Will the combination of the pandemic, the return of inflation and rising interest rates signal the beginning of meaningful change in the investment backdrop? Or is the market in danger of repeating mistakes that extrapolate the now, forever?

The market tends to overlook that, invariably, much tends to stay the same and that this holds true in investing. Getting rich slowly (our often referenced ‘tortoise approach’) remains an achievable way to manage money in this environment.

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

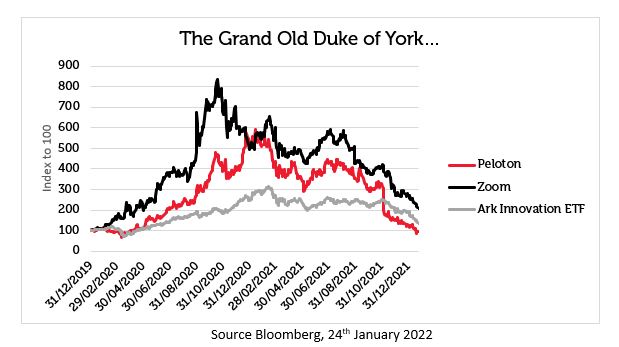

Working from home, exercising at home and virtual interaction became the new normal as those few ‘stay home whilst this blows over’ weeks grew into months and years and the world as we knew it changed around us. The businesses that provided solutions for the change in living, working and lifestyle circumstances thrived as demand for their products and services soared.

Before we have even put COVID behind us, many of the pandemic winners have marched all the way back down the opportunity hill that the pandemic provided.

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part.

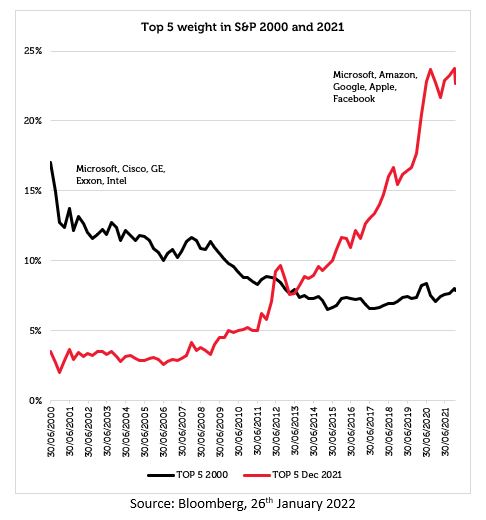

Yet still the market believes that mainly the largest stocks in the world will be the persistent victors for the future. Looking back at the tech bubble, the largest stocks failed to retain their dominance. A bubble as always, should return to the same and the likelihood of today’s largest stocks still being the winners over the next 20 years is low.

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part.

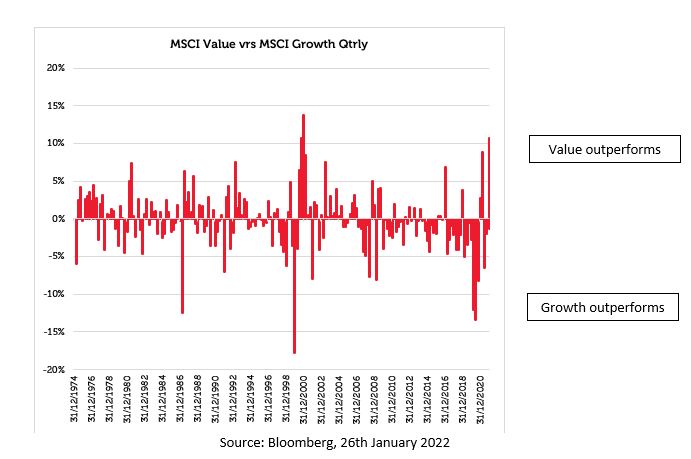

And now, the extrapolation of change is happening again in deep value. The latest quarter’s level of outperformance is already historic in scale terms. Is now the time that change is genuine? We may be seemingly at the foothills of a new economic cycle, where strong growth has the potential to turn deep value cyclicals into the new market leaders. Posing the question: Will deep value be the new Ark?

