Listed renewable energy companies remain materially undervalued

In early 2024 and again in 2025, we published notes drawing attention to the spate of extraordinary M&A activity in the renewable power sector driven by extremely compressed multiples. With valuations on listed companies often below the value of operating assets, private equity firms have seized the opportunity to acquire several renewable energy companies at bargain prices.

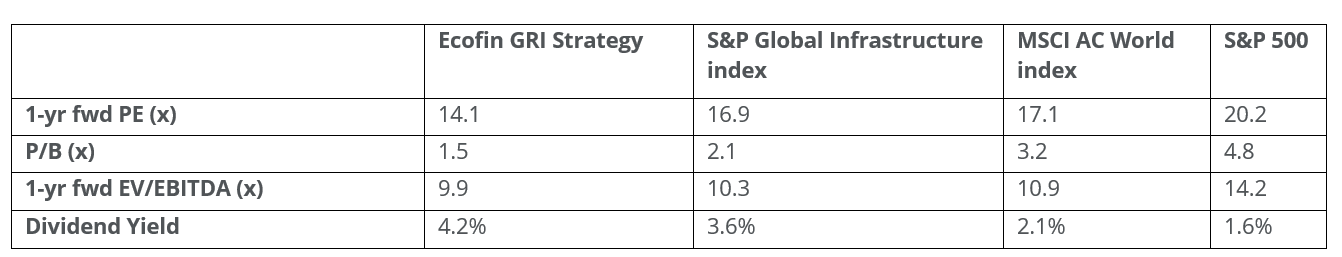

Despite this ongoing activity, valuations remain materially depressed relative to broad equity markets [1]. What’s keeping valuations so low and is an imminent re-rating likely? For a sector that continues to demonstrate robust fundamentals underpinned by increasing demand for clean energy, we argue that current valuations are unlikely to persist.

Recent take-private deals highlight continued undervaluation

We recall discussing the undervaluation of renewable energy companies with Brookfield Renewables. At the time, they were bidding for Origin Energy in Australia, a deal that faced significant hurdles, including the shutdown of coal-fired generation facilities. We suggested that for a similar investment, they could acquire several high-quality European-listed renewable energy companies without the complications of legacy coal assets. These companies offered immediate cash flow from operating assets and attractive project pipelines.

Ultimately, the Origin Energy deal did not materialise. Instead, Brookfield went on to acquire leading French renewables company Neoen at a substantial premium to its prevailing share price [2].

This case is just one of many that underscores the persistent undervaluation in the renewable energy sector and the opportunities this presents for informed investors. For example:

1. ReNew Energy Global in India recently received a non-binding take-private offer from a consortium of investors [3]. These investors likely recognise the disconnect between the company’s valuation and its prospects for compounding growth, improved returns on projects under construction and awarded, and the potential value of its solar panel manufacturing business.

2. Altus Power received a take-private offer from TPG at a 30% premium [4].

3. Innergex received a take-private offer from CDPQ at a 58% premium [5].

Undervaluation persists across the global sector

We believe this disconnect between market valuations and the underlying value of renewable energy companies exists across the global sector. To illustrate, Chart 1 shows the low valuation of our Ecofin Global Renewables Infrastructure Strategy relative to the Global Infrastructure index and broader indices. Moreover, these depressed valuations belie the health of the sector as we project 8.6% and 8.0% EBITDA and EPS growth, respectively for the Strategy in 2025, with similar levels in 2026.

Chart 1: Valuations are low relative to broad indices

Why are valuations so low?

