Old energy lingers for longer

There is naturally much excitement and optimism about the green energy transition and rapid adoption of electric vehicles, but the replacement of installed base hydrocarbon-based energy production and vehicular transportation is likely to be a multi-year process. In our view, Emerging Market oil producers are currently trading at attractive multiples in light of robust demand and potential supply constraints.

Oil price volatility belies persistent demand

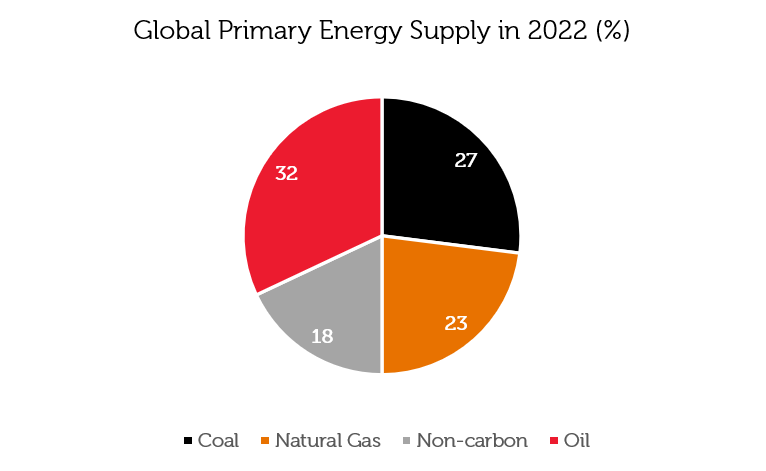

Although there is rapid deployment of new solar and wind projects, the Energy Institute notes that 82% of global primary energy was derived from fossil fuels in 2022, with just over 30% coming from oil [1].

Source: Energy Institute, Morgan Stanley Research, June 2023. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

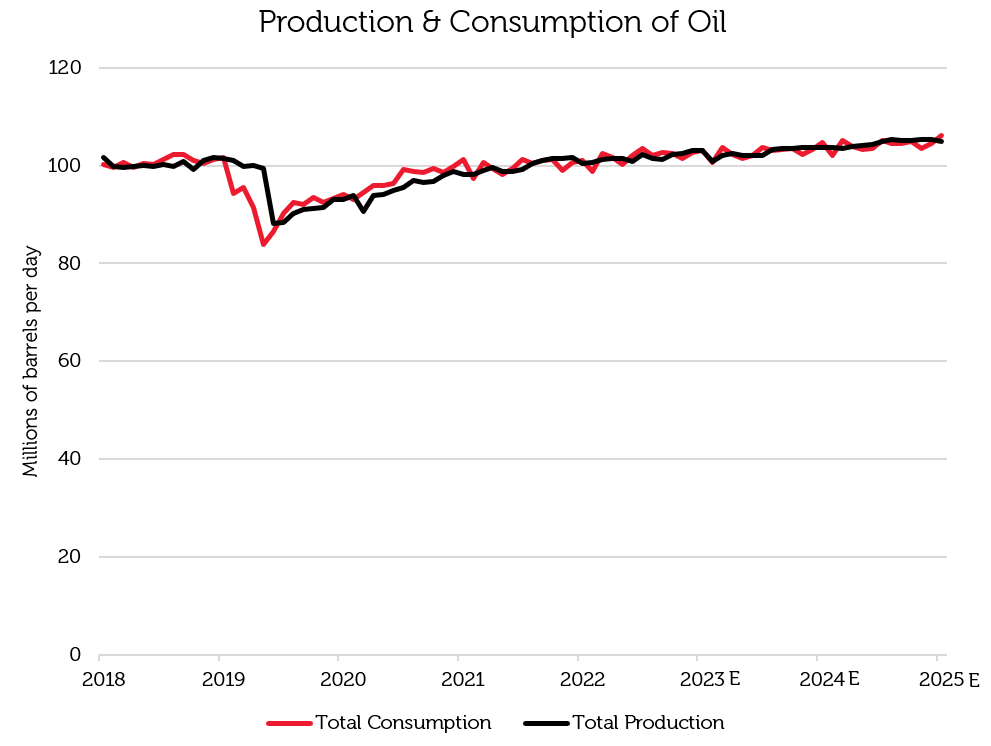

Oil demand is slightly in excess of 100m barrels per day (bpd) and continues slowly to increase because of population growth and a gradual rise in living standards – see the chart below.

Source: Energy Information Administration as of 30 April 2024. Production/Consumption for 2023-2025 is based on forecasts. The information shown above is for illustrative purposes. Past performance is not a guide to future results. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

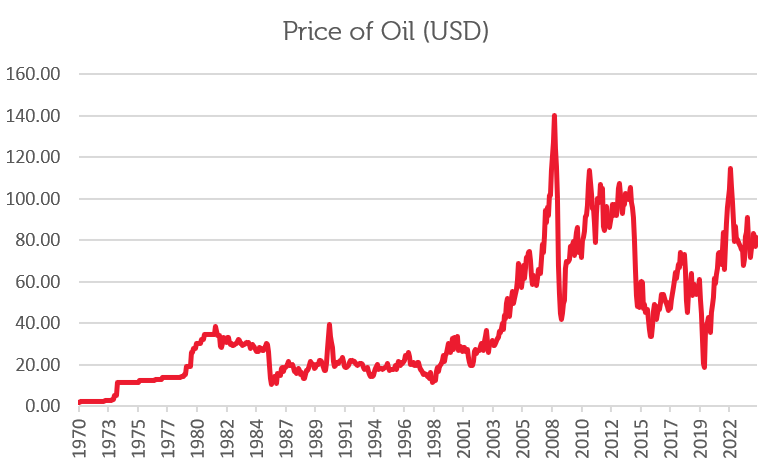

With supply and demand roughly in balance, the price of oil should be relatively stable. However, since the Global Financial Crisis in 2008 (GFC), the price has usually fluctuated within a wide range of $40 to $100 per barrel – see the chart below. Volatility can arise because of geopolitical events. For example, Russia’s invasion of Ukraine led to sanctions and restrictions on the former’s hydrocarbon exports, and recent tensions in the Middle East has the potential to cause higher prices because of the vulnerability of exports through the Strait of Hormuz. In March 2024, OPEC imposed a production cut of 2.2m bpd, to last until June 2024, in order to support the price while global growth is slowing down [2].

