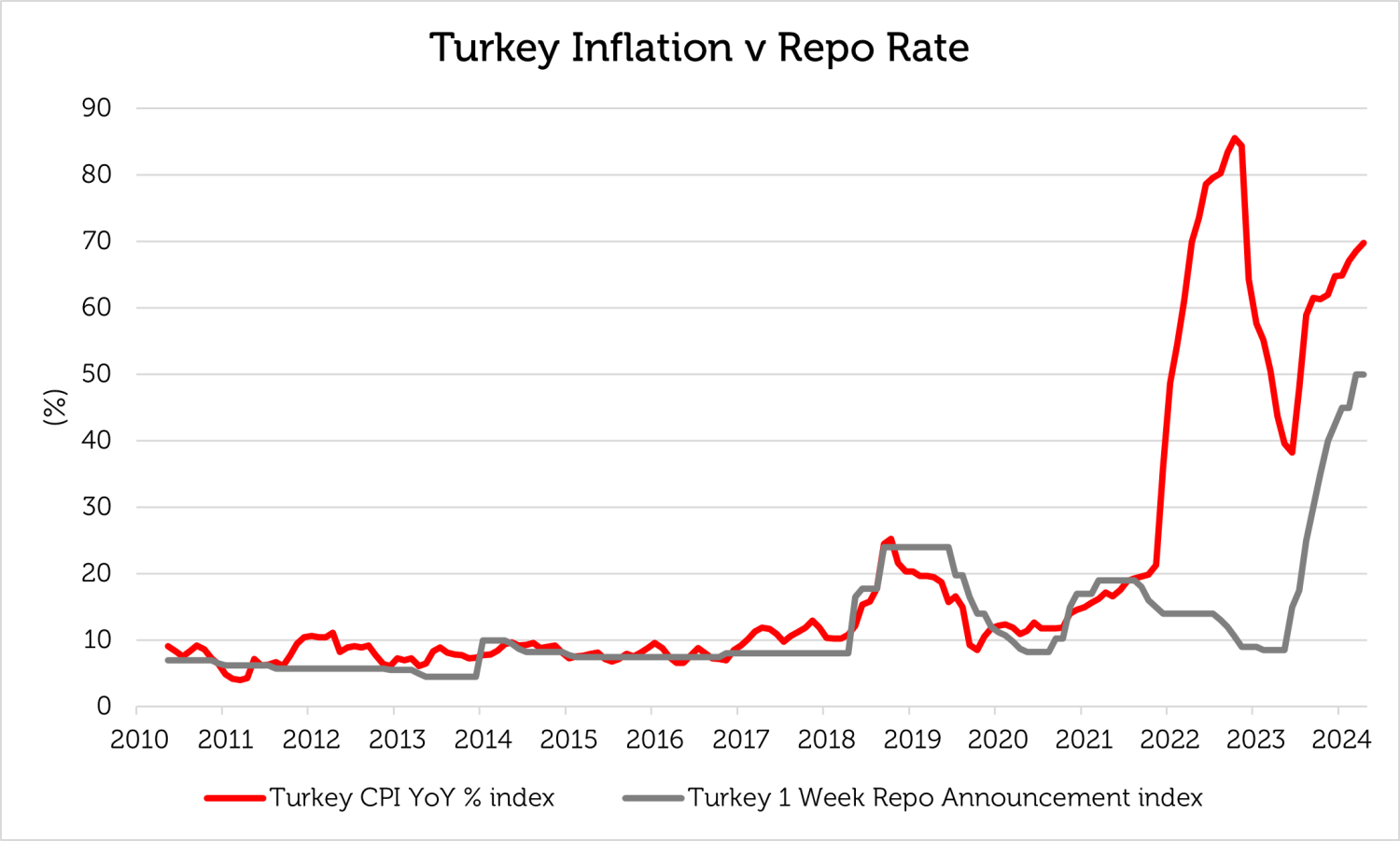

President Erdogan won re-election in 2023 by running the economy hot; he pursued a strategy of strong economic growth to boost consumption, employment and wages. Although this economic policy might have been popular with the electorate, financial markets did not like it because inflation jumped. Turkey experienced inflation in the 1990s but had it under control for most of the last two decades, until 2022 when inflation surged.

