Here we go again. We had optimistically thought that the withdrawal of central bank stimulus would bring an end to a decade in which fundamentals and valuation counted for nothing and the only game in town was guessing the next move from our monetary central planners. But here we are again. The Russian invasion of Ukraine has brought the macro punters to the fore once again with the bet that high commodity prices will lead to a recession and hence the trade du jour is once more to sell cyclicals at any valuation and buy defensives or ‘quality growth’ at any valuation. Whilst this is frustrating to observe, as the share prices of many already lowly valued companies get cut in half purely because they could be loosely described as cyclical, it is also exciting because it expands the opportunity set of very lowly valued businesses in a world in which many asset classes are still very expensive.

This note is not saying that oil at $120 isn’t going to be a challenge for the world economy, it obviously will be. We would also observe that the data is starting to show a sharp slowdown, for instance the initial GDPNow estimate from the Atlanta Federal Reserve for the first quarter of 2022 was 0.9 percent on February 4 and has now been revised down to 0.0 percent. The point we seek to make is that even a sharp economic contraction may have very little impact on the long-term intrinsic value of a sound business providing it is adequately capitalised and hence over-reaction to this creates potential opportunities for long-term investors. This appears to be happening today as investors over-react to short term economic data and value businesses on low multiples of their expected trough earnings.

We believe that our ability to add value as investors results from the fact that we focus on where we think a company’s profits are likely to be in the long term (defined here as five or more years), whilst many other investors will typically focus on short-term earnings momentum (often the next quarter). We try to always remember that when we buy equity in a company, we are buying a share of a very long-term stream of cashflows and that the reduction in one or two years of those cashflows does very little to alter the long-run intrinsic value of the business.

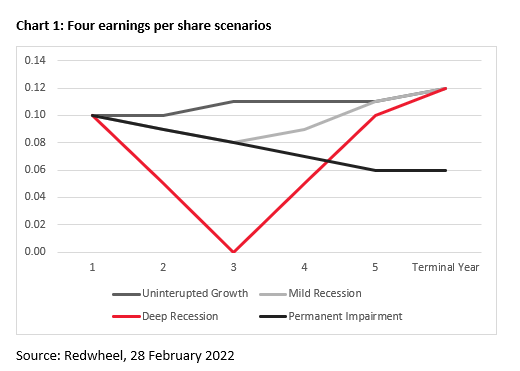

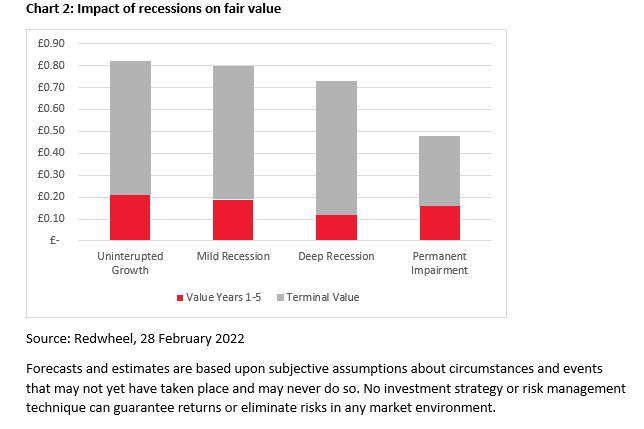

This can be demonstrated using a simple net present value (NPV) analysis, which allows us to see the current value of a company’s future earnings in different scenarios. Below we have simulated different types of earnings declines (chart 1) and noted their impact on the NPV (chart 2). The basic point to note is that, if a short-term earnings decline does not impact the long-term earnings power of the business, it should have relatively little impact on the intrinsic value of the company. Even the deep recession scenario, which halves the company’s earnings in year 2 before taking them to zero in year 3, only reduces the NPV from 82p to 73p, a reduction of 11%. It is only in scenario 4 (permanent impairment) where the earnings are unable to recover to pre-recession levels that the difference is notable.

Despite this, many investors have a tendency towards extrapolation, over-confidence and over-reaction to short-term news flow and earnings trends. For instance, if a company suffers a short-term earnings setback, some investors will often extrapolate this into the future and will over-react by selling the shares and potentially driving the price well below the intrinsic value of the business.

