Continuous glucose monitors (CGMs) have revolutionised diabetes care since the first CGM was approved by the FDA in 1999, offering patients a way to monitor their glucose levels continuously without the need for frequent fingerstick tests.

The technology has improved significantly since then, becoming more accurate, user-friendly and integral to the management of type 1 diabetes, and increasingly important for many type 2 diabetics as well.

Modern CGM solutions have reduced hospitalisations [1], increased the time most patients spend in their ideal glucose range, and reduced incidents of hypo- and hyper- glycaemia [2].

Unsurprisingly, the uptake of these devices has been accelerating and it is estimated more than 7 million CGMs are now in use worldwide [3].

Patient benefits driving market growth

The positive impact on patients’ lives has unsurprisingly also boosted the financial results of companies providing CGM solutions to patients like Abbott, Dexcom and Medtronic.

CGMs have therefore represented an attractive opportunity for investors, particularly where the businesses are diabetes-focused companies, as is the case with Dexcom.

‘How big could the market for these devices become?’ and ‘How long will the solution providers be able to deliver such strong growth?’ become natural questions for many investors.

Clearly, all market opportunities are ultimately finite, and sales growth must moderate at some point. Nevertheless, we believe there is still significant growth ahead for CGM solution providers.

Market adoption has been rapid, driven by the clear positive patient impacts delivered by the devices. Even so, it has been estimated that just 40-50% of type 1 diabetic patients in the US are currently using CGMs. The rate of uptake elsewhere in the world, and in type 2 diabetes, has been much more gradual [4].

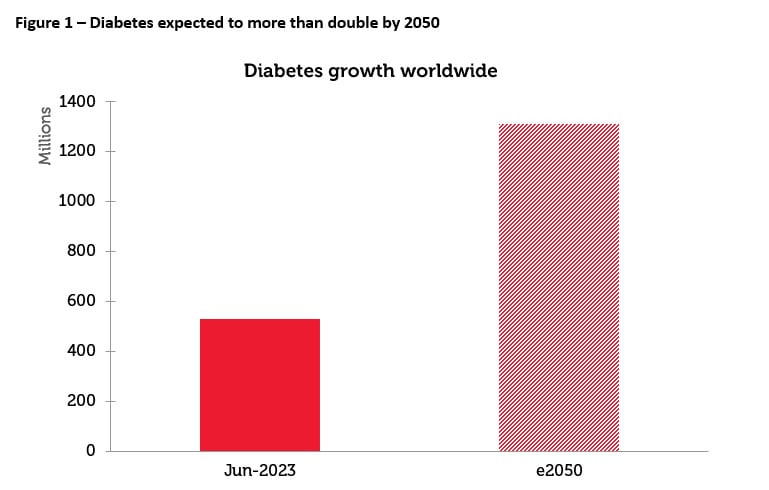

With an estimated 500 million diabetics worldwide today – and expectations that this could grow to over 1.3 billion people by 2050 – this suggests further growth is possible [5].

Source: The Lancet, 24 June 2023. The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

Creating a new wearable tech segment

There are also potential growth opportunities beyond the initial purpose of diabetes management. For example, there is increasing interest in the use of CGMs for wellness, which extends the appeal of the devices well beyond the diabetic population. There could be significant demand from individuals wishing to use the devices for other purposes, such as diet monitoring and optimisation.

Abbott recently launched its own consumer health focused CGM, Lingo, to directly address this additional market opportunity. Zoe, a business that is benefiting from increasing consumer awareness, also offers a CGM device that it describes as “the world’s most advanced nutrition tech, on your arm”.

Pictured: A woman wearing Abbott’s Lingo CGM (credit: Redwheel)

Many commentators see this as a logical next step for wearable tech and the product providers are confident in the potential of their technology. Zoe says it offers the opportunity to “optimize your energy, mood, and metabolism with unique insights into your glucose levels in real-time”. Meanwhile, Abbott says that its Lingo biosensor and app combo helps users “fine-tune habits”, “improve metabolic health”, and “live your healthiest life”.

However, the concept of monitoring blood glucose for non-diabetics is controversial. Some doctors question the strength of the evidence that it is even necessary. At the same time, some diabetics object to the idea that this technology could become a status symbol rather than a medical necessity. Meanwhile, other medical professionals have praised companies like Zoe for gathering the evidence to assess the benefits of these devices for non-diabetics.

The jury is out. However, with Lingo first launching in the UK, we are in the fortunate position of being able to interrogate our investment thesis further by buying the device and trying it for ourselves. And the results of this test will be the focus of our next blog!

Sources:

[1] diaTribe

[2] Dexcom

[3] Close Concerns, 2022

[4] Journal of General Internal Medicine

[5] The Lancet

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.