Metals are powering a sustainable future

The main driver for the consumption of base metals is shifting from Chinese urbanisation to the global renewable energy transition. Base metals, such as copper, nickel and aluminium, are the foundational elements that are driving paradigm shifts across various industries. As a result, the world is beginning to recognise that base metals are indispensable commodities that are powering the modern industrial landscape.

Copper, renowned for its electrical conductivity, and Nickel, used for its corrosion and heat-resistant properties, are in particular demand across key sectors, including defence, electronics and the energy transition. The Redwheel Emerging and Frontier Markets Team believe that base metal producers stand to benefit from growing demand for many of these commodities.

Surging global demand, constrained supply

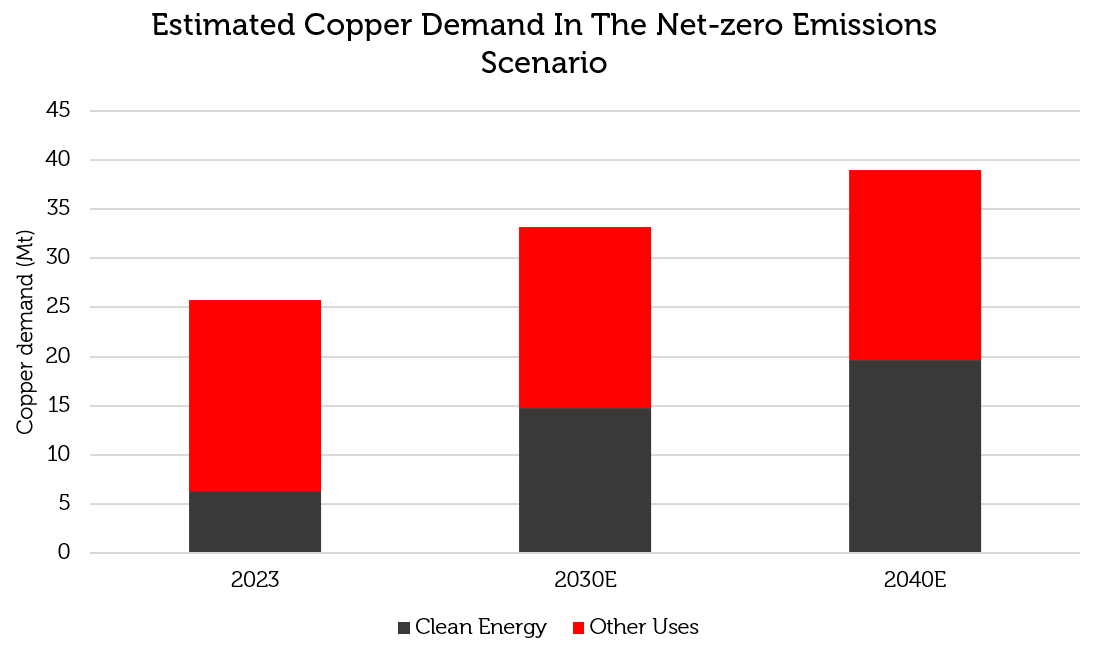

The top-down case for investing in the base metal complex centers around their direct link to economic activity, industrial demand, and multiple structural growth themes, such as electric vehicles and the green energy transition. In recent months, data centres have emerged as a further driver of copper. It is estimated that high-performance and artificial intelligence servers may create demand for up to one million additional metric tons of the orange metal by 2030 [1]. As economies grow and infrastructure spending increases, demand for industrial metals should rise. For copper specifically, it is estimated that demand will grow by over 2% per annum into 2040 from the net-zero emissions scenario alone – see the chart below. As new mine developments are scarce and slow to come on stream, we anticipate that the demand for a wide range of industrial metals will far outstrip supply.

Source: International Energy Agency (IEA), Redwheel as of May 2024. This is a chart derived by Redwheel from IEA material and Redwheel is solely liable and responsible for this derived work. The derived work is not endorsed by the IEA in any manner. The information shown above is for illustrative purposes. Past performance is not a guide to future results. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

