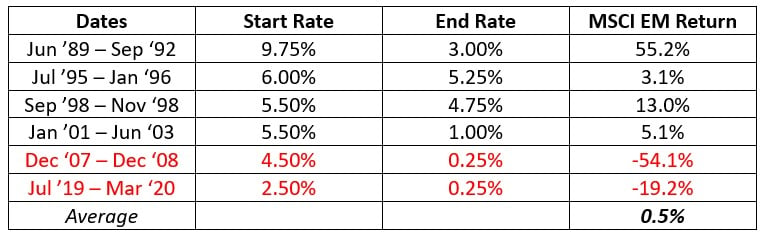

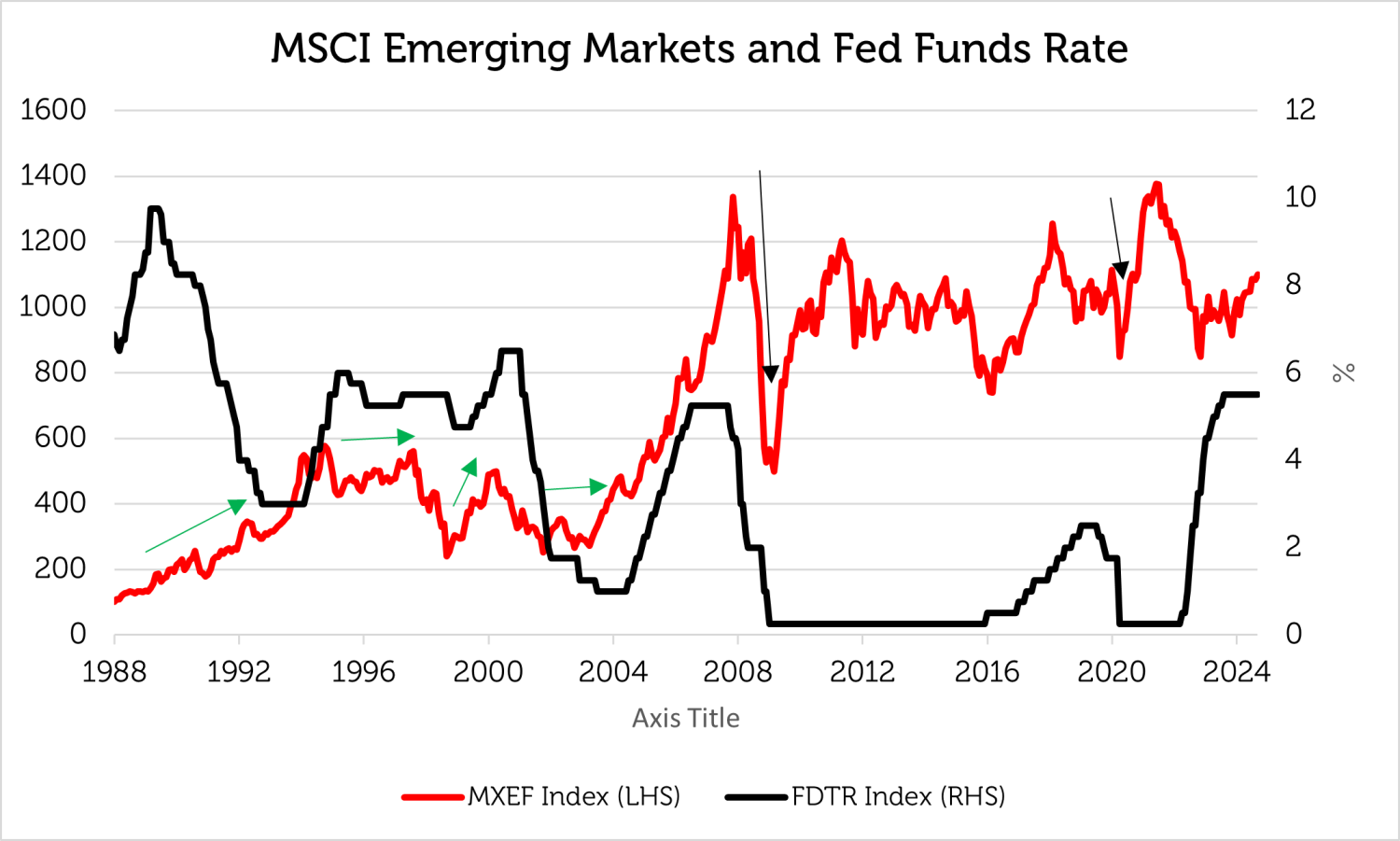

There have been six cycles of monetary easing by the US Federal Reserve since the inception of the MSCI Emerging Markets Index in January 1988. Conventional wisdom presumes that lower interest rates reduce the attraction of cash and bonds in relation to riskier assets with growth characteristics, including emerging markets (EM) equities, and this has been true more often than not.

Source: Bloomberg, Redwheel as of 31 August 2024. Past performance is not a guide to future results.

The equity market outcome depends on the reason for rate cuts

Although the average gain is only 0.5%, the MSCI Emerging Markets Index rose on 4 out of 6 occasions. Where the Federal Reserve has successfully engineered a soft landing (early and mid-90s) or averted an economic or financial crisis (1998 Russian default and early-2000s ‘Tech Wreck’), the average gain during the period of lowering rates has been just over 19%. On the other hand, a rearguard action in response to a sudden global shock (2008 Global Financial Crisis and 2020 COVID-19 pandemic) coincided with average losses of over 36%.