Source: Turkish Statistical Institute, Central Bank of Turkey, as of 30 April 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results

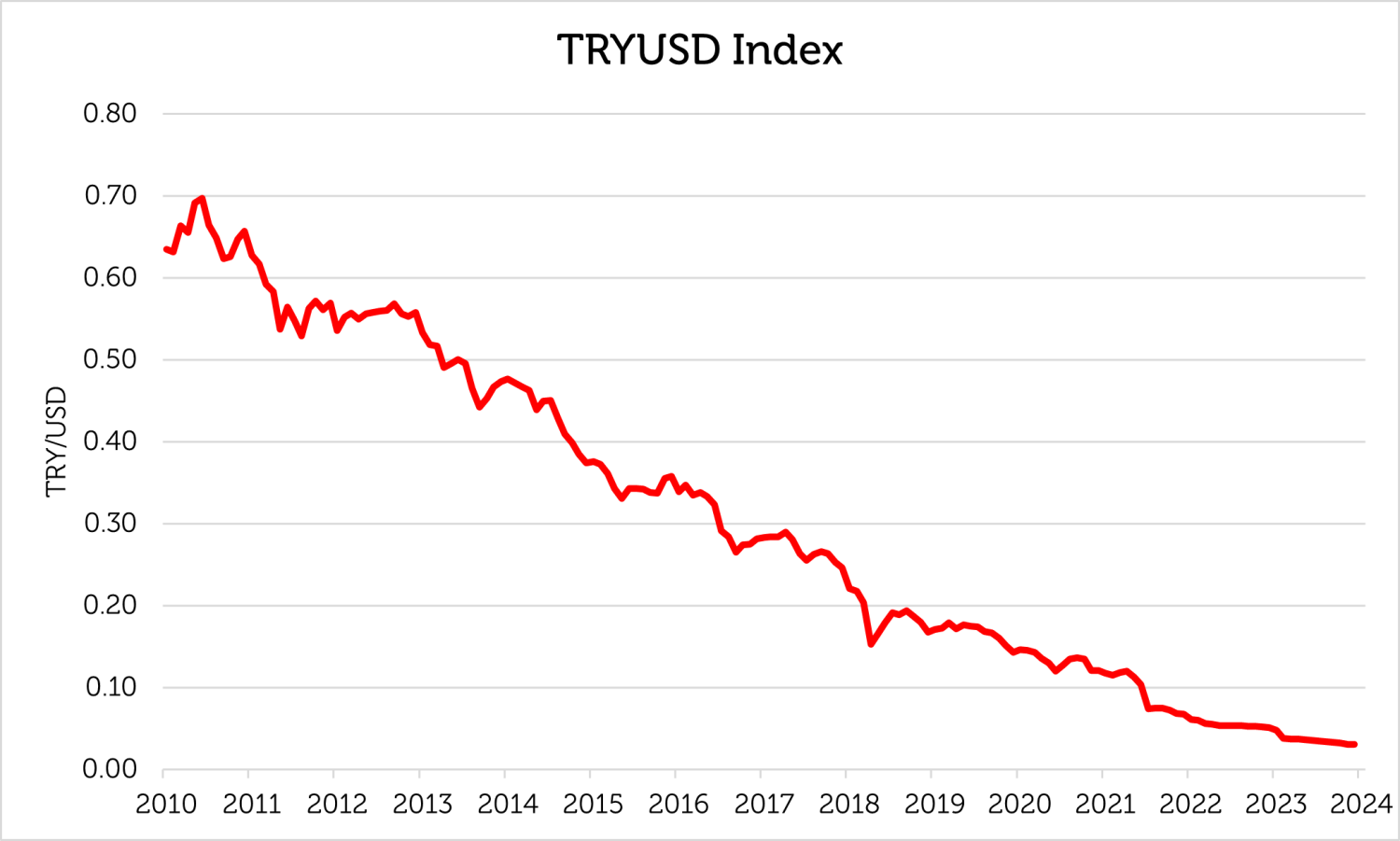

With negative real interest rates, the Turkish lira has depreciated consistently against the US dollar, diminishing financial returns to overseas investors.

