A breath-taking one-third of all food produced is lost or wasted, according to the Food and Agriculture Organisation (FAO). Globally, this translates into 1 billion tonnes of food, or a $1 trillion economic loss each year – and accounts for 6-7% of global greenhouse gas emissions. The losses go on: food that is harvested, but subsequently lost or wasted, guzzles about a quarter of all water used by agriculture, and consumes a land mass the size of China in growing space each year.

With 820 million people going hungry every day, this is a truly woeful situation.

Measuring the challenge

Food loss and waste is a complex subject, and it is very difficult to source reliable data. The statistics above are, by the FAO’s admission, only broad estimates. The ‘measure’ element of the Target-Measure-Act approach tries to rectify this data problem. It’s tough. There are many theoretical and technical problems in measurement – should we focus on quantity of waste, or economic value or calories lost? Is food recycled as animal feed waste? Should the avocado stone and peel be included when making loss measurements?

For the sake of definition; food losses occur along the food supply chain from harvest/slaughter/catch up to, but not including, the retail level. Food waste, on the other hand, occurs at the retail and consumption level. Food diverted to other economic uses, such as animal feed, is not considered as quantitative food loss or waste.

Globally, the ambition for reducing food loss and waste is enshrined in the UN’s Sustainable Development Goal (SDG) 12.3. The goal is to, by 2030, “halve per capita global food waste at the retail and consumer levels and reduce food losses along production and supply chains, including post-harvest losses.” It also links into many of the other SDGs, including for example SDG 1 – ‘No Poverty’, SDG 2 – ‘Zero Hunger’, and SDG 13 on climate action. Across the board, the SDGs aim to cut negative human footprints on land, water and carbon, while increasing food security and lessening poverty.

Product waste and loss: not good for business

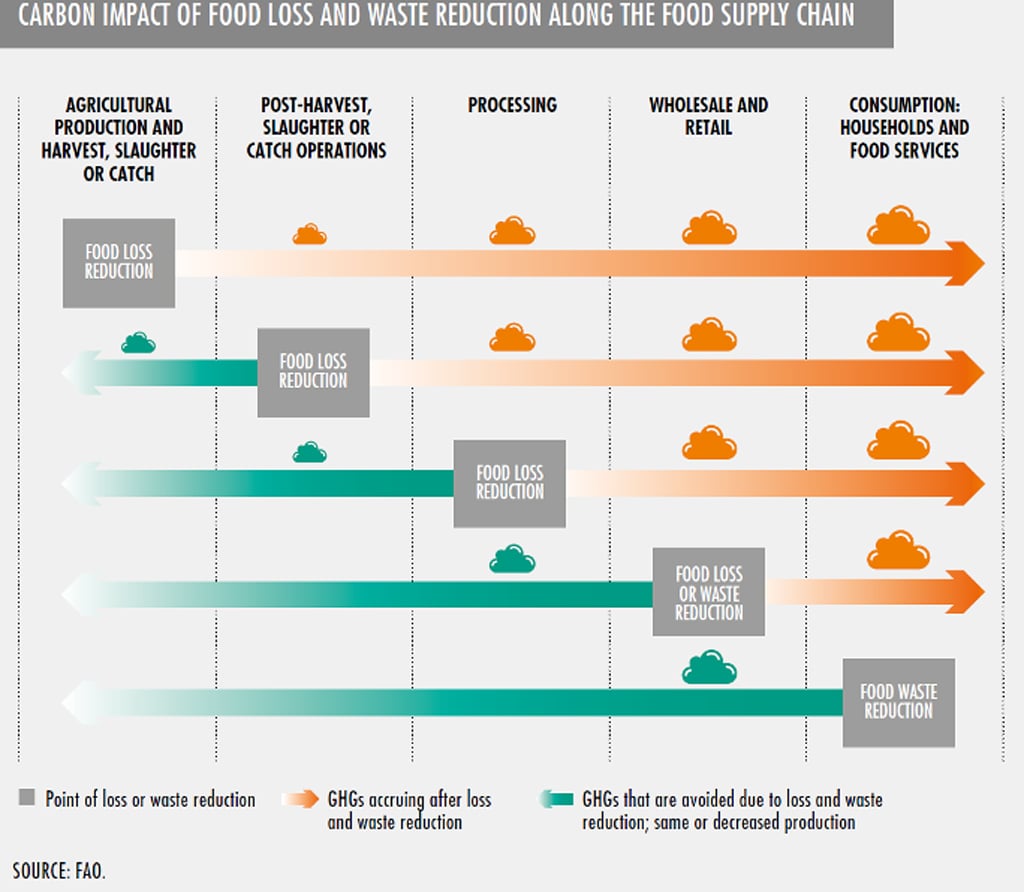

Putting personal views on the immorality of food waste aside, this is a very serious business issue – one that is highly relevant for us as investors in three major UK food retailers. First off, in any business, waste negatively impacts margins. Reducing waste therefore improves profitability. Second, as consumers become ever-more educated on these issues, food waste is bad for a retailer’s brand and image. Third, food losses push up food prices, impacting demand. And finally, waste at the retail end of the food chain has the greatest impact from a greenhouse gas emission perspective. Food that has gone from growing and harvesting, to processing, to potentially chilled store shelves, with transportation in between, has accumulated the maximum amount of emissions for the food chain. Added to the emissions caused by waste from the end consumer, it ramps up Scope 2 and Scope 3 emissions for our investee companies, exposing them to increasing carbon prices and the costs to mitigate emissions.

