In our previous post, we discussed the continuous glucose monitoring (CGM) trend in both diabetes care and wellness markets, and what this could mean for investors. We suggested that continued growth was likely in the former market, but the picture was less clear for the latter. We decided to buy one of these devices for ourselves and test it out.

What is the appetite for CGM in the wellness market?

In their 2020 survey, McKinsey estimated the global wellness market at $1.5 trillion growing at 5-10% per annum [1] . They found that consumers’ understanding of wellness is generally sophisticated, with interest in better health going “beyond medicine and supplements to include consumer medical devices as well as personal-health trackers.” More than one third of 7,500 survey respondents stated they were likely to increase spending on nutrition apps and similar nutrition-focused products and services. Finally, with 88% of respondents saying they prioritise personalisation, it seems that CGM products such as Lingo are launching into a receptive market.

How do CGM solutions work?

We bought Abbott’s Lingo GCM device. Abbott, a leading provider of CGM solutions, launched Lingo in January 2024 [2], with the UK being one of the first markets globally to receive the device [3].

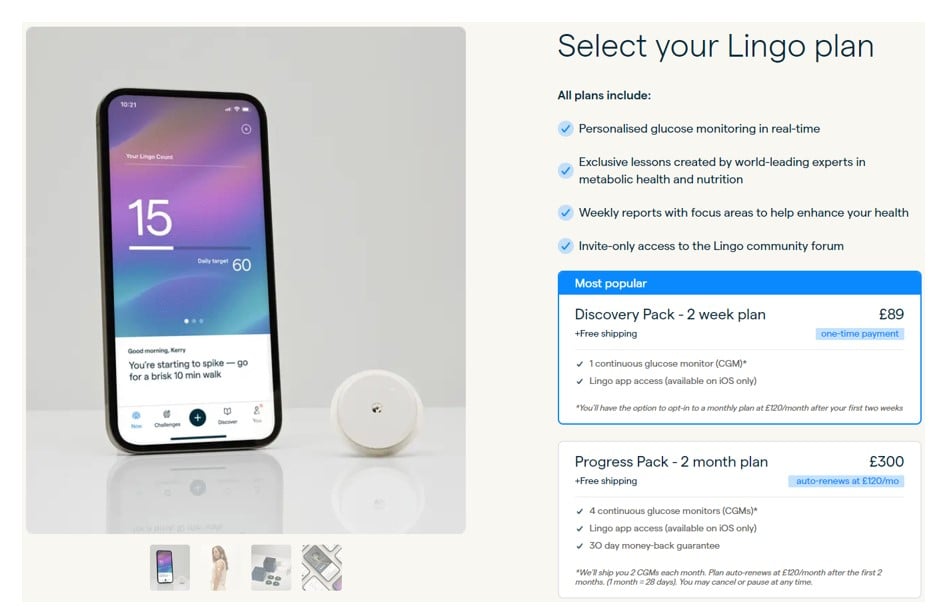

First, we had to select our subscription: Abbott offers a two-week Discovery plan and a two-month Progress plan. I chose the two-month plan to give me a longer time to get to grips with how the device works. The pricing plan is ordinarily £120 per month, for which you receive two sensors and access to the app.

Source: shop.hellolingo.com

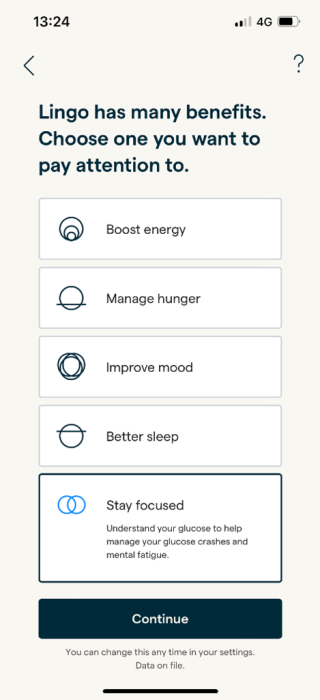

The app is only currently available on iOS, so that does limit the market at present. When setting up the app you choose the main goal you hope to achieve by tracking your blood glucose. I chose increased focus because I am prone to afternoon dips in energy.

