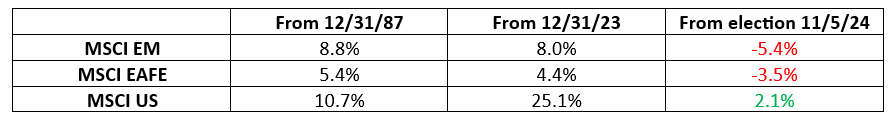

Emerging Markets posted positive returns in 2024. The MSCI Emerging Markets Index rose 8.0%, which is comparable to the annual average of 8.8% per annum since inception on 1st January 1988. This is superior to the performance of MSCI EAFE over the same timeframe and second only to the annual return of the MSCI US Index over this period.

While it might be argued that global equities, including Emerging Markets, began a bull market in the fourth quarter of 2022, returns have felt mediocre due to the dominance of the US equity market since the rebound from the Global Financial Crisis in 2008 and because of the divergence of Emerging Markets from the US market since the US general elections on 5th November 2024.

The Republican clean sweep of the White House, the Senate and the House of Representatives provides a mandate for President Trump’s “America First” programme of deregulation, tax cuts and trade tariffs, which could propel US GDP growth at the expense of its trading partners and reinforce USD strength that might diminish returns from international equities. There are several reasons to consider that this narrative is perhaps too glib and that the overcrowded trade – in this case, US equities – can provide opportunities for the contrarian.

The US is too big!

