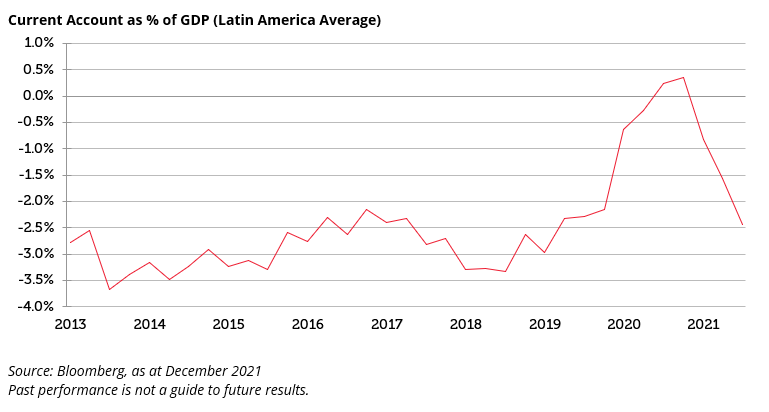

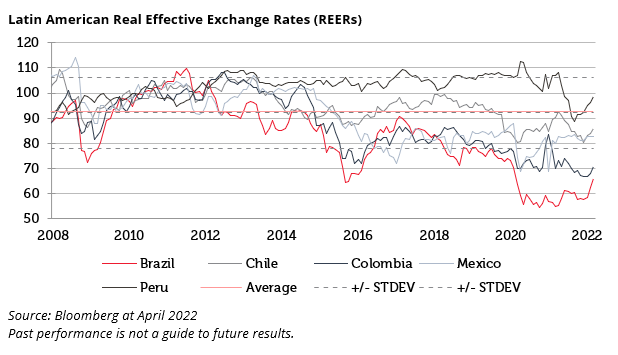

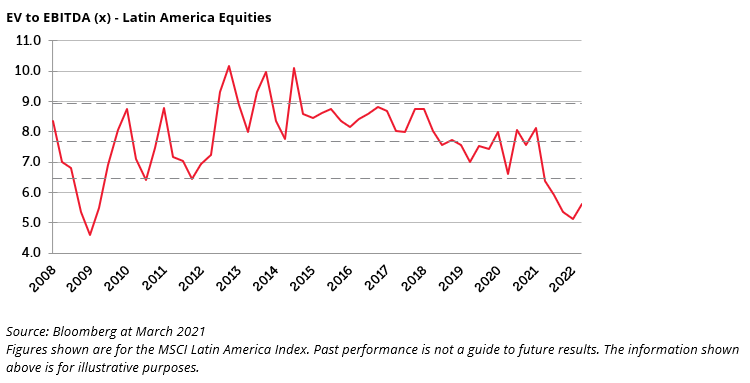

We believe we have reached a turning point in an asset class which has been overlooked for years. Although Latin American currencies were cheap and equity valuations were attractive prior to the pandemic, the asset class did not outperform. However, global macroeconomic conditions have changed dramatically and a combination of strong commodity prices, improving current accounts, competitive currencies and attractive equity valuations should be positive for Latin American equities. Many company fundamentals are robust and we believe that today offers a good entry point for the asset class.

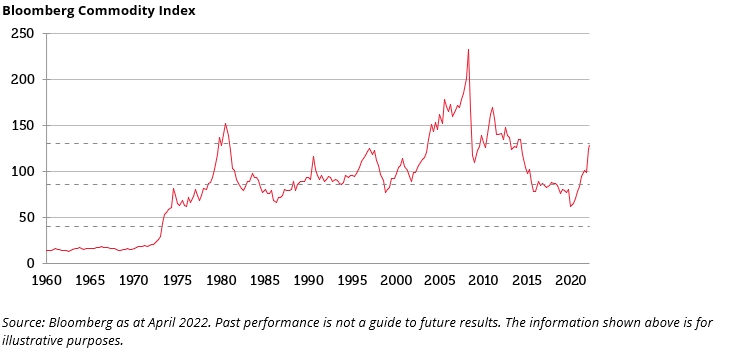

Latin American equities have a positive correlation with commodities due to the region’s abundance of available resources and high commodity exports. Commodities represent approximately 50% of total exports in the region. The six main Latin American countries’ (Brazil, Mexico, Chile, Peru, Colombia and Argentina) commodity exports range from between 5 and 20% of GDP. The region is a large producer of copper, oil, gold, lithium, nickel, silver, corn and soybean. Commodity prices, as measured by the Bloomberg Commodities Index, are back to levels last seen in the 1990s. Additionally, the region has hiked interest rates significantly ahead of many developed markets and most countries globally. As a result, we expect easing cycles to start next year.

