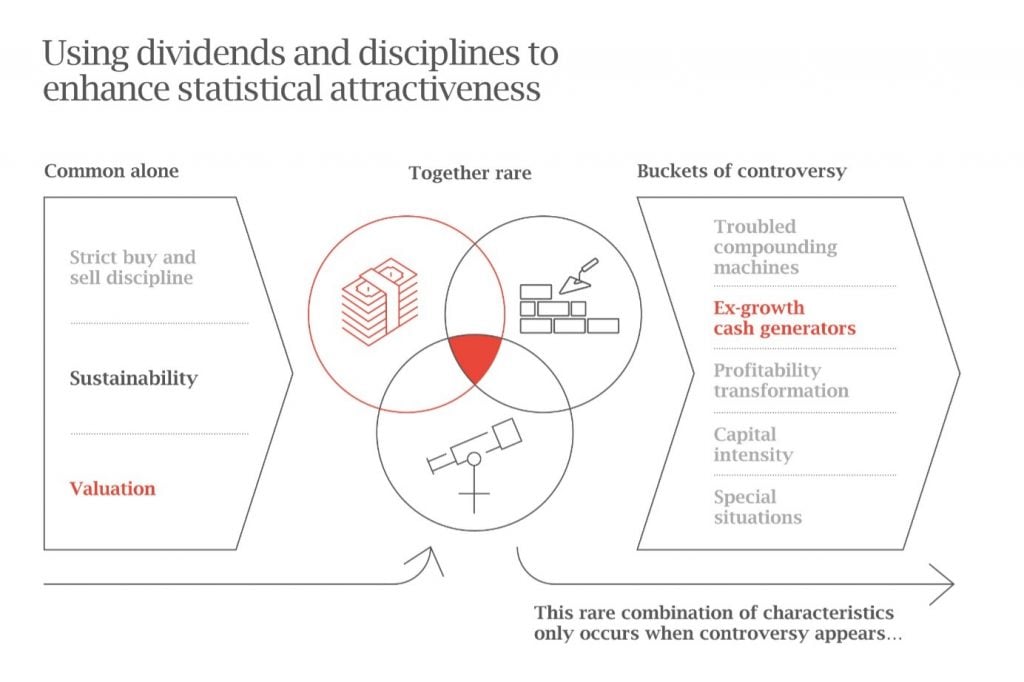

The three requisite features of every investment we make are: a premium yield; dividend sustainability; and a valuation margin of safety. These are relatively easy to find individually but, in combination they are rare and typically only occur when a company is surrounded by some form of risk or controversy.

Here we take a dive into one of the RWC Global Equity Income Strategy’s five buckets of controversy, with the help of three case studies. The Ex-growth cash generators bucket is normally one of the largest constituents of the portfolio – along with Troubled Compounding Machines, stocks within these two buckets typically make up at least two-thirds of the entire portfolio.

Companies with a track record of generating a high ROIC (Return on Invested Capital) are popular among fund managers. ROIC is an important metric for us because it provides a tangible indication of how good a company is at allocating capital to generate future growth and cash. Companies that consistently deliver a high ROIC are sometimes referred to as ‘quality’ businesses. Their high returns allow these companies to sustain underlying cashflows and afford them the ability to suffer without threatening their ability to continue to pay dividends. Hence, one of our three requisite characteristics – dividend sustainability – is commonly found among these quality businesses.

The other two characteristics – a premium yield and a valuation margin of safety – are harder to find, however. The popularity of these high return businesses often means a high valuation which, given our disciplines, would preclude them from our investable universe. They do, however, sometimes trade at a market discount, which is when we become interested. Within this specific bucket, the valuation discount tends to accompany market concerns about a perceived existential threat that is expected to disrupt a successful business, sending future returns sharply lower. The threat posed to Kodak by digital technologies around the turn of the millennium, or to Nokia by the advent of touchscreen technologies, are good case studies of how this can play out deleteriously for a complacent incumbent.

Case study 1: Harley Davidson’s engine splutters

Harley Davidson is a recent example of an investment that sits in the Ex-growth cash generators bucket. A truly iconic brand, Harley Davidson motorcycles are steeped in history and mystique, from its association with cult movies in the 1970s and the rise of the Hell’s Angels, through to its more recent patronage from a range of rock stars and A-list celebrities.