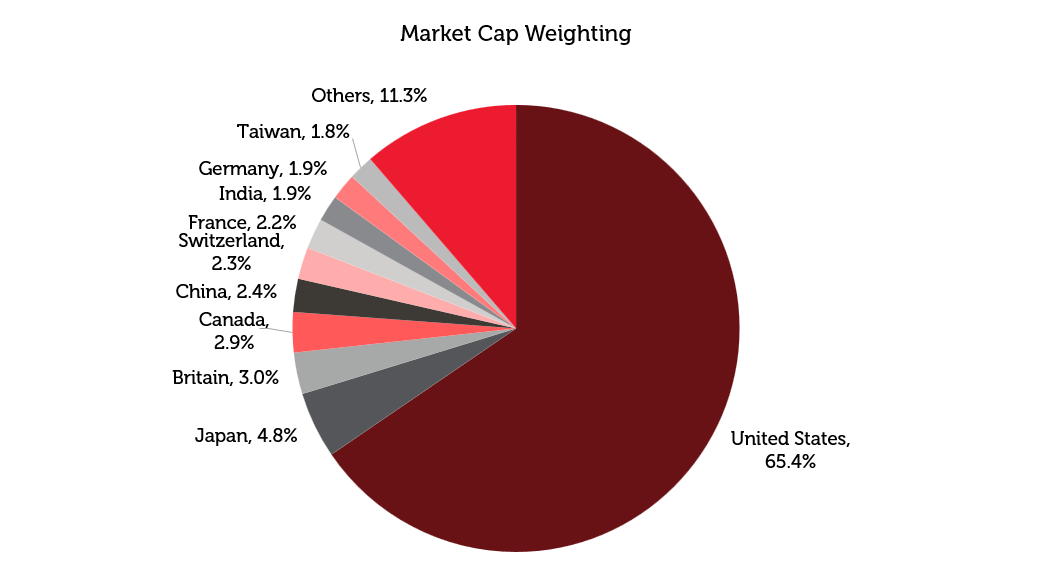

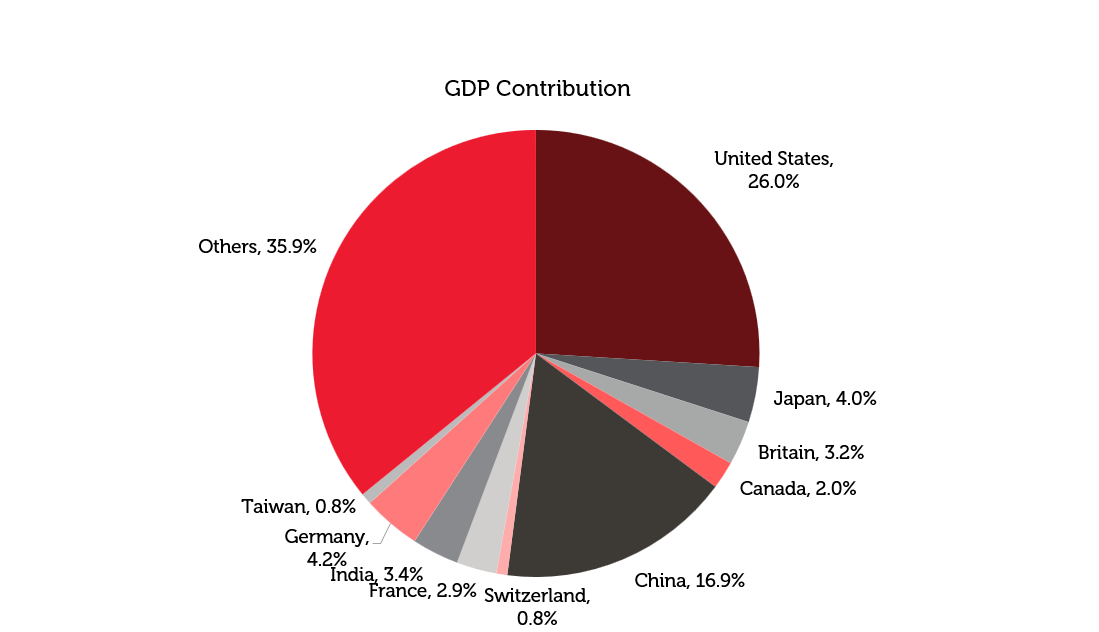

First, the American equity market has now become disproportionately large compared to the rest of the world. The MSCI US Index now accounts for nearly two thirds of global market capitalization compared to just over a quarter of global GDP and only just over 4% of the global population.

