The concept of Artificial Intelligence (AI) has been around for a while, but is it finally ready to be the Next Big Thing?

Over the last 12 months, the release of a large language model to the public (ChatGPT) and a material uplift in Q2 2023 guidance from chipmaker Nvidia based on demand from AI applications has spurred many stock prices higher. In the case of a few companies, dramatically so.

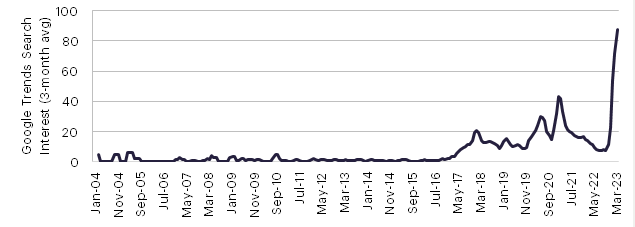

The chart below shows the uptick in Google searches for the term “Artificial Intelligence” – clearly, there are many questions about the impact that AI might have on the economy and for workers, both good and bad. Could the rise of AI justify higher stock prices now, and could there be more to come – or is recent optimism unfounded?

Source: Google, as at March 31st 2023. The information shown above is for illustrative purposes.

We will not claim to have all the answers to these questions, but we will explore the background of AI, some of its use cases, and how we think the convertible bond market and individual issuers have and will play a role in AI developments.

What is AI?

AI is a branch of computer science that uses digitised inputs (text, images, numbers) to generate outputs in a way that can simulate human intelligence, using relationships between data to program algorithms for decision-making or answers. For many, AI became familiar from the creation of structured solutions to a known application – for example, programming computers to play chess, but in the past, these efforts required a high degree of human involvement for fine-tuning.

Historical advances in AI are due largely to the exponential increase in computing power with miniaturisation of chips, driven by Moore’s Law and the parallel process capabilities of GPUs*. Along with gains in storage and software programming, faster computational speeds allow researchers to run statistical models on an enormous amount of data collected over the internet, including new data sets. In turn, AI programmers can now model tasks such as image recognition, natural language processing, and computer vision. More computing power also allows algorithms to automatically incorporate new data – a process referred to as ‘machine learning’ – for efficiency gains.

The launch of Chat GPT, a natural language processing tool developed by OpenAI, which allows users to have human-like conversations, has captured worldwide imagination and the fastest ever consumer adoption, reaching 1 million users in only 5 days (source: OpenAI). ChatGPT does more than lift sections of text from a source, it creates new sentences as a response to a user’s input question. While ChatGPT and other large language models are in their early stages, replication of language-based outputs using AI could have a significant effect on economic growth, especially if they can broaden task automation or enhance search capabilities.

Including other use cases for AI – such as autonomous vehicles and facial or image recognition – this field could create a profound change in business models, potentially creating new winners and categories, while disrupting some existing models. For investors, being able to successfully navigate through this environment and picking the winners won’t be an easy task – just ask those investing in internet stocks in the late 1990s. Most had successfully predicted the huge impact the internet would have in the future, but many companies that were market darlings and were seen as winners ultimately failed to live up to the early promise.

Investing in AI - using convertibles

In our analysis, we currently split AI beneficiaries in three broad categories. The first group includes companies directly making hardware or software (‘Building Blocks’) used for AI development. The second group are those companies using AI to enable change in an industry or for their customers (‘Transformative Potential’). The third group consists of companies using AI to enhance customer experience and interactions (‘Personalised Product Offerings’).

The analysis is by no means exhaustive, but we see it as a good starting point for investors to look at the opportunity set. Our view included a look at some of the largest ETFs focused on AI and robotics, as well as reviews of individual companies and sectors. We have also included a glossary of some of the key terms needed to understand the businesses of these companies.

Building Blocks

- GPU Manufacturers – Nvidia and AMD

- CPU Manufacturers – Intel and AMD

- Foundries – TSMC, Samsung

- DRAM Manufacturers – Hynix, Samsung, and Micron

- Equipment suppliers – ASML

- Hyperscalers – Amazon, Microsoft, and Google

Transformative Potential

- Search and personal assistant – Google, Microsoft, Facebook

- Self-Driving – Tesla, Google, GM, Ford

- SaaS companies – large productivity benefits across the whole industry –Salesforce, Oracle, MongoDB

- Biotech – AI could enable faster drug discovery – Pfizer, Alnylam Pharma

Personalised Product Offerings

- Online marketplaces – Amazon, eBay, Facebook etc.

- Travel – Booking.com, AirBnb, Expedia etc.

- Food delivery – Uber, Delivery Hero, HelloFresh etc.

Source: Redwheel, as at 31st May. No investment strategy or risk management technique can guarantee returns or eliminate risks.

Of course, there is no reward without risk, and stock prices today may not reflect the reality of tomorrow. We think that convertible bonds can help by allowing for upside participation in the theme but with downside protection from volatility and uncertainty.