The Value Opportunities

The ‘In for Free’s’ are back

As many readers will know, during the last indiscriminate sell-off in the summer of 2020, we identified a group of stocks that were so cheap that one part of the business accounted for more than the value of the entire group and hence the rest of the businesses were ‘in for free’. The attraction of these opportunities is that it provides a margin of safety since you are getting ownership of businesses that you are paying little or nothing for. Our original note ‘In for free’ explored this topic and the update to this can be found here.

Following the recent sell-off of cyclicals, these opportunities have re-emerged as the following examples show.

Royal Mail

Having peaked at over £6 in the middle of last year, the share price of Royal Mail has fallen by 45%. As we noted in our original analysis, Royal Mail owns a European Parcels business called GLS which made revenues of £4,040m in the year ended March 2021 and Operating Profits of £358m. Even if we valued these historic profits on a low multiple of 10x, the value of GLS would be £3,580m and today the market cap of the entire Royal Mail Group is £3,200m. Thus, the UK business which last year generated £8.7bn of sales and £344m of operating profits is being valued by the market at less than zero. The group trades on 6x March 2022 forecast earnings and has a dividend yield of over 7%. In addition to that ordinary dividend, however, the group are paying a special dividend of £200m and a share buyback of £200m. This £400m divided by today’s market capitalisation of £3.2bn is 13% which added to the ordinary dividend of 7% gives a total payout of 20%. As I write this, a sell-side analyst has moved his recommendation on the shares to ‘sell’ and taken another 5% off the share price. In our opinion, this sort of behaviour should be labelled ’speculation’ rather than ‘investing’.

Data source: Redwheel, Bloomberg, 02 March 2022

Marks & Spencer

The share price of Marks & Spencer has fallen by 45% year to date as investors have become concerned about the impact of an economic slowdown on the business and has left the shares trading on 6x this year’s earnings forecast. But looking at the valuation in more detail, we believe the enterprise value of the business is £2.8bn once we adjust for the value of their stake in Ocado (market cap of £3.2bn plus £1.1bn of debt). The food retail business of Marks & Spencer is forecast to make £290m of operating profits in the year ended March 2022 and even if we value this on the 10x multiple of a less profitable food retailer such as Sainsbury, we get a value of £2.9bn. Hence the market now places no value on the international business which we estimate to be worth over £1bn and no value on the Clothing and Home Business which is forecast to make operating profits of £275m in the year ended March 2022 and which should therefore be worth in excess of £2.5bn. If we do place reasonable values on these businesses, we can easily get to an intrinsic value over 300p which is double today’s share price.

Data source: Redwheel, Bloomberg, 02 March 2022

Currys

Currys has a very strong electrical retail business in the Nordic region called Elkjop which has 27% market share and made operating profits of NOK1.7bn (£151m) in 2021. Putting this on 10x would value this business on its own at £1.5bn versus the market capitalisation of the entire group of £1bn thus putting a negative value on the UK electricals business. The latter has 26% market share in UK and Ireland electrical retailing and with c£6bn of sales should be capable of making £180m of operating profit at a 3% margin. The group is targeting £250m of sustainable free cash flow by 2023/24 which would represent 25% of the current market cap. The company are expecting to pay £35m in ordinary dividends in the next twelve months in addition to £75m buyback which combined is over 10% of the current market capitalisation.

Data source: Redwheel, Bloomberg, 02 March 2022

The Cash Machines

Energy Sector

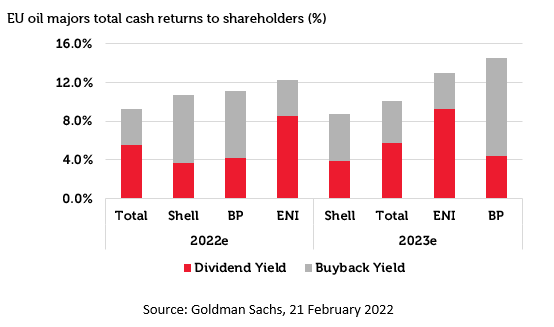

We have previously articulated our thesis on the energy sector where we believe that too much capital has been taken out of the industry thus creating a tightness in supply which will drive up energy prices and subsequently the cash flow of the energy companies. This fragile situation has obviously been exacerbated by the situation in Ukraine with the net result that oil prices are now above $120 per barrel. Even at $70 oil prices, the energy companies had indicated they would generate free cash flow that equated to approximately 15% of their market capitalisation but at current levels that would equate to over 20% (were these prices to be sustained). This prodigious cash flow is being returned to shareholders as the chart below shows; the average cash return across the energy stocks that we are invested in is over 10%.

