Convertible bonds are an inherently lower duration asset class, owing to the fact that bondholders are long embedded call options, which are positively exposed to interest rates. Furthermore, maturities tend to be a little shorter in nature (typically 3–5-years), which reduces the sensitivity to interest rate changes versus corporate debt.

There is however another component of the asset class which is not in plain sight: exposure to high growth, mid-cap companies that will likely benefit from falling interest rates. We assess how convertible bonds could perform in a range of potential scenarios compared to high yield bonds, in light of this ‘hidden duration’.

The effect of higher discount rates on growth stocks

The convertibles universe is generally skewed towards high growth companies. The value of these companies, calculated as the present value of future cash flows, is typically more sensitive to interest rates, which form the discount rate on future cash flows (i.e., a higher discount rate lowers the present value of future earnings for stocks). Growth companies tend to focus on revenue expansion, often at the cost of delaying profitability and strive to maximise profits at a later stage. Growth stocks depend on cash flows in the distant future that are heavily discounted, hence higher interest rates have a greater impact on their valuations than the companies whose value comes from near-term cash flows.

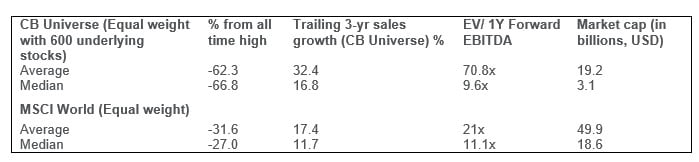

In the table below, you can see the revenue growth for the convertibles universe versus the broader MSCI World. Companies in the convertibles universe have grown their top lines by 32% on average vs. 17% for the broader index.

Source: Bloomberg, as at 17 April 2024. CB Universe is the Refinitiv Global Convertible Index (USD) equal weighted. Calculated as three-year arithmetic average growth of Sales/Revenue/Turnover (IS010, SALES_REV_TURN). The information shown above is for illustrative purposes. Past performance is not a guide to future results.

We recently conducted a study to consider the relative value of convertible bonds versus high yield bonds. This is a comparator we are acutely aware of; with the recent spike in interest rates and the coupons available to investors from high yield issuers, convertibles have suffered in terms of relative performance. But nothing lasts forever and we highlight two scenarios to explain some nuances of convertibles.

“Goldilocks” scenario

We broadly use this term to describe an environment where current economic policy yields positive results: the [US] economy remains on track with steady growth and lower inflation, which allows for market-friendly monetary policy. In this environment, global central banks, particularly the Federal Reserve, will likely cut interest rates in the near-term.

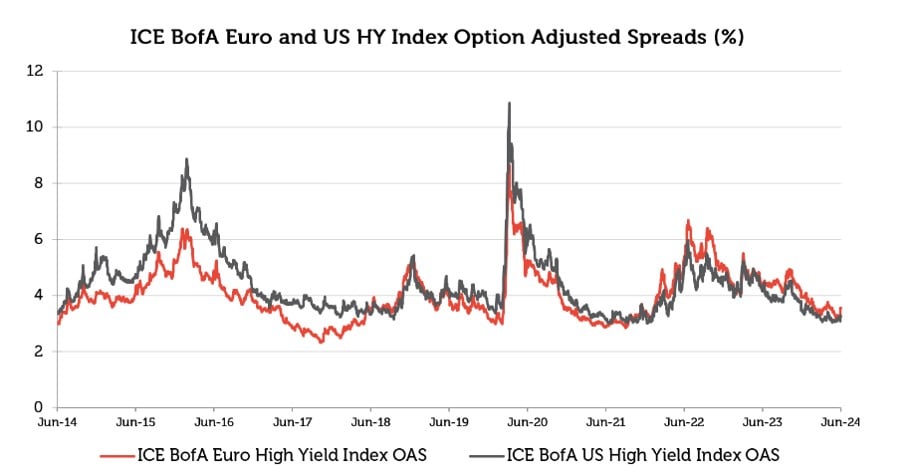

High yield spreads are already very tight – see the chart below – and thus, in this scenario, the main source of return from here would be duration driven.

Source: Federal Reserve Bank of St. Louis, 17th June 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

On the other hand, the majority of the underlying companies into which global convertible bonds convert remain at valuations significantly lower than their highs (see the table detailing revenue growth above). This means that convertible bonds would not only benefit from the duration moves, owing to lower rates (albeit less than straight corporate bonds), but also from the impact this has on underlying company valuations. Thus, convertibles should also stand to benefit from equity participation. This is further emphasised by the fact that convertible bonds are highly exposed to mid-cap and/or growth companies, which are poised to likely benefit from lower interest rates.

“Hard Landing” scenario

In an environment where inflation remains stubbornly elevated – and central banks are forced to hold or increase interest rates – high yield spreads are likely to widen more than for convertible bonds. We find it a little surprising that for now, spreads on US high yield bonds remain tight despite a significant pick-up in distress within the asset class; the dollar volume of defaulted debt rose to over US $33 billion in the first quarter from roughly US $19 billion in the fourth quarter of 2023, according to a report by Moody’s Ratings on 2nd May 2024 [1].

