Inflation as a policy choice

Governments are traditionally expected to control inflation. But in today’s economic environment—with record debt levels, fiscal stimulus, and expectations for rate cuts—an alternative view is emerging: inflation may not just be tolerated but actively encouraged.

A return to sustained inflation could be the path of least resistance for indebted governments that remain committed to spending. Recession fears consequently seem off the table for now, but the conditions are in place for inflation to persist. Could this be the start of a new inflationary cycle and how can investors prepare?

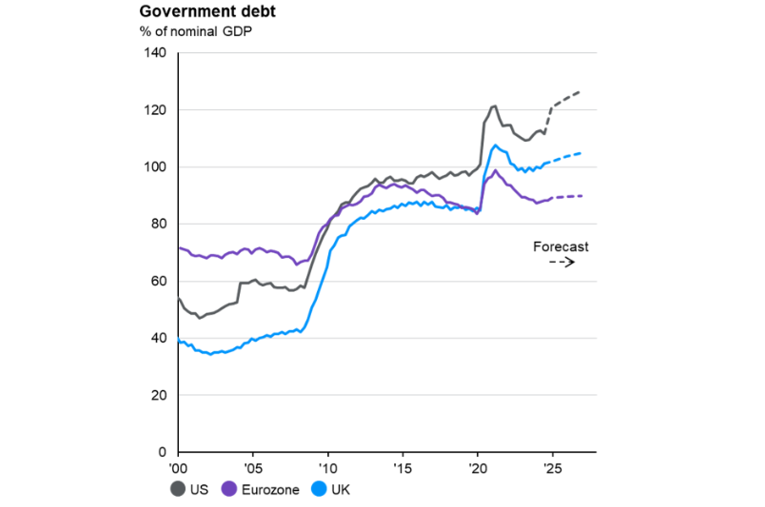

Government debt is a growing concern

Across the US, Europe, UK, Japan, and China, government debt as a percentage of GDP has returned to levels last seen in the aftermath of World War II—approaching or exceeding 100% of GDP. With fiscal spending expected to remain elevated, these debt dynamics are only set to worsen.

Chart 1: Debt dynamics are forecast to increase

While reserve currency status allows some economies greater fiscal flexibility, the trajectory of government debt is clearly unsustainable. The question is: how will governments deal with it?

Options for tackling debt are limited

Governments have few viable paths to addressing their rising debt burdens.

