Anyone who was investing in the period 1997 to 2000 will have their own memories of the extremes of the dot.com madness. For those of us in the UK, one of the defining moments was the IPO of lastminute.com, the first major British internet company, where the share price leapt from 380p to 511p in its first hour of trading, valuing a company with quarterly sales of just £409k at £768m. Two weeks after listing, the share price had dropped to 270p and by Monday, 17 April 2000, lastminute.com was trading at 30% of its flotation price. The story of Boo.com was told in the book Boo Hoo: A Dot.Com Story from Concept to Catastrophe. The company launched in the autumn of 1999 selling branded fashion apparel over the Internet and spent $135m of venture capital in just 18 months before being placed into receivership on 18 May 2000 and liquidated. In the US, older investors will remember Webvan which raised $375m when it went public in 1999, valuing it at almost $5bn and was bankrupt two years later or Pet.com which went public on NASDAQ in February 2000 and raised $82.5 million but was bankrupt by November of the same year.

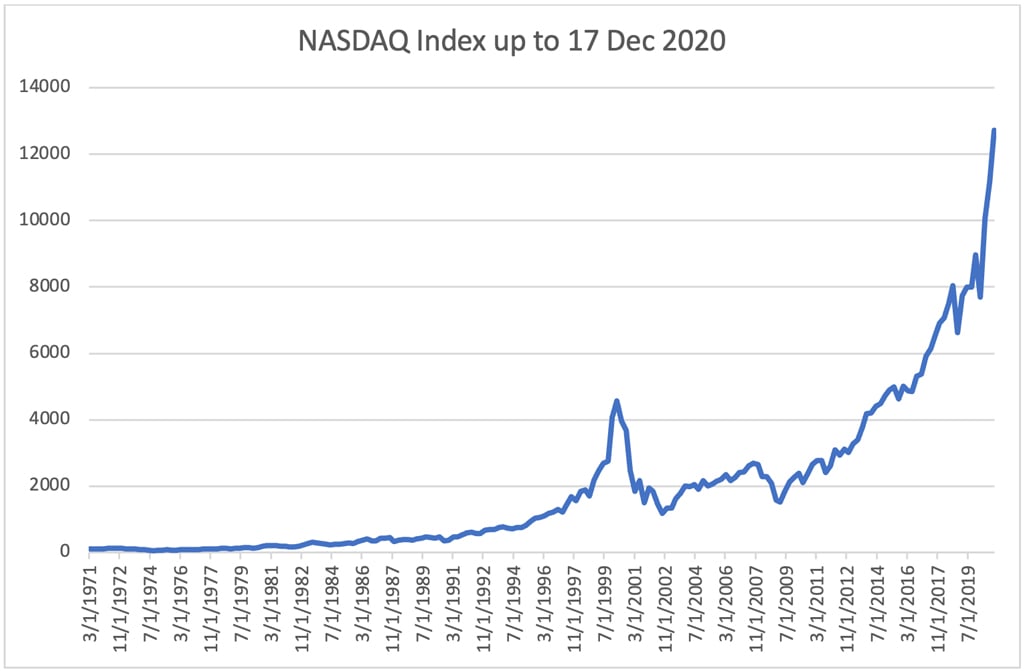

Source: Bloomberg 17 December 2020. Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested

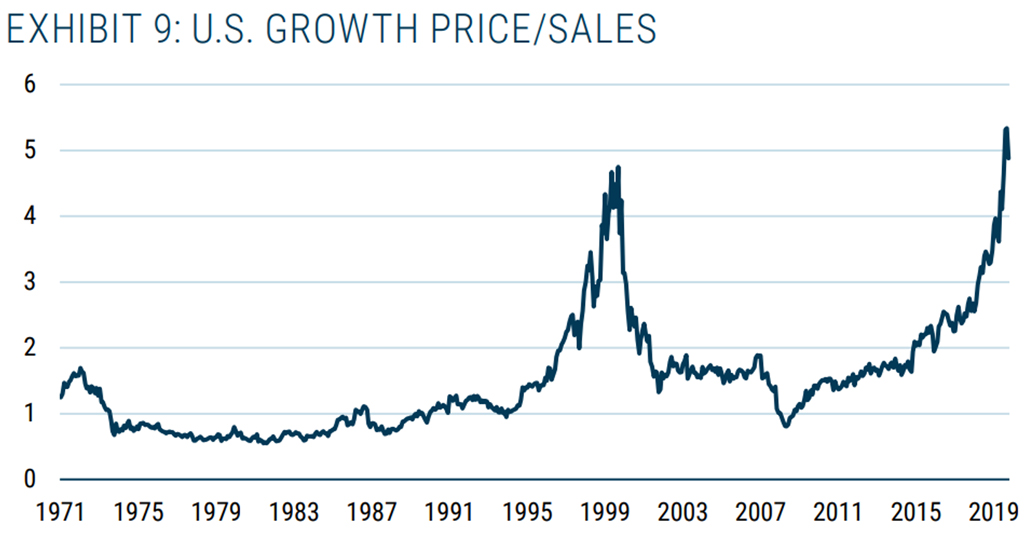

Sources: GMO, Worldscope, Compustat, MSCI. As of 30 Sep ’20. Note: Valuation ratios calculated using a weighted median.