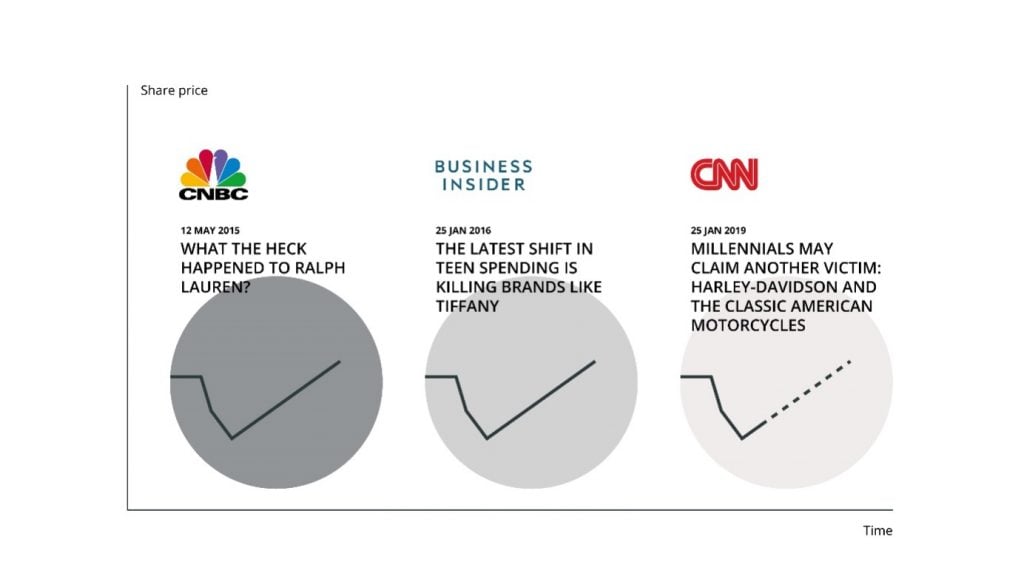

In 2018, however, the share price started to come under increasing pressure due to worries that Millennials were distancing themselves from a product seen as representative of the Baby Boomer generation. Meanwhile, Harley Davidson’s core demographic was generally viewed as having reached a stage in life during which they were less likely to buy and ride a motorcycle.

This led to market concerns that the brand was in danger of becoming irrelevant. Sales had indeed come under pressure, as a result of declining motorcycle ownership in the US and some analysts feared that this signalled a fundamental shift in the popularity of motorcycling as a leisure pursuit.

Refuting the controversy

Our contention to the popular market narrative of the time, was that motorcycle unit sales have always followed an observable cycle. Our analysis showed that Harley Davidson was actually gaining market share in total (new and used) motorcycle demand and, rather than distancing themselves from the brand, younger generations were simply accessing it in different ways, favouring used, vintage and customised product.

We therefore built an investment thesis around the continued strength and relevance of the genuinely iconic Harley Davidson brand, a strong balance sheet and a commitment to returning all excess cash to its shareholders.

Repeating patterns

In recent years, we have seen a similar repeating pattern play out at other luxury brand companies such as Ralph Lauren, where temporary problems stemming from a period of over-expansion were incorrectly perceived by the market as being structural and permanent. A similar pattern played out at Tiffany, which implemented a successful brand turnaround strategy, introducing new products and expanding its online presence to appeal to Millennial and Generation Z shoppers.

Although some companies will inevitably face a Kodak-like future, more often than not, we find that the perceived threat is exaggerated. Usually, a combination of headwinds dent growth temporarily but do not amount to anything terminal. This is an opportunity for us. Indeed, the valuation attraction in this bucket can be particularly significant. In mistaking a temporary controversy for a permanent problem, the market will already be discounting a level of risk that the company may go under. In this context, the valuation asymmetry may be skewed even further in our favour. Simply surviving can be enough to deliver a good return, but if the company eventually resumes its prior growth trajectory, the upside is even greater.

We particularly like companies with a strong franchise that have the ability to adapt to the challenges they face. Mature technology companies have demonstrated this adaptability in the past, as discussed in the Cisco case study below. Slowing growth and new competitors can be interpreted by the market as the death knell for a hitherto dominant franchise. However, closer analysis can reveal a different picture. In situations like this, we work on building evidence for a counter-argument. A simple survey of customers, for example, may reveal a strong reluctance to compromise security or performance, not to mention the technical difficulties of changing providers. Where this is the case, a franchise may prove to have significantly more longevity than the market realises. With patience, and by tracking the progress of the investment thesis with some pre-determined flags, we can ultimately be rewarded when growth returns.

Case study 2: Reports of ad agency’s death are greatly exaggerated

Omnicom is a marketing communications business, which offers a range of creative, advertising and related media services to a wide variety of clients globally. Historically, it has delivered better growth than many of its peers and is well represented across the key advertising disciplines. Despite the cyclical nature of its industry, Omnicom’s profit margins have tended to be relatively stable and its returns have been consistently attractive. It also benefits from a highly diverse revenue base across regions, sectors and individual clients.