Source: Lingo mobile application. The Lingo app allows you to choose the benefit you are trying to achieve.

The device comes with clear instructions for applying the sensor and pairing it with my phone. It works by inserting a needle under the skin to detect sugar in the fluid around the cells from which it calculates equivalent blood glucose levels. The needle looks big but I found its application to be completely painless. If anything, removal of the sensor was more painful because it sticks onto the skin with strong adhesive pads.

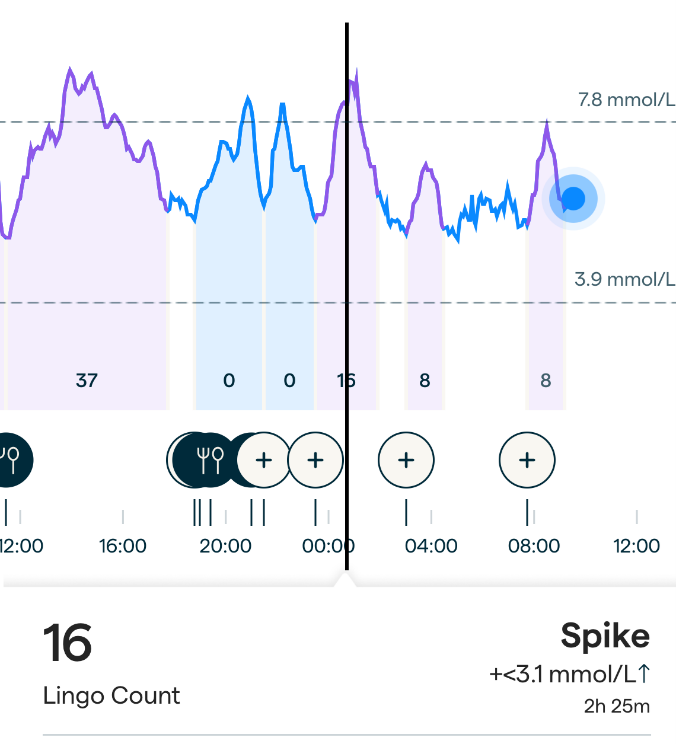

Once the sensor is applied, paired and warmed up, the device tracks blood glucose levels, looking for spikes from food, and potentially stress. The magnitude and duration of each glucose spike is used to calculate a Lingo count for each day and the app sets me the goal of keeping my total Lingo count below a certain daily score. The objective is for me to adjust my diet to moderate my blood glucose spikes throughout the day. As we discussed last time, the data around this is somewhat controversial and some physicians have questioned the value of tracking blood glucose for non-diabetics [4]. But if we accept prevailing wellness assumptions, reductions in blood glucose spikes could improve my overall energy, mood and sleep [5].

Source: Lingo mobile application. The Lingo app assigns a Lingo count for spikes in blood glucose and sets the user a target total Lingo count per day to stay below.