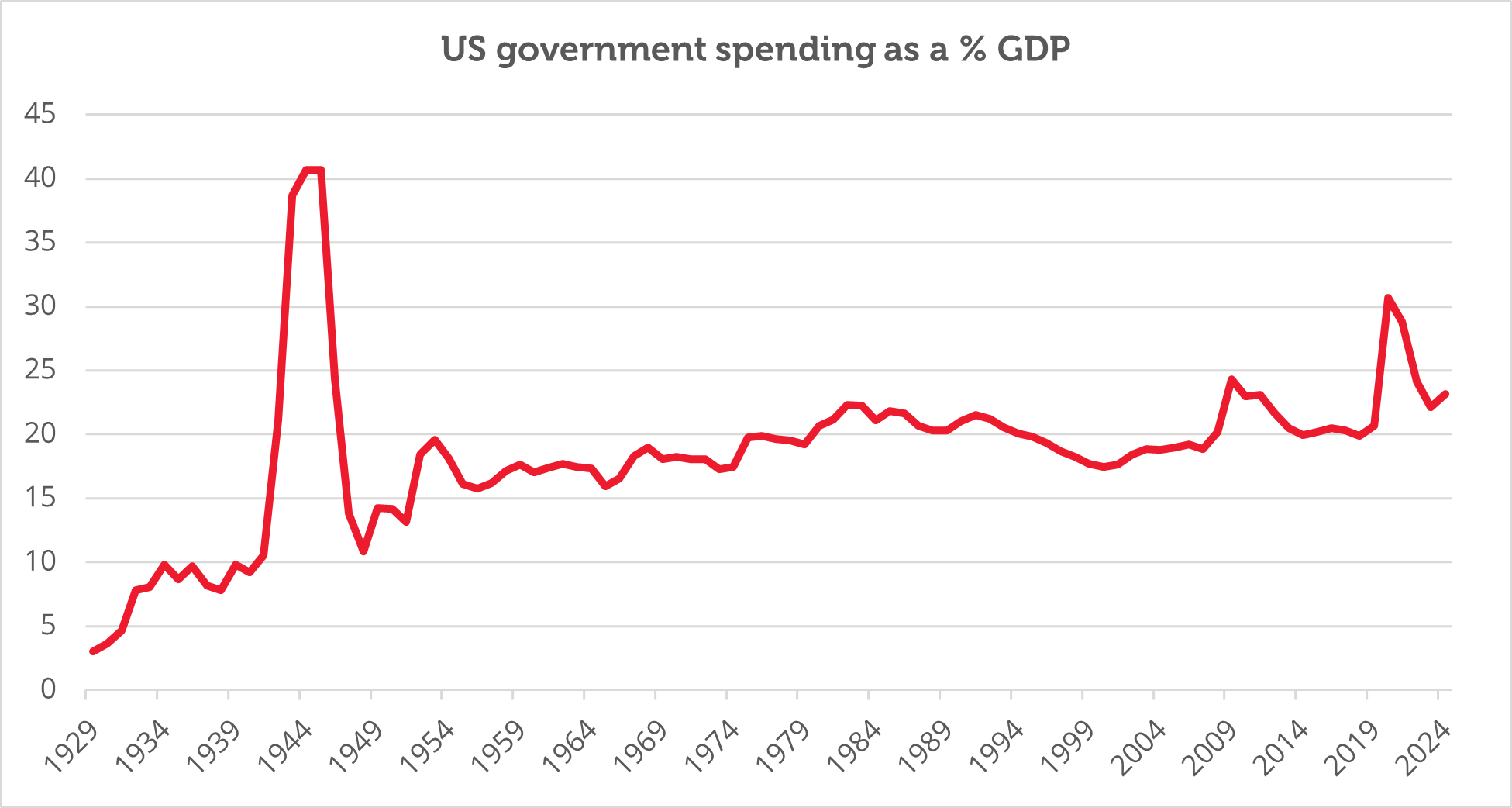

Austerity: Historical evidence suggests that austerity rarely succeeds in reducing government indebtedness. Additionally, political realities make significant spending cuts unlikely—governments do like to spend!

Chart 2: US government spending has grown consistently since the 50s

Monetising Debt: Governments could increase ownership of their own debt, as Japan has done. This buys time and affords a degree of flexibility in managing debt and interest rates, but it also risks crowding out private investment and reducing economic dynamism.

Default: This is unthinkable for major economies given the catastrophic financial consequences.

Inflation: The most politically expedient solution. By allowing inflation to rise, governments can erode the real value of their debt while maintaining nominal growth in GDP. This strategy was used effectively in the post-WWII era. Inflation enables governments to keep spending while reducing the burden of existing debt in real terms. More importantly, it shifts the economic pain to future administrations and generations, making it an attractive short-term policy.

Indeed, inflation can even feel beneficial over the short term. Wages rise, making people feel wealthier while companies raise prices, easing business pressures. It is only over time that the negative effects, such as declining purchasing power and economic distortions, become fully apparent.