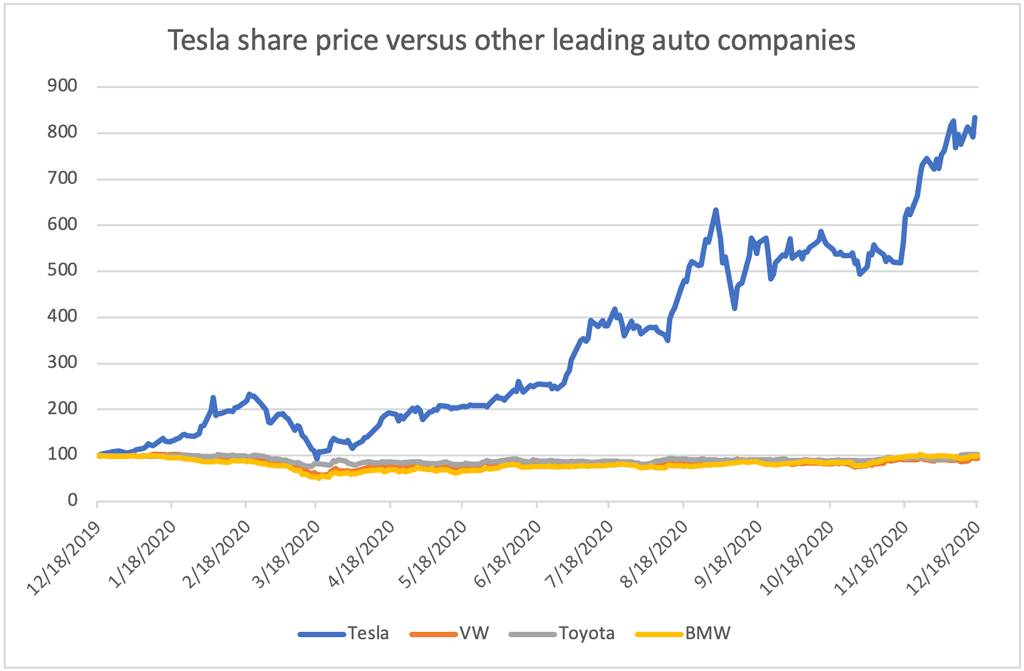

Tesla

Sources: Bloomberg 17 December 2020. Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested.

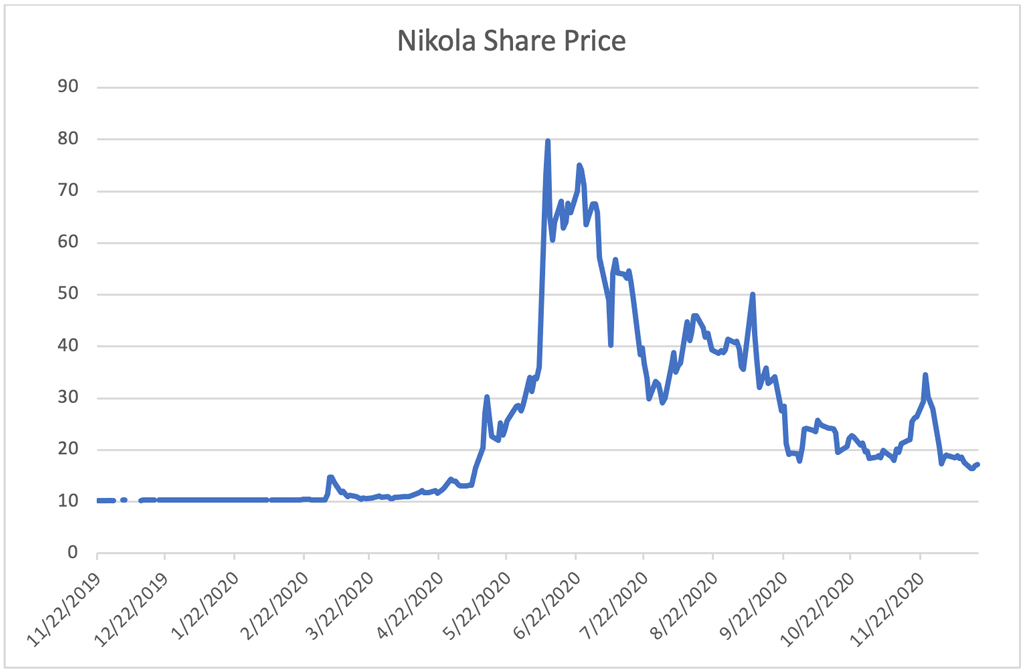

Sources: Bloomberg 17 December 2020. Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested.

