Successful economic development is a well-trodden path. Countries with attractive demographic profiles and a young, educated workforce usually entice investment into their manufacturing industries. Labourers tend to migrate away from agrarian employment, lured by the factory work on offer in the growing towns and cities. Urbanisation levels should increase dramatically, with a positive impact on consumption, which benefits both staple and discretionary spending levels.

A virtuous cycle

From the industrial revolution of the late 18th century through to the economic miracle of the Far East over the last fifty years, a number of economies have followed this same path to prosperity. One thing has changed, however. As more developed countries have experienced wage inflation and moved up the economic value chain, the process appears to have accelerated.

This virtuous cycle still takes decades to play out, but observing the transformation of China since the 1980s, which has pulled more than 750 million people out of poverty and turned China into the second largest economy in the world, has been like watching the original industrial revolution in Europe on fast-forward.

From emerged to emerging

It is now time to re-define how we think about emerging markets. The fastest period of growth occurs in the earlier stages of this virtuous cycle, meaning that the nations that we currently think of as “emerging” have, in fact, now largely “emerged”. That is not to say that the likes of China, South Korea and Brazil do not offer opportunity anymore. These economies should continue to offer long-term growth potential, but they are now on a flatter growth trajectory. The genuine opportunities now exist elsewhere, in regions at an earlier stage of their development. It is time to make space for the next generation of emerging markets.

That is why, three years ago, we launched the Redwheel Next Generation Emerging Markets Fund. To embrace the vast opportunity that exists in regions currently on the steepest part of their emergent growth trajectory.

First steps

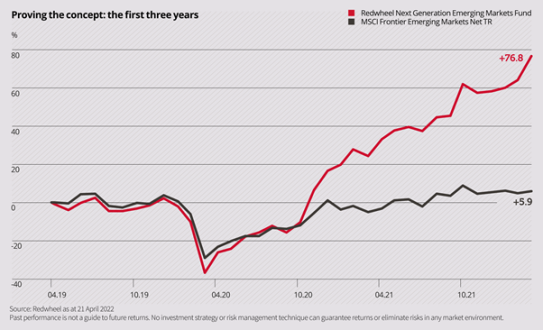

The Redwheel Next Generation Emerging Markets Fund launched in April 2019, amid rising trade tensions between the United States and China. Although this was helpful in highlighting the need for global businesses to diversify away from China and towards the regions the fund was targeting, it took some time for this trend to start to influence performance.

As the chart below demonstrates, next generation emerging markets did not escape the initial impact of the Covid-19 pandemic, but the fund did recover relatively strongly through the remainder of 2020. Many next generation emerging market governments and authorities handled the pandemic effectively, and the regions that the fund invests in also benefited from the unprecedented levels of monetary and fiscal stimulus that were implemented to aid the global economic recovery. This resulted in a weaker dollar and increased capital inflows into emerging markets.

As economies gradually re-opened through 2021, higher commodity prices and the rollout of global vaccination programmes continued to benefit many next generation emerging markets. Many economies within our regions tended to display a tightening bias to monetary policy, raising interest rates to rein in inflationary pressures and pre-empt any tightening from the US Federal Reserve in order to mitigate any risk of capital flight. Although that tightening bias weighed on the performance of broader emerging market indices, our thematic positioning and careful stock selection allowed the Redwheel Next Generation Emerging Markets Fund to continue to deliver strong positive returns.

This year, the Russian invasion of Ukraine has reverberated across markets and supply chains globally. The main channel of impact is via the price and supply of commodities produced by Russia and Ukraine. Higher commodity prices will support growth and external balances in commodity exporting countries but is likely to weigh on commodity importing countries. The recovery of global travel has and will continue to play a part in supporting next generation emerging market economies where tourism is a large proportion of GDP, such as Greece.

Throughout the first three years, the fund’s three main drivers – tourism, new factories of the world and commodities as described below – have been significant positive contributors to performance.

