On 24th September, the Chinese government announced an economic and financial stimulus package to counter the country’s declining growth rate, which has been caused by weakness in the property market and cautious consumer spending.[1] Details of the measures implemented by the People’s Bank of China (PBOC), National Financial Regulatory Administration, and China Securities Regulatory Commission include:

- A 20-basis point reduction in the 7-day repo rate

- A 50-basis point reduction in both the Reserve Requirement Ratio (RRR) and the mortgage rate

- An increase in PBOC funding from 60% to 100% for the housing inventory buyback programme

- A RMB 500 bn swap facility for financial institutions with the PBOC to buy equities

- A RMB 300 bn lending facility for listed companies to buy their own stock

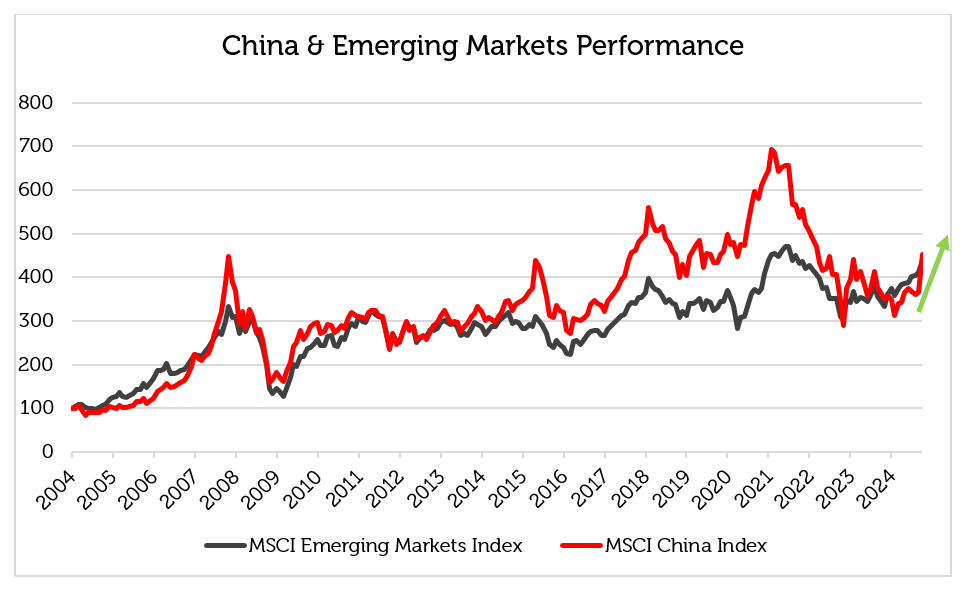

The introduction of these monetary features caused a 15.5% rally in the MSCI China Index from the day of the announcement on 24th September to the day the stock market closed for Golden Week on 30th September, taking its gain for the year to 29.6%.

Source: Bloomberg, 30 September 2024. Uses the MSCI Emerging Markets Net Total Return and MSCI China Net Total Return – USD indices. Normalized to 100. Past performance is not a guide to the future.

Why did the market rally so hard?

