The case for investing in next generation emerging markets is underpinned by strong long-term structural growth drivers. In the current environment, one of these drivers is further boosted by a significant cyclical recovery. Here we take a look at the outlook for travel and tourism within the next generation emerging markets universe and explain why the Redwheel Next Generation Emerging Markets Fund is poised to benefit.

People love to travel and, in recent decades, it has become increasingly easy to do so as disposable incomes have risen and the cost of long-distance travel has fallen. As a result, travel and tourism has been a fast-growing industry for many years and become an important part of the global economy. Today, the sector accounts for 12% of global GDP and roughly one in every ten jobs worldwide is linked to the travel industry. In many parts of the world, such as the next generation emerging markets of South America, Asia, Eastern Europe and Africa, it is a vital part of the economy.

There has always been cyclicality within the industry given its dependence on disposable incomes and corporate profitability but no one had foreseen a world in which travel would grind to a complete halt. The COVID pandemic had a tremendous impact on the travel and tourism sector and many of the next generation emerging market economies were particularly hard hit by the temporary inability to go on holiday or travel for business.

Looking ahead there are good reasons to expect the structural growth characteristics of the sector to resurface now that borders are re-opening and other covid restrictions are being relaxed. In short, the headwinds of 2020-21 are turning into tailwinds for 2022 and beyond.

Desirable destinations

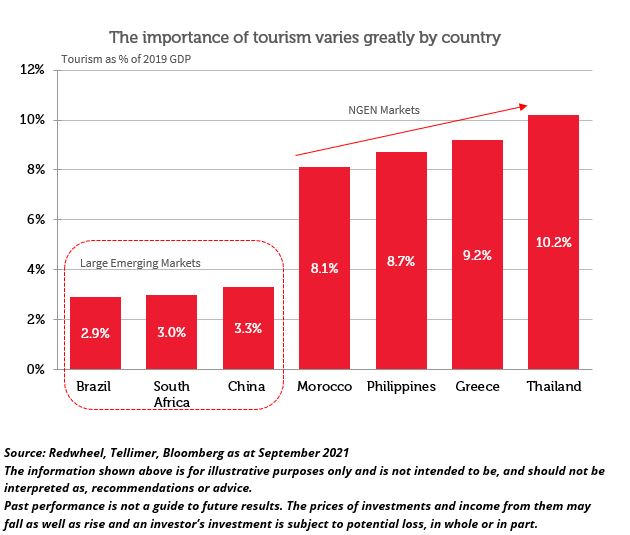

The exposure of different economies to the travel industry varies considerably from country to country. The importance of travel to relatively mature emerging market economies like China and Brazil is low in relation to many of the next generation of emerging markets, as the chart below illustrates.

The figures above relate only to direct exposure to the travel and tourism industry. When we consider indirect exposure, through the hotels, restaurants, retailers and entertainment providers and many other types of other small businesses that benefit from tourist arrivals, the overall importance of tourism to these economies is much greater. As a general rule of thumb, the indirect impact of tourism on GDP is typically double the direct contribution, so it is easy to understand how influential this industry can be for the economies that are most exposed to it.

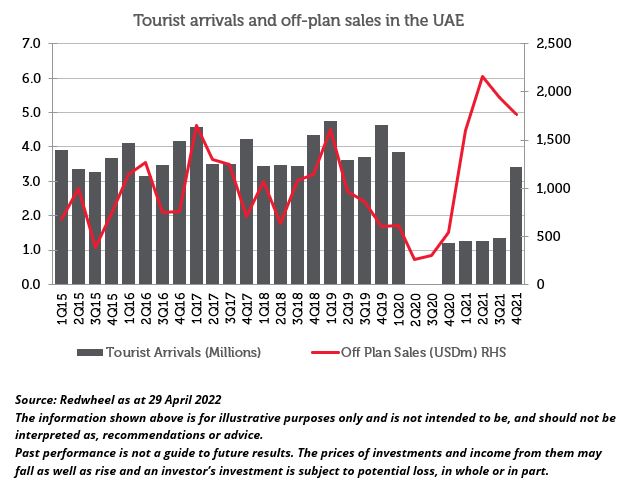

As a result, we do not have to invest only in businesses that are directly involved with the provision of travel and tourism services to get exposure to the travel theme. The economic benefits of tourism are much broader. Take the United Arab Emirates (UAE), for example. The country receives approximately four times its domestic population in visitor arrivals each year, which highlights how important travel is to its economy (Worldbank). Having handled the pandemic well, it was able to reopen its borders relatively quickly and tourist arrivals are now almost back to pre-covid levels already.

The UAE is not just a tourist destination story. Dubai is also an increasingly important global business hub. Modelling itself on the success of Hong Kong and Singapore, Dubai has positioned itself as the centre of business for the whole region. As we see the rise of the next generation of emerging markets, Dubai looks very well situated to benefit from much broader growth, from East Africa, across the Middle East and along the old Silk Road. As a result, the UAE’s real estate market has started to recover after years of stagnation, as reflected in the recent significant rise in off-plan sales. EMAAR Properties, the leading real estate developer in Dubai and an important holding in the portfolio, reported its highest ever real estate sales figures in 2021. The company trades on less than 9x earnings, has excellent earnings growth potential and, despite an accelerating share price recovery, it still offers plenty of upside towards the highs of 2014-15.

Elsewhere, we expect increasing tourist arrivals to be positive for the local economy in the Philippines, which is the largest country exposure within the Next Generation Emerging Markets Fund. The portfolio is also well-positioned to benefit from a continued recovery in travel to Egypt, Thailand and Greece. Many people are desperate to get back on the plane and visit these beautiful countries again.

Proceed to departure gates

Contemporary data supports the thesis that the next generation emerging markets are poised to enjoy a strong recovery in global tourism over the next couple of years. We are maintaining a close eye on metrics such as improving airline capacity and the recovery in hotel occupancy rates. Recent data points appear to be heading in the right direction as we see covid restriction continue to be relaxed.

However, this return of tourism is not just a bounce back story. Looking beyond the initial cyclical recovery in travel, we expect long-term secular growth to continue. Next generation emerging markets look particularly well-placed to benefit from the increasing wealth of more mature emerging markets. Before the pandemic, we were seeing considerable growth in outbound tourism from China and were starting to see it from India too. The proximity and attractiveness of near neighbours such as Vietnam, the Philippines and Thailand, have made them popular destinations for Asia’s emerging middle-classes.

When we launched the Redwheel Next Generation Emerging Markets Fund three years ago, we identified travel and tourism as one of the well-trodden paths to growth. By following these paths, the next generation emerging markets could develop into the next China or the next South Korea. We are looking to invest in businesses that can help to profitably enable that long-term development. Despite the temporary impact of covid, the fund has made a positive start to its journey and we are confident that it is travelling in the right direction.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment.

Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part.

Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.