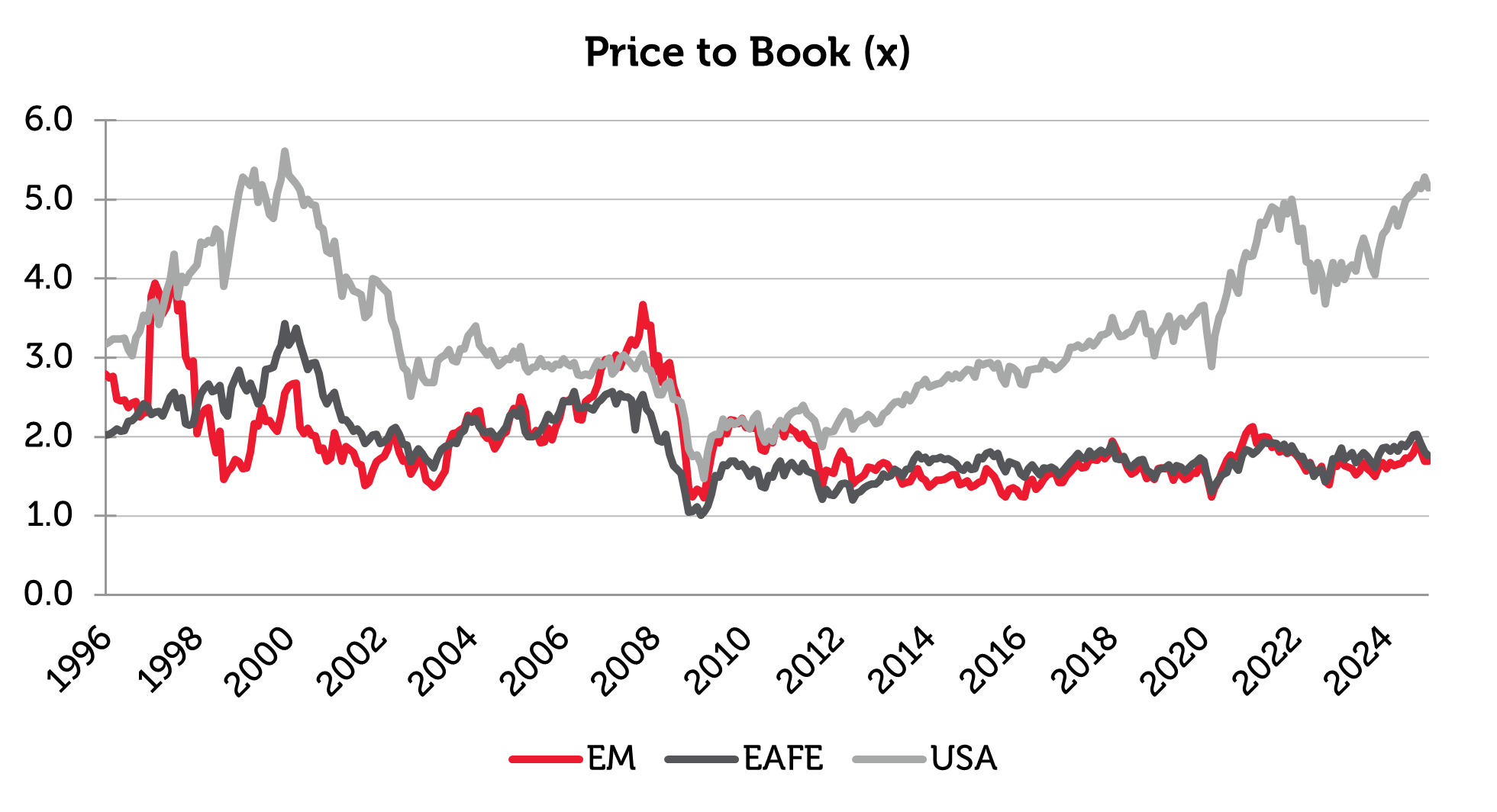

Many investors believe this situation to be justified by the favourable US market structure with dominant global technology and consumer companies that generate higher growth and profitability than companies domiciled elsewhere. While this may be correct, since the market trough at the end of 2008, the expansion of valuations has contributed as much to US market returns as earnings growth. The MSCI US Price / Book valuation has climbed above 5, which it last attained at the end of the bull market in late 1999 and early 2000 before succumbing to a bear market in the early 2000s – the “Tech Wreck.”

