Ernest Hemingway famously wrote in The Sun Also Rises – “How did you go bankrupt?” “Gradually, then suddenly”.

Silicon Valley Bank (SVB) had been a poor stock performer for over a year until Thursday 9th March. Then within 24 hours it had gone bankrupt, the shares halted on Friday afternoon, 10th March and the bank was taken over by administrators.

It is a timely reminder that certain business models are always fragile, but that the market frequently forgets this. Banks particularly fall into this category.

During the period of Quantitative Easing (QE) and ultra-low interest rates Zero Interest Rate Policy (ZIRP) and a lack of any economic or financial cycle, many investors had become conditioned to overlook a fundamental truth: banking by its very nature is a levered business model. It is exactly how a bank makes money.

However, false comfort had been gained from the narrative that banks today are far less levered than they were going into the Global Financial Crisis of 2008. Hence, they were far more stable and safe, this time round, going into a slowing economic environment and rising interest rate backdrop.

This is focusing on the wrong metric. Banks will always be levered businesses and because of this that they remain fragile to things going wrong. During the 1980’s recession, when bank leverage was lower than many today, c.275 banks went under in the US as per data from the Federal Deposit Insurance Corporation (FDIC).

What causes the problems for banks changes over time, yet the outcome is the same. Traditionally it is loans defaulting that causes the problems, such as corporate loans, mortgages or complex products. This time it is the reliance upon deposits causing the headache.

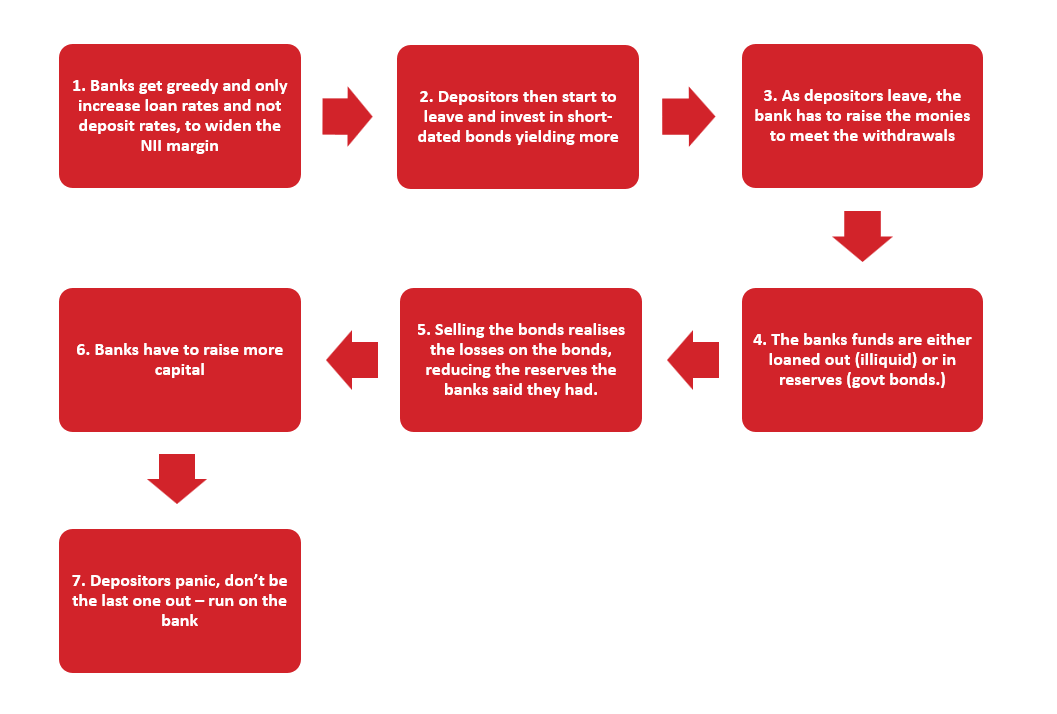

Having lots of depositors earning nothing on their deposits is fine in zero-interest-rate policy (ZIRP). The Banks then lend out these deposits to make its profit. The problem though, has been that the lending by the banks happened at low rates and thus profits have been low (Net Interest Margin – NII). Therefore, when interest rates start rising, we see a series of events occur:

Source: Redwheel as at 31 March 2023. The information shown above is for illustrative purposes.

This is essentially what happened at SVB. [1]

• SVB was the 18th largest bank in the USA. It is the second largest bank to go bankrupt in US history.

• SVB had $209bn of assets, $175bn of deposits from not many customers.

• Had grown the loan book by $198bn from 2019 to Q1 2022

• It was 13x levered.

• It had unhedged positions in Government bonds and mortgage back securities intended to be held to maturity in its capital reserves.

• Depositors withdraw $42bn in two days.

• Couldn’t meet the withdrawals so had to sell bonds, which forced a realisation the losses on them due to the rising interest rate backdrop.

• So then tried to raise $2.25bn in new shares to re-build the capital hit – which failed.

• caused a run on the bank.

• 95% of the customer’s deposits fall outside the insured limit of $250,000 per client.

• US Govt has now fully backed all deposits

What are the lessons to learn from all this?

Firstly, it is a timely reminder that banks are fragile businesses. In the Redwheel Global Equity Income portfolio, we have been underweight in banks precisely because we view them through a capital-intense lens. Remember, although the reasons change, the outcomes are the same when things go wrong. Thus, given where we are in the cycle currently – removing quantitative easing (QE), increasing interest rates, inflation being more stubborn, and slowing economies desired – the potential for things to go wrong is high.

Further, it is worth remembering from the GFC that government help for banks doesn’t come for free. Standing behind depositors is not something the US government can do for all deposits nor indefinitely. This would simply increase further moral hazard and break an already heavily indebted government. More regulation will follow. Greater control and influence over banks from governments has never been shareholder friendly.

Stepping back a little, banks survive because of trust. That trust cannot be underwritten by governments, it should be inherent to the industry itself. Such trust keeps being eroded with each passing cycle, and history (Asian crisis, Japanese crisis) points to banks becoming utility-like in their structure.

Finally, it is further evident, that as the world is taken off the dependence of QE and ZIRP, the rehabilitation process will be painful and volatile. This is simply a return to normal investment conditions but feels very different given how addicted markets had become to the abnormal period of QE. The way to generate wealth over time is changing the mindset back to slow growth, through not losing monies on the downside from the get rich, make more money on the upside environment. This is suited to the manner in which Redwheel’s Global Equity Income fund looks to build total return for its clients.

Sources:

[1] Bloomberg, as at 13 March 2023

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.