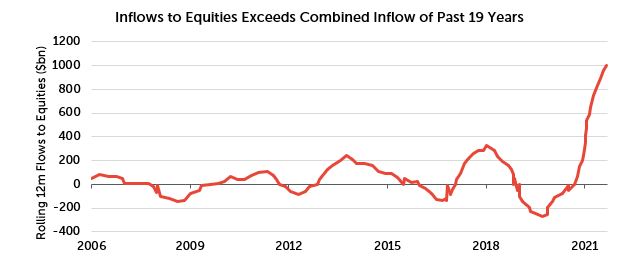

One of the most consensus trades in asset management for the last five years has been to reduce exposure to UK equities and increase exposure to the US. In 2021, however, this reached a crescendo when more money was allocated to US equity funds than had been cumulatively for the previous nineteen years.

Source: Bank of America, 25 November 2021

According to a recent white paper from legendary investor and founder of GMO, Jeremy Grantham, what investors have been doing is allocating money to one of the biggest bubbles in financial market history[1]. Whilst I would recommend all investors read this paper, I would particularly recommend it to anyone involved in asset allocation and especially those with a significant weight to US equities (which is probably most people since the US is now 70% of MSCI World). Grantham’s main points are as follows:

- All bubbles, without exception, eventually burst

GMO have identified a total of more than 300 bubbles (defined as 2-sigma moves) and highlight that ‘in developed equity markets, every single example of a 2-sigma equity bubble in the last 100 years has eventually fully deflated with the price moving all the way back to the trend that existed prior to the bubble forming.’

- There have been five superbubbles, the current US equity market is the sixth

‘All 2-sigma equity bubbles in developed countries have broken back to trend. But before they did, a handful went on to become superbubbles of 3-sigma or greater: in the US in 1929 and 2000 and in Japan in 1989. There were also superbubbles in housing in the US in 2006 and Japan in 1989. All five of these superbubbles corrected all the way back to trend with much greater and longer pain than average. Today in the US we are in the fourth superbubble of the last hundred years.’

- Recent price action suggests the US equity bubble is deflating

Whilst Grantham acknowledges that valuation is not effective as a timing tool, he believes the bubble has started to burst judging by recent price action. Grantham highlights that ‘equity bubbles begin to deflate from the riskiest end of the market first – as it has been doing since last February’ We also suggested this in our recent note ‘Canary in the Coal Mine’.

- Equities is one of three superbubbles currently occurring in the US

Normally one can diversify into bonds to protect against a deflating bubble, but that option is not available since bonds are also in a superbubble according to Grantham who states that ‘for the first time in the US we have simultaneous bubbles across all major asset classes’

Thus if you are currently allocating to the US, either you are making a bet that this will be the first bubble in history that doesn’t deflate, or you believe that you have the skill to jump out of it just before it pops. As Clint Eastwood’s character, Dirty Harry, says in the film of the same name ‘You’ve got to ask yourself a question: ‘Do I feel lucky?’ Another less catchy, but equally important, question might be ’would my investors judge that this was a reasonable position to take If the US does follow the pattern of all previous bubbles?’

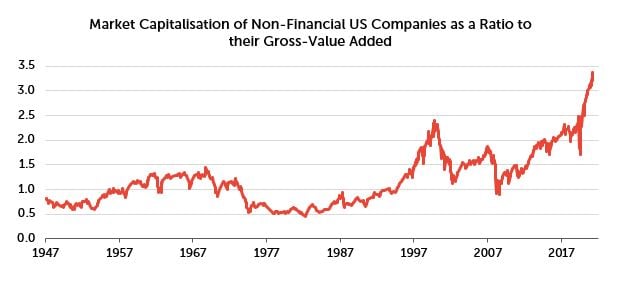

Grantham points out that the losses from the superbubbles have been devastating. The potential losses from the current US equity bubble could actually be worse than previous ones; having identified that ‘2000 US equities’ was one of five superbubbles, the chart below shows that the current valuation of the US is significantly higher than in 2000. In fact, the US market would have to lose one third of its value to get down to the peak valuation of 2000. Grantham estimates that if US equities, bonds and real estate returned even two-thirds of the way back to trend, then $35 trillion of wealth would be wiped out.

Source: Hussman Strategic Advisors, 14 January 2022

So what to do now?

Grantham does make a recommendation for what investors can do to avoid the pain of the US bubbles popping: ‘avoid US equities and emphasise value stocks of emerging markets and several cheaper developed countries’. We would assume that the UK would stand out amongst these cheaper developed markets.