Our investee companies are focused on meeting the SDG 12.3 goal. All three have committed to halving food waste by 2030 and they have also signed up to the UK-specific Courtauld Commitment 2025.

Tesco is a company demonstrating leadership on the issue. A member of Champions 12.3 (a coalition of stakeholders to driving the agenda to achieve the SDG 12.3 target), it has reduced total food waste by 15% since its 2012/2013 base year. Tesco and Morrisons have tried to tackle the problem of the desire for food products to meet aesthetic standards in terms of colour, shape and size via their ‘Perfectly Imperfect’ and ‘Naturally Wonky’ ranges, respectively. Our three retailers (including M&S) are partnering with numerous charities to redistribute surplus food; these charities include FareShare, FoodCloud, City Harvest, The Bread and Butter Thing and the Felix Project.

Careful how we judge

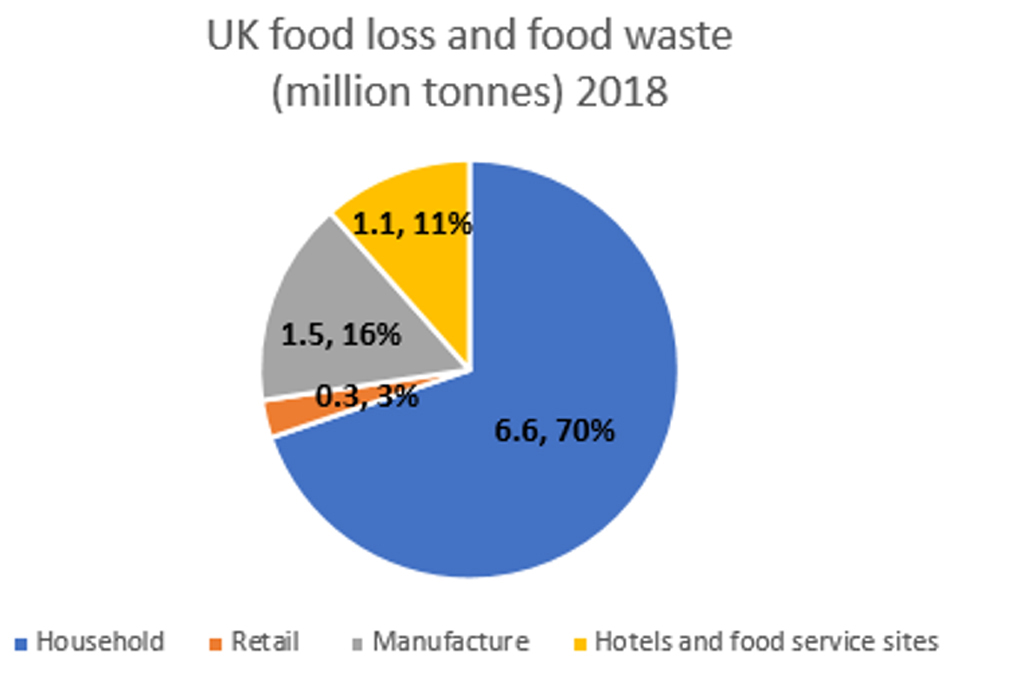

Nevertheless, they continue to contribute to the UK’s approximately 10 million tonnes of wasted food every year. Tesco’s UK operations contributes 41 thousand tonnes of net food waste, after redistributions to charities and recycling of food waste as animal feed. This is an underestimate, as it doesn’t account for waste in the supply chain or by the end customer resulting from retailer behaviour. However, before we get too harsh with Tesco and its peers, the pie chart points to us, the end consumers, as by far the biggest culprits of food waste. We account for 70% of UK food waste post farm-gate; retailers directly account for less than 3%.

The good news is that on a national level, the UK, along with the Netherlands, is leading on the SDG 12.3 goal. The UK has reduced food losses and waste by 27%, so we are over halfway to hitting the 2030 target. Organisations such as WRAP are doing heroic work in driving the agenda. We will support this agenda by encouraging our three food retailers to continue to reduce food waste, and to go faster if possible. As a team and as a firm we are also supporting one of the charities mentioned, the Felix Project, in redistributing surplus food to London-based charities.

This is one of those sustainability issues where we are totally aligned in our fiduciary duty to our investors, and to the interests of wider society. We are aligned with those stakeholders in our local community and globally who want to tackle climate risk, hunger and poverty. Meanwhile, if our investee companies are successful in reducing waste, they will be more profitable, enjoy enhanced brands – and thereby generate more attractive returns for shareholders.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

The term “RWC” may include any one or more RWC branded entities including RWC Partners Limited and RWC Asset Management LLP, each of which is authorised and regulated by the UK Financial Conduct Authority and, in the case of RWC Asset Management LLP, the US Securities and Exchange Commission; RWC Asset Advisors (US) LLC, which is registered with the US Securities and Exchange Commission; and RWC Singapore (Pte) Limited, which is licensed as a Licensed Fund Management Company by the Monetary Authority of Singapore.