Source: Bloomberg, Redwheel as of 31 August 2024. Past performance is not a guide to future results.

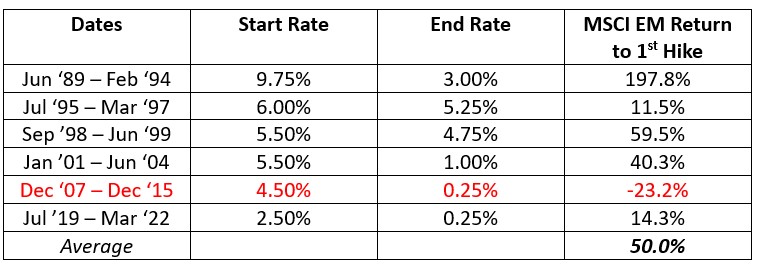

It’s better at the bottom of the rate cycle

Although EM equity performance has generally been positive during the period of interest rate reductions, it has been typically better from the time when the Federal Reserve finishes cutting rates to the first increase of the next cycle. The period between the first interest rate reduction and the first increase in the subsequent rate cycle has historically been beneficial for equity markets, delivering an average return of 50%. This reflects that improvement in growth that lower interest rates eventually deliver. The only exception was the Global Financial Crisis and its aftermath, when even an extended period of Zero Interest Rate Policy (ZIRP) could not propel the MSCI Emerging Markets Index beyond the Super-Cycle high that was reached in 2007. The features of the Global Financial Crisis were not only the depth of the bear market, but the unusually high valuations that Emerging Markets had reached, which had to normalize during the period of ZIRP.

Source: Bloomberg, Redwheel as of 31 August 2024. Past performance is not a guide to future results.

Where are we now?