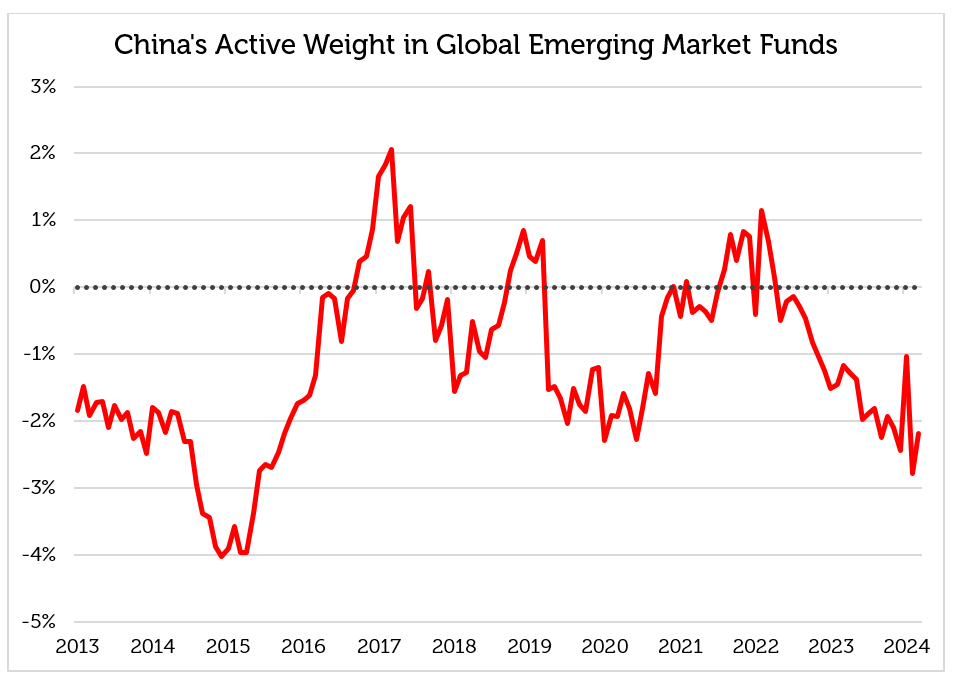

The size and timing of the stimulus package caught many investors by surprise. First, the majority of Emerging Market portfolio managers have established underweight positions in the largest country in the MSCI Emerging Market universe, forcing them at least partially to increase exposure to a rapidly rising market.

Source: HSBC, 31 August 2024. Past performance is not a guide to the future.

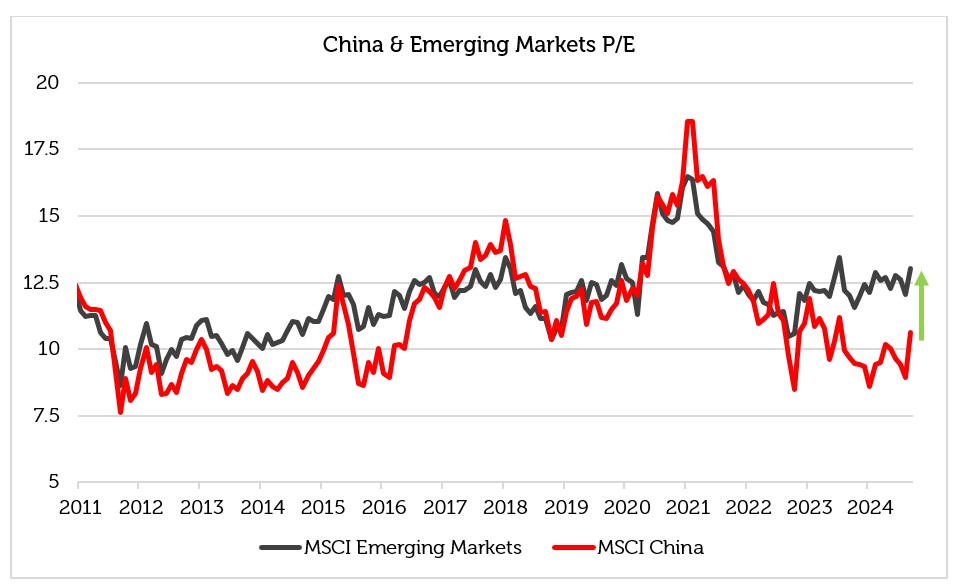

Second, the valuation of the MSCI China equity index had fallen to a depressed level of only 9 times forward earnings at the beginning of September, when it has normally traded in line with the overall MSCI Emerging Markets Index that is currently valued at 12 times forward earnings.

Source: Bloomberg, 30 September 2024. Past performance is not a guide to the future.

Third, after two years of declines, Chinese corporate earnings have started to recover, showing 10% year-on-year growth in September.

Source: Bloomberg, Redwheel, 30 September 2024. Past performance is not a guide to the future.

The combination of the announcement of a substantial stimulus package for a currently cheap market whose earnings are recovering, but which has been ignored by investors, has proved a powerful combination to propel share prices higher.

Will the stimulus work in the long run?

Some market participants might be sceptical that a modest reduction in interest rates amid weak demand for credit, together with an increase in stock market liquidity when the housing market is the main source of a negative wealth effect, can be sufficient to support equity market gains over the medium and long term. The experience of Japan after the property crash in the 1990s and Europe and the USA after the Global Financial Crisis in 2008, as well as the COVID pandemic in 2020, suggest that both fiscal and monetary support are necessary for a durable economic and financial recovery.

For example, the US Troubled Asset Relief Program (TARP) in 2008 -2009, which amounted to approximately 5% of GDP, enabled the US Treasury to purchase impaired assets from financial institutions and help recapitalize banks to ease credit conditions. In addition, the American government provided fiscal stimulus of about c.20% of GDP in response to the COVID pandemic. Investors in China are expecting substantial fiscal and monetary measures in relation to GDP to be confident of a durable economic rebound.

We believe that the actions of the Chinese government after Golden Week will be critical to the continuation of the bull market in China. Monetary support for the property market and fiscal stimulus for the consumer to stimulate domestic growth should ensure that the rally that began from depressed levels in September results in a long-term bull market underpinned by improving economic fundamentals. Detailed fiscal easing policies are expected from high-ranking policymakers in the near future, possibly as soon as October.

Sources:

[1] Bloomberg, 24 September

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.