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part

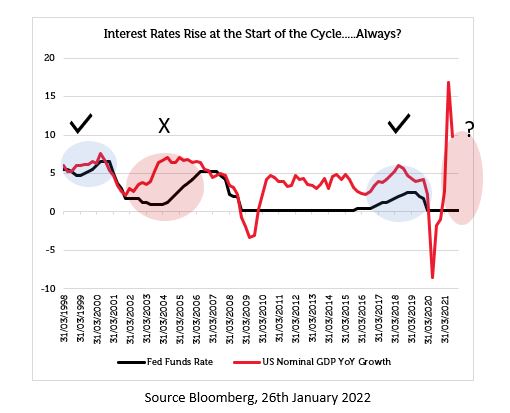

Interest rates are only just about to start lift off and with COVID restrictions ending, does this mean that we are at the start of economic acceleration when cyclicals and deep value usually soar?

In the chart below, for the periods marked by ticks, rates started to rise, and GDP continued to accelerate predominantly in the late 1990s and 2017.

But, as can be seen by the cross this is not the case post the tech bubble. By the time rates started to rise, GDP acceleration had started to roll over. Post the tech bubble Greenspan supported the market and was late to raise rates, leading to the 2008 Global Financial Crisis.

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part

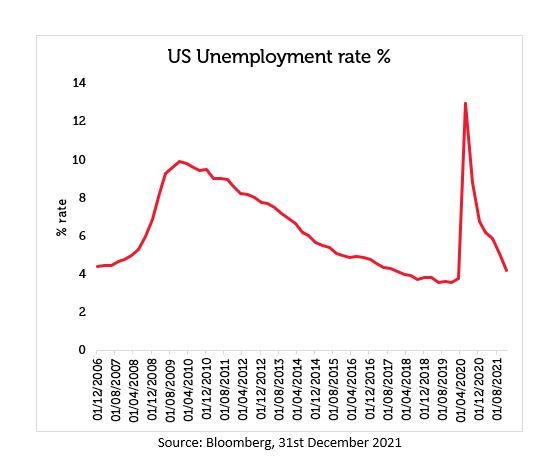

What about this time? Are we late? Evidence would suggest so as we are already almost back to the employment levels pre pandemic.

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice

Current demand for goods is above pre-pandemic levels and services demand is almost back on that same level too (Source: BEA Oct 2021 – US consumer spend on services and goods). We have already seen debt levels soar again: global corporate debt has risen by $10 trillion in just two years! (Source: BIS Q2 2021).

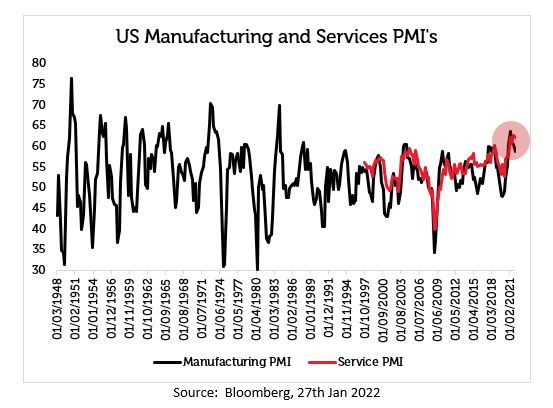

The Fed (and other central banks) balance sheets are now ceasing to grow and even reversing. Manufacturing and Services Purchasing Managers Index (PMI’s) in the US have reached the top of the long-term range.

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice

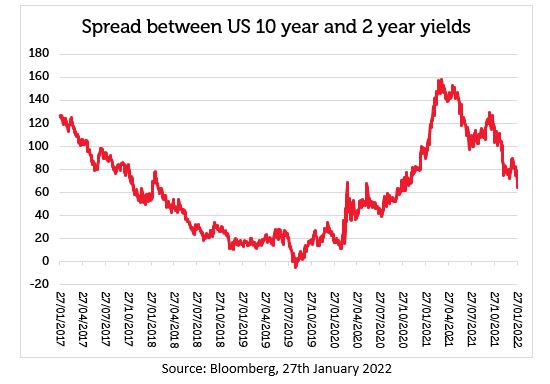

Meanwhile, the yield curve is flattening when it historically steepens at the start of the cycle.

This evidence points to the cycle already being late. The global economy was late in the cycle in 2019 when US rates had peaked at 2.5% and then had begun falling. Governments created the pandemic recession and created the pandemic recovery, simply to return ourselves to late 2019 but with far more stimulus in the form of drugs and debt! Rate rises this time appear behind the curve.