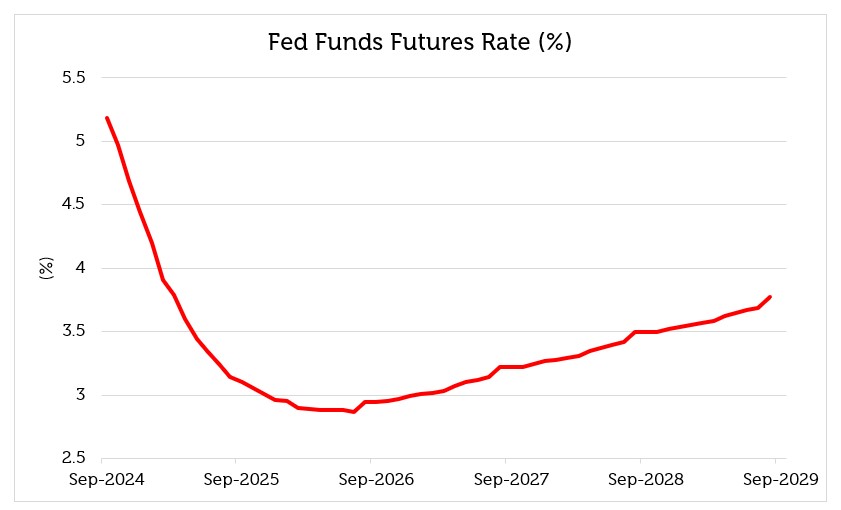

We believe that the Federal Reserve is in the process of engineering a soft landing such that the gradual reduction in interest rates will avert a recession. The Fed Funds Rate should fall from its current range of 5.25% – 5.50% today to 2.75% – 3.00% by the end of 2025. This would be in line with average Federal Reserve easing since 1989: a 2.50% reduction in the overnight rate over a sixteen-month period.

Source: Bloomberg, Redwheel as of 31 August 2024. Past performance is not a guide to future results.

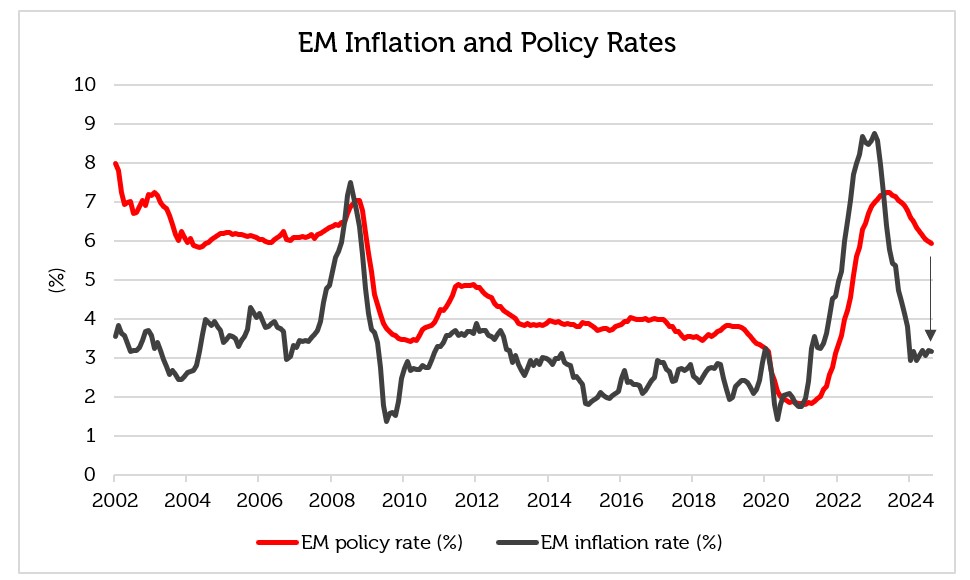

This would allow emerging market central banks to reduce their own overnight interest rates, which is justified by the deceleration in local inflation, but which has been delayed by the long plateau of high rates in the US. Many Emerging Market central banks worry about the potential for currency weakness if they pre-empt the Federal Reserve in lowering rates.

Source: HSBC, Redwheel as of 31 August 2024. Past performance is not a guide to future results.