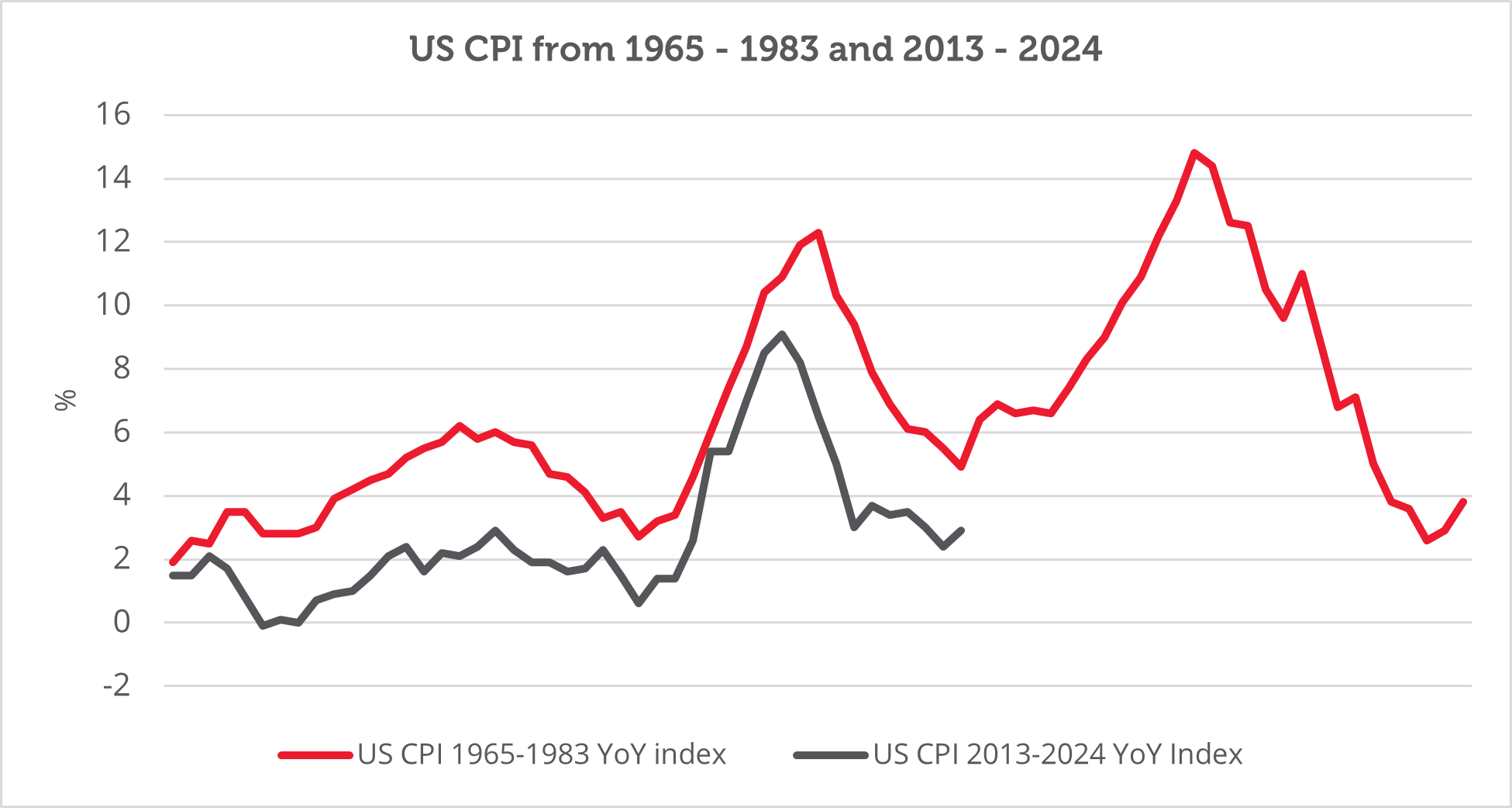

Are we entering a new inflationary cycle?

The 1970s, one of the most prolonged and severe periods of inflation in economic history, were characterised by multiple surges in price growth. Chart 3 shows that a similar pattern could be emerging today.

Chart 3: US CPI inflation has historically moved in waves

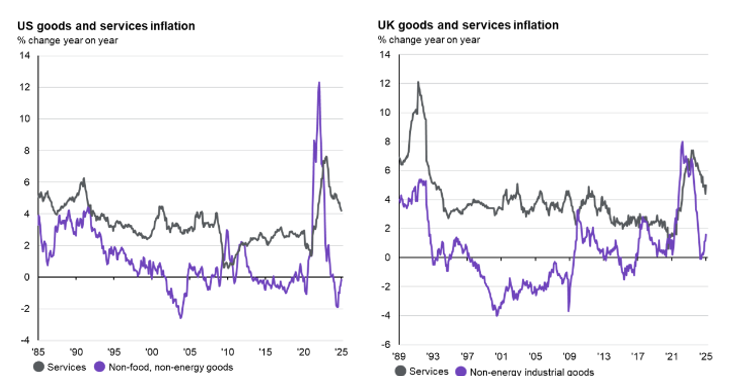

Moreover, the chart below shows that the recent decline in inflation from its peak in June 2022 was largely driven by falling goods prices. In both the US and UK, goods inflation growth has fallen well below services inflation, underscoring the significance of this trend.