Interest rates are going down, supporting earnings and valuations

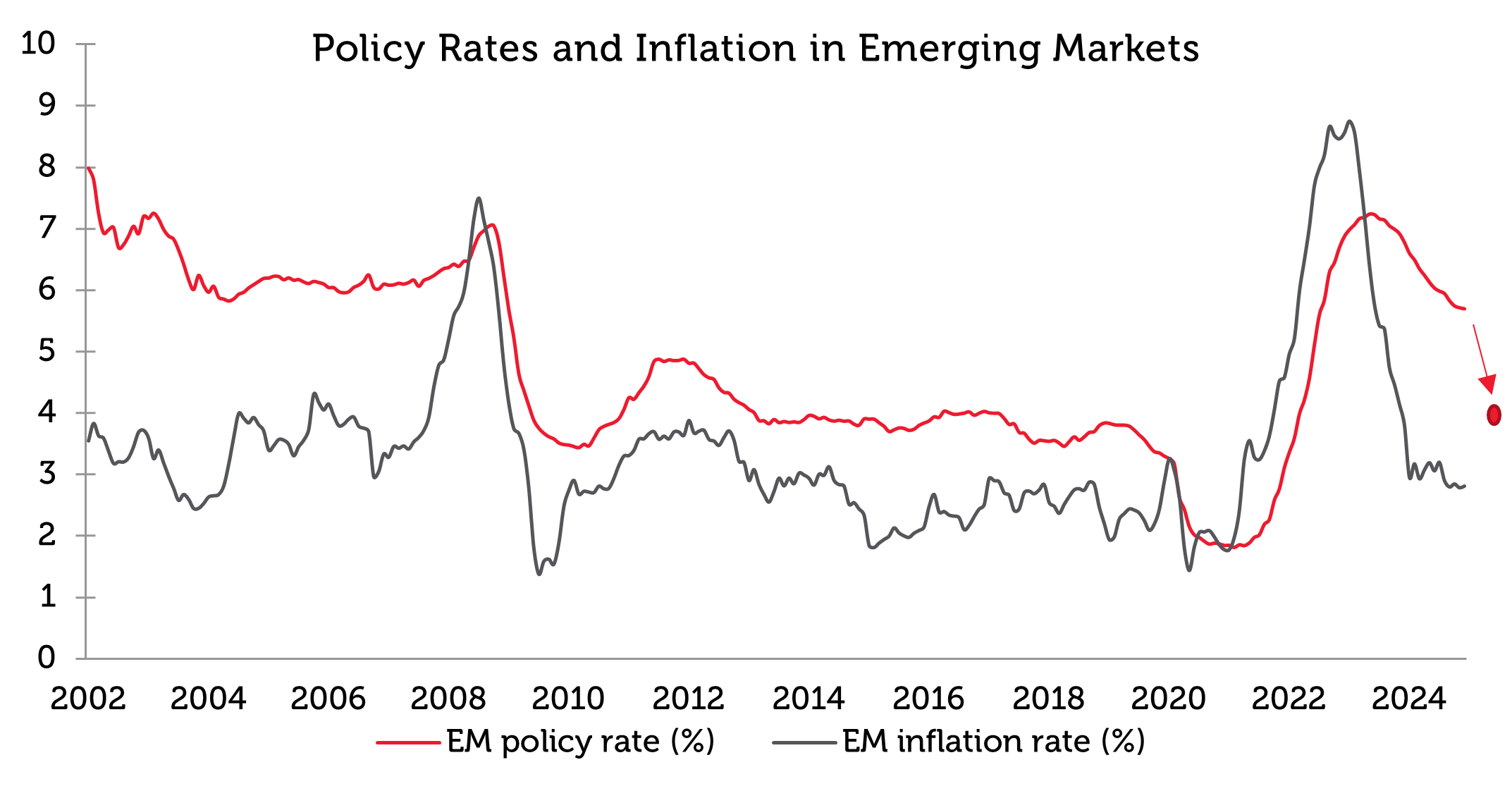

The Federal Reserve has cut interest rates to 4.25% – 4.50% and is likely to continue reducing the Fed Funds Rate gradually in 2025. This reduction will encourage emerging market central banks to lower their policy rates as well. Lower discount rates can stimulate growth, increase the relative attractiveness of equities and allow equity valuations to expand.

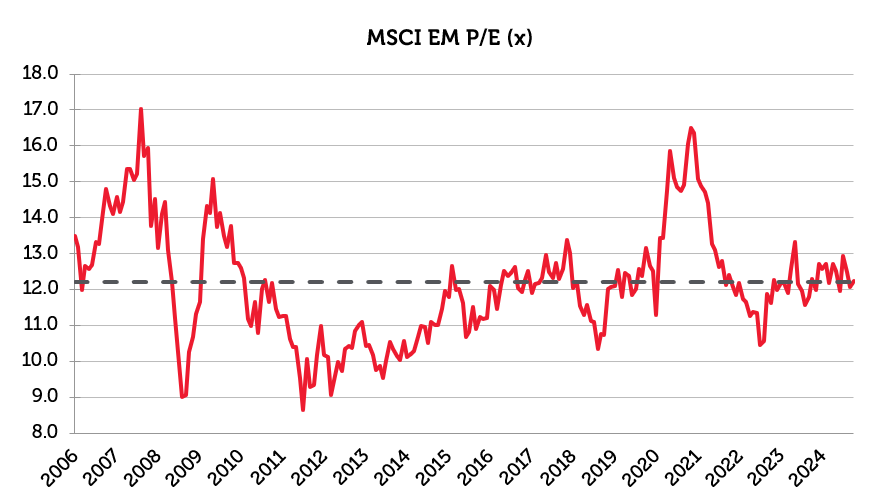

Lower rates should support a higher valuation which, at 12.4 times 2025 earnings, is only at an average multiple and should be re-rated with the rebound in corporate earnings that began in the spring of 2024.

