Cash is finally worth talking about. Almost two decades of considerable accommodative policy have handed cash a woeful reputation, but despite inflation being still too high for comfort, cash in various parts of the world is managing to offer a real return – but is this really the return of the king?

% | Cash Yield | Inflation |

|---|---|---|

US | 5.3 | 3.7 |

UK | 5.4 | 6.7 |

Germany | 3.6 | 6.1 |

Source: Bloomberg, 3-month government bond yields and CPI as at 29/09/23 and 31/08/23, respectively. The information shown above is for illustrative purposes.

After an era of relatively unassuming inflation, investors are now largely keen for it to lose steam – but not without weighing up the cost, with the higher for longer narrative still fuelling speculation of a hard landing. Both cash and equities are influenced by, and at times arguably at the mercy of, central banks getting these decisions right, with current efforts to ‘land’ inflation proving a good example. Thankfully, equities have much more to their story through owning a piece of a company and capturing its potential; cash lacks the possibilities that equities can offer over the longer term.

The outcomes of these possibilities are, undoubtedly, not always favourable; being an equity investor can certainly be painful at times. But we mustn’t forget what being an investor means and requires: long-term thinking, and crucially, patience.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

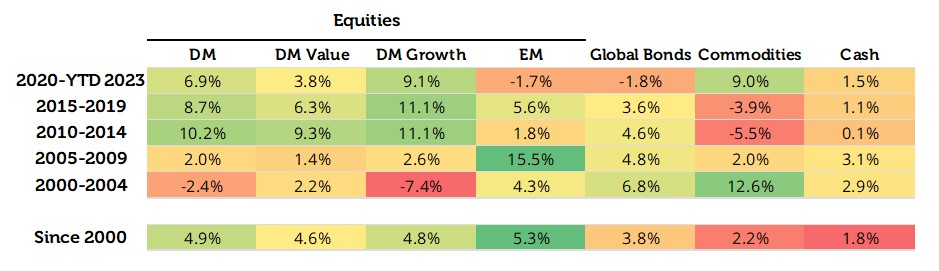

And patience often pays off. Whilst cash can seem like an idyllic cocoon for investors in choppier markets, investors run the risk of being left behind in the longer term. Without a doubt, cash has often provided better returns in challenging market backdrops, but over longer periods of time, other asset classes have flourished – particularly equities.

On top of this, typically when cash yields are trending higher, the economy is heating up – and a burgeoning economy is usually supportive of equities. When cash yields are high and this constrains economic activity, then not only should equities struggle, but yields will likely have to fall to encourage a recovery. Whilst these scenarios are not exhaustive, both highlight how equities still will often, ultimately, have the upper hand.

Source: Redwheel, Bloomberg, total annualised returns in USD as at 29/09/23 . Past performance is not a guide to future results. No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

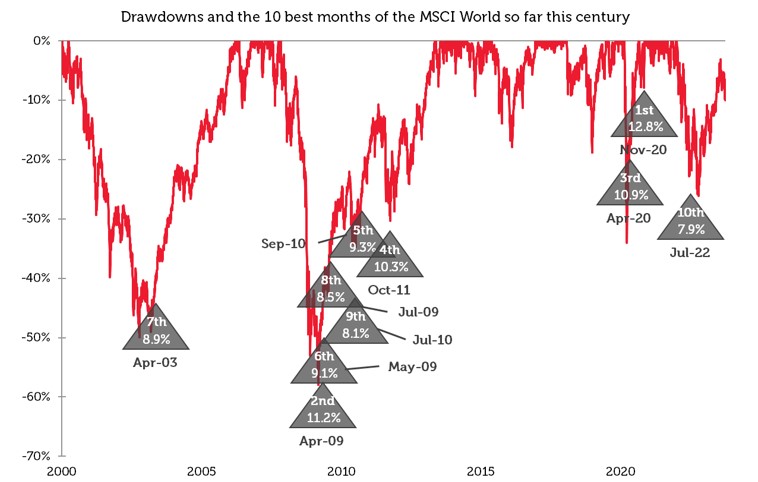

Equities may have reigned, but these returns mask the sizeable downturns equity markets experienced during these periods. This points to another key drawback to allocating to cash: timing.

Once you are out of the market, there is the notoriously difficult – and practically impossible to consistently get right – call of when to get back in. This daunting job is one of the best kept secrets in the world of investing; even when removing human emotion and behavioural biases, algorithmic approaches have been inconsistent in finding ways to time the market, though with AI in relative infancy, it could hold some promise if it can evolve to be able to keep up with markets.

The recent uncertainty has seen cash continue to attract flows, but with an equity market that ultimately seems to be evergreen – no matter what you throw at it – investors could easily find themselves holding onto cash balances for longer than anticipated.

Let’s not forget that the longest US stock market bull run lasted nearly 11 years, or 131 months, following the fallout of the 2007/08 global financial crisis that created a much shorter, 17-month bear market. It was only stopped in its tracks by the Covid pandemic, but a new bull run was subsequently born, albeit narrower and shorter. Further, the bear market prompted by the outbreak of Covid only lasted a mere 33 days and may have wiped over c.30% off the market, but the market rebounded c.70% for the rest of the year, which meant the S&P 500 delivered a total return just shy of 20% for 2020 – considerably higher and a real return compared to 0.7% from US T-Bills.