Five Reasons to buy the UK

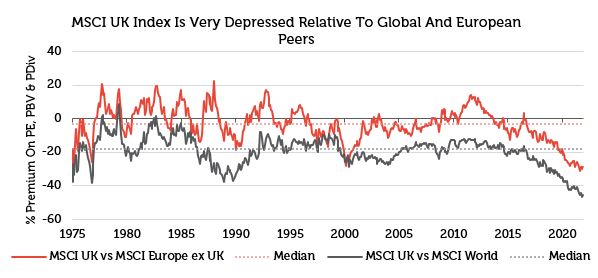

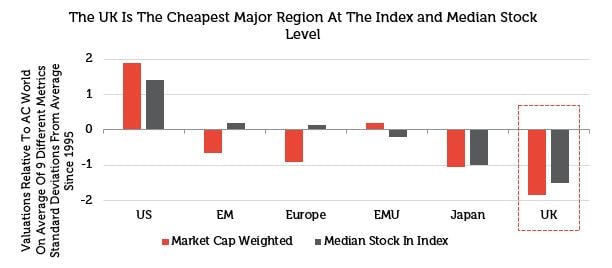

1. UK is one of the cheapest major global stock markets

Source: Morgan Stanley, 30 September 2021

Source: Morgan Stanley, 24 January 2022

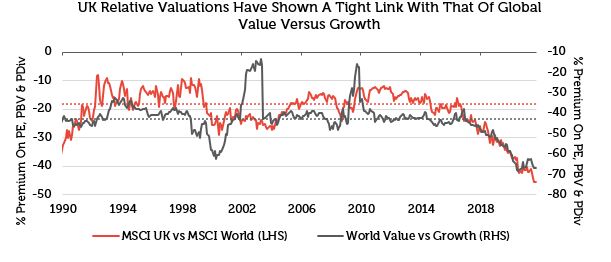

2. UK is strongly correlated to value

Source: Morgan Stanley, 30 September 2021

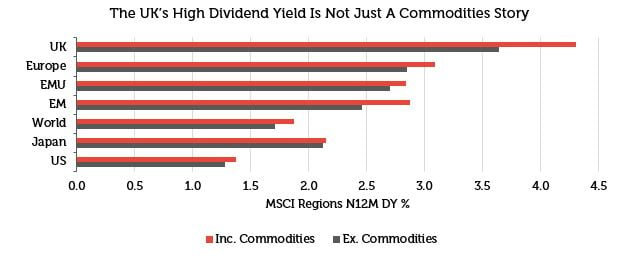

3. UK offers one of the highest dividend yields

Source: Morgan Stanley, 30 September 2021

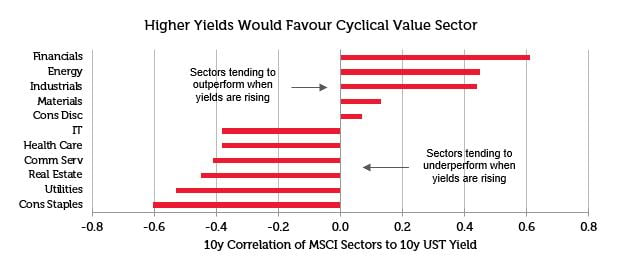

4. UK has a large weighting to the sectors which historically do well as interest rates rise

Source: JP Morgan, 31 December 2021

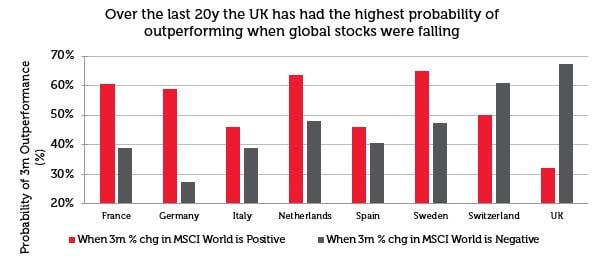

5. The UK tends to outperform in risk off periods

Source: Morgan Stanley, 31 January 2022

Conclusion

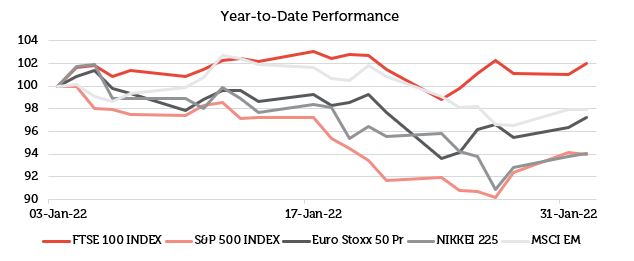

Source: Bloomberg, 01 February 2022

Having lagged MSCI World for a number of years, the UK is the best performing market year to date and this is presumably before any of the vast amount of money allocated to the US is switched back to the UK. We believe that those investors who agree with Jeremy Grantham’s view that the US ‘superbubble’ has started to deflate should consider allocating to UK value as one of the few paths to protect clients’ capital.

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested.

The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of RWC Partners Limited. This article does not constitute investment advice and the information shown is for illustrative purposes only.

[1] Let the Wild Rumpus Begin by Jeremy Grantham 20 January 2020

Unless otherwise stated, all opinions within this document are those of the Redwheel UK Value & Income team, as at 7th February 2022.