Other signs of excess in growth stocks[4]

- DoorDash, a food delivery app with several deep pocketed competitors, $1.9bn in revenue in the first nine months of 2020 and $149m in losses rose 85% on its first day to hit a valuation of over $70bn.

- Airbnb, which had revenues of $2.5bn and losses of $697m in the first nine months of 2020 went up 112% on its first day. The company now has a valuation of $89bn which is 20x forecast revenues for 2021 of $4.5bn.

- C3.ai, a software company that lets businesses create artificial intelligence applications and has a handful of large clients, rose by 200% in its first three days and is now valued at $12bn which is 75x last year’s revenues of $157m

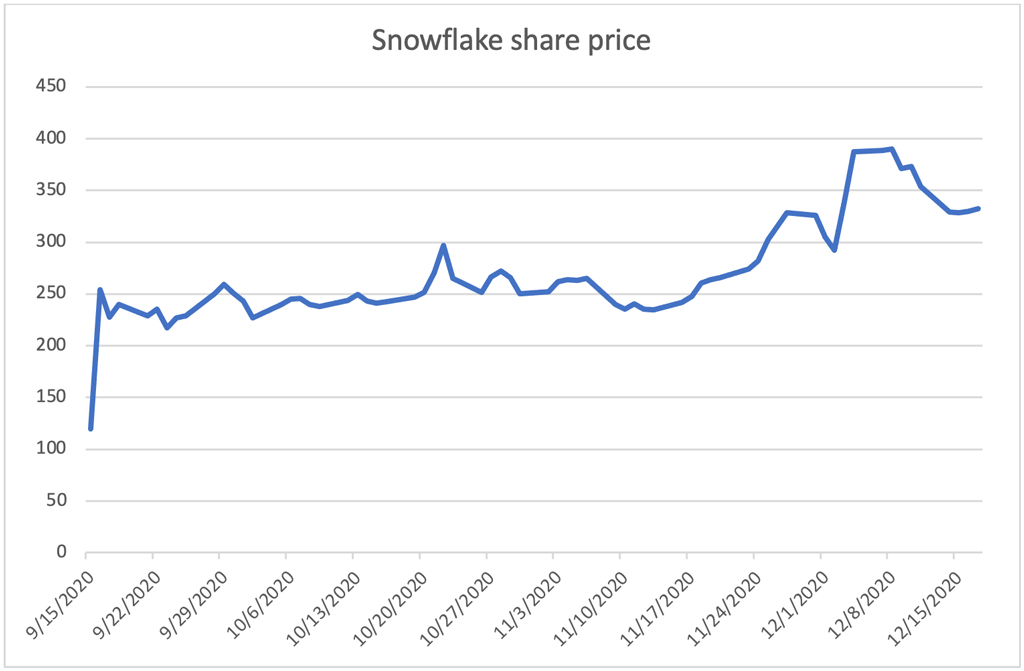

- Snowflake Software company, Snowflake, now trades at 155x forecast revenues for 2021 and has a market capitalisation of $92bn. Since the company stated in their prospectus that their total addressable market was $81bn, investors seem willing to believe that they will take 100% of that market (without any concerns from the competition authorities) and then have added on a premium for some other avenue of growth!

Sources: Bloomberg 17 December 2020. Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested.

- Signs of excess in the private markets as well

A recent article in the New York Times highlighted how crazy things were in private markets as well as public:

But as the pandemic spread and more people held virtual events, Hopin’s business took off. Unsolicited offers from investors started pouring in. “It’s like a drumbeat,” Mr. Boufarhat said. “That’s become the new way for investors to tempt founders.”

In June, Hopin raised a fresh $40 million from venture capital firms such as Accel and IVP. Last month, without even building a formal presentation, the company garnered a further $125 million, valuing it at $2.1 billion — a 77-fold increase from a year ago."

New York Times, 7 Dec 2020

[1] Tesla, the Largest-Cap Stock Ever to Enter S&P 500: A Buy Signal or a Bubble? By Rob Arnott,Vitali Kalesnik,Lillian Wu December 2020.

[2] Value: If not now, when by Ben Inker and John Pease, GMO, Dec 2020.

[3] Value: If not now, when by Ben Inker and John Pease, GMO, Dec 2020.

[4] The following bullet points are sourced from Bloomberg 9th December 2021.

The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of RWC Partners Limited. Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. This article does not constitute investment advice and the information shown above is for illustrative purposes only and should not be construed as a recommendation or advice to buy or sell any security. No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment