Over the past few quarters, investors in the renewables power generation sector have pushed down valuations, questioning growth and return opportunities following a confluence of headwinds. However, while the stock market remains sceptical, we have seen private equity firms, utilities and renewables companies themselves conclude that valuations are now too attractive to ignore. We believe that this highlights the attractive buying opportunities that can currently be found in the renewable power space.

Multiple actors are exploiting depressed valuations

The sector had experienced a few years of cheap capital fuelling unabated growth for clean power as the market grew confident in perpetually declining cost curves of power generation equipment that would support attractive returns. Then, fast-rising interest rates, equipment cost inflation and falling power prices raised questions about returns and reduced confidence in renewables companies’ capacity to grow and the value of that growth. More recently, we have seen private equity firms making takeover offers, utilities buying out minority owners or investing in listed renewable companies as well as management buying back their own shares.

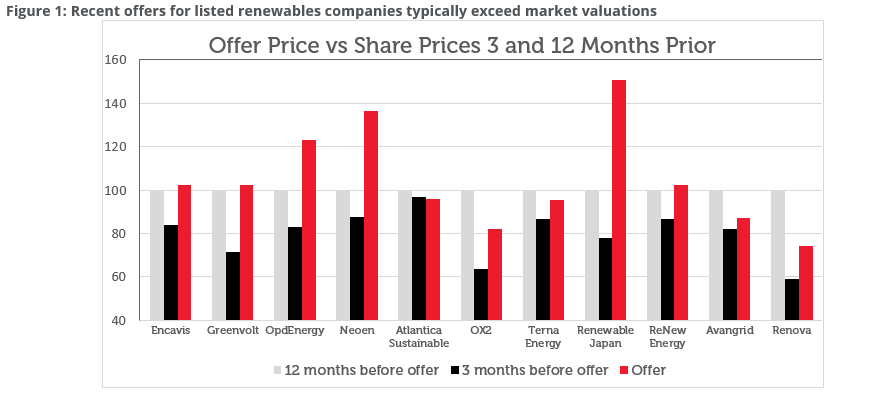

In terms of M&A, we have seen a number of transactions over the past year – see Figure 1. Some companies have been taken private, others have wholly merged into other entities, while others have seen significant minority stakes acquired. The chart clearly illustrates the premia to market valuations that private transactors are willing to assign to renewables companies. The appendix below provides more information on each transaction.

Why is this happening and why are we seeing an acceleration over the past year?

One can claim it is purely opportunistic with bidders taking advantage of short-term stock market dislocation. Indeed, some weakness in the first quarter of 2024 certainly offered an opportunity to motivated buyers. However, much value had emerged at the end of the third and beginning of the fourth quarter of 2023 and we have seen management activate buybacks throughout the last two years. As such, we believe that these buyers have found additional reasons for investment:

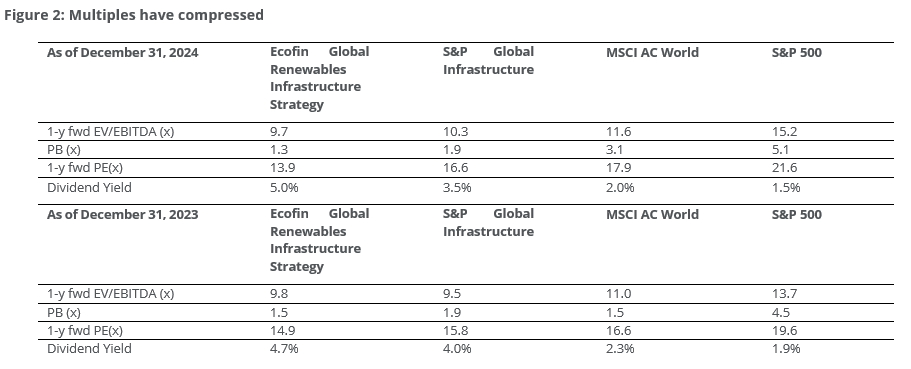

- First, as the companies continue growing independently from the economic cycle, multiples have compressed and provide an even more compelling value proposition (See Figure 2). It is worth noting that the broader utility sector is also trading at unusually low levels with U.S. and European utilities sectors trading one standard deviation below their historical relative PE multiples.

- Second, given company exposures to datacenters, AI and transport, and relationships with the leaders in those sectors, buyers have developed a view that electricity demand and green electricity demand in particular will be rising substantially in the coming years, making renewables assets and development pipelines more valuable. They might, as we do, anticipate a power cycle on the back of datacenter, EV and heat pumps growth.

- Thirdly, having a longer-term time horizon than stock market participants, their conviction has risen that interest rates have stabilized and may fall in the next 1-3 years. This will give an opportunity to refinance the acquisition and the debt on the targets’ balance sheet at much lower rates and therefore create equity value

Strong fundamental support

As much as the exact timing of the pick-up in M&A activity might be tactical, we believe that the rationale is much more fundamental and we would expect this trend to continue unless public markets recognize the mispricing of shares, based on current fundamentals and relative to the market. It is worth noting that Infrastructure private equity funds have raised substantial amounts of money in the past year with Macquarie European Infrastructure Fund 7 reaching EUR 8bn in commitments, Brookfield raising $28bn and KKR $6.4bn for its Asian Infrastructure Fund. We believe that a significant portion of this dry powder will be directed to buying more listed renewables companies should current market valuations persist.

In the meantime, while renewables developers and operators continue to grow, they have also been frustrated by the lack of market recognition, with many companies launching share buyback programs. What is striking is that this happened in Europe and China, despite the fact that companies face totally different regulatory, contracting, interest rates and power prices environments. In our view, it reflects how top-down sentiment has affected the sector, providing a great opportunity to identify value.

In conclusion, we are getting strong signals from multiple actors in the market that the renewables power generation sector is very attractively valued. This, in addition to rising momentum for electricity demand, should drive an upward adjustment to valuations of listed shares over time.

Appendix: Recent offers for renewables companies

Regarding full acquisitions, Antin (Private Equity) made an offer for Opdenergy (Spain) and KKR (Private Equity) made an offer for Greenvolt (Portugal) and Encavis (Germany). Brookfield (Private Equity) purchased Neoen (France), Energy Capital Partners (Private Equity) bought Atlantica Sustainable (US), EQT (Private Equity) bought OX2 (Sweden), Masdar (UAE-State Owned) bought Terna Energy (Greece), Tokyu Fudosan (Private) bought Renewable Japan (Japan) and a consortium of private investors announced a plan to take ReNew Energy (India) private. Iberdrola (Spain) offered to buy out the minority owners in Avangrid (US) and Tokyo Gas (Japan) took a 15% stake in Renova (Japan).

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.

*Representative Portfolio

The Representative Portfolio is Ecofin Global Renewables Infrastructure UCITS Fund, a sub-fund of Gateway UCITS Fund Plc, which is an umbrella investment company with segregated liability between funds authorised by the Central Bank of Ireland as a UCITS pursuant to the UCITS Regulations. Please refer to the Representative Portfolio’s Fund Documents including the Prospectus, KIID & KID for more information.