Source: Bloomberg as of 30 June 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

New supply constraints

Eventually, the spare capacity will be utilized through the gradual process of economic growth and depletion of current producing fields. New supply will probably be introduced cautiously due to a variety of economic, environmental and social constraints. First, the base rate of interest has climbed above 5%, a sharp increase from the range of 0% to 2% where it was pegged for almost 15 years after the GFC [3]. The higher cost of borrowing raises the required rate of return for new projects, meaning that oil companies must be certain of a high price of oil over the entire life of a long-term project. Second, at COP 27 the United Nations participants committed to limit the rise in global temperature to 1.5 degrees above pre-industrial levels, including phasing out fossil fuel subsidies. This will make it more difficult to gain new permits to develop oil fields, particularly on public land, because of political and social pressure. Third, public scepticism for the oil industry is generally on the rise, and companies could be reluctant to develop long-life projects that might have to be abandoned – either for environmental or legal reasons – before yielding the volume of production required to make them financially viable.

Attractive multiples on oil stocks

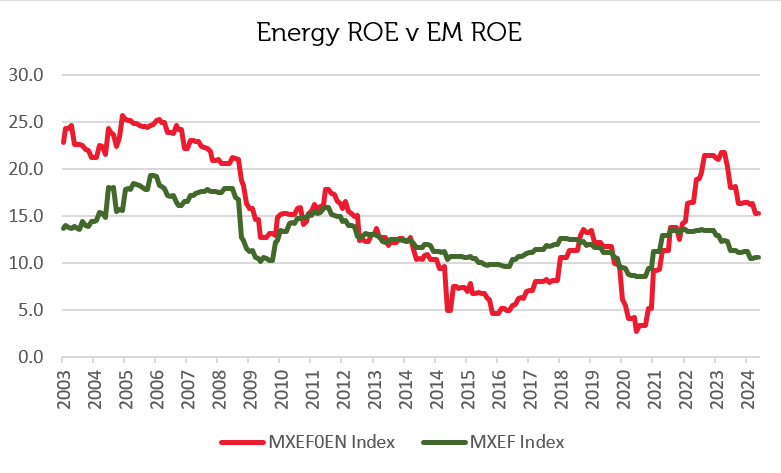

Oil analysts generally believe that the price of crude oil will remain in the range of $70 – $80 per barrel, at which price upstream oil companies are quite profitable. The chart below illustrates that the return on equity (ROE) is presently higher for MSCI Emerging Market Energy companies than it is for the MSCI Emerging Markets Index as a whole.

Source: Bloomberg as of 30 June 2024. ROE stands for return on equity. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

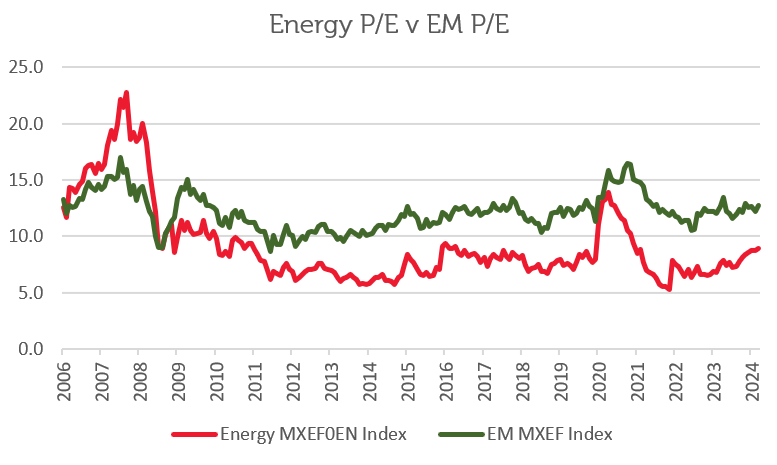

In addition, the energy companies are in aggregate cheaper than the rest of the MSCI Emerging Markets Index itself. The combination of high profitability and low valuation can be seen as an attractive investment opportunity.

Source: Bloomberg as of 30 June 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

The Redwheel Emerging Markets, Frontier Markets, and Next Generation Markets strategies are overweight the energy sector. The strategies hold a position in YPF, an upstream energy company in Argentina that produces traditional energy, as well as renewable energy from solar and wind power. YPF could also benefit from President Milei’s economic reforms to attract foreign investment. The Redwheel Emerging Markets Strategy also owns shares in Reliance Industries, an Indian downstream energy company engaged in refining and petrochemicals, which is the largest Indian company in the MSCI Emerging Markets Index [4].

Sources:

[1] Energy Institute: ‘Energy system struggles in face of geopolitical and environmental crises’ June, 2023

[3] Bloomberg, as at 30 June

[4] Source: Bloomberg, as at 30 July

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.