RWC may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. RWC seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by RWC are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

This document has been prepared for general information purposes only and has not been delivered for registration in any jurisdiction nor has its content been reviewed or approved by any regulatory authority in any jurisdiction. The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by RWC; or (iv) an offer to enter into any other transaction whatsoever (each a “Transaction”). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party.

RWC uses information from third party vendors, such as statistical and other data, that it believes to be reliable. However, the accuracy of this data, which may be used to calculate results or otherwise compile data that finds its way over time into RWC research data stored on its systems, is not guaranteed. If such information is not accurate, some of the conclusions reached or statements made may be adversely affected. RWC bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction. Any opinion expressed herein, which may be subjective in nature, may not be shared by all directors, officers, employees, or representatives of RWC and may be subject to change without notice. RWC is not liable for any decisions made or actions or inactions taken by you or others based on the contents of this document and neither RWC nor any of its directors, officers, employees, or representatives (including affiliates) accepts any liability whatsoever for any errors and/or omissions or for any direct, indirect, special, incidental, or consequential loss, damages, or expenses of any kind howsoever arising from the use of, or reliance on, any information contained herein.

Information contained in this document should not be viewed as indicative of future results. Past performance of any Transaction is not indicative of future results. The value of investments can go down as well as up. Certain assumptions and forward looking statements may have been made either for modelling purposes, to simplify the presentation and/or calculation of any projections or estimates contained herein and RWC does not represent that that any such assumptions or statements will reflect actual future events or that all assumptions have been considered or stated. Forward-looking statements are inherently uncertain, and changing factors such as those affecting the markets generally, or those affecting particular industries or issuers, may cause results to differ from those discussed. Accordingly, there can be no assurance that estimated returns or projections will be realised or that actual returns or performance results will not materially differ from those estimated herein. Some of the information contained in this document may be aggregated data of Transactions executed by RWC that has been compiled so as not to identify the underlying Transactions of any particular customer.

The information transmitted is intended only for the person or entity to which it has been given and may contain confidential and/or privileged material. In accepting receipt of the information transmitted you agree that you and/or your affiliates, partners, directors, officers and employees, as applicable, will keep all information strictly confidential. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information is prohibited. The information contained herein is confidential and is intended for the exclusive use of the intended recipient(s) to which this document has been provided. Any distribution or reproduction of this document is not authorised and is prohibited without the express written consent of RWC or any of its affiliates.

Changes in rates of exchange may cause the value of such investments to fluctuate. An investor may not be able to get back the amount invested and the loss on realisation may be very high and could result in a substantial or complete loss of the investment. In addition, an investor who realises their investment in a RWC-managed fund after a short period may not realise the amount originally invested as a result of charges made on the issue and/or redemption of such investment. The value of such interests for the purposes of purchases may differ from their value for the purpose of redemptions. No representations or warranties of any kind are intended or should be inferred with respect to the economic return from, or the tax consequences of, an investment in a RWC-managed fund. Current tax levels and reliefs may change. Depending on individual circumstances, this may affect investment returns. Nothing in this document constitutes advice on the merits of buying or selling a particular investment. This document expresses no views as to the suitability or appropriateness of the fund or any other investments described herein to the individual circumstances of any recipient.

AIFMD and Distribution in the European Economic Area (“EEA”)

The Alternative Fund Managers Directive (Directive 2011/61/EU) (“AIFMD”) is a regulatory regime which came into full effect in the EEA on 22 July 2014. RWC Asset Management LLP is an Alternative Investment Fund Manager (an “AIFM”) to certain funds managed by it (each an “AIF”). The AIFM is required to make available to investors certain prescribed information prior to their investment in an AIF. The majority of the prescribed information is contained in the latest Offering Document of the AIF. The remainder of the prescribed information is contained in the relevant AIF’s annual report and accounts. All of the information is provided in accordance with the AIFMD.

In relation to each member state of the EEA (each a “Member State”), this document may only be distributed and shares in a RWC fund (“Shares”) may only be offered and placed to the extent that (a) the relevant RWC fund is permitted to be marketed to professional investors in accordance with the AIFMD (as implemented into the local law/regulation of the relevant Member State); or (b) this document may otherwise be lawfully distributed and the Shares may lawfully offered or placed in that Member State (including at the initiative of the investor).

Information Required for Distribution of Foreign Collective Investment Schemes to Qualified Investors in Switzerland

The representative and paying agent of the RWC-managed funds in Switzerland (the “Representative in Switzerland”) is Société Générale, Paris, Zurich Branch, Talacker 50,

P.O. Box 5070, CH-8021 Zurich. In respect of the units of the RWC-managed funds distributed in Switzerland, the place of performance and jurisdiction is at the registered office of the Representative in Switzerland.