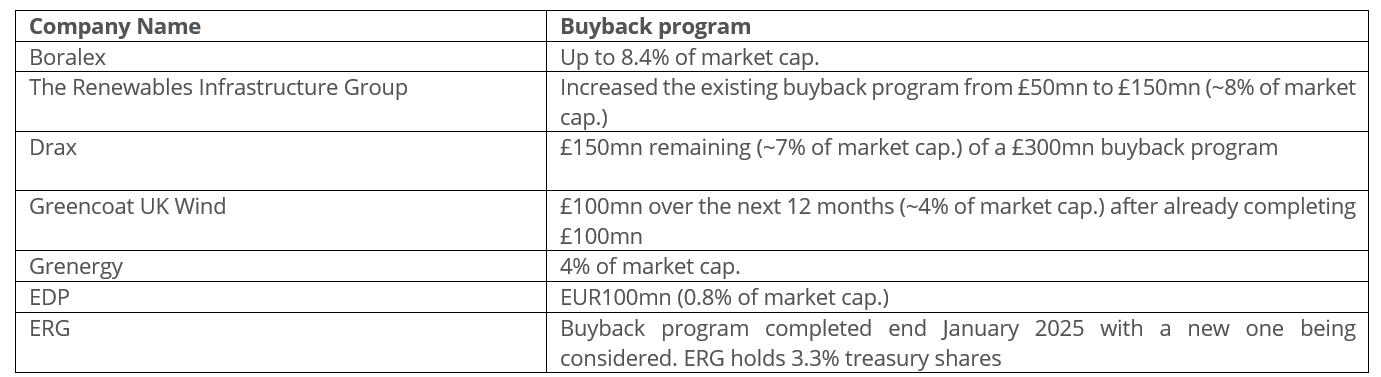

Investors might reasonably ask whether the sector is financially challenged with weak balance sheets. Aside from the US rooftop solar segment that has always been much higher risk (Sunpower filed for bankruptcy and Sunnova has issued a warning about its ability to remain a going concern[6]), credit ratings and the prevalence of ongoing share buyback programs indicate solid balance sheets.

Chart 2: Buyback programs indicate corporate health

However, several factors are contributing to low valuations in the sector:

1. Political uncertainty in the US: The Trump administration’s policies are creating uncertainty for the renewable energy sector.This includes potential changes to tax incentives, import duties on equipment, and overall sentiment towards clean energy.

