Despite rebounding in the first quarter of 2021, the energy sector is one of the worst performing sectors in the last year (and for several years). This seems puzzling given that it is the sector with the fastest earnings growth and the most positive earnings revisions in 2021. It seems that many investors are not willing to consider the sector, but we believe there are five reasons why they should take another look.

1. Forced Selling Can Lead to Irrational Behaviour

Since thousands of investors have access to huge amounts of data, one can assume that their collective wisdom leads to assets being reasonably fairly priced most of the time. Where this does not apply is when investors become forced buyers (pension funds being forced to buy government bonds with negative real yields) or forced sellers as is currently the case with the energy sector. In their rush to virtue signal their green credentials, many fund managers have excluded sectors such as energy and mining from their investable universe. We have discussed before why we think this makes no sense here but it also leads to the situation where investors become forced sellers of these stocks irrespective of how low the valuation is and potentially create an opportunity for others to exploit.

2. Out of Favour[1]

As an indicator of how out of favour the energy sector is, consider that in 1980, it made up 30% of the S&P500 index whereas today it represents less than 3%. To put that in context, the Technology sector is now 28% of the S&P500 and both Apple and Microsoft represent more than 5% of the index.

3. Fundamentals

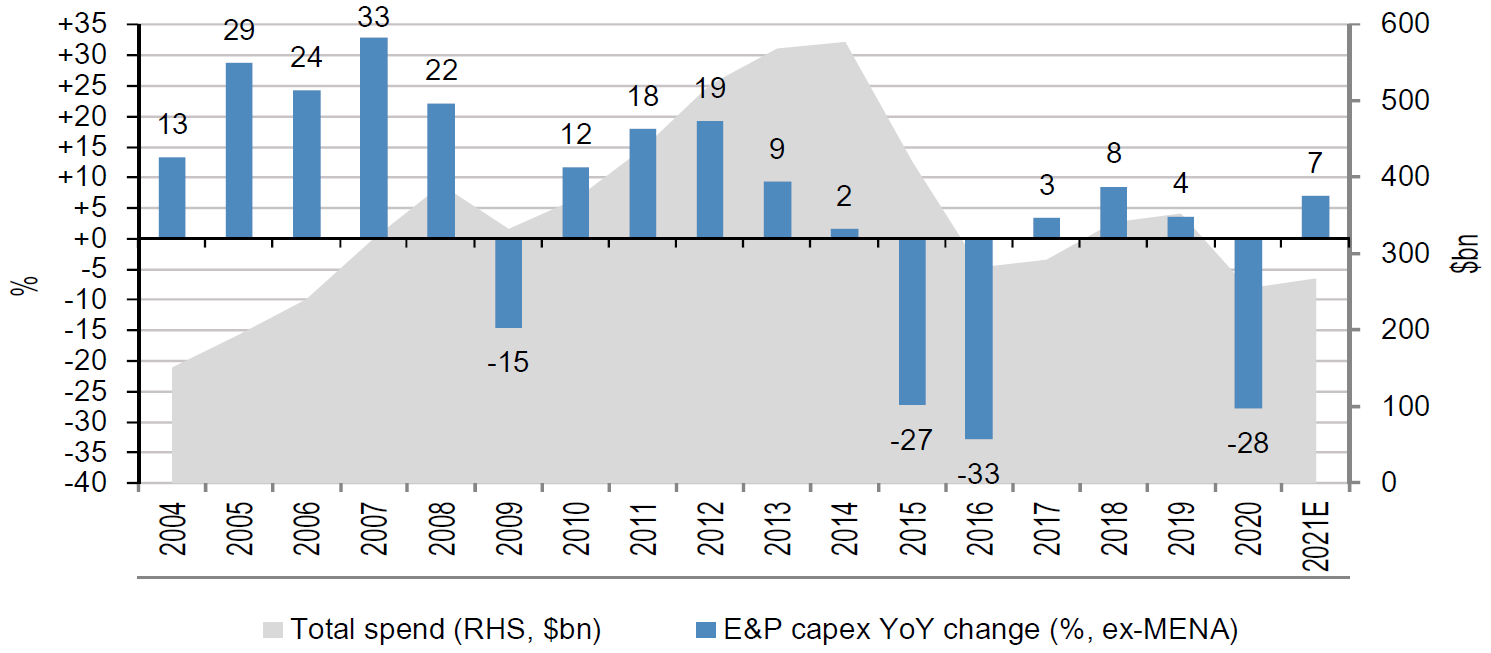

The irony of the energy sector being out of favour is that it comes at a time when the fundamentals are looking very promising. In response to falling energy prices as well as environmental pressure, energy companies have slashed their capital expenditure, for instance the chart below shows that the 43 largest listed producers have cut their exploration & production capital expenditure by two-thirds. Some believe that as Covid subsides and world economies re-open, there may be insufficient production to meet rising energy demand.

[1] Source: Bloomberg, 9th August 2021

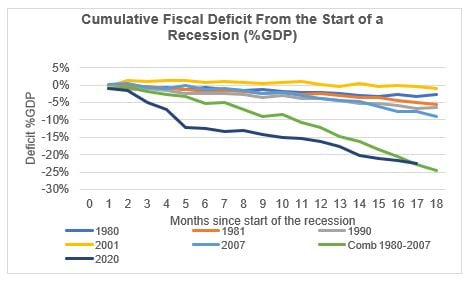

4. Cheap Inflation Hedge

