When we look at companies, we look for three key features: premium yield to the market, durable cash flow generation, and margin of safety. In isolation these are common to find, but much rarer all together. The final element – margin of safety – is perhaps most tricky for investors in the current climate.

Many have been opting to move the goal posts and abandon valuation, insisting that quality of the business alone provides the margin of safety. We disagree and believe valuation is and should always be key, especially so at times of extremes. To adhere to this, discipline is required to avoid the temptation of moving the goal posts.

So, how do you secure a margin of safety when global, quality companies often come at a premium? In short, it often comes down to buying when others do not want to, but how do you identify when to do so? Over the years we have seen similar scenarios play out in various iterations that have uncovered a playbook of how to pick up quality names at attractive levels.

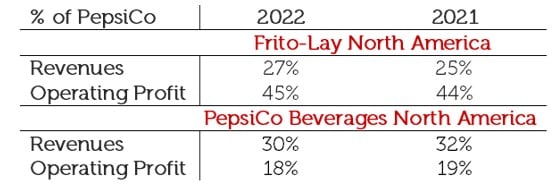

For example, PepsiCo is not just a business engaged in a battle of the colas: it also enjoys a strong position in other product markets, including snack brands. In fact, more of the company’s revenues have been coming from snack brands than beverages – for their fiscal year ending December 2022 it was a 58/42 split.[1]

This is only half of the picture, and when you take PepsiCo’s most successful divisions by sales – Frito-Lay North America and PepsiCo Beverages North America, respectively – the former had an operating margin of 2x PepsiCo’s overall operating margin of 13% in 2021 and 2022, compared to the latter’s being lower than PepsiCo’s.

Source: PepsiCo as at 2022, Redwheel. The information shown above is for illustrative purposes.

Understanding ‚Troubled Compounding Machines‘

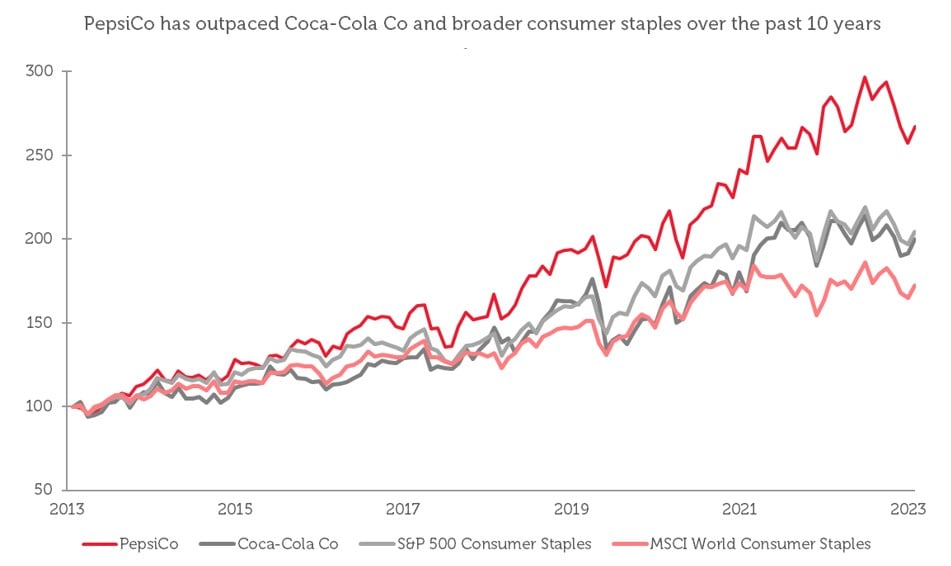

We bought PepsiCo in May 2018, which was a challenging year for consumer staples, and not least for Pepsi, which also had to contend with sugar taxes and a general shift in consumer preferences away from sugary beverages. At one stage, it was down c.20% from late January to early May. We dug into whether the market was getting ahead of itself and concluded that PepsiCo presented as what we like to call a “Troubled Compounding Machine”: ‘misunderstood’ strong cash generators capable of compounding (growing) dividends but, in our view, disproportionately dampened by market sentiment.

2023 has been another difficult year for Consumer Staples, but we ultimately believe PepsiCo remains a business with a strong collection of brands that can demonstrate pricing power; its product differentiation should give it an edge in navigating the evolving landscape of the food and beverages industries, including in tackling the latest headwind posed by GLP-1 weight loss drugs. Further, PepsiCo’s strong Free Cash Flow (FCF) generation has helped it grow its dividends for over 50 years, so much so that the total value of the dividends paid out for the year to Dec 2022 was more than the value of the whole of PepsiCo in 1987! PepsiCo was 2.4% of the portfolio as at the end of October 2023.

Source: Bloomberg as at 30/11/23. Past performance is not a guide to future results.