Other countries, particularly China, have fiscal firepower

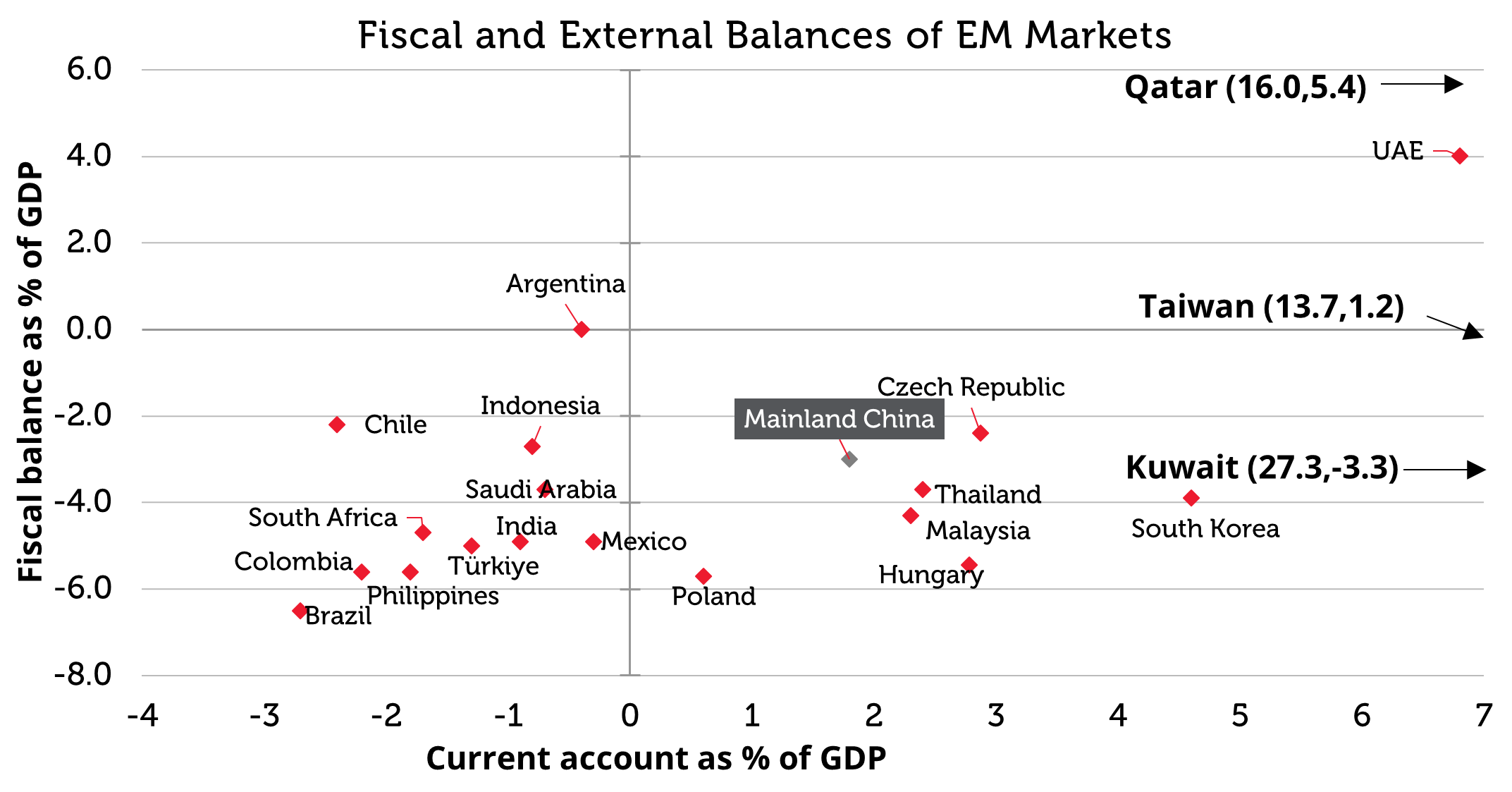

Trade tariffs, especially if reciprocated, are likely to dampen the growth of exporting countries, particularly in Asia. However, countries with current account surpluses and sound fiscal management are likely to pursue fiscal stimulus in the form of tax cuts or subsidies that can encourage domestic spending to offset the potential effect of tariffs on trade.

The most obvious example is China, the principal target of American tariffs, which can attempt to reduce reliance on manufacturing and exports and boost domestic consumption through fiscal measures.

The same is also true for Taiwan and the Middle East, who have the resources to stimulate domestic demand to compensate for any loss of trade.

Many idiosyncratic opportunities exist that are independent of US trade policy

Active management involves realigning investments away from the given benchmark towards countries, sectors and themes that can be backed with conviction. Examples of idiosyncratic opportunities include:

Strong domestic growth that might be insulated from global trade – China, India

These two countries are not only still the largest in the MSCI Emerging Markets Index with weights of 25% and 20%, respectively, but they remain amongst the fastest growing. Bloomberg estimates India’s GDP growth rate at 6.4% in 2025 and China, estimated at 4.5%, still exceeds the Emerging Market average of 4.2%. Easier monetary and fiscal policies underpin high single-digit and low double-digit EPS growth in China and India, respectively, in 2025.

