“We believe 2023 will see a return to the tortoise way of investing. It’s why we believe that a strategy that puts compounding a higher yield than the market at the centre of generating total return is appropriate; why having a discipline on valuation will be beneficial once again and why a return profile that has a lower volatility than the market, consistently re-investing dividends throughout, will allow investors to suffer a return to normal.”

2022 could be considered a year of considerable change, where the extraordinary came to an abrupt halt and a return to the long forgotten normal began. Yet, few believe this to be true. The investment backdrop has changed from an upward only, get rich quick environment created by Quantitative Easing (QE) and zero interest rates (inflation has seen to this). These “good times” have lasted so long (since 2008, maybe even since 2000 one could argue) and have caused many investors and traders to believe it to be the normal investment environment. Because of this, the narrative remains that if we want to invest back in growth, then we should choose bonds, as interest rates should soon be back down to zero again.

2022 also brought Cathie Wood’s largest inflows (back at the start of the summer) and Meme stocks even made a reappearance, one example being AMTD Digital Inc. We must not forget, one of the major focuses of the markets in H2 2022 was the Fed pivot. A pivot intended to return us back to those wonderful days of the get rich quick environment. However, the reality is that those days were never the “normal” investment backdrop. They were the abnormal. From the lows in March 2009 to the peak in December 2021, the MSCI World in USD returned c.550% over 13 years according to Bloomberg. The capital gain for that period was c.370% and the compounded income gain c.181%. This should not be possible. The power of compounding a number over a sensible period of time should dominate everything, in our opinion. And yet during this period, QE has broken maths, making the capital gain by far the largest driver of total return. This is highly abnormal. Over long time periods, the compounding of income dominates total returns, as many studies have shown (for example SG Quantitative Research on Total Annualised Real Return).

Now though normality is returning. The persistency of inflation has led to rates rising fast from their zero lows. We believe a global recession of sorts is all but guaranteed in 2023 in an attempt to tame inflation. Such economic cycles and asset price volatility are, again, simply the norm. Yet here too, the draw of the recent past has seen the central narrative being one of a soft slow-down in growth, peak and then declining rates and inflation back to 2%. This seems a highly improbable fantasy viewpoint. But such has the lack of pain over the last decade or so been, that such an outcome is the central assumption.

We believe there could be a range of outcomes for 2023. Firstly, inflation may be tamed, but at the cost of a proper recession and causing rates to remain higher for longer to ensure inflation’s demise. Or the prospect of such pain is too much to bear and the Fed pivots to avoid a deep recession. However, the cost to this will be that inflation is more likely to remain higher than the targeted 2% and is likely to resurge again. Therefore, we feel out of the two possible outcomes the highest probability is that of the pivot scenario. But why?

The pivot scenario seems likely as a means of protecting the most indebted actor today – the governments. Corporates are not good either, but governments’ debt to GDP is back to the levels of WWII (Source: JP Morgan Sept 2022). As was the case back then, the path to exiting this debt burden is to default. But default by stealth. Inflation is the means by which many governments default on their debt. When looking at governments around the world, it is evident that the government debt to GDP is high almost everywhere you look (source: IMF), causing many governments to have a vested interest in keeping inflation higher for longer. This could deliver a sense of relief in the short term, but over the longer term, the cost of inflation remaining present could be far worse than the cost of a deep, but probably short recession. The destruction of real wealth from persistent inflation is huge, across many asset classes.

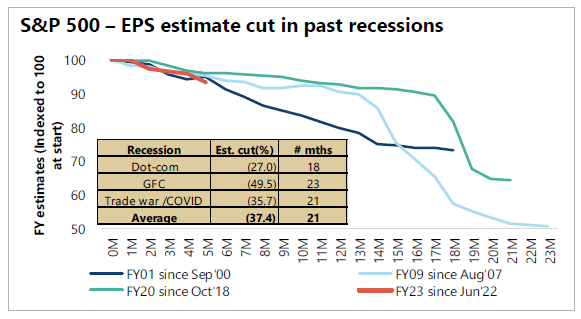

Either way though, the outcome of either a Fed pivot or inflation taming is one of greater volatility for asset markets. Both possible outcomes see the return of an economic cycle and earnings cycle. And it is this earnings cycle that the market in 2023 may have to come to terms with. As the graphic below shows, the earnings downcycle has yet to begin and, even in the pivot scenario, some kind of economic slowdown may still be necessary.

Source: Jefferies, December 2022: Past performance is not a guide to future results. The information shown above is for illustrative purposes. Forecasts and estimates are based upon subjective assumptions.

The S&P500 has only retreated its valuation back to a forward price / earnings ratio (p/e) of 17.5x, according to Jefferies this is the same valuation as its long-term average since 1990. Europe is better prepared for the earnings downgrades at 12x, below its average. However, only if the market believes the earnings downgrades will be short-lived, will market declines be able to better the extent of the downgrades. This again, points to further volatility. However this is also simply a return to normal. It is normal to have cycles (in fact one can argue they are necessary for a capitalist system), to have higher interest rates, to experience inflation and to have volatility in asset classes.

By normal, we mean the way to grow the wealth of clients is slowly and not quickly. The old ways should dominate again, and the compounding of a dividend should drive total returns. The growth in dividends over time can combat the impact of inflation. We should see valuations matter again and high-quality companies with excessive valuations possibly becoming the riskiest investments. The valuation you pay for a stock may impact your ability to suffer volatility. Companies that have pricing power should suffer better than those who’s business models are based around driving prices ever lower, or who are price takers.

It will take a while for the adjustment back to normal to fully occur. Being weaned off an addiction always does. Hope is a powerful emotion which will continue to drive many investor actions. We believe 2023 is the start of a return to a tortoise way of investing: growing wealth slowly, via compounding. It is why we continue to believe that our investment approach, which puts compounding a higher yield than the market at the centre of generating total return, is appropriate. It’s why having a discipline on valuation should be beneficial once again. It’s why a return profile that is lower volatility than the market, consistently re-investing dividends over time should allow investors to suffer a return to normal.

Key Information:

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.