Source: Redwheel, Haver, Tellimer and Bloomberg as at 4 February 2022. Based on the latest Information available

Company valuations across the region are attractive, trading well below historical valuations. Combined with considerable growth opportunities across sectors, we believe that this is an opportune time to gain exposure to Latin American equities.

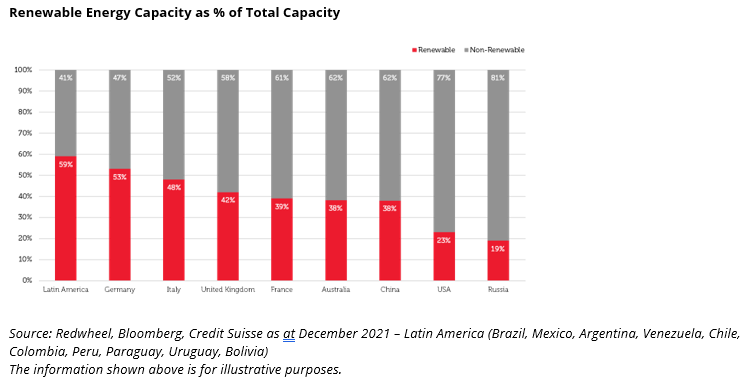

Today, we are finding many attractive investment opportunities in the region with significant upside potential. We have also identified several themes in Latin America that we believe are potentially poised to outperform over the long-term. Among them, we highlight financial inclusion, healthcare, new auto tech and travel. Additionally, we see a clear trend of improvement in ESG which should continue to accelerate. Latin America is already the world’s cleanest region regarding electricity generation. Most of its electricity generation comes from hydro, solar and wind sources.

Financial inclusion

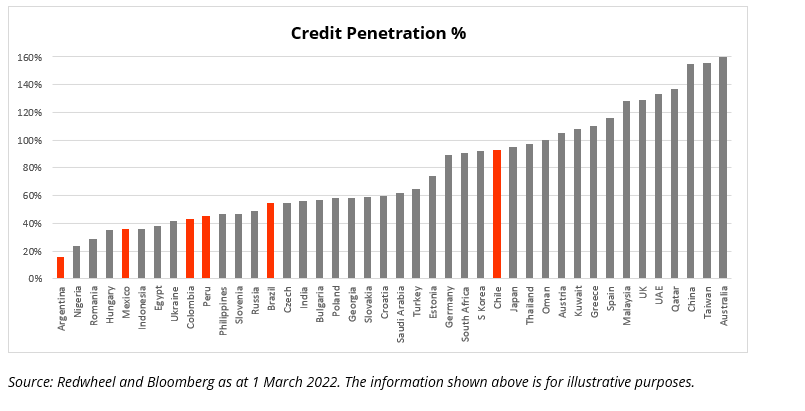

Credit penetration is low in Latin America compared to many developed markets and even other emerging markets. We believe that financial inclusion in Latin America is poised to continue outgrowing most markets in the next five years. The outlook for large banks in Brazil remains attractive due to a combination of higher interest rates and strong loan growth. Bradesco is one of the leading banks in Brazil and has consistently delivered resilient growth in net income while maintaining robust asset quality and capital ratios in recent history. There is significant pent-up demand for credit in Mexico, Peru and Colombia. Gentera, with operations in Mexico and Peru, should be a beneficiary of this demand for credit as the company’s profitability recovers to pre-pandemic levels.