Although these are extreme examples, over the years, some of the most sizeable stock market gains have taken place during, or just after, bear markets. Clearly, based on this, cash is not king – unless you (miraculously!) have impeccable timing. Time in the market often proves a lot more fruitful than market timing. You have to be in it to win it; granted, this mantra is an oversimplification – reaping the benefits of equities’ outperformance does not come without experiencing some shorter-term volatility; investing isn’t about a quick and easy win but comes down to wins outweighing losses and incrementally building on those wins over time when it comes to achieving longer term gains.

Source: Redwheel, Bloomberg. MSCI World Index, total returns in USD as at 29/09/23. Past performance is not a guide to future results.

We have always believed that it is better to stay engaged with equities, but we don’t just mean any equities. When it comes to investors thinking about taking risk off the table, we believe balancing the equity mix needs more of the spotlight than turning to cash.

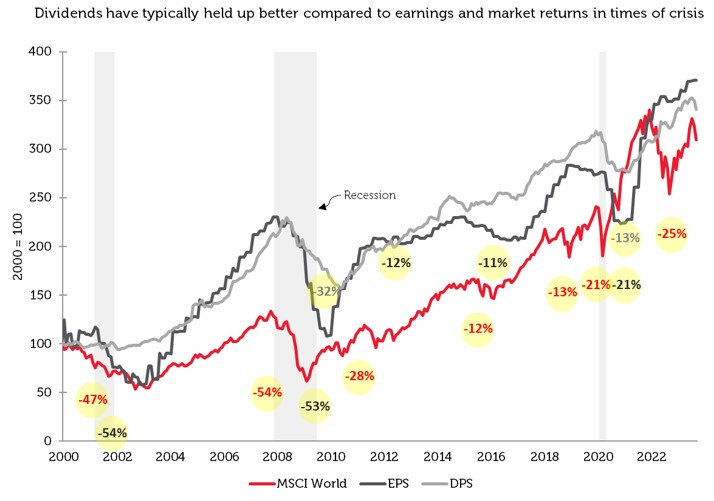

Stocks offering higher income than the market are often put head-to-head with cash given their dividend payments. Income stocks may not offer the prospect of sizzling returns in the shorter term compared to other areas of the equity market, but those with quality characteristics, particularly, can compound (growing) dividends as well as offer capital appreciation when it comes to longer return horizons, where equity volatility tends to even out.

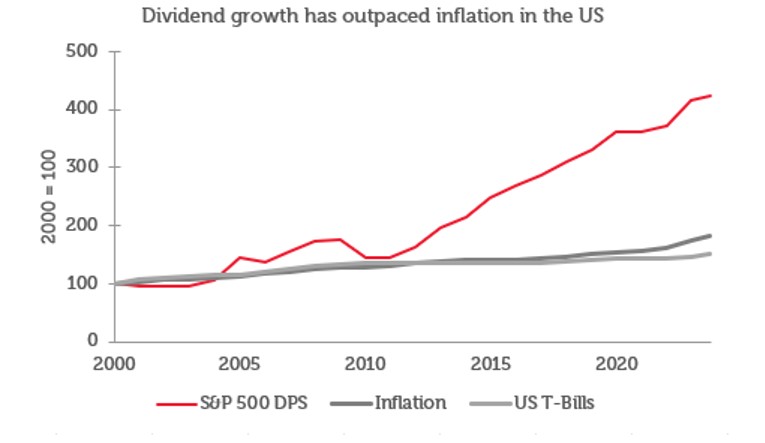

Compared to cash, dividend payments come with greater uncertainty, but we have found that focusing on quality companies cushions the risk to dividend payments. Further, dividends have often experienced softer contractions and recessions compared to earnings and market returns. We have also found that being disciplined in sticking to stocks that compound income that is higher than the broader market helps evade temptation to time the market, due to the focus on compounding dividends given its significant contribution to returns over the longer term. Even though this century has so far seen dividends often take more of a backseat in US markets, they have firmly outpaced inflation, whilst the same cannot be said for US T-Bills.

Source: Redwheel, Bloomberg. Total returns (monthly) in USD, EPS (earnings per share) and DPS (dividend per share) of the MSCI World Index, rebased indices, as at 29/09/23. Past performance is not a guide to future results.

Source: Redwheel, Bloomberg. DPS of the S&P 500, US CPI and Bloomberg US Treasury Bill Index, rebased indices, as at 29/09/23. Past performance is not a guide to future results.

We believe that for cash to truly serve more of a strategic purpose, it ultimately comes down to timing to ensure to not miss out on equity markets’ ability to soar. After all, when was the last time investors were inspired by a bull market in cash? We recognise that market timing is not our forte; as investors we are in it for the longer term – but we don’t believe cash is when it comes to helping our strategy and investors achieve longer term returns.

Sources:

[1] Indices: Developed Market Equities (DM) – MSCI World Index; Developed Market Value Equities (DM Value) – MSCI World Value Index; Developed Market Growth Equities (DM Growth) – MSCI World Growth Index; Emerging Market Equities (EM) – MSCI Emerging Markets Index; Global Bonds – Bloomberg Global Aggregate Bond Index; Commodities – Bloomberg Commodities Index; US T-Bills (Cash) – Bloomberg US Treasury Bill Index.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.