6% decrease in Indian earnings estimates might put pressure on India’s premium valuation, and investors might prefer exposure to other parts of emerging markets where earnings revisions are positive.

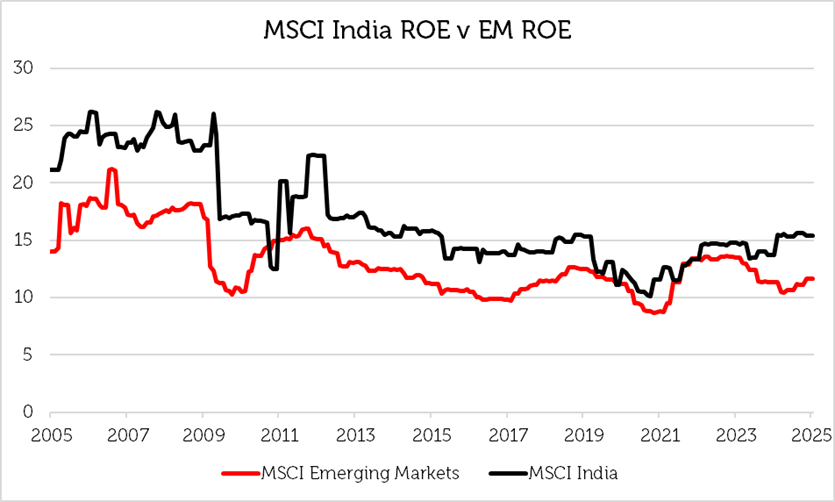

Might higher ROE in India justify the premium? MSCI India ROE is currently 15.4%, which is better than the overall MSCI Emerging Markets Index ROE of 11.7% but lower than its own long run average of 17%. Investors risk paying a premium price for only slightly better than average growth and below average profitability.

What is the right valuation for India?

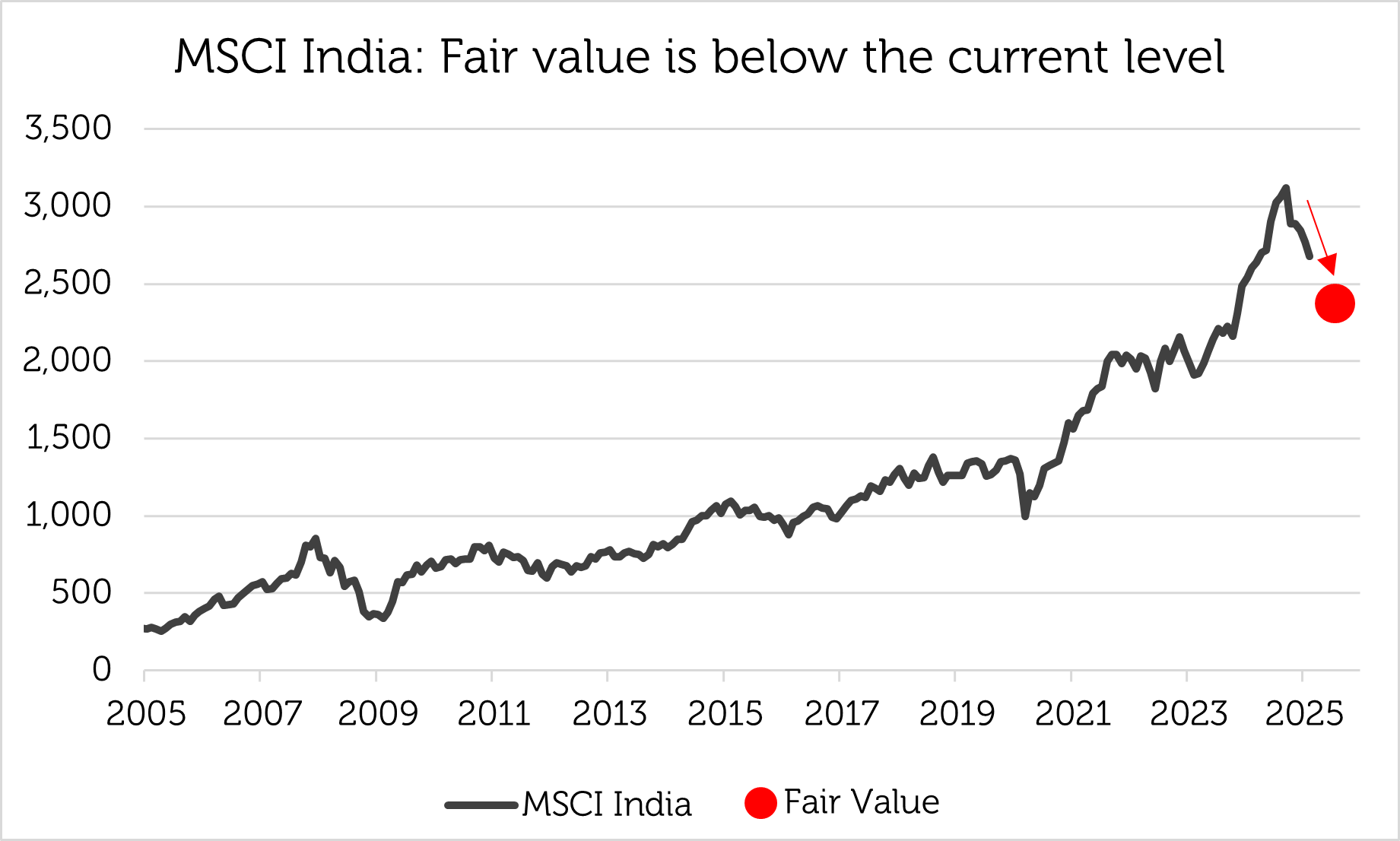

Since the MSCI India Index demonstrates only about average earnings growth with below-average profitability, investors ought only to pay an average multiple of earnings for market exposure. The earlier examination of historical multiples for the Indian market suggests that investors might wait until a more reasonable valuation emerges before allocating heavily to India; a long-term average multiple of 19 times 2025 earnings of INR 129 suggests a fair MSCI Index level of 2,451, or about 12% below the level at the close on 31 January. The market was last at this level at the end of 2023 and has appeared fundamentally overvalued since then, in our view.

The challenge is still to identify sectors and themes that are relatively attractive for the GARP investor. With a growth rate in the low teens and a P/E ratio higher than 20 times, a PEG ratio of 2 or below might be seen as a decent yardstick by which to measure growth at a reasonable price.

GARP sectors and themes in India

While our investment team continues to monitor the market for opportunities and themes as they arise, the financial sector is among the most attractively valued on a GARP basis, in our opinion.

Investment themes that might capture growth in India include Financial Inclusion as well as Urbanization and Travel & Tourism. For instance, India’s banked adult population doubled between 2011 and 2021[4], which has created new financial product sales opportunities for India’s banks. In addition, new rural banking options are increasing access to financial services in India’s marginalized communities. These two factors are the key drivers that we believe will contribute to earnings growth for India’s financial firms.

India is expected to experience significant growth in urbanization as important economic, political and social considerations, such as affordable housing schemes and luxury living, continue to broaden the opportunities for investment. At the same time, Indians are expected to pursue higher paying jobs in India’s urban centres, which should be supportive of property demand and lead to robust top- and bottom-line growth for India’s real estate developers and related companies.

Transportation infrastructure development is increasing the pace of urbanization, expanding domestic travel and attracting international visitors. Infrastructure is expected to be a stronger contributor to India’s GDP growth in the years to come.

Sources:

[1] Bloomberg, 31 January 2025

[2] Bloomberg, 31 January 2025

[3] Bloomberg, 31 January 2025

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.