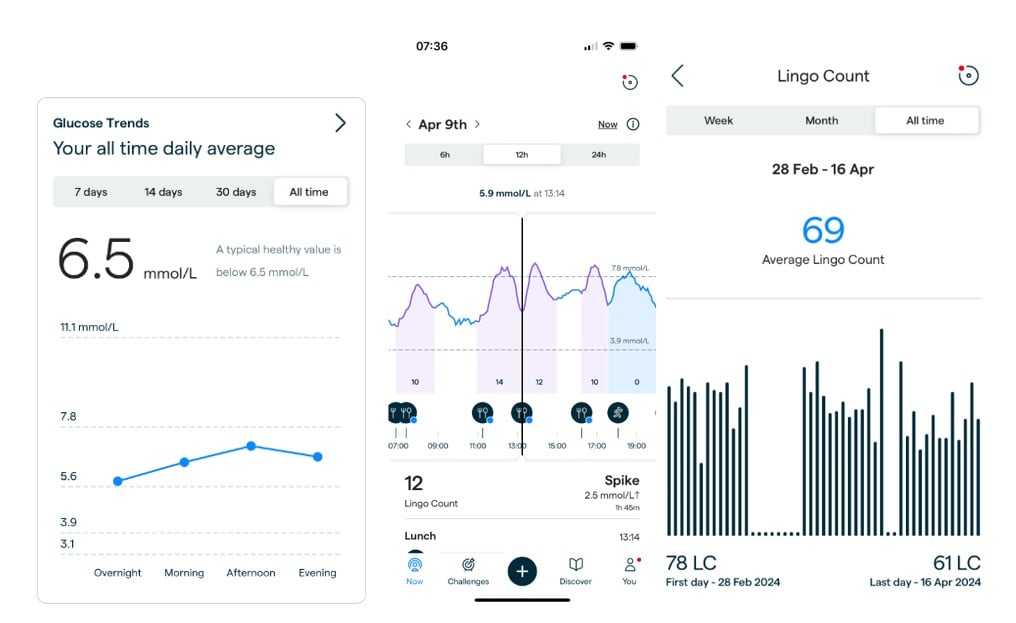

Source: Lingo mobile application. The Lingo app gives historic information around average daily blood glucose levels, real time levels and Lingo count over time.

What did we find?

Did it change my behaviour? A little bit. We can see a small move down in my average Lingo Count (see the screengrab labelled ‘Lingo Count’ above) by the time I got to my third sensor (each sensor lasts about two weeks). Probably the biggest effect it had on me was highlighting the consequences of my actions. When I opened the cupboard for a snack, I’d avoid the chocolate and choose a healthier option instead. However, this is likely because I knew I was being monitored rather than because I was better informed.

Source: Lingo mobile application. The application helps users to identify which foods trigger blood glucose spikes.

Users have to manually enter the food they eat and when. The app then associates subsequent spikes in blood glucose with particular foods and, over time, tells me which foods spike my blood glucose more than others. The results are often unsurprising: a cupcake with icing prompted the biggest spike in my blood glucose (see the image above). I knew this would happen, but I felt less good about eating it than I normally would.

Bananas currently seem to be a controversial food for wellness advocates. Some experts assert that one banana is the equivalent of eating six teaspoons of sugar[6], but as Zoe, another CGM solution provider, pointed out in a blog post, everyone responds differently to different foods[7] . Bananas didn’t spike my blood glucose as much as some other foods, so my breakfast of peanut butter and banana on wholemeal toast is safe (for now!).

What is our conclusion?

Having tried the device for over two months, we aren’t convinced that Lingo will gain mass market adoption. However, we do think there are some niche consumer groups with high disposable incomes and a strong interest in wellness that could adopt CGM solutions.

Enthusiasm could be tempered by the price. At £120 per month, the number of consumers that can afford the device will be limited. Moreover, a reported link between socioeconomic status and diet[8] means that those who might benefit most from the technology will be less likely to afford it.

A key question for us is how long would a person need to monitor their blood glucose before they have learned everything they need to optimise their diet? This is another reason why we don’t think wellness adopters will use CGM solutions over the long term – it’s more likely that they’ll use them for a short time before cancelling a subscription. We think companies providing CGM to non-diabetics will need to convince consumers that they should monitor over the long term.

We conclude that CGM outside of diabetes management is likely to remain a niche interest, and unlikely to see the kind of adoption rates experienced by other wearable wellness technologies, such as smart watches and fitness trackers.

Sources:

[1] Source: https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/feeling-good-the-future-of-the-1-5-trillion-wellness-market

[2] Source: https://www.abbott.co.uk/media-center/news/Abbott-introduces-first-ever-consumer-biowearable-Lingo-TM-set-to-re-energise-the-nation.html

[3] Source: Abbott third quarter 2023 earnings call, 18/10/2023

[4] Source: https://www.bbc.co.uk/news/health-68452019

[5] Source: Jarvis, P. R. E., et al. Metabolism. 2023, 146

[6] Source: https://www.dailymail.co.uk/health/article-8513229/Is-banana-bad-type-2-diabetes-SIX-spoons-sugar.html

[7] Source: https://zoe.com/post/banana-blood-sugar

[8] Source: Pechey, R., and Monsivais, P. Prev. Med. 2016, 88, 203-209

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.