The US electrification revolution and what it means for investors

The US power sector is on the cusp of a profound transformation, driven by surging demand for electricity. This seismic shift is creating multi-decade opportunities for investors, particularly those with a focus on grid modernisation, digitisation, and decarbonisation. Three compelling charts highlight the scale of this opportunity.

Accelerating growth in power demand

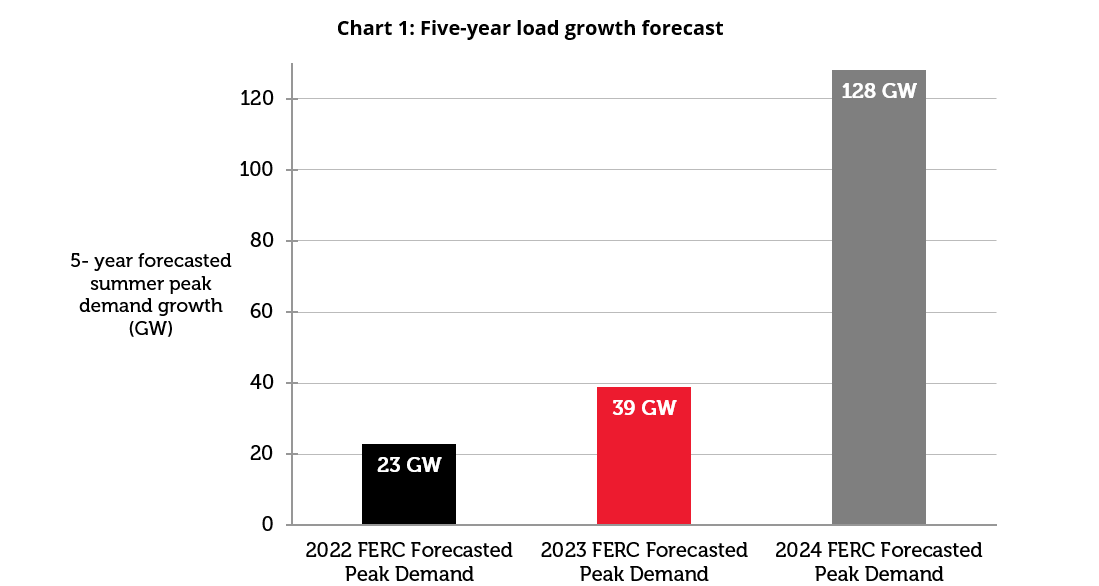

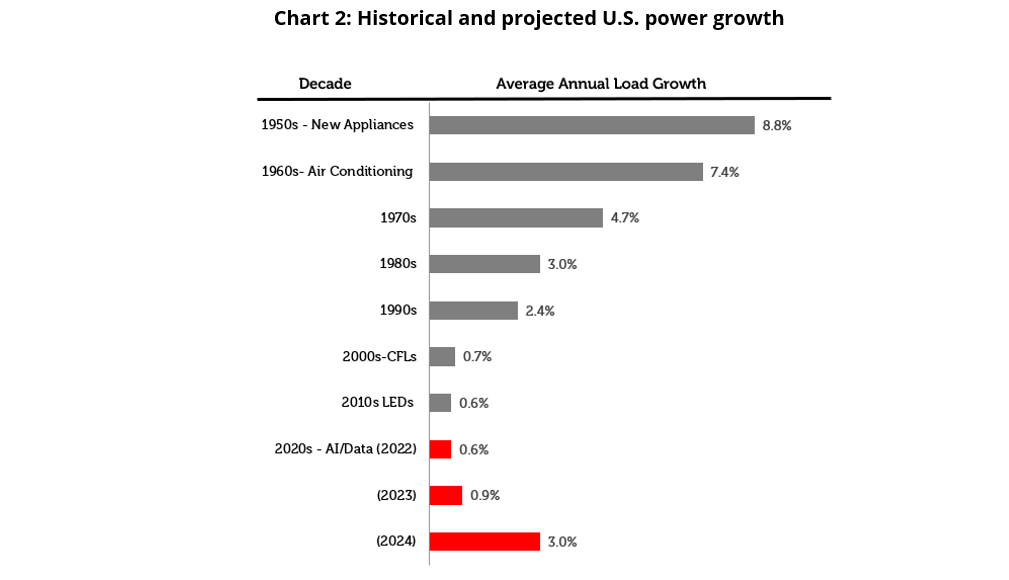

Electricity demand in the US looks set to grow at rates not seen since the 1980s. According to GridStrategies, the five-year US load growth forecast has surged by 456% in just two years, from 23 gigawatts (GW) to 128 GW. To put that in perspective, this is the same as adding twice the peak demand of Germany [1].