The asset class has long been favoured by technology companies as the vehicle of choice to raise capital to make productive investments or re-investments. We also see that demands for investment in AI development can be well-suited for financing with a convertible bond, given a multi-year payoff period and the possibility of high future growth and cash flow from an investment today.

Convertible bonds give these issuers flexibility with a financing tool that can be converted into equity, but at a premium to its stock price at issuance. Convertible investors accept lower coupons than if the bond were a straight corporate bond because they hold a valuable longer-term option to convert; in turn, these lower coupons provide flexibility to the issuer. In case the company’s stock price does not rise during the life of the convertible bond, convertible investors still consider the credit of the issuer and its ability to repay or refinance its debt. Where these two groups meet in the middle is that convertible investors want issuers to reinvest profitably over the life of the convertible and drive value for their share price, rather than simply to repay this debt while earning a coupon.

For each of the three categories, we present a review of one specific convertible bond issuer that we see as being a good representative of the potential impact of AI. We also note other convertible bond issuers within each of the categories.

Building Blocks

Hynix is a DRAM* manufacturer, which along with peers Samsung and Micron, operates in an oligopolistic industry consisting of these three main suppliers, whom have significant scale benefits compared with smaller operators. Hynix should be a key beneficiary from AI because Hyperscalers* require DRAM; the company is also a key supplier of high bandwidth memory to Nvidia. DRAM is at the heart of AI servers, and we see the AI boom driving a large multi-year demand cycle for memory.

Other notable issuers include: Lenovo (computers and peripheral devices), Microchip (microcontrollers and integrated circuits), STM Micro (semiconductors), SOITEC (semiconductors), Lumentum (opticals for semiconductor manufacturing).

Transformative Potential

Microsoft – the firm needs little introduction: under CEO Satya Nadella, the company has successfully transformed itself into a leader in AI across various parallel uses. Three of its largest segments stand to benefit from emergence of AI. Azure, Microsoft’s data centre product, is playing a fundamental role as a building block with AI, as the percentage of cloud spend is expected to pick up meaningfully in the next three years. The company has started integrating AI into its productivity suite such as Office 365, allowing Microsoft to add a premium tier to its current offering. Finally, Microsoft’s 50% stake in OpenAI offers transformative potential in the search business.

Other notable issuers include: SaaS vendors, Kingsoft (AI in products), Tesla (Electric Vehicles and autonomous driving), and Ford (Electric Vehicles and autonomous driving).

Personalised Product Offerings

Airbnb – one of the most popular platforms for offering and booking homestays worldwide.[1] In a recent interview, company founder and CEO Brian Chesky laid out his vision of AI integration becoming central to how the company’s app works. The company envisions the app becoming almost like the ultimate host, the ultimate concierge. This means leveraging the power of AI to offer a personalised experience for its customers, driving recommendations based on their preferences, choices, and data. Customer services is another area where the company expects AI to drive large efficiency gains by augmenting traditional customer services with AI. For example, customer service agents will be assisted by AI to gain quick access to the relevant sections of one of the 72 user policies: each 100 pages long, helping them resolve queries faster and cutting down training times.

Other notable issuers include: Booking.com, Expedia, Uber, Block, Etsy, Zillow.

Conclusion

We believe that AI is here to stay and many of the companies at the forefront have used the convertibles market for financing, both in the past and now. Because there is no return without risk, convertibles can provide exposure to AI and relevant technologies, with structures which allow for upside capture but with protection on the downside from volatility and uncertainty.

Sources:

[1] Skift, 3rd May 2023, https://skift.com/2023/05/03/interview-airbnb-ceo-on-how-its-service-will-radically-change-with-ai-by-next-year/

Glossary

CPU (Central Processing Unit)

The key processor in a computer that runs most functions, such as logic and arithmetic.

GPU (Graphics Processing Unit)

Enables graphics, visual effects, and video in a computer to be run in parallel with other functions.

Hyperscaler

An extremely large-scale cloud-based data and service provider.

Foundry

Fabricates semiconductors using silicon wafers and integrated circuits. Some foundries are owned by semiconductor companies, others manufacture semiconductors to customised designs by semiconductor designers that are using a “fabless” operating model.

SaaS (Software as a Service)

Typically, a subscription-based business model where users connect to and use cloud-based applications via the Internet, often accessed through web browsers.

DRAM (Dynamic Random Access Memory)

Dynamic RAM is one of the most typical types of semiconductor memory. DRAM generally uses a capacitator to store electrical energy and a transistor to regulate voltage to store data in a memory cell. Using DRAM involves a trade-off between the low cost of units versus the need to recharge the capacitators, which also involves re-writing data to the memory cells (‘memory refresh’). More DRAM available to a computer allows it to run a greater number of computations and processes; advances in power management help to reduce the electricity requires for operation and the memory refresh process.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.