Healthcare

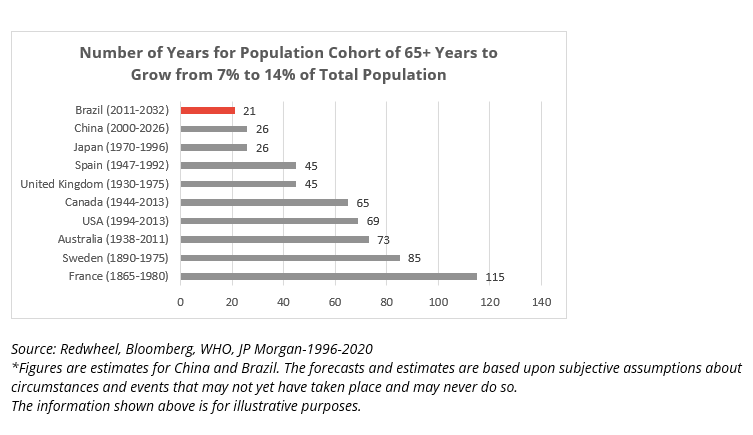

The global population will age considerably over the coming decades and Latin America is no exception. This should put significant strain on public systems paving the way for growth in private healthcare. New technologies such as telemedicine, care co-ordination and digital platforms have been emerging and are becoming important tools to improve service quality and control medical inflation. Hospitals, verticalized players and providers are best positioned to capture the growth as the sector transitions to alternatives for traditional fee service structures. For instance, Hapvida in Brazil has developed an innovative business model that has allowed the company to grow, gain market share and reach industry-leading margins. We believe the business model will continue to outgrow the industry. Hapvida could also benefit from consolidation within the healthcare sector. We are finding several investment opportunities within this theme with significant upside potential.

New Auto Tech

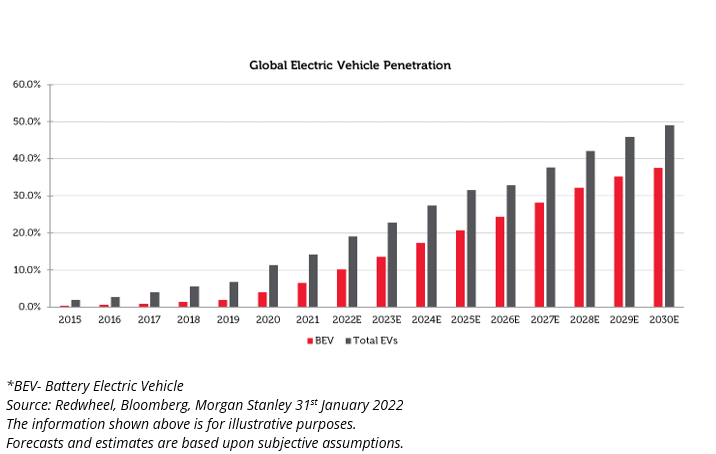

Electric Vehicles (EVs) are the main driver of future lithium demand, accounting for c.30% of total lithium demand currently and potentially rising to over 60% by 2025e. As a result, lithium demand is expected to grow 20-25% annually in the medium term. We expect lithium prices to be supported over the next decade by strong demand and lagging supply leading to deficits. We believe that SQM in Chile is well positioned to take advantage of this price environment. The company should see robust production growth through the end of the decade, while its projects have attractive positions on the cost curve. We think that SQM and other lithium producers in Latin America will benefit from the large increase in lithium demand over the coming years.

Source: Bloomberg and Redwheel

Travel

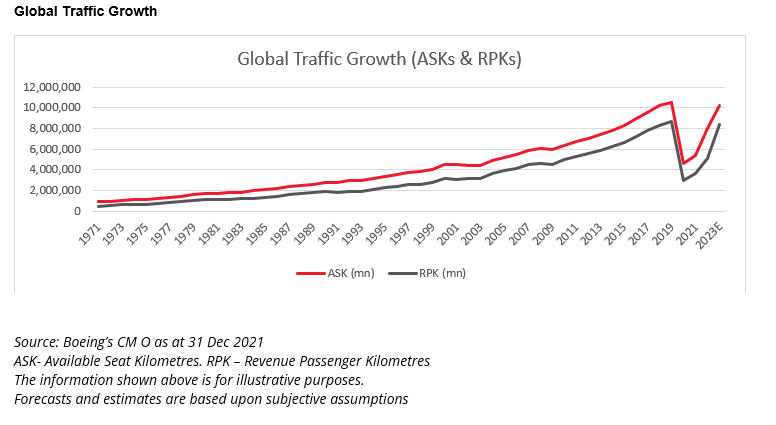

Travel and tourism are recovering fast after the pandemic. Additionally, as disposable incomes rise in Latin America, tourism levels should also increase. While there are many different beneficiaries, we think Mexican airports are one sector which is attractive as footfall continues to recover due to pent-up travel demand during Covid-19 lockdowns. Stocks such as Asur remain cheap. Online travel is another area of interest as online flight and hotels bookings are also growing considerably. Through its recent acquisitions, Despegar has access to the whole Latin American region resulting in an improved and more efficient business with more capillarity post the pandemic.

Conclusion

We are excited about the investment opportunities in Latin America. Fundamentally, Latin America remains a continent with significant growth potential, interesting investment thematics and secular growth drivers. Additionally, ESG is improving considerably in the region. In our view, the outlook remains positive for region’s equity markets and this should lead to outperformance going forward.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.