Data source: Redwheel, Bloomberg, 02 March 2022

Anglo American

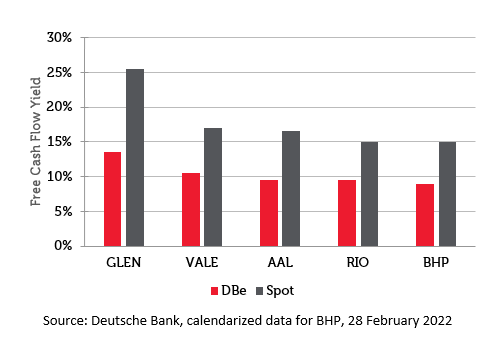

In the year ended December 2021, Anglo American generated $9.6bn of free cash flow and returned $6.2bn to shareholders via ordinary and special dividends and share buybacks. The US dollar market capitalisation of the company is $65bn hence the historic free cash flow yield is 15% and the shareholder return was 10%. Whilst free cash flow is forecast to fall to c.$6bn in the current year, this would still represent a nearly 10% free cash flow yield and a dividend of $2.9 per share would give a dividend yield of nearly 6%. These forecasts assume that commodity prices decline from last year’s levels although many are currently at or above last year’s levels. At current spot prices, the free cash flow yield will be above 15% as the chart below shows.

Data source: Redwheel, Bloomberg, 02 March 2022

Aviva

Having spent much of the last two years in disposal and deleveraging mode, the management of Aviva have now laid out plans for how they intend to return surplus capital to shareholders. Aviva will return £4.75bn in total (£1bn buy back just completed, £3.75bn via B share scheme). The dividend policy has been reset to reflect lower share count with dividend per share +40% to 31.5p 2022E and 33.0p 2023E. Whilst the capital return emanates from the disposal of businesses and is therefore now repeatable, the net result is that Aviva is trading on less than 7x 2023E EPS and an 8% 2023E dividend yield whilst the £3.75bn buyback represents 25% of the current market capitalisation of £15bn.

Data source: Redwheel, Bloomberg, 02 March 2022

NatWest Group

The expectation that the energy crisis will lead to an economic recession has caused some investors to flee to safe havens such as government bonds although when a bond yields 6% less than the current rate of inflation one might question how much of a safe haven this really is. This flattening of the yield curve has seen the share prices of the banks decline over recent weeks with, for instance, the share price of NatWest Group falling by 15% in two weeks leaving the market capitalisation at £25bn. As the company is currently over-capitalised (current tier 1 capital ratio of 18% versus a target of 13%) they have pledged to return this surplus capital to shareholders. Analysts at Deutsche Bank estimate this could take the form of on market buybacks (£2bn), directed buybacks (£1.2bn), ordinary dividends (£0.8bn) and special dividends (£1.2bn). Whilst it should be noted that this return of capital is not likely to be repeated every year, this £5bn return represents 20% of the current market capitalisation. The ordinary and special dividend alone would represent 8% of the market cap. The management of NatWest have increased their return on tangible equity targets to ‘comfortably above 10%’ which, when combined with the share count reduction, would produce earnings per share of c35p. This would leave the shares trading on only 5x their potential earnings and at 0.8x tangible book value.

Data source: Redwheel, Bloomberg, 02 March 2022

Conclusion

We are very aware that the situation surrounding Russia and Ukraine is very stressful but would caution that making quick decisions during periods of stress can often be costly in the long term; selling in the middle of the Great Financial Crisis or during the pandemic would be obvious examples of this. Once more it seems that the market is pricing in an economic recession that will result from rapidly rising commodity prices and has driven the prices of some companies that make little sense even if that scenario occurs. Conversely there seems virtually no interest in considering the long-term earnings power of a business nor its intrinsic value. Those of us who focus on the latter seem to be firmly in the minority today and yet we are confident that the extrapolation and over-reaction to short-term news which usually has little or no impact on long term value by other investors is creating considerable opportunities for us to invest in businesses at material discounts to their intrinsic value. The fact that this comes at a time when so many other parts of the stock market are materially over-valued offers a great opportunity to investors looking to shelter from a possible bursting of the US stock market bubble.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part.

Unless otherwise stated, all opinions within this document are those of the Uk Value & Income team, as at 09th March 2022.