Surging infrastructure needs and private equity fundraising bodes well for listed infrastructure companies

For years, investors have allocated to infrastructure to reap the benefits of an asset class with attractive return potential, higher yields than equity markets, defensive characteristics and inflation mitigation[1]. Today, investor interest in infrastructure is expected to grow as global electrification, digital innovations, increasing demand for energy and energy security, and the need for efficient transportation drive new development opportunities.

Redwheel’s Ecofin team believes in the fundamental rewards of a blended approach to investing in listed and private infrastructure. Both investments offer exposures to essential assets critical to the functioning of economies and yield steady cash flows. However, discerning investors will focus on the diversification and access to a range of sub-sectors, geographies, political systems, valuation differences, and liquidity that listed investments can also offer.

Listed infrastructure is a complement and a diversifier to private infrastructure

Listed infrastructure shares many of the same attractive traits as private infrastructure. Investments are underpinned by real assets with visible cash flows that should provide attractive and consistent returns with low correlations to traditional equities. Listed infrastructure also provides access to high quality assets and leadership teams globally.

However, by contrast, listed infrastructure allows investors to gain full exposure immediately and offers the flexibility to adjust allocations based on risk and opportunities. Beyond this, we see four additional advantages that strengthen the case for increasing allocations to listed infrastructure: attractive relative valuation, enhanced risk diversification, a resurgence in M&A activity and greater scope for value capture.

Advantage 1: Attractive valuation compared to private assets

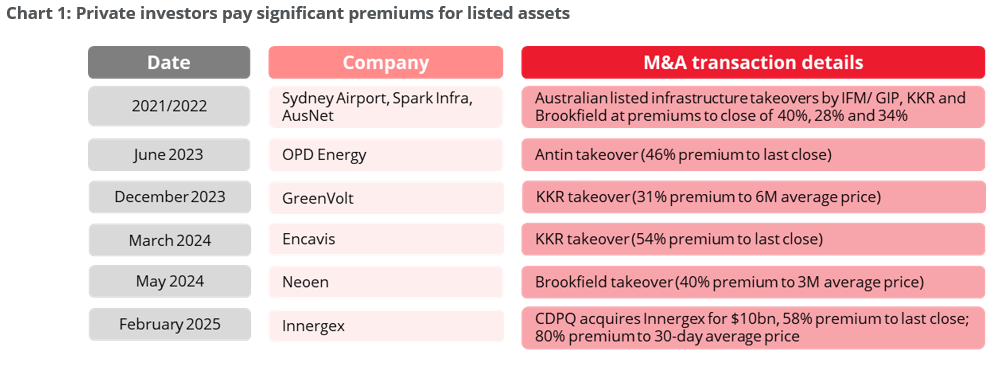

Valuations of listed infrastructure assets stand at a significant discount to their private equivalents and by historical measures, in our view. While private equity specialists have historically paid premiums to listed assets, justified to a large extent by the majority control of operations, we believe that the valuation gap has increased over the past couple of years. The table below reveals that recent take-out transactions in the space, whether for renewables assets, power & gas networks or transportation infrastructure, have averaged a c.40% premium to listed valuations. Most recently, Caisse de Depot et Placement du Quebec acquired Innergex for a 58% premium over the prevailing share price and an 80% premium to the 30-day volume weighted average price.

We read this situation as an illustration of the longer-term perspective of typical private equity players while listed equity investors tend to be more focused on the short-term outlook. This is a key differentiator for the analysis of infrastructure, which consists of long-duration assets and projects. The trend also reflects significant inflows into private equity infrastructure funds, generating competition to grasp scarce listed assets on relatively low valuations.

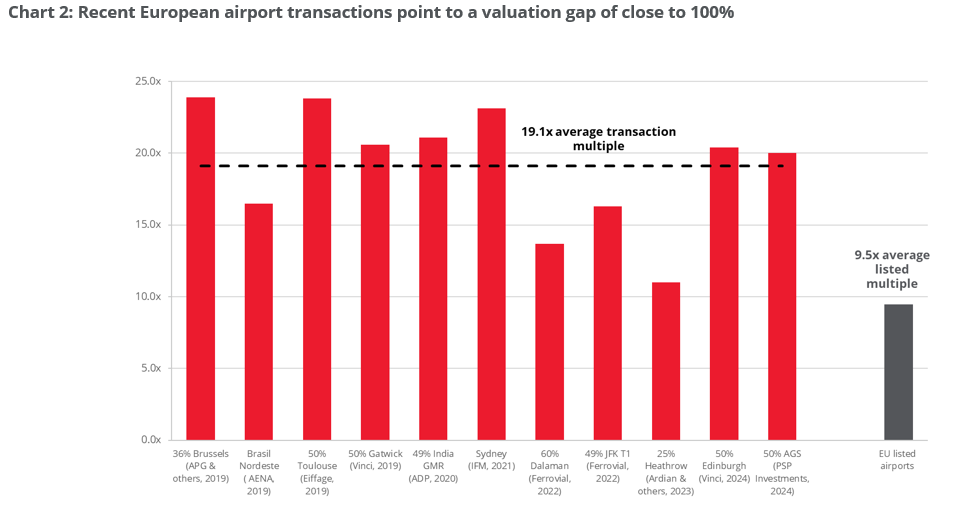

A clear example of this valuation gap can be seen in recent transactions for European airport concessions. Since 2019, private M&A transactions have been concluded at valuations (EV / EBITDA) that were appreciably higher than listed assets, with individual premia on several transactions exceeding 100%. While listed airports trade at an average EV/EBITDA of 9.5x, we calculate that the average multiple paid in private transactions over the past six years has been 19.1x EV/EBITDA.