Source: Redwheel as of 30 April 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

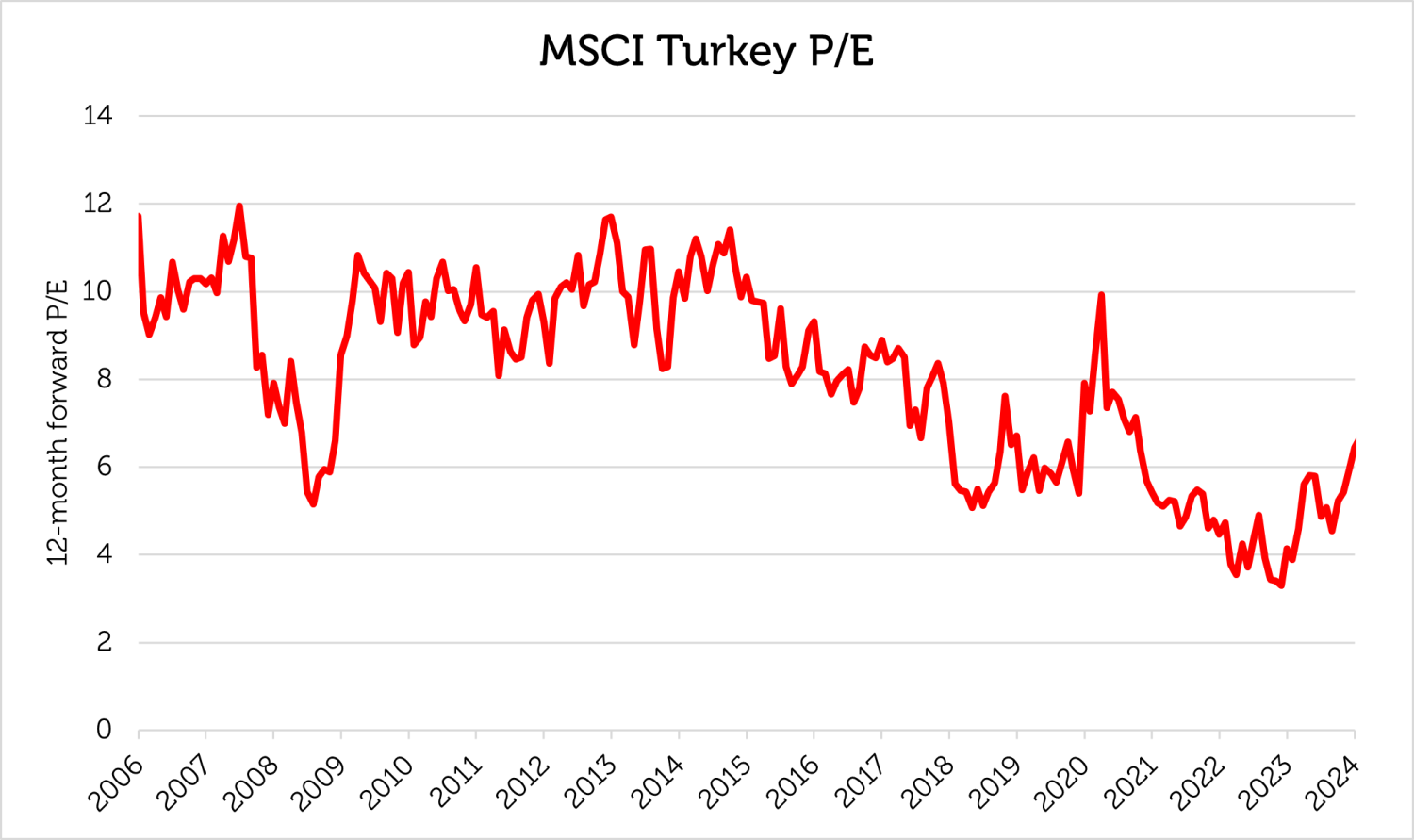

The consequence of currency depreciation and overall disappointing returns since the Global Financial Crisis in 2008 has been that the equity market has de-rated and has become very cheap, now valued at just over 6 times forward earnings.

Source: Bloomberg, Redwheel as of 30 April 2024. Uses 12-month forward consensus estimates. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

President Erdogan’s U-turn – Finance Minister Simsek revives confidence

Recognising the problems that resulted from unorthodox economic policy and overheating, President Erdogan appointed Mehmet Simsek as Minister of Finance, a position the latter held from 2009 to 2015. A former economist at Merrill Lynch, Dr. Simsek is a highly respected figure in financial markets, and he has begun to implement more orthodox economic policies that include raising interest rates and reducing public spending in order to curb inflation. After Dr. Simsek’s appointment as Finance Minister, the Central Bank of Turkey embraced orthodoxy and increased interest rates to get inflation under control.