What’s driving this surge?

- Electrification across industries: The shift toward efficient and cleaner electricity, and away from combustion activity, has intensified. Manufacturing processes that once relied on combustion are increasingly adopting electric power.

- Digital revolution: The rise of cloud computing, artificial intelligence (AI), and data centres is significantly increasing electricity consumption. While past efficiency gains helped offset demand growth, these improvements are now slowing, while emerging technologies like generative AI and cryptocurrency mining are intensifying power needs.

“A lot of people don’t realise that AI is going to be a big thing but you’ll need double the electricity at least that we have right now.” US President Donald Trump

- Renewed industrial activity: Regions like the US southeast are seeing record-breaking industrial electricity usage, fuelled by the production of batteries, solar panels, and semiconductors [2].

Building the future grid: Challenges and opportunities

Meeting this growing demand will require huge upgrades to the US electricity grid, often described as the world’s largest machine. After decades of stagnation, an annualised growth rate of 3% until the end of the decade will demand six times the planning and construction of new generation and transmission capacity compared to recent years[1]. The US grid must be radically expanded, modernised, and integrated to support this transformation.

A structural growth opportunity

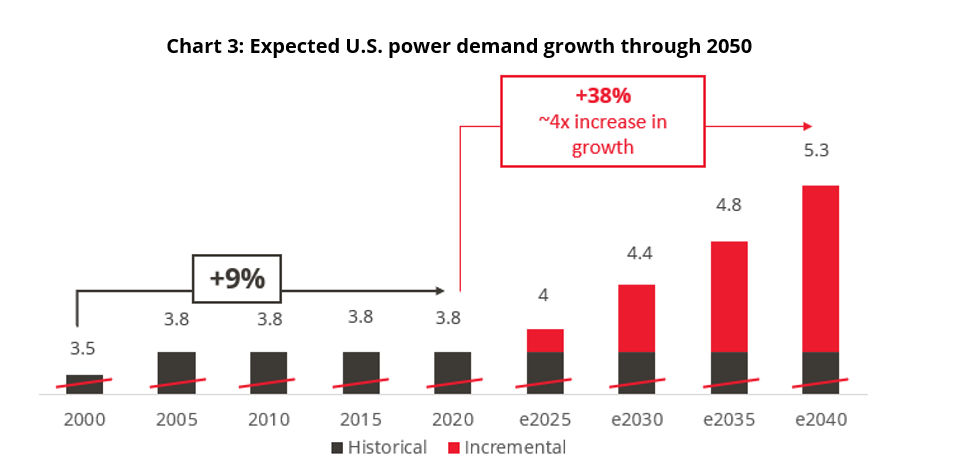

Forecasts from NextEra Energy and other industry leaders indicate that this is just the beginning of a multi-decade trend in the US. The transition to electrified transportation, heating, and industrial processes will continue to drive this secular growth.

Meeting demand growth

The unprecedented surge in electricity demand will require transformative investments in power generation, infrastructure and storage.

In the short and medium term, capacity growth will likely be dominated by renewables and gas power generation. Renewable sources, particularly solar and onshore wind, are not only cost-competitive but also quick to deploy. Baseload power from gas will remain critical for grid stability.

Looking further ahead, nuclear power – which offers low carbon, consistent baseload electricity—could redefine the US energy landscape. Recent announcements highlight growing confidence in the potential to restart retired units [4], while small modular reactors may offer cost efficiencies over traditional nuclear, as well as quicker and more flexible deployment options [5].

Finally, hardening and modernising the US power grid to handle higher loads, integrating renewables, and eliminating bottlenecks are critical priorities. New and improved battery storage systems will be essential for balancing intermittent renewable energy, ensuring consistent power for both industrial and household consumers.

Investing in a dynamic and expanding investment opportunity

Like AI, the trajectory of power demand growth is rapid, broad-reaching, and irreversible. For companies poised to deliver solutions, the economic potential is immense.

Investing in renewable energy and grid infrastructure therefore offers a unique opportunity to capitalise on long-term growth. And with current market conditions providing attractive valuations for renewable infrastructure, we believe that now is an ideal time to act.

The Ecofin investment team at Redwheel is uniquely positioned to help our clients navigate this generational opportunity. Leveraging a depth of expertise in electrification and decarbonisation, the team applies a rigorous, fundamentals-based approach to invest in companies they regard as best-in-class in power, energy storage, and smart grid technology.

Sources:

[2] Washington Post, March 2024

[3] GridStrategies, December 2024

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.