The convertibles asset class benefits from a mixture of investment grade and high yield exposure, lending itself to a lower overall credit spread sensitivity.

In the case of a hard landing, we are likely to see volatility increase, which increases convertible valuations (convertibles are long volatility via the bondholder’s call option) and reduces the relative impact of a potential downturn in markets.

And, returning to duration, convertibles will structurally benefit from overall lower duration versus straight debt due to the embedded call option.

The notorious “Maturity Wall”

In an FT article from August last year [2], Goldman Sachs was quoted as saying “debt maturities [will] jump from US $790bn in 2024 to over US $1tn in 2025, and that is when companies are really going to notice the bite of higher rates.”.

It is no secret that there is a maturity wall approaching and for some issuers, the absolute rate of repayment is going to really hit the bottom line. The form of corporate bond maturities always looks a bit like an unscalable wall when charted, however the difference this time is the sudden move from an elongated period of low-to-zero interest rates to a more normalised rate environment. At the very least, more companies will have to steer more of their revenues to cover the increasing interest expenses. Some fledgling issuers, for example, have only ever known low rates.

We estimate the average tenor of high yield bonds is c. 4-5 years, with the average tenor of 4.3 years for iShares iBoxx HY Corp. Bond ETF [3]. We saw a plethora of growth companies issue bonds in 2020/21 and thus we expect to see a lot of stretched balance sheets when the need to raise capital hits from 2025 onwards. This demonstrates significant refinancing risk for high yield issuers, especially given the amount of leverage some companies amassed in the low-rate environment [4].

Convertible bonds benefit from shorter maturities (typically 3-5 years) and can, to some extent, be seen as a constantly refinancing market.

In terms of our potential exposure to high yield credit events, our Redwheel Global Convertibles strategy has greater than 50% exposure to investment grade-quality issuers and this is something we expect to continue as issuers across the credit spectrum turn to convertible bond markets as a means of lowering their cost of capital (we have seen a greater proportion of investment grade issuance in the last twelve months) [5].

Rate declines will likely favour mid-caps (MSCI World vs MSCI World Mid Cap)

Notwithstanding the fact that the Federal Reserve decided to hold interest rates at its June meeting, the market is still pricing in one cut during 2024 (observed by looking at interest rate futures [6]), with the expectation of additional cuts during 2025. The trajectory and ambition of central banks is for interest rates to plateau at slightly lower than current levels if the inflation environment permits.

Mid-caps have been disproportionately affected by higher rates because their financing needs are generally greater than their blue-chip peers on listed markets. See the chart below which highlights the current dispersion in valuations between MSCI World and MSCI World Mid Cap stocks.

Convertibles have a significant exposure to mid-caps – particularly within the Technology sector – and would benefit from future rate decreases (with a possibility of valuation dispersion between mega and mid-caps narrowing), which we talked about in The Balancing Act.

Source: Bloomberg, as at 13th June 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results. Returns rebased to 100 from June 2021 and expressed as a percentage.

The case for convertibles versus high yield looks compelling from here

In summary, whether we see a softening of interest rates this summer or later in the year, we feel the case for balanced convertibles is compelling. High yield corporate debt has been an undeniably strong source of returns of late, particularly during the initial spike in rates.

However, looking ahead, the maturity wall, deceleration of monetary policy intervention and an uncertain macroeconomic outlook means that the asset class is not without significant – and potentially increasing – risks.

Fundamentally, as balanced convertibles managers, we are long volatility, long mid-cap companies, and long growth. We feel volatility has been subdued, owing to the prolonged period of expansionary monetary policy, unidirectional equity markets and seemingly unlimited liquidity. Some mega-cap valuations look stretched and the dispersion of valuations between mid-cap and large/mega-cap companies has been exaggerated.

However, we are already seeing a shift in sentiment towards valuations as the market refocuses on fundamentals and liquidity/ETF flows abate. Whilst a reduction in interest rates has taken longer than some market commentators anticipated, we believe it is inevitable. It is our conviction that disproportionate beneficiaries will be high-growth businesses whose valuations stand to benefit from a reduction in earnings discount rates.

Overall, with higher coupon levels, a historically “normalised” rate environment and potential pick-up in volatility, balanced convertible investors are being paid to wait and are likely to benefit from pivotal thematic equity exposures such as artificial intelligence, healthcare and energy, to name a few.

Sources:

[1] Source: Moody’s article: US high yield spreads still tight despite pick-up in distress | Reuters

[2] Source: FT article: The notorious wall of maturities revisited (ft.com)

[3] Source: BlackRock, as of 18th June

[4] Source: Goldman Sachs article link

[5] Source: Bloomberg, as of 18th June

[6] Source: Bloomberg as at 13th June 2024

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.