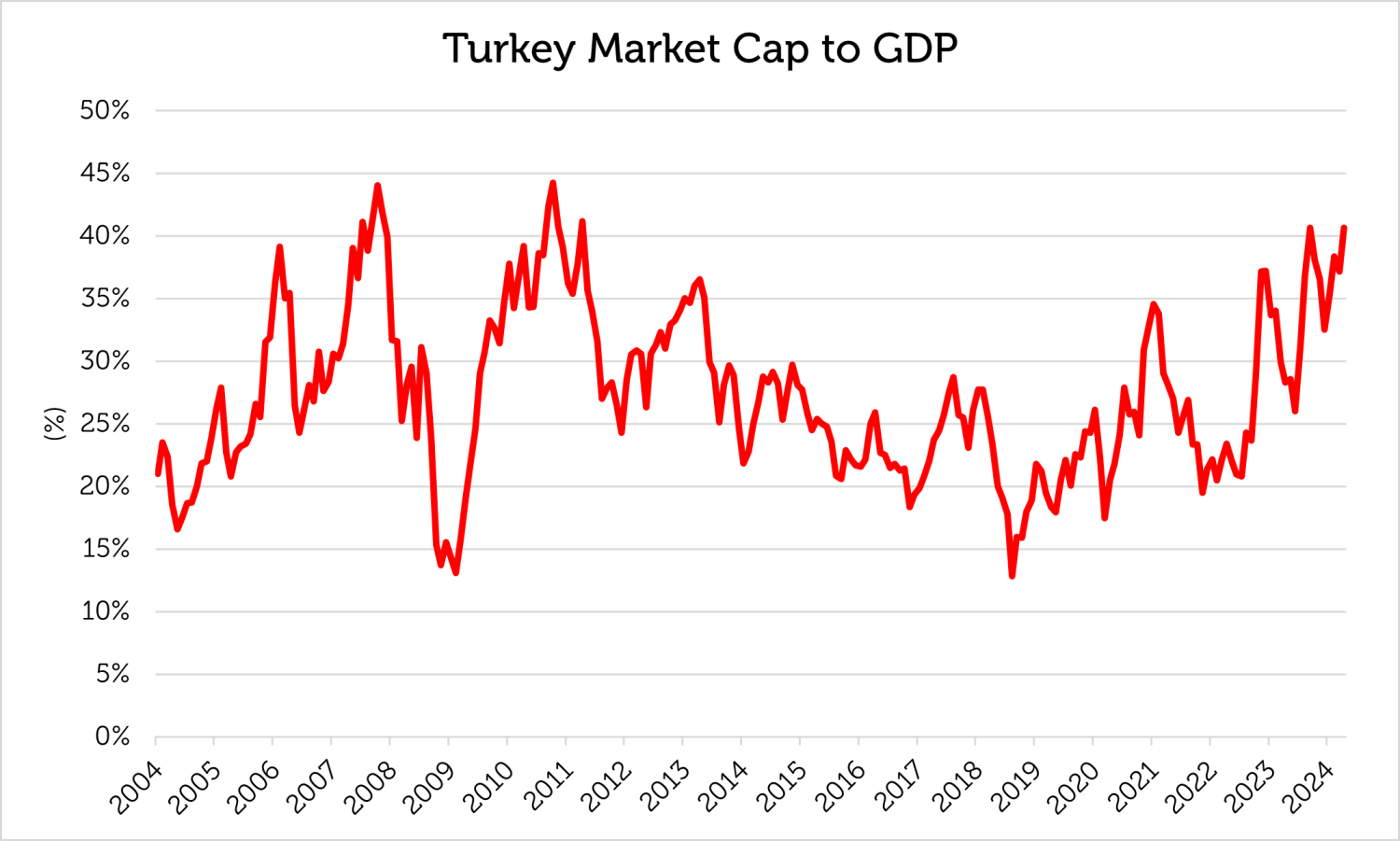

The Finance Ministry also plans to cut public spending by TRY 100 bn ($3.125 bn) in order to reduce the fiscal deficit, which should reduce inflationary momentum and improve sovereign creditworthiness. A lower cost of capital would allow companies to raise equity capital for growth domestically, and the market valuation could re-rate upwards, giving Turkey’s stock market a more prominent role in economic development with a higher ratio of market capitalisation to GDP.