More recently, the advertising sector has seen a sharp slowdown from mid-single-digit annualised growth to barely above zero. This has prompted fears that the industry is facing structural challenges, with the shift to digital being cited as the key threat. Google and its peers have enjoyed spectacular growth in advertising revenues compared to the likes of Omnicom, which supports a widely held view that advertising agencies are being disintermediated.

Meanwhile, the dramatic exit of Martin Sorrell from WPP highlighted the ‘key man risk’ associated with people businesses and shone a light on the appropriateness of its historic merger & acquisition (M&A) strategy. Omnicom has not been acquisitive, but these issues have weighed on share prices across the sector, with valuations moving from broadly market multiples to a significant PE discount.

Refuting the controversy

The variant perception is simply that the sector is not permanently disrupted and remains relevant for the digital age. While digital is causing a shift in the mix of advertising spend (retailers for example spend less on their overall brand and more on targeted digital ads based on people’s search history), this is not the death of traditional advertising. Thus far, the media industry has been able to deliver modest growth despite the shift to digital and with no negative impact on margins.

Omnicom’s business model remains highly relevant to the current age. It offers a range of specialised skills which, when coupled with its scale and an independent creative view, can deliver a valuable integrated marketing communications service from strategy, through to execution and measurement.

Repeating patterns

The sector fits the repeating pattern of a temporary malaise being mistaken for permanent disruption. Within the retail industry, Next is a prime example of an incumbent business that has used its advantage of scale to ‘out-digitise’ the disrupters, a pattern also seen at Accenture and Infosys.

The characteristics we look for in each of our five buckets are different, as are the specific questions we try to answer. This is because the associated risks can vary a great deal. With respect to the Ex-growth cash generators bucket, some of the questions we seek answers to are:

- How vulnerable is this business to disruption?

- Has the company or its industry risen to the challenge of disruption before?

- How strong are customer relationships?

- How specialised is the company’s offering?

- What are the barriers to entry?

- What evidence is there for wholesale customer switching?

Case study 3: Cisco heads for the clouds

American technology business Cisco Systems literally helped to build the internet. Its connectivity solutions have become embedded in computer networks worldwide, to the extent that it is estimated that 85% of internet traffic travels across its systems.

In 2017, the company commenced a significant shift in its business away from its legacy hardware solutions, and towards software-based, recurring revenue streams. Major corporate transitions are always fraught with risk, and the controversy here initially stemmed from the market’s scepticism about Cisco’s ability to successfully execute this pivot. Meanwhile, concerns about the cyclicality of its end markets resurfaced, impacting its bookings across geographies. These factors combined to lead a derating of the shares and Cisco began to be viewed by the market as an ex-growth legacy hardware vendor.

Refuting the controversy

Our contention was that the slowdown in sales was caused by a pause in spending on key projects, rather than a structural decline. We continued to view Cisco’s technology and services as absolutely core to its clients’ technology strategies and expected investment to rebound. The global pandemic of 2020 has highlighted the risks to companies of underinvesting in their technological infrastructure.

The pivot towards software also looked strategically sensible to us, given the anticipated growth in cloud computing. We viewed the transition more positively than the market, drawing confidence from Cisco’s dominant market shares in the majority of its business lines, and its embedded relationship with its customers. The company consistently scores highly in CIO surveys, being seen as a critical and indispensable partner and a key beneficiary of cloud initiatives.

Instead of viewing the transition as a reason to value the shares more modestly, we concluded that Cisco’s shares deserved a premium rating, courtesy of its recurring revenues streams and a reinvigorated growth outlook.

Repeating patterns

Conclusion

Collectively, we are confident that our track record of identifying and investing in high quality, high return businesses when the market is worrying inappropriately about their future growth prospects, can generate good long-term returns for our investors.

The term “RWC” may include any one or more RWC branded entities including RWC Partners Limited and RWC Asset Management LLP, each of which is authorised and regulated by the UK Financial Conduct Authority and, in the case of RWC Asset Management LLP, the US Securities and Exchange Commission; RWC Asset Advisors (US) LLC, which is registered with the US Securities and Exchange Commission; and RWC Singapore (Pte) Limited, which is licensed as a Licensed Fund Management Company by the Monetary Authority of Singapore.

RWC may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. RWC seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by RWC are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

This document has been prepared for general information purposes only and has not been delivered for registration in any jurisdiction nor has its content been reviewed or approved by any regulatory authority in any jurisdiction. The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by RWC; or (iv) an offer to enter into any other transaction whatsoever (each a “Transaction”). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party.