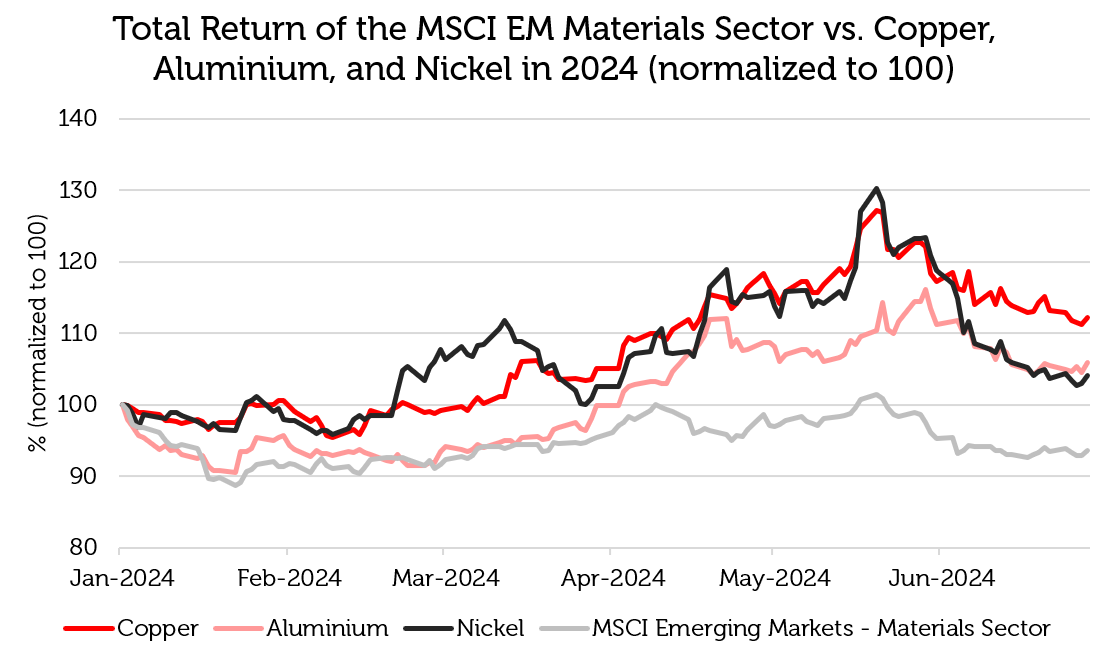

Supply constraints and underinvestment in new projects have created a unique supply-demand dynamic due to rising consumption amidst low inventory levels. We anticipate that this should lead to a secular increase in base metal prices, which presents an attractive investment opportunity in producers that are gradually expanding their production capacity. Copper, nickel, and aluminium have added +12.2%, +4.1%, and +5.9% year-to-date respectively, as of 28 June 2024 [2]. All three metals are outperforming the Materials sector in the MSCI Emerging Markets Index, which has lost -6.4% as of 28 June 2024 [3]. The significant performance deviation between the underlying metals and producers is something that we expect to narrow over time.

Source: Bloomberg, London Metal Exchange (3-month rolling forward contracts) as of 28 June 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

We believe that metal producers are poised for growth

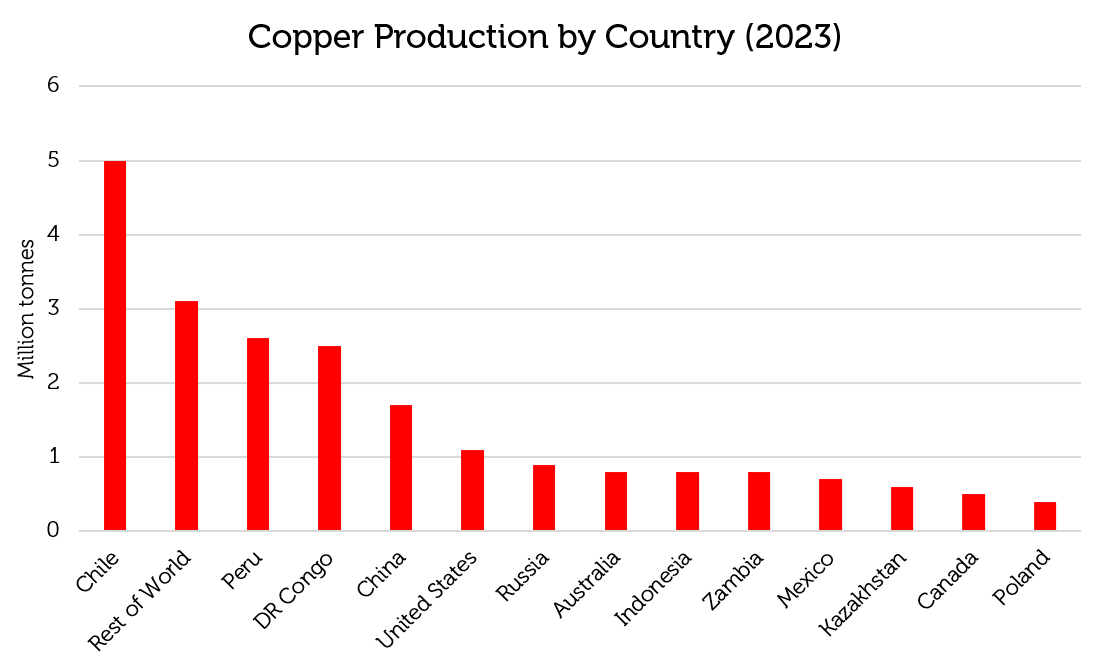

The production of base metals should be a key driver of growth in many Emerging and Frontier Market economies. On a country level, four countries within our investment universe are within the top-five largest producers of copper – Chile, Peru, the Democratic Republic of Congo, and China (see the chart below). Together, these four countries alone accounted for over 50% of the world’s copper production in 2023 [4].