Source: HSBC, Redwheel as of 30 April 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

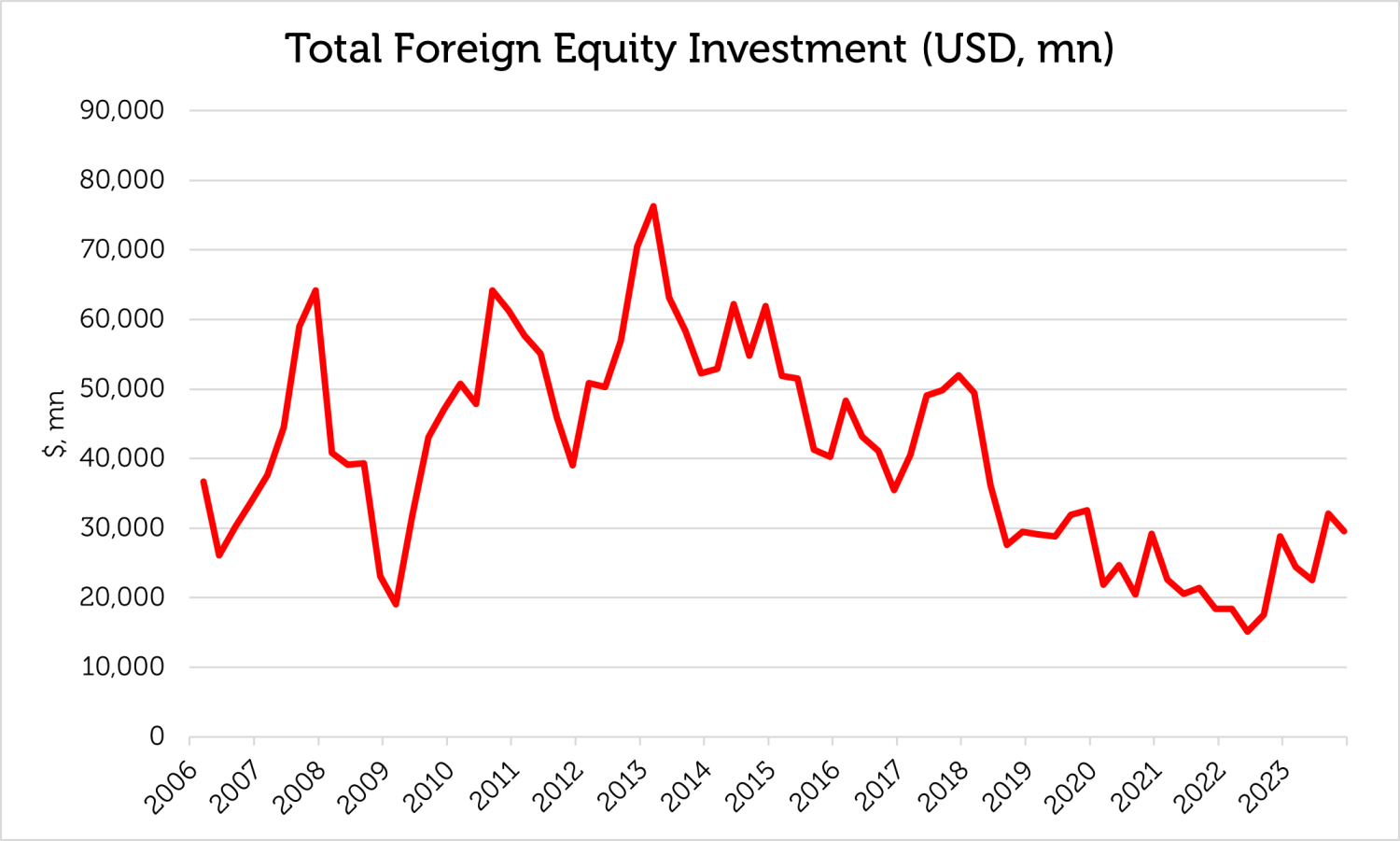

The credit rating agencies have recognised the improvement in Turkey’s economic management, with both Fitch and S&P raising their credit rating to B+ from B in March and May 2024, respectively. The amelioration in the credit rating lowers borrowing costs for the Turkish government and, by extension, Turkish companies. This should encourage foreign direct investment and portfolio investment, which is now beginning to rise from a low level.