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

Where we are now: the current opportunity

Despite the attractive returns delivered to date, we believe that the valuations within next generation emerging markets are not stretched and our key markets continue to trade at a big discount to their larger emerging market counterparts.

Any uneasiness in global stock markets with respect to policy normalisation or political uncertainty may represent a timely opportunity to invest, as the markets we target remain on a long-term structural growth trajectory. The correlation of these markets with the broader global indices is low because in the main, their fortunes are largely tied to their own economic fundamentals.

There are currently three key drivers of growth that we are looking to capture for the Redwheel Next Generation Emerging Markets Fund: tourism, new factories of the world and commodities. We will explore each of these in future content, but the paragraphs below serve as a short introduction to the opportunities we are embracing.

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

Travel and tourism

As global disposable incomes have risen over the last few decades, tourism levels have increased dramatically. The travel and tourism industry now accounts for roughly 10% of world GDP and one out of every ten jobs globally is linked to it[1]. The pandemic interrupted growth temporarily, but as the world re-opens its borders, travel and tourism is poised to continue to recover.

Next generation emerging markets benefit considerably as tourist arrivals increase. Economies such as Egypt, Thailand, Greece and Peru are looking particularly well-placed.

New factories of the world

Low-cost labour and cheap manufactured goods attract capital in the search for higher returns. Rising costs and high political risks mean that the world is currently diversifying away from its manufacturing reliance on China. Companies are looking towards new economies in which to expand their production centres and provide for their growth ambitions for the next two decades. Chinese firms themselves are often at the forefront of investment into these new locations as they also need to remain cost-competitive on the international stage.

Next generation emerging market economies such Vietnam, Romania and Morocco look poised to benefit from this inward investment. Meanwhile, as workers receive wages and companies increase profits, local economies boom and consumers look to increase spending, resulting in an economic multiplier effect that benefits the local economy much more broadly.

Commodities

The road to global net zero emissions will likely increase the demand for many metals, with significant implications for the broader commodity complex. The supply of “green wave” materials like copper, uranium and lithium remains limited after a decade of under-investment. Without these commodities, there is arguably no way that the world can achieve its de-carbonisation goals. New mines and resources are predominantly being discovered in Africa and South America, but costs of production have increased dramatically alongside demands for cleaner extractive methods. Meanwhile, Russia’s invasion of Ukraine has highlighted the issue of supply security across the world’s key food, energy and mineral resources.

These trends are likely to persist for many years and should benefit net exporters of these key commodities, such as Chile for copper and lithium, Zambia for copper and Indonesia for a range of soft commodities.

The path ahead

Three years is a mere footstep on the well-trodden path that next generation emerging markets take towards industrial development. Nevertheless, it represents an important milestone for a fund investing in these markets when they are on the most rewarding part of their journey towards economic success.

Of course, political stability and good governance are important foundations for progress, paving the way for future development. In certain circumstances, such as Zimbabwe and Venezuela, countries have suffered from tragic political failures and economic collapse. But over the broad sweep of history, there are many more examples of successes than failures.

The world has witnessed the economic rise and fall of many countries over the last fifty years. Looking forward, the Next Generation of emerging markets appear well set to embark upon a journey of growth and economic success. Some will of course fail but the winners will look to emulate the success of countries such as China and Korea. In 1980, very few people had foreseen that China would grow from one of the world’s smallest economies into the world’s second largest economic superpower. By 2050, will the next economic surprise be Turkey, Indonesia or Vietnam? It is certainly an investment path worth exploring.

We have made great strides in proving the Next Generation Emerging Markets Fund concept. The well-trodden paths to growth that we are pursuing are clearly defined. There will be potholes along the way – there always are – but our disciplined approach is adept at identifying them and avoiding them. As a result, we are confident that the long-term opportunity that lies ahead for the fund looks brighter than ever.

[1] Source: Tellimer, World Bank

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part.