We have long described the equity market as a Taylor Swift market– shake it off shake it off. Good news, bad news, no news the market kept rising inexorably as a consequence of Quantitative Easing, zero interest rates and a Fed whose only apparent concern has been to underpin the market – always. This phenomenon, almost 15 years old, has led to excess. It seems clear to us that the party is now potentially over.

The market is arguably now more like the Garbage song – ‘I’m only happy when it rains’. Only bad news will do, as it is only bad news that brings an end in sight to inflation and rising interest rates. As a line from the song says – ‘Wanna hear about my new obsession, Getting high upon a deep depression’.

As we have seen, the market is rallying on bad news and, with each rally, the bad news is seen as the end of the bear market. However, history teaches us some pertinent lessons when bubbles burst. Most notably, the majority of the largest and fastest rallies in the market tend to happen during a bear market.

Bubbles also tend to burst in stages. The initial sell-down, for example, is regarded as a healthy correction, necessary for revitalising the party again. ‘Buy the dip’ remains the mentality and this is where we are today, we would argue. Much of the froth has been removed. The zero profit, zero cashflow and, quite unbelievably, some zero revenue businesses, previously valued at many billions of dollars, have been rightly pummelled.

However, with the next phase comes the downgrade cycle as economic reality bites. This has barely begun, but we expect inflation and rising rates to slow growth and eat into corporate earnings. This could lead to another down draft as valuations become unappealing as earnings and cashflows disappoint.

The final stage of the bear market is capitulation as flows reverse and we encounter forced selling as, for example, hedge funds/investment businesses close. The capitulation phase is normally precipitated by outside events e.g. the housing market precipitated the last bear market during the global financial crisis. We are not certain this phase ultimately materialises, but we would argue that, should it do so, it may well be the result of the combination of record levels of corporate debt and rising interest rates.

Another lesson from history is that whatever leads the market into the excesses of the bubble almost never leads it out e.g. the nifty fifty, the tech bubble and the financial crisis. So, despite the mindset of when to move back into tech/ARK, we would argue the key question is what will be the next area that takes us forward once through the bear market?

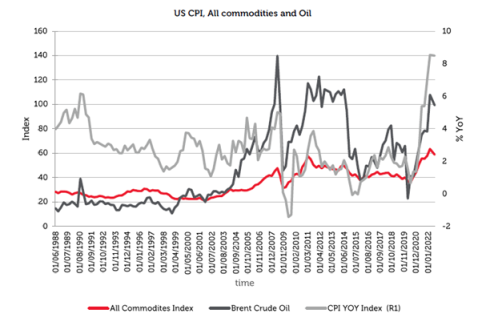

The answer essentially comes down to inflation. It is inflation which is currently dictating how central banks must act giving them no choice but to sacrifice all else – growth and asset markets.

Source: Bloomberg, 8 June 2022.

Past performance is not a guide to the future results. The information shown above is for illustrative purposes only.

Whether inflation is temporary or structural is far from certain, but we would argue that the balance of probabilities is tipped in favour of the latter. This is based upon the notion that the effect of, and the response to, the pandemic has meant that all commodities have generally been rising. These widespread pressures increase the likelihood of inflation being higher and for longer, thus seeping into many other areas, ultimately wages. At the corporate level we note that the effects of inflation are being felt across almost all sectors.

Inflation will likely drop in the second half of 2022 simply from the lapping effect, but it is unlikely to return straight back to 2%. Sanctions from the war will remain, re-shoring will continue, and ESG and climate investments should put pressure on costs. As a result, we would argue that the age of minimal inflation has now passed and that, settling in the region of 3-4%, inflation will be higher for longer.

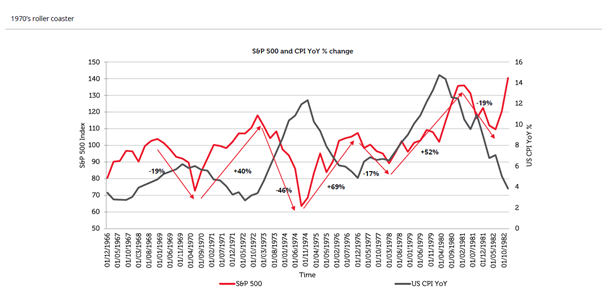

The return of inflation means higher volatility in equity markets. The following table profiles the 1970s rollercoaster.