Chart 4: US and UK goods and services inflation have diverged

Ongoing fiscal stimulus, supply-side constraints, and a tight labor market all increase the risk of goods inflation increasing from here. But perhaps most inflationary of all is tariffs.

The inflationary impact of tariffs

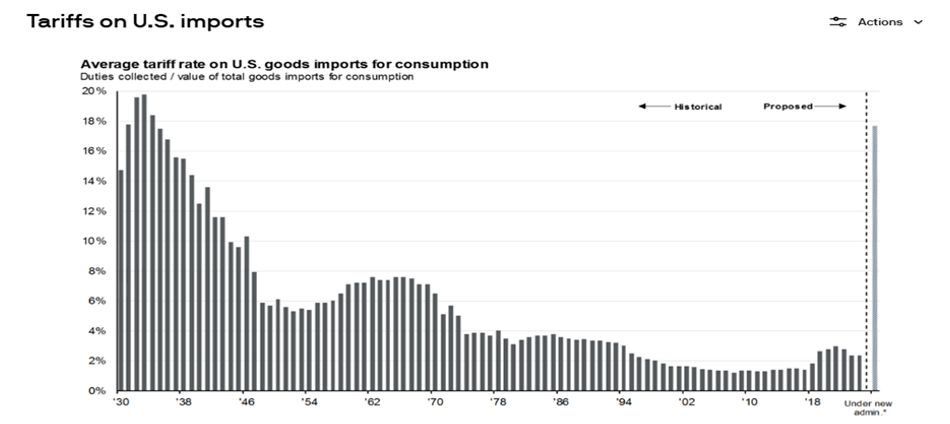

Tariffs act as a tax on consumption, driving inflation through price increase and exchange rate adjustments between trading partners. President Trump has signaled his intention to impose sweeping tariffs to fund new tax cuts, with estimates suggesting these policies could cost between $5-11 trillion[1].

Efficiency drives within government, even under the most optimistic assumptions, will generate only a fraction of the required funding—an estimated $1 trillion at best. More is therefore needed and President Trump has been clear that tariffs are his preferred economic tool.

While markets currently perceive tariffs as a negotiating tactic, this perspective may be misplaced. For Trump to fulfill his campaign promises—tax cuts, job protection, and encouraging domestic consumption—tariffs will need to be enacted at a meaningful scale.

The return to tariffs at such levels, as illustrated in the chart below, would likely lead to a significant increase in goods inflation, reversing the disinflationary trends of the past decade.

Chart 5: the average tariff on US imports since the 1930s and the proposed tariffs under Trump

What investment approaches work in inflationary periods?