Source: Haver Analytics, Redwheel as of 30 April 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

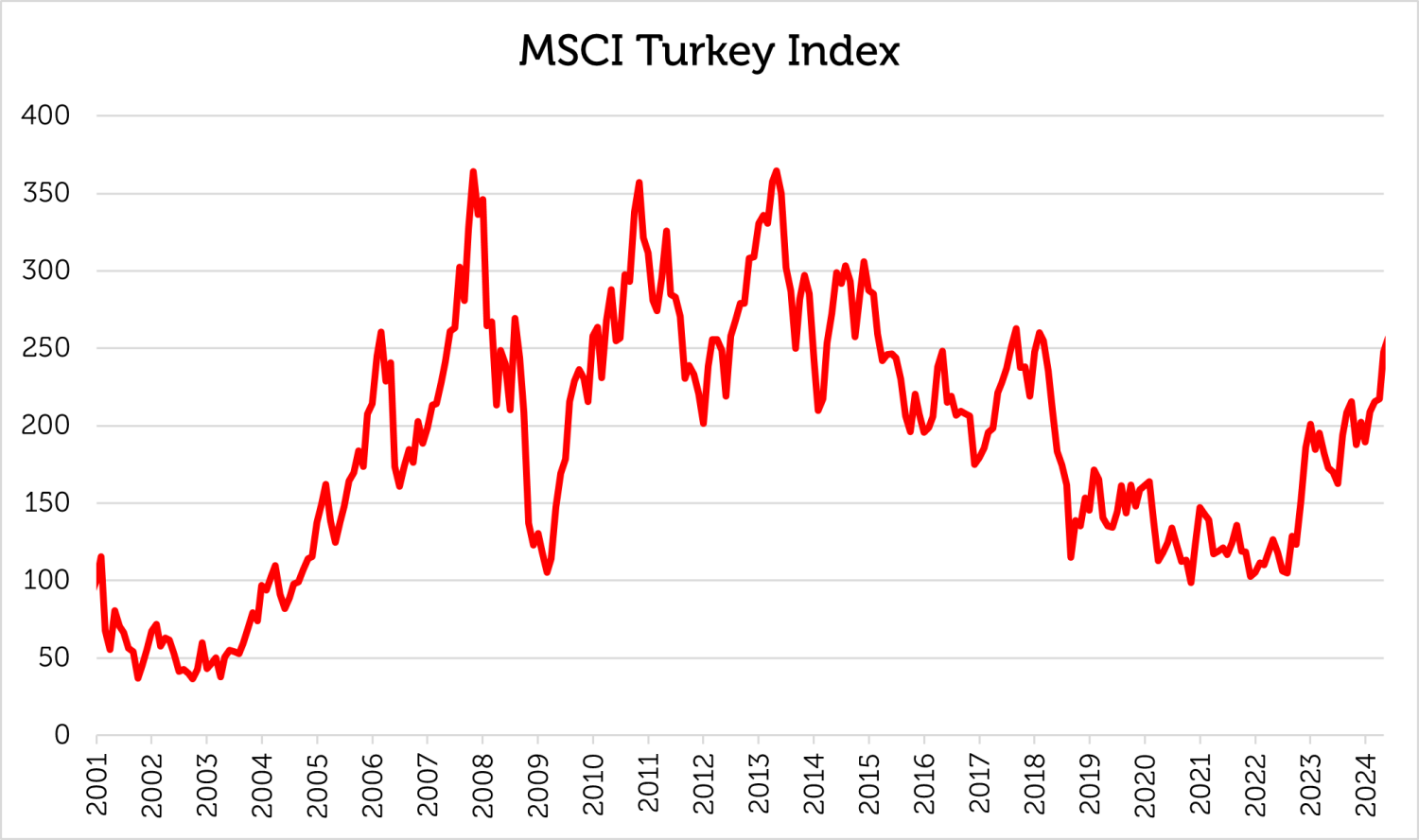

The market is paying attention

Financial markets have applauded this progress, and the MSCI Turkey Index has gained over 50% since the elections in May 2023. Turkey is one of the best performing equity markets so far in 2024, having gained 33% in US dollar terms year-to-date.

Source: MSCI, Redwheel as of 30 April 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

There are risks to the market during the phase of higher interest rates and lower public spending, for tighter monetary and fiscal policy tend to slow the rate of economic growth. Austerity tends to lose public support if it is not implemented quickly and does not result in rapid economic improvement.

However, the next elections are not until 2028 so there is little political pressure to abandon the reform programme. There is time to reap the medium- and long-term benefits of lower inflation, for which the immediate target is 36%. Success in reaching the inflation target should lead to a significant reduction in interest rates; a low inflation and interest-rate environment should allow for higher investment and sustainable economic growth that would benefit equity investors in the long run.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.