Whilst central banks continue to assure markets that rising inflation is transitory, investors need to consider the possibility that they could be wrong (or that they have a vested interest in this claim). With the Federal Reserve having expanded their balance sheet by $4 trillion in just six months last year (the same amount as occurred between 2008-2018) and the US government running a deficit amounting to the total of the cumulative deficits in all the recessions from 1980 to 2007, the ingredients for an increase in inflation are certainly there.

Historically energy stocks have performed well during periods of rising inflation and given the low starting valuations of them today, one can make the case that they offer the possibility of a cheap inflation hedge.

This argument can be extended to more broadly to commodity prices which are at their lowest point relative to the S&P500 since 1969 which preceded one of the best decades for commodities ever.

5. Low Valuations

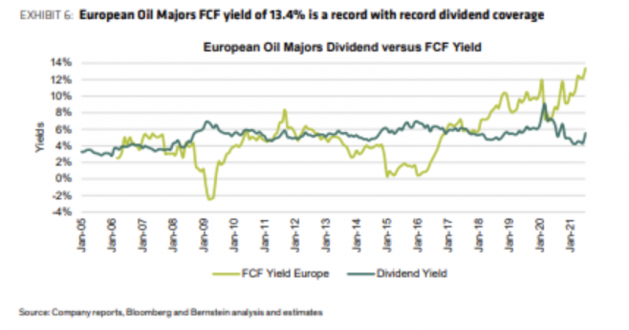

Buying stocks with low starting valuations has gone out of favour in recent years but we still believe that this holds as one of the best guide to future returns. If we use BP as an example, management have guided that at the current oil price of $70, the company would produce free cash flow per share of 73 cents which at the current USD share price of 422 cents, equates to a 17% free cash flow yield (and note this is AFTER all the capex required to transition to renewables production). At $60/bbl Brent, the company expects to be able to deliver buybacks of around $1.0bn per quarter and have capacity for an annual increase in the dividend per ordinary share of around 4%, through 2025. BP’s plans imply ~10% of market cap returned to shareholders split about equally via a ~5% dividend yield and an annual cut of ~5% of its share count meaning that BP could return >55% of its market cap across 2021-25 back to shareholders.

The chart below shows that the dynamics highlighted above apply more broadly across the European oil majors but particularly illustrates the scope for dividend increases given the very high dividend cover afforded from the current cash generation.

With many indicators suggesting that the US equity market is currently more expensive than at any time in history, the energy sector would appear to have a lot of positive attributes that investors should consider.

Unless otherwise stated, all opinions within this document are those of the RWC UK Value & Income team, as at 27th August 2021.