When talking about valuation, most of the time we focus upon the implications for returns. Ultimately the valuation you pay for an investment is simply you saying, “what level of return am I happy to receive?”

In the short term, there is normally little correlation between the value one pays and the return one gets. Given the short-term nature of some investors today maybe this is all that matters. When trading, many are only concerned with the greater fool theory – that there is someone out there willing to pay an even higher price than you.

If investing though, the price you pay does influence the likely return you will receive. The higher it goes the lower the likely future return.

However, far less talked about is that the valuation establishes the range of outcomes required to deliver such a return for a particular investment. As the valuation rises the range of outcomes required to deliver more return narrows, until eventually a point is reached where only perfection will do. In other words, you are saying that the future is knowable and that nothing else could possibly turn out to be different from this. What we are talking about here is perfection.

“Talking and investing in “certainty” is one of the great traits of hubris frequently exhibited by investors.”

We have been taught these lessons many times before and yet we either want to forget or believe that it will be different this time.

Let’s look at Microsoft –an amazing company by all accounts. But priced for perfection.

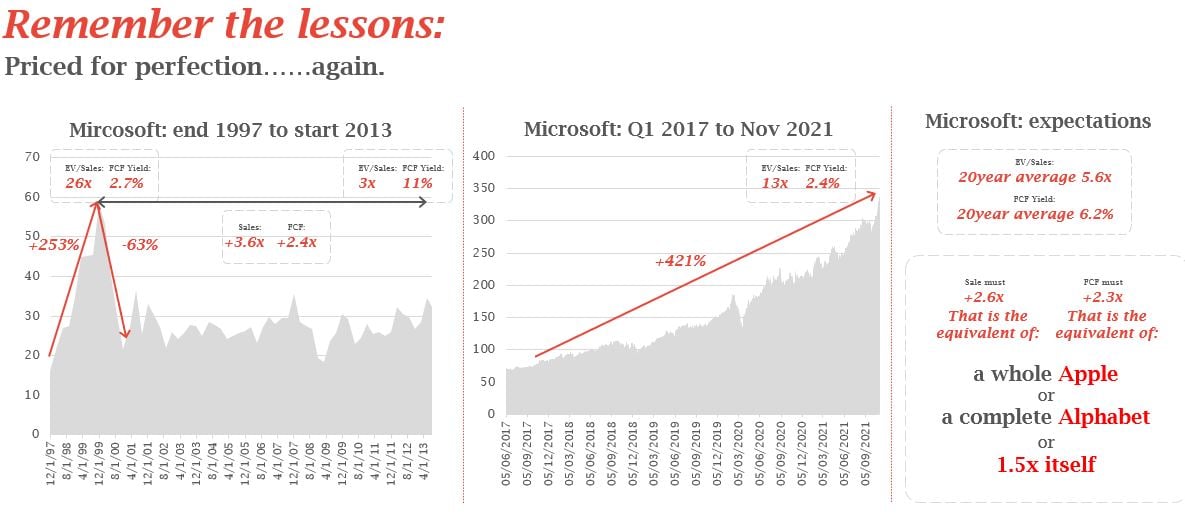

In 1999, at the peak of the tech bubble, Microsoft traded at 26x sales (trailing 12m revenue of c.$20bn) and a Free Cash Flow (FCF) yield of 2.7% (free cash flow of c.$13bn) according to Bloomberg. Perfection is demanded.

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested.The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

Yes, Microsoft fell at a rate of 63% due to the burst in the tech bubble however, despite going on to grow its sales over threefold and its free cash flow by over twofold over the next 13 years, it failed to respond in share price terms and instead simply de-rated the stock to 3x sales and 11% FCF. Even delivering almost perfection you can still lose 50% absolute (Source: Bloomberg)

Here we are again in December 2021:13x sales and 2.6% FCF yield. Yet, again, perfection is being demanded and this time from a far higher base level – sales are now c.$176bn and FCF c.$60bn(Bloomberg).

For Microsoft to return to its 20-year average multiples, for no further price appreciation, it will need to grow sales and cash over twofold. That is asking Microsoft to grow (say over the next 5 years – reasonable investment horizon) by the size of Apple, or Alphabet or to create another 1.5x itself!

Simply, this would give a return of ZERO by allowing it to return to average valuations. The result: to make more from this point it has to do even more.

Elsewhere and similarly again, perfection may not be enough…

Apple at the start of 2022 briefly touched $3trn of market cap. For comparative purposes at the end of September 2018 it was $1trn. Since then, Apple revenues have risen from $266bn to $366bn – 37% increase (Source: Bloomberg).

Its EBITDA (earnings before interest, tax, depreciation and amortization) #has risen from $82bn to $120bn, a 46% rise, and its free cash flow from $64bn to $93bn – a 45% increase.

Yet, its “value” has risen 200% over the same time period. Has Apple’s business changed so much it is worth so much more? Are we now putting expectations upon Apple to “make sure” its next businesses, be it cars or metaverse or wearables, to be perfect? Have we become “certain” of Apples future?

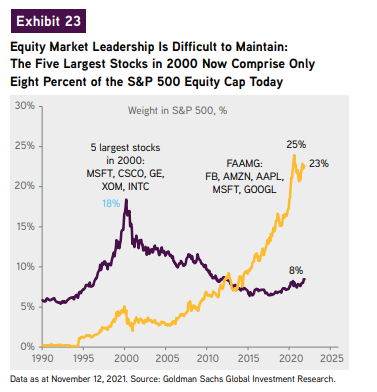

There comes a time when even the greatest companies, at the wrong valuation, become the riskiest. The five largest stocks in 2000, which represented 18% of the S&P 500 as at the end of December 2021, were c.8%. Today’s top five are c.23%.

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested.

Is it certain that ten years from now they will still be the dominant ones?

The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of RWC Partners Limited. This article does not constitute investment advice and the information shown is for illustrative purposes only.

Unless otherwise stated, all opinions within this document are those of the Redwheel Global Equity Income team as at 7th January 2022.