We expect this striking valuation gap to gradually reduce as private infrastructure investors put capital to work in coming years. Investors with private exposure can compound returns in the space by playing both sides of anticipated transactions as well as through rising valuations in listed assets.

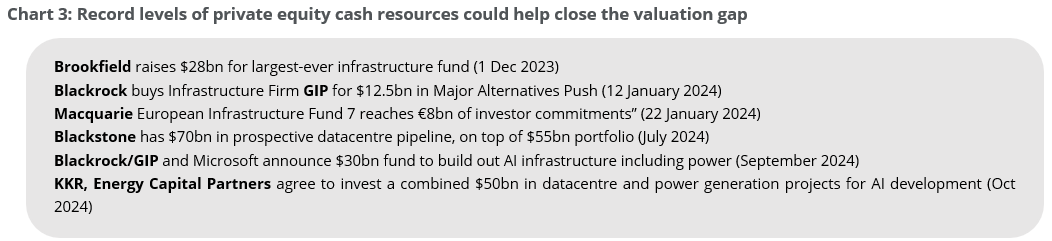

Over the past year, as shown in the table below, private equity majors have raised more than $100bn to invest in infrastructure. Infrastructure is seen as a portfolio diversifier away from more cyclical businesses, with growth trends underpinned by structural tailwinds in decarbonisation and electrification. The growing needs of AI-driven datacentres to secure their energy supplies fuels further growth prospects for the utilities part of the infrastructure universe. However, the opportunity is broader and more diverse than AI, encompassing the electrification of transportation through electric vehicles, the surge in cooling and heating needs globally, and reshoring initiatives for manufacturing in the US.

The growing needs of AI-driven datacentres fuels further growth prospects for utilities

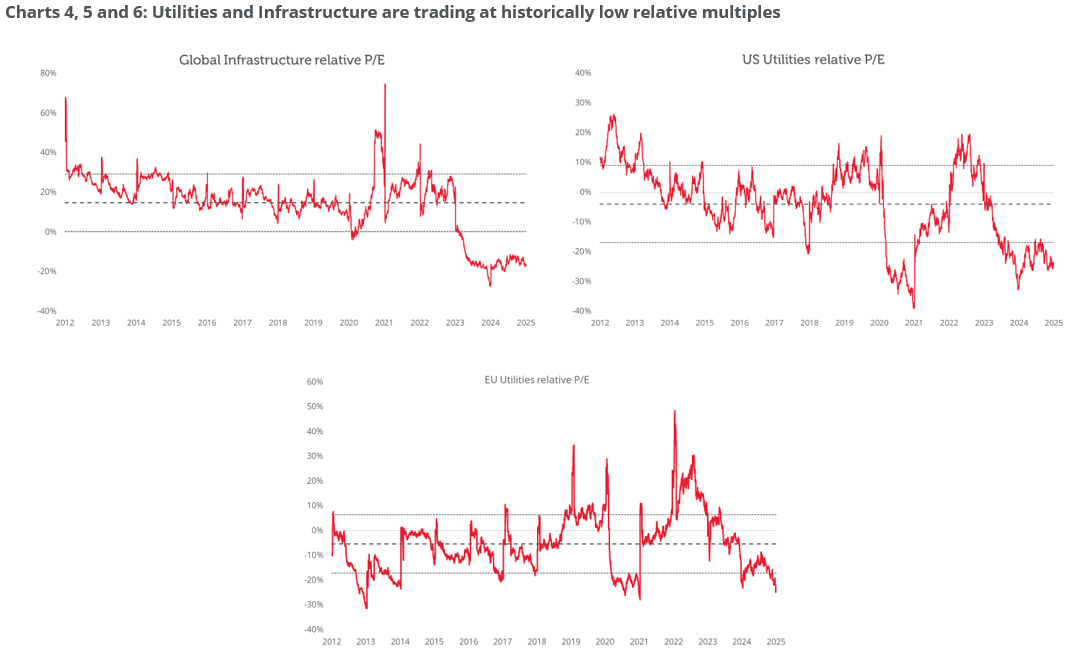

We also note that listed valuations are close to their historical lows relative to general equity indices. The charts below show that global Infrastructure companies have rarely traded at such low relative P/E multiples and Utilities, both US and European, are trading at low relative multiples as well.