The effects of rate cuts in EM

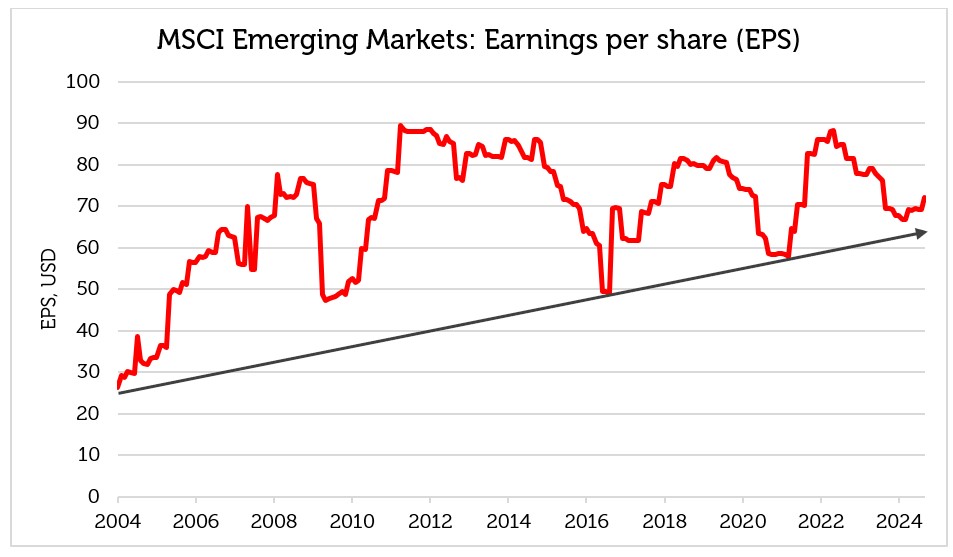

Lower interest rates have the potential to help emerging markets equities in two ways. First, easier monetary policy can stimulate economic activity by lowering corporate and household interest expenses and freeing up money for consumption and investment. Accelerating economic growth should feed into higher corporate earnings, which are close to a cyclical trough and starting to recover.

Source: Bloomberg, Redwheel as of 31 August 2024. Past performance is not a guide to future results.

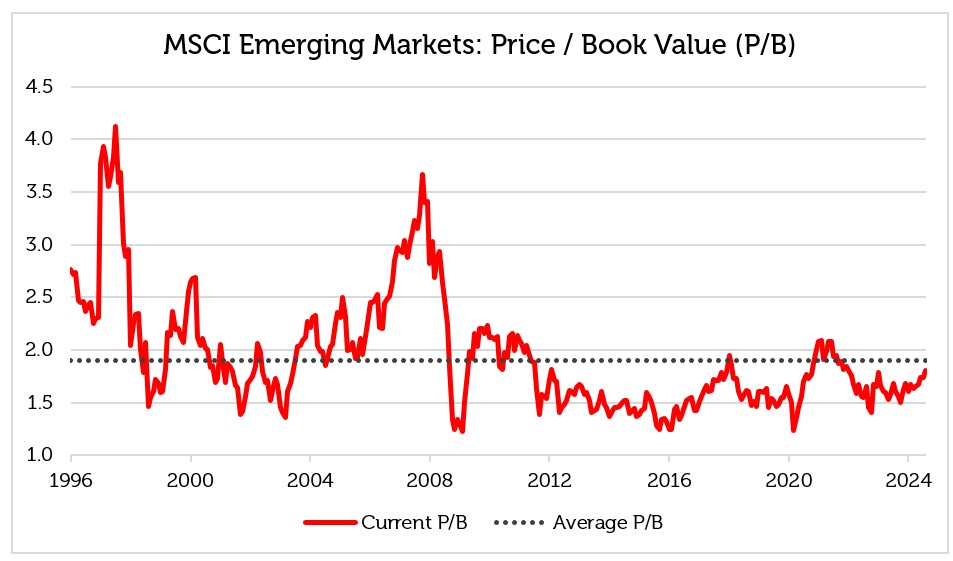

Second, the combination of lower rates and higher earnings should cause an upward re-rating of equities, because higher growth should be discounted at a lower rate, leading to higher valuations. The current Price to Book Value ratio of 1.7 is slightly below its long run average of 1.9, suggesting there is more potential for upside than downside at this level.

Source: Bloomberg, Redwheel as of 31 August 2024. Past performance is not a guide to future results.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.