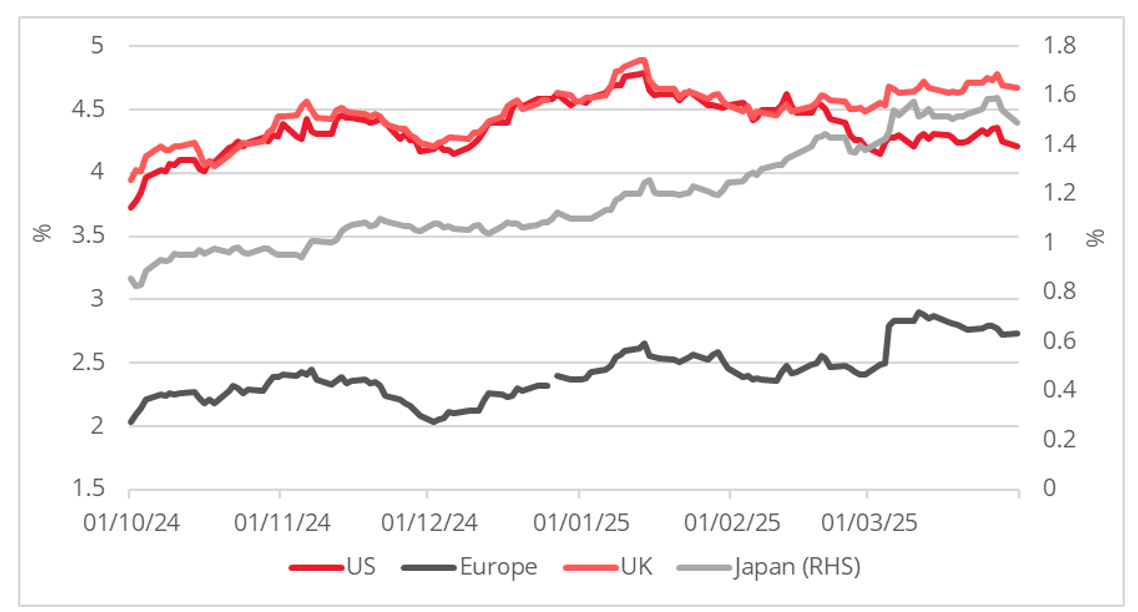

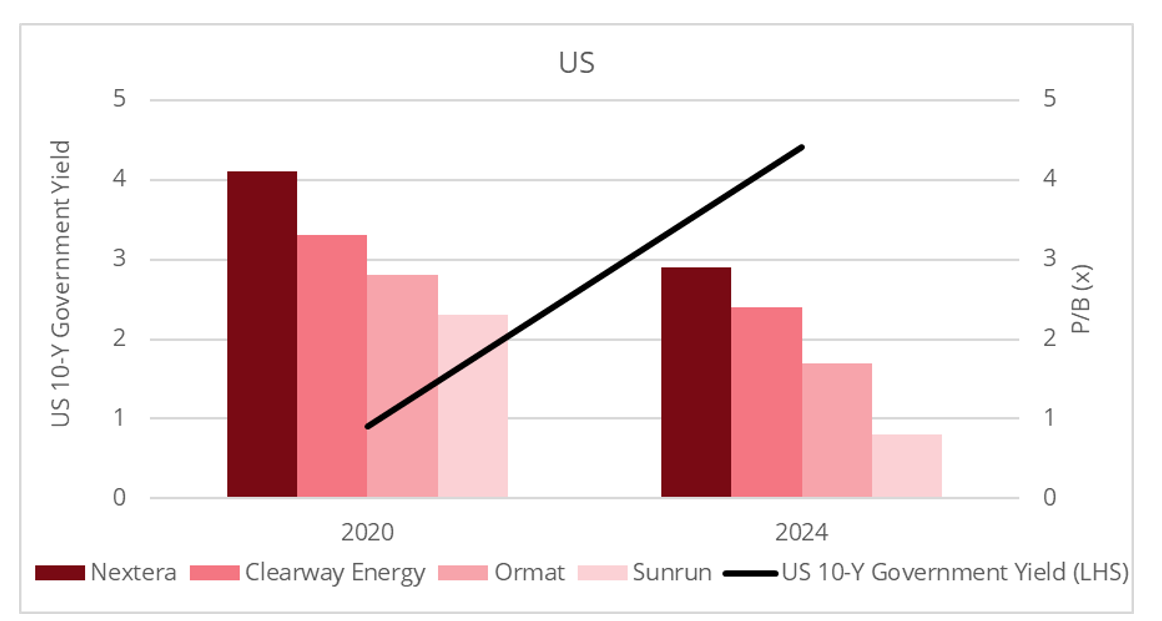

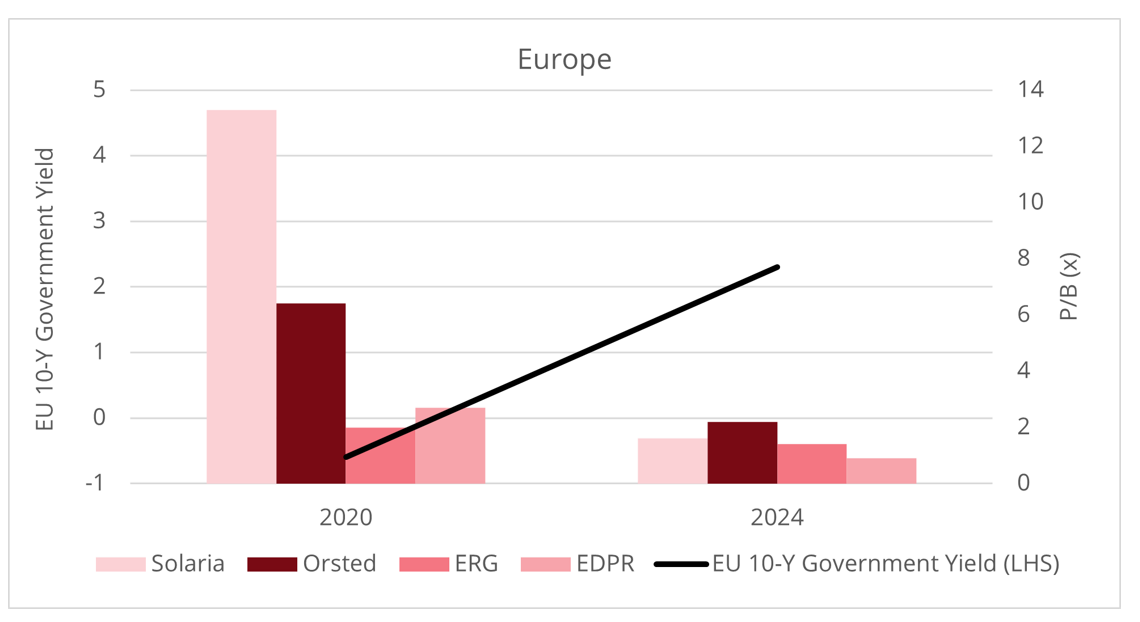

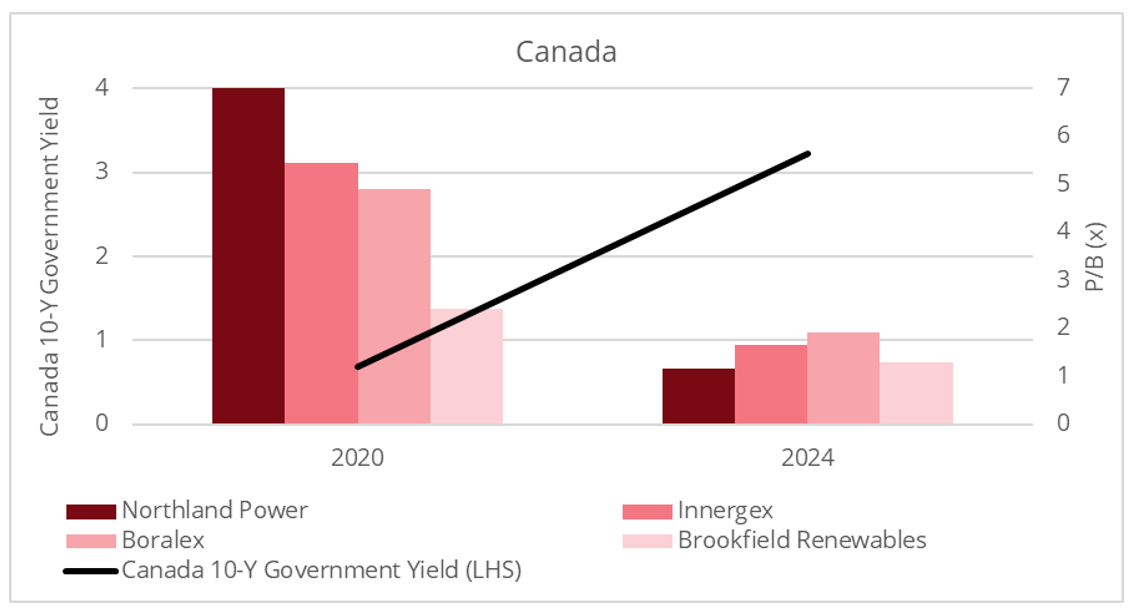

2. Interest rate concerns: Rising interest rates are particularly challenging for capital-intensive businesses, especially smaller companies with less financial flexibility.Despite several central banks cutting rates, yields have increased over the past six months – see Chart 3. Charts 4, 5 and 6 show that valuations are inversely correlated to interest rates and rising rates have consequently led to multiple compression.

Chart 3: 10-year government yields: US, Europe, UK and Japan

Charts 4,5 and 6: Price to book valuations vs. 10-yr government yields: US, Europe and Canada

3. European energy price concerns: In Europe, investors are wary about downward trends in gas and power prices. An end to hostilities in Ukraine could lead to the resumption of natural gas supply from Russia and we have seen markets anticipate declining power curves. Lower power prices would negatively affect companies with open positions in the market but, so far, these negative trends have not materialised and short-term expectations have been revised upwards.

4. Poor execution by some companies: Several companies failed to recognise that the cost of capital would not always remain low and equity would not always be plentiful, that equipment prices could face inflation in the short-term even if they are on a downward slope over the long-term and that development and construction businesses were not without risks. These companies have seen their stock prices decline as a result. For example, in its drive to grow, Orsted has erred in terms of prudence and risk management, while Renova has encountered recurring problems during construction projects.