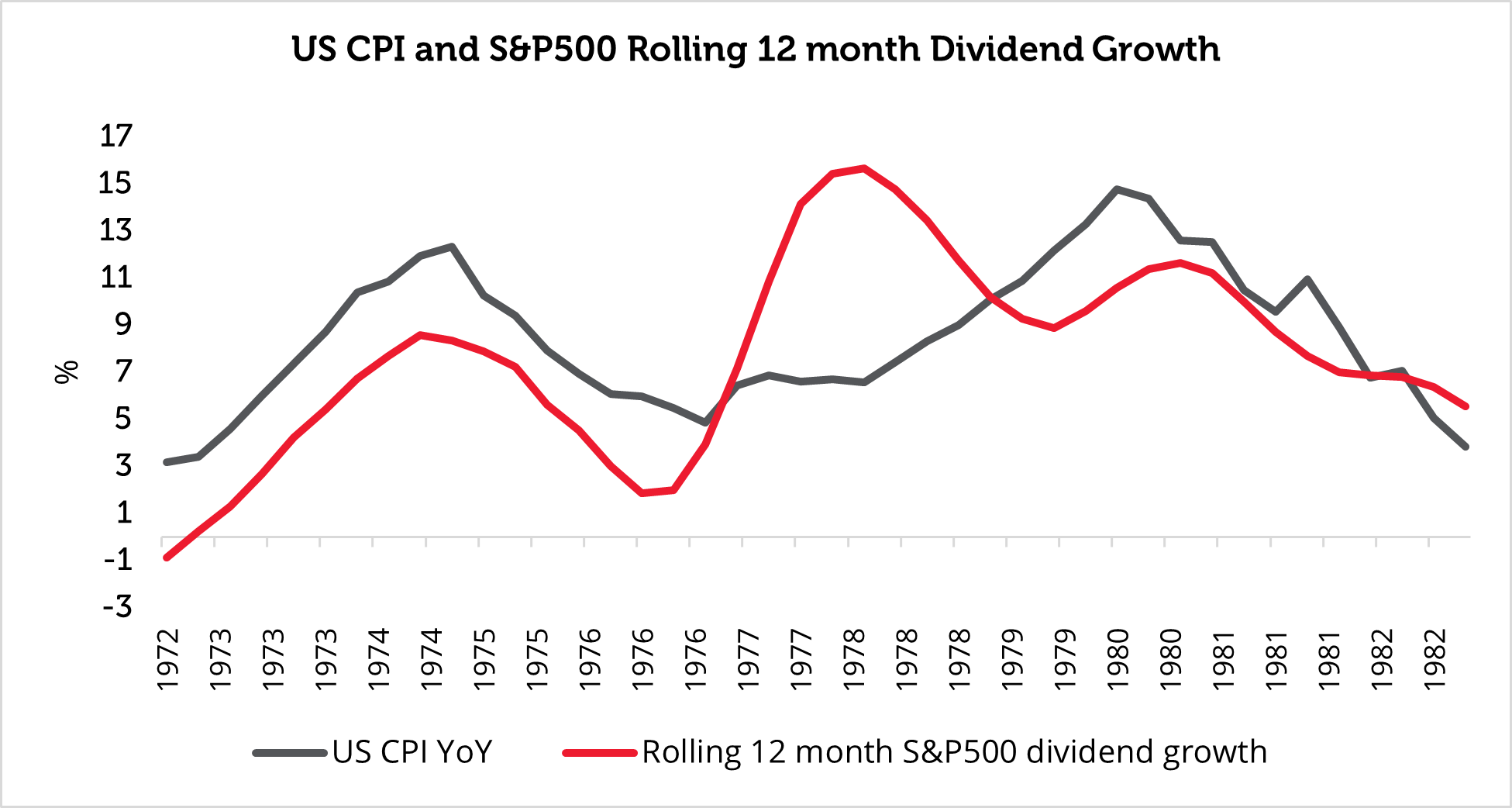

Historically, dividend-paying value stocks in key sectors have provided a strong hedge against inflation. Chart 6 illustrates how dividend growth in the S&P 500 kept pace with inflation during the 70s. Companies with strong pricing power can pass rising costs onto consumers, allowing them to grow revenues, cash flows, and dividends that provide a real return to investors.

Chart 6: Dividends can protect against inflation

Value stocks, particularly those with strong cash flows, also tend to outperform in inflationary environments as they are less susceptible to multiple compression from rising rates. The market can often undervalue companies in industries like utilities and consumer staples despite solid balance sheets and an ability to maintain margins during inflation periods.

The Redwheel Global Equity Income strategy exemplifies this blend of value and income investing. In 2023, its distribution grew 11.5% in GBP terms, following a 9.8% increase in 2022 [2]. By focusing on high-quality, undervalued companies with sustainable pricing power, the strategy aims to compound income over time, providing resilience during inflation periods.

Positioning for a return to inflation

As the macroeconomic landscape shifts, we encourage investors to prepare for a world in which inflation is not an obstacle to be fought, but a tool actively embraced by policymakers. Given the policy environment and potential for tariffs, inflationary pressures may persist for longer than currently anticipated.

Consequently, we believe that inflation returning in waves, much like the 70s, is a likely scenario from here unless a significant recession or debt restructuring occurs. Equity income strategies, particularly those with a proven ability to grow dividends, offer a compelling solution for investors seeking to navigate the challenges of a rising inflation cycle.

Sources:

[1] Committee for a Responsible Federal Budget, 6 February, 2025.

[2] Redwheel

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.