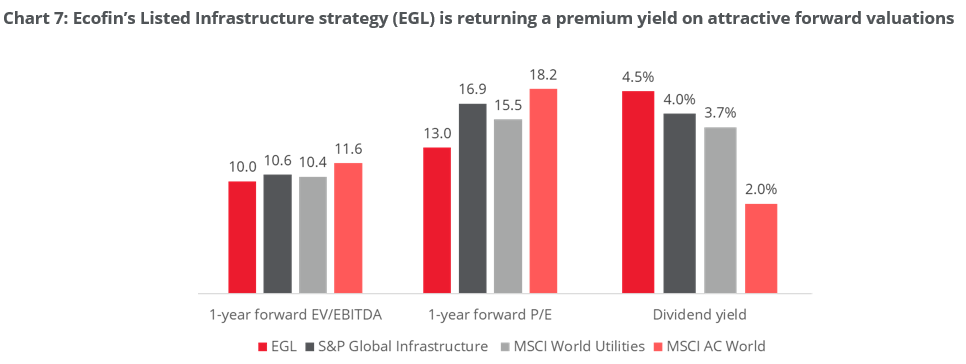

Finally, the chart below further supports our view that listed infrastructure, including Ecofin’s dedicated strategy, is attractively valued relative to various market indices, yet offers a higher dividend yield.

Advantage 2: Risk diversification and financial prudence

Unlike private ownership, which is typically restricted to a single asset or a small number of similar assets in single regions or countries, listed infrastructure provides the option to invest in companies whose portfolios are diversified across geographies (thereby mitigating interest rate, currency, and regulatory risk) and technologies (e.g., combining wind and solar, intermittent renewables with baseload conventional power generation, toll roads and airports etc.).

Beyond portfolio diversification, we would also note a marked difference in financial leverage between public and private companies. While investors often perceive listed infrastructure as riskier than privates due to stock price volatility, the intrinsically more prudent financial structures of listed infrastructure companies – and the resulting mitigation of risk for equity holders – are often disregarded. Listed companies generally need to comply with stricter metrics for their credit ratings, and self-imposed leverage targets often fall well below the rating thresholds to provide equity investors with additional comfort. Listed companies are continually incentivised to retain attractive credit ratings (and correspondingly low financing costs) given their need to periodically refinance debt as developers – as well as owners – of infrastructure assets. Listed infrastructure groups, whether in Europe or the US, have a typical credit rating of BBB+[2].

The intrinsically more prudent financial structures of listed companies are often disregarded

Advantage 3: The return of big M&A?

Constellation’s recent acquisition of Calpine[3] (private US gas and geothermal power provider) marks a potential turning point for M&A activity in listed infrastructure. After several years of subdued deal flow, low valuations in publicly traded infrastructure assets are drawing the attention of strategic buyers. High-quality, cash-generating assets have become materially undervalued following periods of rising interest rates and political uncertainty, creating compelling acquisition opportunities. With Constellation’s move serving as a strong indicator (close to $100bn combined market capitalisation post-transaction, making it one of the largest transactions in the sector in a decade), attractive pricing could drive a resurgence of big M&A deals in listed infrastructure. We think this should be a clear tailwind for listed infrastructure in 2025 and beyond.

The need to reshuffle asset portfolios to adapt to the energy transition, requirements by hyperscalers to get suppliers capable of delivering large amounts of power 24/7, together with significant cash inflows into private equity infrastructure funds, bode well for future consolidation activity in the global infrastructure universe.

The need to reshuffle portfolios to adapt to the transition bodes well for future consolidation activity

Advantage 4: Greater scope for alpha generation

A fundamental reason why listed infrastructure could compound higher returns over time is its ability to provide exposure to the full infrastructure value chain. Listed companies typically own operating infrastructure assets and, in most cases, they develop new ones. Having exposure to greenfield projects offers listed infrastructure companies the opportunity to deliver superior returns through operational expertise and efficiencies in the development and construction phases of a project. Construction tends to be a determinant stage during which considerable value is either created or lost. Conversely, private infrastructure portfolios tend to focus on the ownership of operating (brownfield) assets, and there is potentially a more limited scope for return enhancement in the operation and maintenance of these assets.

Greenfield projects offer the opportunity to deliver superior returns in the development phases of a project

Listed infrastructure stands out as a competitive structural growth play

There is a multi-decade upswing in economic infrastructure development driven by the needs of the modern economy and decarbonisation priorities. Investors, we contest, should increasingly participate via listed securities which screen favourably on valuation and provide important attributes such as liquidity, portfolio diversification and a broad opportunity set. These features should set the scene for listed infrastructure securities to close the valuation gap with private infrastructure assets.

Finally, investors will not be able to fully access this opportunity through a broad equity allocation. Listed Infrastructure (and private infrastructure) requires a dedicated allocation. Ecofin’s Listed Infrastructure strategy delivers a meaningful yield pick-up over the MSCI AC World index on lower multiples – see Chart 7 – yet the portfolio represents only 1.6% of the index’s market capitalisation and there is no overlap with its top 80 constituents[4]. To access the secular growth and value opportunities in listed infrastructure, investors are encouraged to seek specialised allocations.

Sources:

[1] Redwheel and Morningstar, February 2025

[2] Bloomberg, December 2024

[4] Source: Bloomberg and Redwheel. EGL data as of February 2025; MSCI data as of January 2025

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.