Source: U.S. Geological Survey, Mineral Commodity Summaries as of January 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

One of the sites where we have seen the strongest growth in mining over recent years is the Kamoa-Kakula Copper Mine in the Democratic Republic of Congo, which began commercial production of copper in 2021. In 2024, the site is expected to produce 440,000-490,000tonnes of copper. The project is a venture between two of Redwheel’s investments, Ivanhoe Mines and Zijin Mining Group [5][6], the Democratic Republic of Congo government, and other entities.

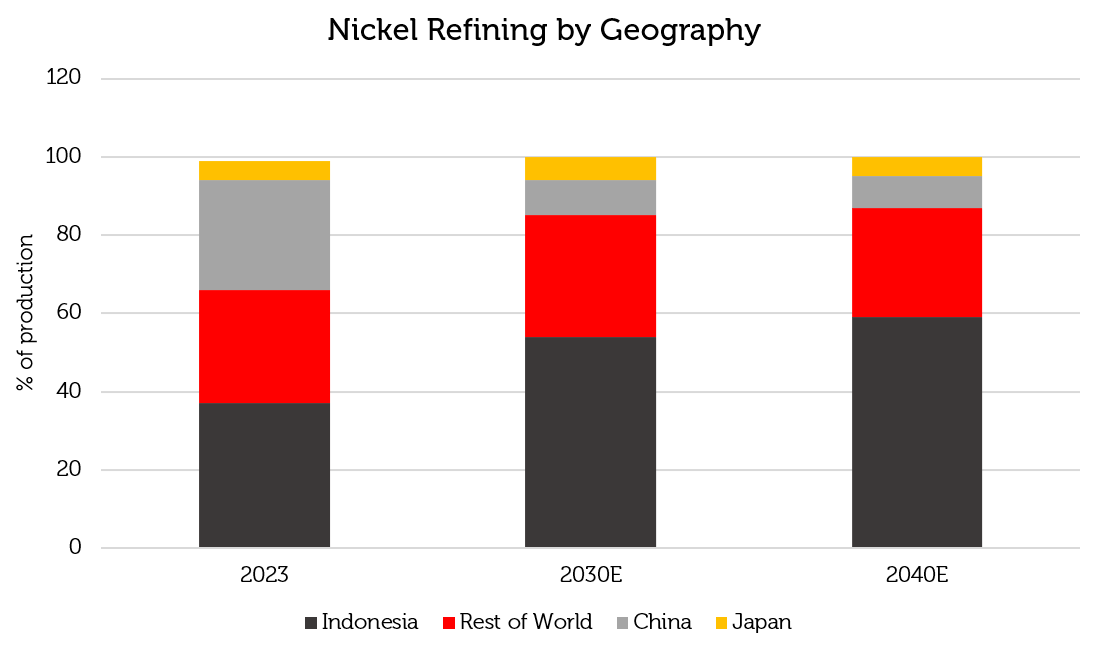

In terms of nickel production, Indonesia was the world’s largest producer and refiner in 2023 – see the chart below. Indonesia’s leading position in the Nickel industry is due to the immense resources on the North Malaku province, particularly Obi Island. Indonesia should remain the largest producer and refiner into 2040, which will provide tailwinds for improvements in the broader economy.

Source: IEA, Redwheel as of 13 May 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

The Redwheel Next Generation Emerging Markets strategy has exposure to Trimegah Bangun Persada, which is an integrated nickel producer in Indonesia that held its IPO in April 2023. The company announced +149% YoY revenue growth in FY23 [7] as production capacity ramped up. In addition, the North Malaku province has seen a significant increase in GDP [8], which reflects the impact that Indonesia’s Nickel industry is already having on the economy.

Sources:

[1] AI could add 1 million tons to copper demand by 2030, says Trafigura | Reuters

[2] Bloomberg, as at 28 June 2024

[3] Bloomberg, as at 28 June 2024

[4] U.S. Geological Survey, Mineral Commodity Summaries as of January 2024.

[5] Ivanhoe Mines is a holding in the Emerging Markets, Next Generation Emerging Markets, Frontier Markets, and International Markets strategies.

[6] Zijin Mining Group is a holding in the Emerging Markets and China Equity strategy.

[7] https://tbpnickel.com/files/pdf_assets/Harita%20Nickel%20Annual%20Report.pdf

[8] Badan Pusat Statistik Indonesia

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.