There seems to be a belief amongst many investors that value can only perform if interest rates go up because that is what they have observed in the recent past. For about a decade interest rates have fallen and growth stocks have done significantly better than value stocks. Some investors have assumed causation here and have also invented an ex-post rationalisation to explain this supposed relationship: growth stocks will typically have most of their cash flows further out in time and are thus considered longer duration. Thus, it makes perfect sense that they would do better as interest rates decline in the same way that long-dated bonds typically beat short- duration ones in a falling interest rates environment.

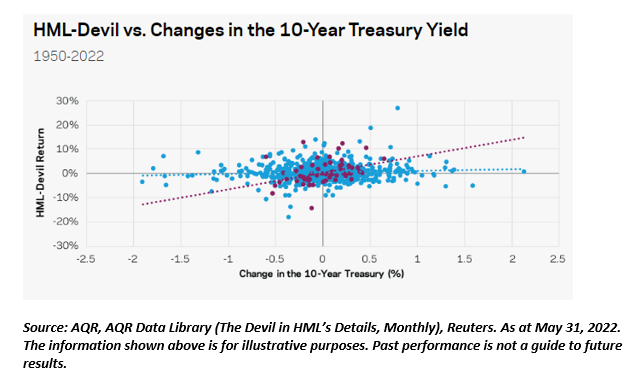

A recent paper[1] from Cliff Asness at AQR Capital Management casts doubt on all of this and shows that in the longer term there is essentially no correlation[2] between interest rates and performance of value, as shown in the chart below which plots the rolling five-year monthly correlation of the Fama-French value factor returns for the US with the contemporaneous change in the US 10-year Treasury yield. The paper also suggests that the difference in duration is much less than investors assume because the growth rate of earnings is only 4% p.a faster for growth stocks than value for five years with most of that coming in the first two years. After five years, there is no excess growth and hence the duration of the growth and value groups are much closer than many investors would assume.

In behavioural terms, this is known as recency bias (a tendency to overweight more recent data over the longer term and hence more statistically significant data) but I think there is also a bit of confirmation bias going on here. Most investors are still very overweight growth and hence want to believe that the peak of the interest rate cycle is in and that rates will now fall, and that this will lead to growth outperforming once again. This seems to be one of the reasons cited for the rebound in growth stocks during July and August. Given that in the seventies, Fed Chairman Volker had to take interest rates to 20% in 1980 in order to curb inflation, it would be a minor miracle if Fed Chairman Powell could carry off the same trick with inflation at 9% and interest rates at 2.5%.

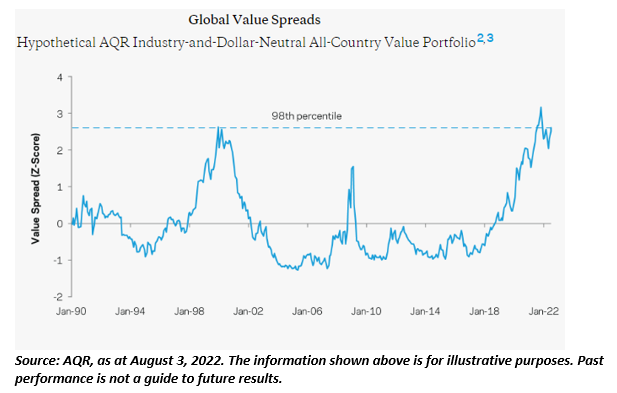

This means that the recent rebound in growth stocks is offering investors who are still overweight another chance to switch into value when the spread between the two is in the 98th percentile (see chart below) i.e. has only been wider 2% of the time. This could be considered one of those ‘if not now, then when’ moments.

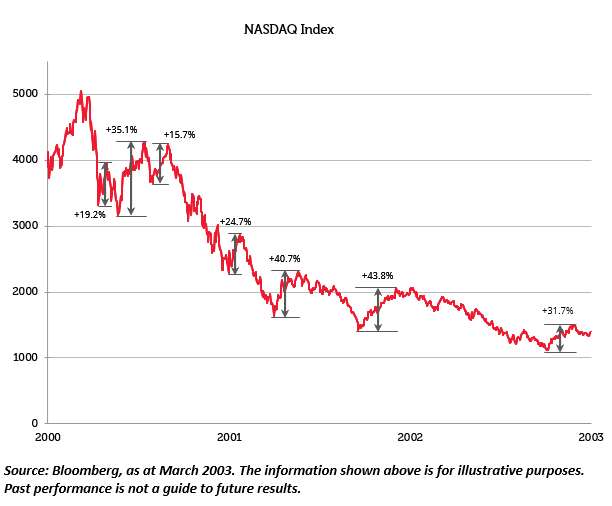

Finally, for those saying that the rebound in technology stocks could be the start of a new bull market, not only does the valuation chart above make that unlikely, but I would also suggest that history is not on their side either. The chart below shows all the rebounds in NASDAQ as it lost 78% in the two years following 2000; two were over 40%, four were over 30%. Each was as an opportunity to exit as I believe the current rally is. Remember that even ‘quality tech’ like Microsoft took 16 years to get back to its 2000 level and I suspect the same will be true of the FANMAG stocks. Personally, I believe it speaks volumes when retail investors are piling back into Tesla, pushing the share price up by 45% in six weeks and back to 75x earnings, and Elon Musk is using it as an opportunity to sell c.$7bn of the stock[3]. My guess is that Elon, rather than the Robin Hood traders, will come out on the right side of this trade and others would be well advised to follow him and use the recent rally in growth stocks to exit.

[1] Is Value Just an Interest Rate Bet? By Cliff Asness, AQR, 11 August 2022

[2] The actual R squared is 0.10.

[3] https://www.bbc.co.uk/news/business-62488144

Key Information:

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.