Idiosyncratic reform and restructuring – Argentina, South Africa, Turkey and Frontier Markets

Each of these countries undertook moves towards economic orthodoxy in 2024. Argentina underwent fiscal consolidation to reduce inflation and improve public finances, which reduced the cost of capital and encouraged investment. South Africa’s Government of National Unity (GNU) pledged to eliminate corruption and waste, improve the reliability of Eskom, the national electric utility, and rebuild dilapidated infrastructure to boost economic growth. Turkey finally raised interest rates to positive real levels to get inflation under control and reduce economic volatility. Each country remains cheap by historical standards on P/E multiples of 10 or below, which should re-rate as interest rates fall and growth recovers.

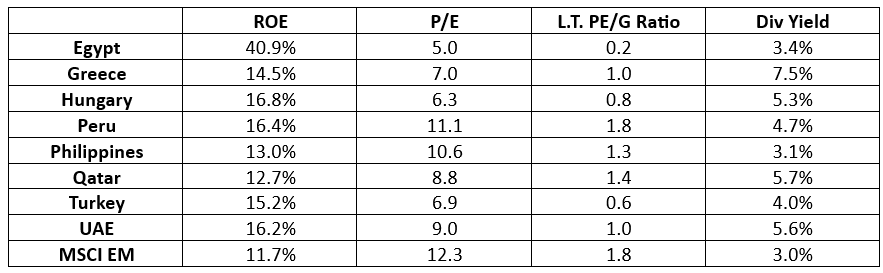

Small countries with improving profitability and growth trading at below average multiples – Greece, Hungary, Peru, Philippines, Qatar, Turkey, UAE

Often overlooked for their small size, smaller countries can be sources of outperformance. Several countries in the EMEA region in particular have attractive growth characteristics at low valuations.