Don’t overlook the value cash giants can bring

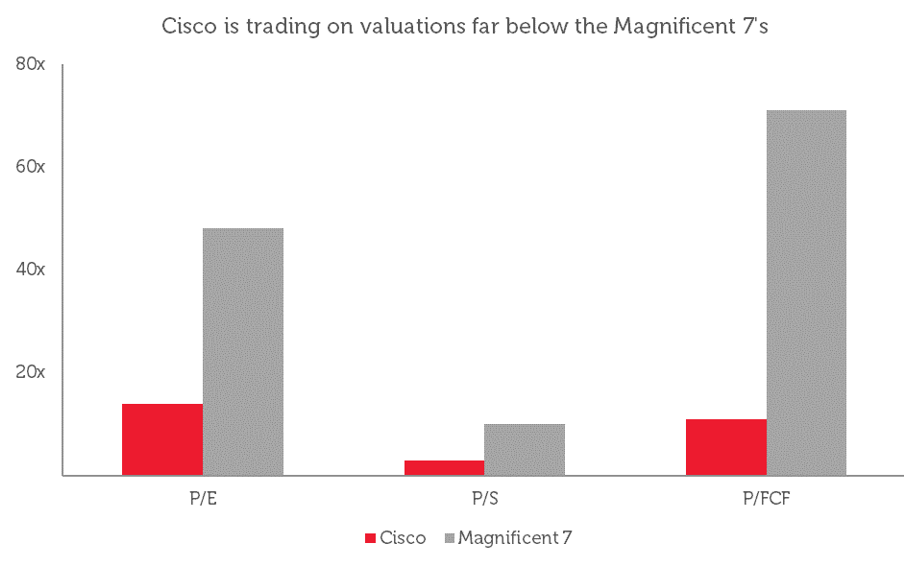

Then we have the companies that have faded into the background due to reaching a more mature phase of their business lifecycle, despite still being formidable cash generators. We call these ex-growth cash generators. Drawing attention to something being ex-growth could be seen as a risky move to some, but although these companies may not seem to have the same allure as the Magnificent Seven, for example, they are still quality companies that can add value over the longer term, including from sizeable dividends, and can provide some balance to portfolios.

They can also be opportunities to play structural themes in a less crowded way. For example, AI remains a hot topic – on and off ‘The Street’, but companies like Cisco, for example, fly relatively under the radar as a ‘picks and shovels’ play, complete with more modest valuations when compared to those names that have captured much of the spotlight.

Source: Morningstar as at 05/12/23. The information shown above is for illustrative purposes.

Cisco may not be part of the next generation of technology names, but over the years, To further sweeten the deal, the company leads in security software, something that will become of paramount importance in a world of AI. Cisco was 5.8% of the portfolio as at the end of October 2023.

Look for profitability transformation stories

And then there’s the sleeping cash giants that awaken with an economic rebound, or to many investors, the ‘cyclical’ part of the market. What we find helps us in avoiding those that cannot suffer their cycle is having an embedded focus on cash generation and sustainable business models to leverage the significant long-term return contribution of compounding dividends. Thus, for us, these do not tend to be highly levered companies, and a track record of sustainable cash generation should lead to them being able to suffer their cycle, sustain their dividends and re-appear stronger.

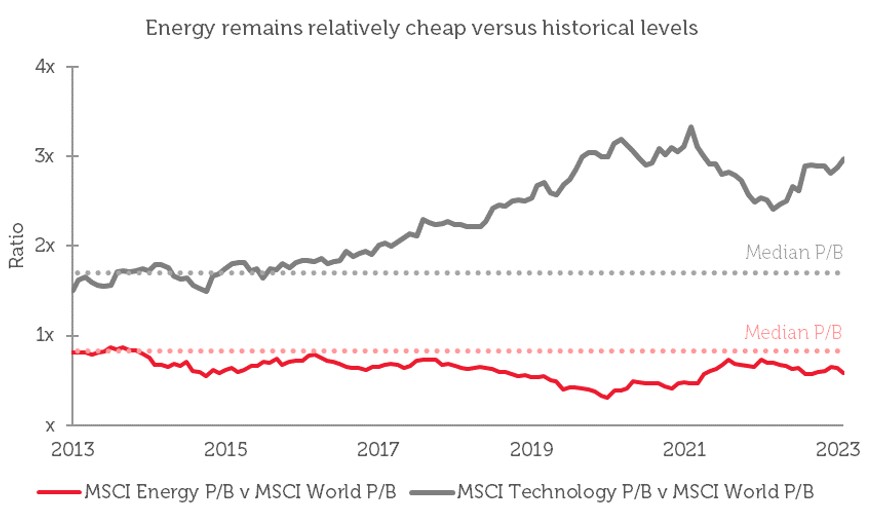

Many areas of the market could fit into this bucket; some may capture it through financials, but we believe it is too late in the cycle. Instead, this is where we express our view on energy, as we believe the sector is supported by various factors which remain to be fully priced in. Traditional energy sources are still needed in the global shift to greener energy, and the energy majors have potential to come through the other side as key renewable energy players. Further, geopolitical risk continues to spur themes such as energy security and reshoring.

We see energy as a classic transformation story. It used to be that when the oil price is high, energy majors directed capital to capex, with cash dividends displaced by scrip dividends. But the energy transition has twisted this dynamic. Now these names are more leveraged to the oil price: capex is more constrained and so an increasingly common destination for these companies’ cash is funding dividends and share repurchases, paying down debt and increasing building out their low carbon capacity. But this is not the whole story, which is what makes this a fitting case study for the important art of position sizing.

Even though we see traditional energy firms as still being too cheap, the sector is not only clouded by stranded asset risk and adverse sentiment; the other elephant in the room remains: windfall taxes. This softens our conviction on just how much of the pie is available to shareholders, and why our positions in global energy majors form a moderate commitment.

Source: Bloomberg as at 30/11/23. Past performance is not a guide to future results.

Clearly, quality doesn’t have to come at a premium; the caveat being that it can come with daring to differ from the crowd. Thinking in these scenarios, or ‘buckets’, provides a common thread of the stocks in our Strategy being misunderstood quality businesses capable of strong cash generation that can protect and even grow their dividends.

And being forced by our buy discipline to wait for these quality companies to be attractively valued helps with securing a margin of safety, with our sell discipline aiding with exiting positions when asymmetric risk/reward has shifted against us.

Sources:

[1] PepsiCo, Company Report 2022

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.