What could drive a re-rating from here?

For many companies, uncertainties and problems are transitory, and we are seeing their assets and cash flows continue to grow. We expect the asset class to garner increasing interest globally from long-term investors – in both public and private markets – focused on cash flows and asset values. This should in turn prompt a re-rating, driven by five key catalysts:

1. Declining yields: As we stated above, interest rates have been a headwind for our investment universe and macro drivers such as US tariffs, the German infrastructure package and increased defence spending in Europe could be inflationary. However, we believe that a slowing economy with increasing Chinese imports into markets outside the US could be powerful drivers for declining rates.

2. Clarity on the US Inflation Reduction Act (IRA): Over the coming months, the new US administration should provide clarity on the IRA. We see it as a clearing event that should allow the US sector to move forward as uncertainties are lifted. The key provisions for the developers and operators of renewables power are the Investment Tax Credit and Production Tax Credit, i.e. the tax incentives. It is important to note that some companies have prepared themselves for an adverse outcome in two ways:

a) Contract structuring: Building on their experience over the past few years with changes in policies and equipment costs that can affect project returns, several companies have formally imbedded passthrough clauses in new renewables development contracts. As such, if taxes or import duties change, they will be borne by customers, which protect developers against declining returns.

b) Safe harbouring: Many companies have spent 5% of new project costs, primarily on equipment, to lock in the tax incentives benefits [7].