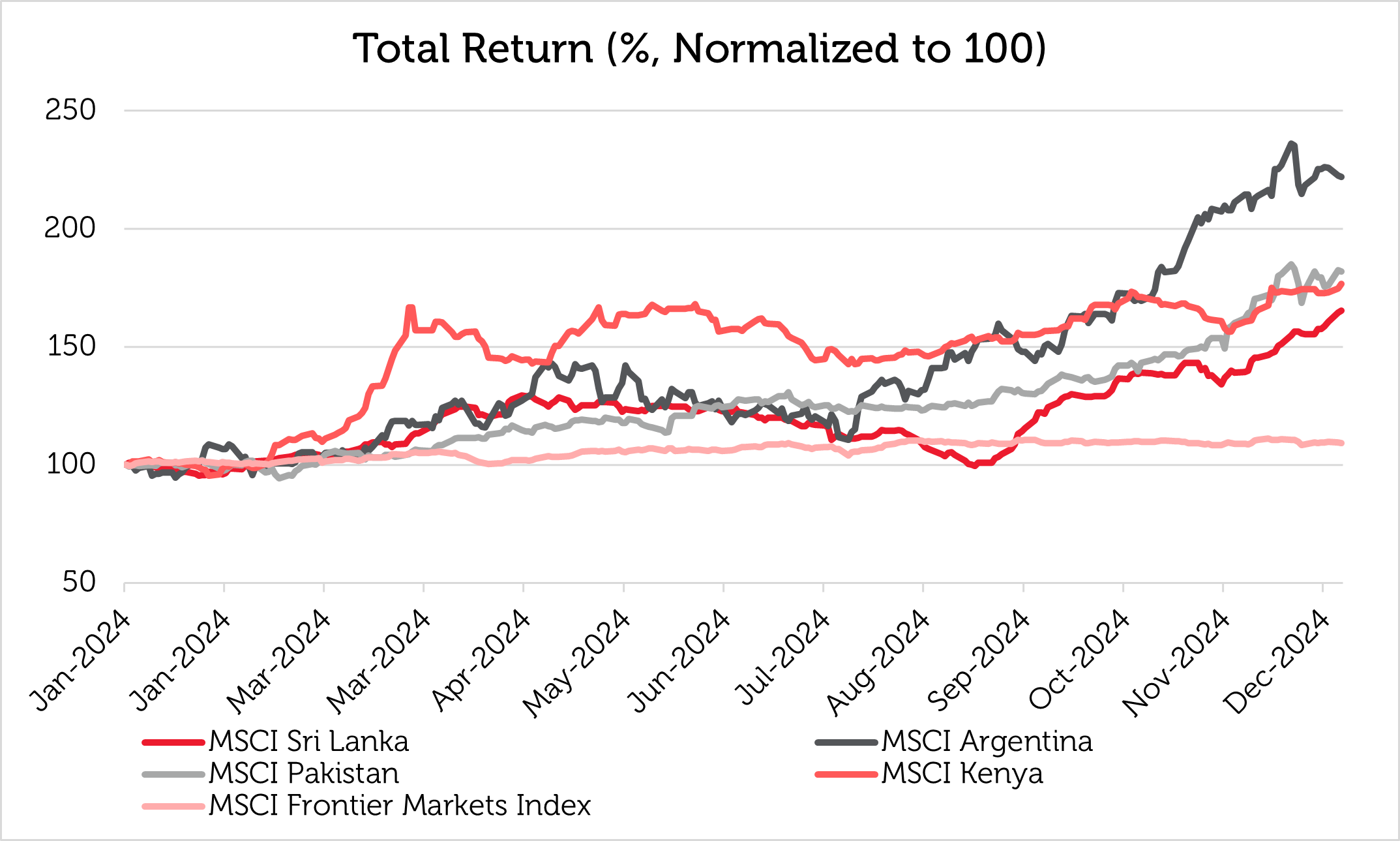

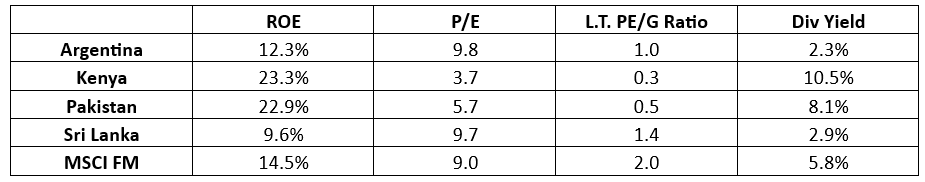

Several frontier and off-index economies are improving their fiscal management and undergoing economic reforms that are gradually bringing investors back to the market. In 2024, this macro environment drove strong outperformance for certain countries in our investment universe.

This trend is expected to continue as these economies further integrate into global supply chains, capitalize on their young populations, and sustain their focus on macroeconomic stability. We believe that valuations remain attractive and growth prospects are robust.

Long-term themes that transcend shorter market cycles – e-commerce, energy transition, financial inclusion, gold, reshoring, technology

Several themes will give rise to opportunities that are independent of global trade.

Retailing, which is underpinned by employment growth and wage growth, continues to be transformed online. As income levels in emerging markets rise, driving the continued expansion of the middle class, consumers are spending more on new retail and e-commerce platforms.

The transition to green energy is reaching critical mass throughout the world so that renewable energy is often more economically attractive than carbon-based energy. Adoption of clean energy is likely to continue globally despite any changes of policy in Washington DC, and China is a world leader in new energy technology, both in electricity generation and transportation. Many emerging economies are encouraging renewable energy with ambitious targets and green-friendly policies. These initiatives focus on enhancing energy security, reducing pollution, fostering economic development and attracting private investments for sustainable development. Governments are implementing regulatory frameworks, offering incentives, and collaborating with global institutions to accelerate the transition.

Reshoring: Mexico and many smaller Asian economies, under threat from American tariffs, are attracting foreign investment for manufacturing and regional distribution as both corporate and national logistical preferences have changed since the COVID-19 pandemic and Russia’s invasion of Ukraine. Reshoring and shortening supply chains could grow as an economic theme with President Trump back in office.

Gold: Lower interest rates in emerging markets should encourage credit growth and demand for other financial products. As an alternative to fiat currency, gold, which climbed 26% in 2024[1], is likely to remain in demand because of fiscal profligacy, unsustainable sovereign debt burdens and political fractures across the world. Emerging market central banks broadly continue to buy gold at a rapid pace[2], driven by its status as a store of value amidst these uncertainties. Finally, technological progress and the adoption of AI depend upon many of the technology hardware and software companies that are based primarily in Asia.

Sources:

[1] Bloomberg 31 December 2024

[2] World Gold Council, November 2024

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.