Source: Bloomberg, 8 June 2022.

Past performance is not a guide to the future results. The information shown above is for illustrative purposes only.

The 1970s demonstrates that when inflation has returned, it is hard to put back in the bottle.

We see inflation coming in waves, ranging from 3% to 14%. Market volatility followed, though ultimately going sideways, for much of the decade. That is until 1979 when Volcker and the rain finally arrived.

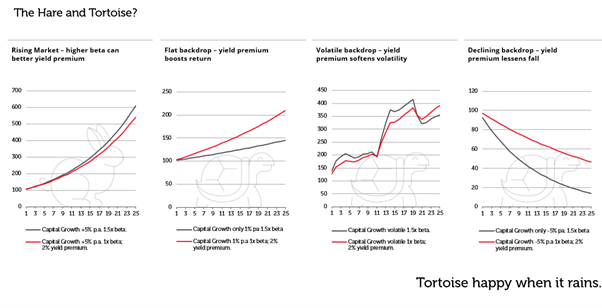

So what works in a volatile market – the hare or the tortoise?

Source: Redwheel, FLPA/REX/Shutterstock;A-Zanimals.com

Past performance is not a guide to the future results. The information shown above is for illustrative purposes only. No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment

Not the hare anymore. The hare and its 1.5x beta has been winning the race for as long as the tenure of most market participants. However, the hare only dances to Taylor Swift and upward-only markets. The tortoise is far happier when it rains i.e. in flat, volatile or down markets. Compounding a yield premium to the market whilst matching the market is far more appropriate.

As is being able to suffer in an inflationary backdrop. Dividend growth, which has historically been able to match CPI over time, is an excellent tonic. And, so far this year, we are seeing this dynamic play out as companies we own increase their dividends at levels which will help suffer a more permanent inflation backdrop. This is achieved by putting up prices and growing nominal profits.

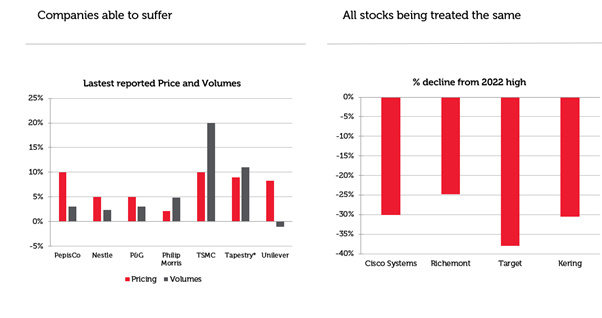

A wide variety of areas in the portfolio are demonstrating such ability. For example, we are seeing this in the case of staples stocks – PepsiCo, Nestle and P&G. Tobacco has always put prices up but we are now seeing volume growth from new generation products. Unsurprisingly, monopoly-type businesses such as TSMC and Qualcomm are also able to suffer inflation through passing on price increases, as are luxury goods companies Tapestry, Richemont and Kering.

With bear markets, however, the largest opportunities come as bear markets dramatically shorten time horizons. With shortened time horizons, the temporary and the structural are regarded as the same. In particular, despite most of our holdings demonstrating a clear ability to flourish in inflationary conditions, some are being treated in the same way as manifestly inferior businesses.

Source: Bloomberg, 8 June 2022. *Tapestry numbers based upon Coach N. America

Past performance is not a guide to the future results. The information shown above is for illustrative purposes only.

By way of example, Target, the US discount retailer, has suffered from a wave of earnings downgrades as it struggles to pass on rising costs. Yet, the fund’s holding in Richemont, whose cashflows are dominated by Cartier, has suffered almost as badly. Cartier is perhaps the pre-eminent luxury brand in the world whose goods sell for $10000 per item on average. The issue here is not its ability to pass on inflationary pressures.. We believe, concerns are centred on Chinese consumers being locked down (a temporary issue) and Russian oligarchs being sanctioned (immaterial in the grand scheme of Cartier’s long term earnings power).

It is this confusion surrounding the temporary with the structural, brought about by shortened time horizons, which makes us genuinely excited by the outlook for stock-picking in an era of higher inflation and interest rate volatility. And, where the tortoise rather than the hare is more likely to win the race…

Key Information:

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.