3. The US Federal Energy Regulatory Commission (FERC) has clarified its stance on the potential location of datacentres, i.e. inside or outside the perimeter of power plants (‘behind the meter’ vs ‘front of the meter’). This clarification has significant implications for energy grid reliability, market fairness and competition.

4. Confirmation that robust demand for new data centres will persist in both the US [8] and Europe into the medium-term [9,10].

5. Global electricity demand growth [11]

Capturing the full breadth of the opportunity set

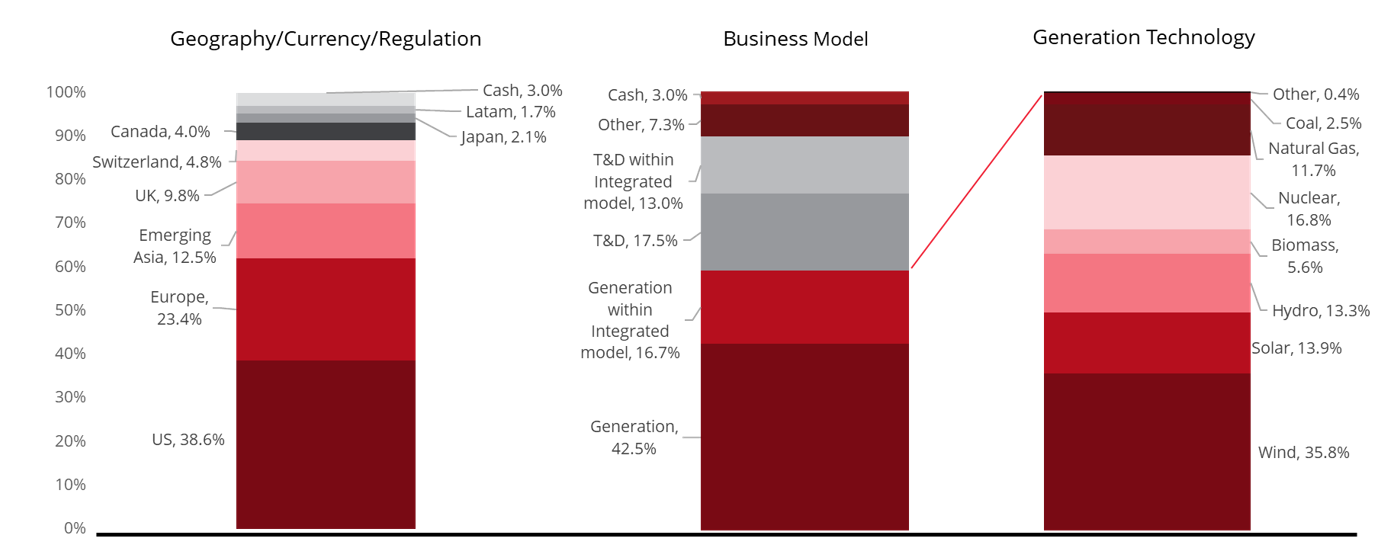

In an environment in which they are many moving parts, our approach has been to focus on delivering attractive risk-adjusted returns since the strategy’s inception nearly 10 years ago. Diversification allows us to mitigate some of the risks discussed above and shows the breadth of opportunities in the strategy.

Chart 7 highlights the Strategy’s diversification across multiple elements, including not just geography, currency and regulatory environments, but also prevailing technology environments and business focus. Exposure to all these attributes offers a high degree of resilience during periods of market turmoil.

Chart 7: Ecofin Global Renewables Infrastructure Strategy: Diversified across multiple factors

We expect a re-rating

The renewable energy sector remains materially undervalued, presenting compelling opportunities for long-term investors. This undervaluation, as evidenced by recent take-private offers at substantial premiums, stems from factors such as political uncertainty, interest rate concerns, and company-specific execution challenges. However, the sector’s robust fundamentals, driven by increasing demand for clean energy and improving policy environments, suggest a potential for a significant re-rating.

Sources:

1] Bloomberg, Redwheel, March 31, 2025

[3] ‘Statement regarding the proposed acquisition of ReNew Energy Global plc’, Redwheel, February 2025

[6] Source: CNet.com, March 2025

[8] Jefferies, Equity Research, April 2025

[10] FDIIntelligence, August 2024

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.