And then of course there is inflation running at very high levels, relative to the last couple of decades and therefore across the globe inflation is increasing the pressure on central banks to raise rates fast. The Russian-Ukraine conflict is also serving to perpetuate such high inflation which again is putting further pressure on rates to rise in an already late, economic cycle.

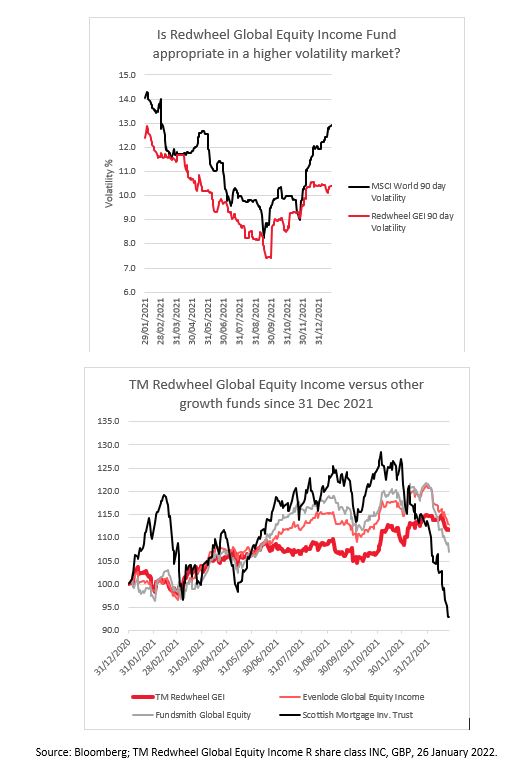

The market is returning to the same from a Quantative Easing supported upward only backdrop. Volatility is rising from exceptionally low levels and the extraordinary pandemic environment is now coming to an end. This reminds us that the markets can be volatile, and do not always go up in a straight line. It reminds us that slow and steady normally wins the race.

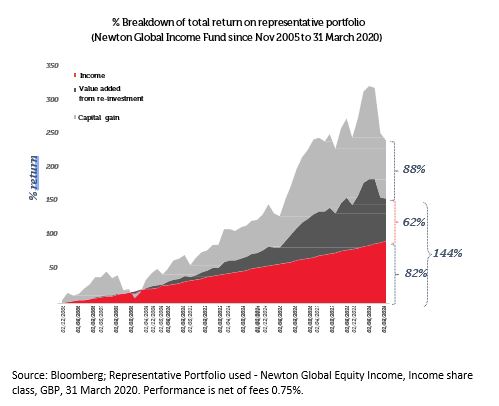

The tortoise approach is to compound a premium yield to the market and match market capital returns, as opposed to the hare approach which has a high beta to market returns. In rising only markets the hare is arguably the best approach but in all other market environments the tortoise is more appropriate.

And now that we at Redwheel Global Equity Income have over a year of performance underway, we can show the resumption of the same serving our clients well.

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested.

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

As volatility has picked up in the markets, the fund’s own volatility has remained low. As the hare funds have suffered in the “returning to the same” backdrop, the tortoise-like characteristics of Redwheel Global Equity Income have shown to be far more resilient.

We have resumed the processes of the last 15 years, seeking to make our clients a total return slowly. The process consistently provides our clients with quality at a reasonable yield.¹

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part

We believe that the disciplines in this process make these characteristics deliverable over time. Having known and followed this process for the past 15 years we believe that this is repeatable and achievable.

Companies who are able to suffer difficult backdrops at reasonable valuations give our clients an appropriate portfolio in an environment where the market is betting on change forever whether it be growth or value. However, we see, both in the backdrop and in the portfolio, the same is more likely to occur than change.

Unless otherwise stated, all opinions within this document are those of the Global Equity Income team, as at 17th March 2022.

¹The portfolio was managed by James Harries from 2005 until 31st December 2015, whilst Nick Clay was Co Portfolio Manager from 31 July 2012, then became Portfolio Manager from 31st July 2012 -31st March 2020. TM Redwheel Global Equity Income R share class INC , GBP 24 Nov 2020 – 31 Dec 2021.