RWC uses information from third party vendors, such as statistical and other data, that it believes to be reliable. However, the accuracy of this data, which may be used to calculate results or otherwise compile data that finds its way over time into RWC research data stored on its systems, is not guaranteed. If such information is not accurate, some of the conclusions reached or statements made may be adversely affected. RWC bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction. Any opinion expressed herein, which may be subjective in nature, may not be shared by all directors, officers, employees, or representatives of RWC and may be subject to change without notice. RWC is not liable for any decisions made or actions or inactions taken by you or others based on the contents of this document and neither RWC nor any of its directors, officers, employees, or representatives (including affiliates) accepts any liability whatsoever for any errors and/or omissions or for any direct, indirect, special, incidental, or consequential loss, damages, or expenses of any kind howsoever arising from the use of, or reliance on, any information contained herein.

Information contained in this document should not be viewed as indicative of future results. Past performance of any Transaction is not indicative of future results. The value of investments can go down as well as up. Certain assumptions and forward looking statements may have been made either for modelling purposes, to simplify the presentation and/or calculation of any projections or estimates contained herein and RWC does not represent that that any such assumptions or statements will reflect actual future events or that all assumptions have been considered or stated. Forward-looking statements are inherently uncertain, and changing factors such as those affecting the markets generally, or those affecting particular industries or issuers, may cause results to differ from those discussed. Accordingly, there can be no assurance that estimated returns or projections will be realised or that actual returns or performance results will not materially differ from those estimated herein. Some of the information contained in this document may be aggregated data of Transactions executed by RWC that has been compiled so as not to identify the underlying Transactions of any particular customer.

The information transmitted is intended only for the person or entity to which it has been given and may contain confidential and/or privileged material. In accepting receipt of the information transmitted you agree that you and/or your affiliates, partners, directors, officers and employees, as applicable, will keep all information strictly confidential. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information is prohibited. The information contained herein is confidential and is intended for the exclusive use of the intended recipient(s) to which this document has been provided. Any distribution or reproduction of this document is not authorised and is prohibited without the express written consent of RWC or any of its affiliates.

Changes in rates of exchange may cause the value of such investments to fluctuate. An investor may not be able to get back the amount invested and the loss on realisation may be very high and could result in a substantial or complete loss of the investment. In addition, an investor who realises their investment in a RWC-managed fund after a short period may not realise the amount originally invested as a result of charges made on the issue and/or redemption of such investment. The value of such interests for the purposes of purchases may differ from their value for the purpose of redemptions. No representations or warranties of any kind are intended or should be inferred with respect to the economic return from, or the tax consequences of, an investment in a RWC-managed fund. Current tax levels and reliefs may change. Depending on individual circumstances, this may affect investment returns. Nothing in this document constitutes advice on the merits of buying or selling a particular investment. This document expresses no views as to the suitability or appropriateness of the fund or any other investments described herein to the individual circumstances of any recipient.

AIFMD and Distribution in the European Economic Area (“EEA”)

The Alternative Fund Managers Directive (Directive 2011/61/EU) (“AIFMD”) is a regulatory regime which came into full effect in the EEA on 22 July 2014. RWC Asset Management LLP is an Alternative Investment Fund Manager (an “AIFM”) to certain funds managed by it (each an “AIF”). The AIFM is required to make available to investors certain prescribed information prior to their investment in an AIF. The majority of the prescribed information is contained in the latest Offering Document of the AIF. The remainder of the prescribed information is contained in the relevant AIF’s annual report and accounts. All of the information is provided in accordance with the AIFMD.

In relation to each member state of the EEA (each a “Member State”), this document may only be distributed and shares in a RWC fund (“Shares”) may only be offered and placed to the extent that (a) the relevant RWC fund is permitted to be marketed to professional investors in accordance with the AIFMD (as implemented into the local law/regulation of the relevant Member State); or (b) this document may otherwise be lawfully distributed and the Shares may lawfully offered or placed in that Member State (including at the initiative of the investor).

Information Required for Distribution of Foreign Collective Investment Schemes to Qualified Investors in Switzerland

The representative and paying agent of the RWC-managed funds in Switzerland (the “Representative in Switzerland”) is Société Générale, Paris, Zurich Branch, Talacker 50,

P.O. Box 5070, CH-8021 Zurich. In respect of the units of the RWC-managed funds distributed in Switzerland, the place of performance and jurisdiction is at the registered office of the Representative in Switzerland.