Ask yourself these questions...

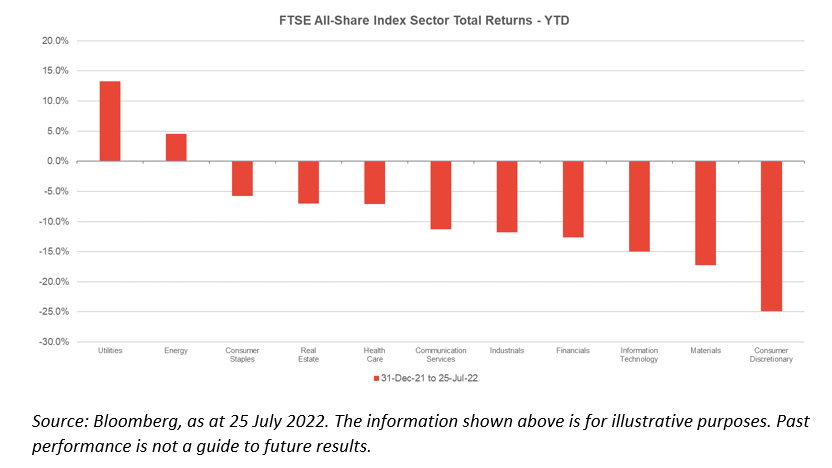

Since the start of February, cyclical stocks have performed much worse than the wider market as many investors have become concerned that rising interest rates and high energy prices will lead to an economic slowdown or possibly a recession. As the chart below shows, more defensive sectors such as utilities and consumer staples have been amongst the best performers whilst cyclical sectors such as consumer discretionary and materials have been the worst.

In last few weeks, however, we have started to see signs of real capitulation as some investors have begun redeeming funds that are exposed to cyclical value after many of the stocks they own have already halved in value in five months and now trade at mid-single digit price to earning multiples. As a wise investor said to me many years ago “If you are going to panic, panic early” and selling cyclicals now feels too late to us. Indeed, as contrarians, we would argue that now is the time to buy these stocks but for anyone still thinking about switching from cyclicals to defensives, we would urge them to ask themselves the following questions:

1. How reliable are your own economic forecasts (be honest with yourself here)?

Can you predict with confidence where and when there will be recessions? Whether they will be reminiscent of the stagflation experienced in the 1970’s, or a deflationary bust like the thirties, and how long they will last for? Do you know if or when central banks are likely to suspend monetary tightening? If Jerome Powell pivots, what is likely to happen to the cyclical stocks you just sold? If the honest answer to these questions is “no”, should you be building an investment strategy around your ability to predict these factors? Warren Buffett famously advised against this as an investment strategy and advocated exploiting the over-reaction of others to the swings of the economic cycle.

“We will continue to ignore political and economic forecasts which are an expensive distraction for many investors and businessmen. Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%. But surprise: None of these blockbuster events made even the slightest dent in Ben Graham’s investment principles. Nor did they render unsound the negotiated purchases of fine businesses at sensible prices. Imagine the cost to us, if we had let a fear of unknowns cause us to defer or alter the deployment of capital. Indeed, we have usually made our best purchases when apprehensions about some macro event were at a peak. Fear is the foe of the faddist, but the friend of the fundamentalist”

Source: Warren Buffett Letter to the Shareholders of Berkshire Hathaway Inc., www.berkshirehathaway.com. March 7, 1995.

2. Is the recession already priced in?

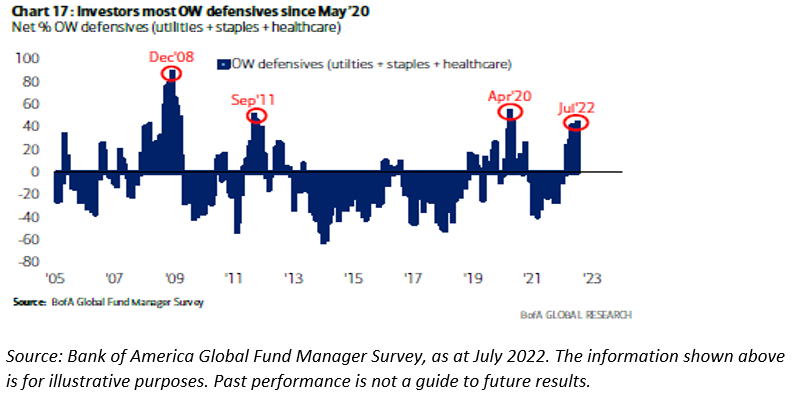

Even if you know there is a recession coming, isn’t there a chance that others do and hence it is already priced in? The chart below would suggest that is a strong possibility since it is now the consensus view.

3. Should you sell cyclicals at the top or bottom of an economic cycle?

If you are about to sell your cyclical stocks is the best time to sell cyclicals at the top of a cycle, when they are priced as if high levels of profitability are sustainable, or at the bottom when they are priced as if earnings will never recover? As we finished this note, the first estimate of US Q2 GDP came in at -0.9%, far below the 0.5% consensus forecast, and while an improvement from Q1’s -1.6%, this was still the second consecutive quarter of declining GDP which is the definition of a recession. Hence it would appear that we are closer to the bottom of the cycle than the top and this would seem to be an odd time to be selling cyclicals unless you genuinely believe that there will be recovery this time.

“Every recession brings out the skeptics who doubt that we will ever come out of it, and who predict that we will soon fall into a depression, when new cars will sit unsold in the showrooms forever and houses will stand empty, and the country will go bankrupt.”

Source: Peter Lynch, www.novelinvestor.com

4. Are you an investor or a speculator?

An investor would be taking advantage of the fact that many cyclical stocks are trading at a fraction of a conservative estimate of their intrinsic value and use this opportunity to grab some bargains. He would recognise that buying an equity involves ownership of a long stream of cashflows and thus the reduction in even a couple of years of these will not significantly reduce long run intrinsic value.

The speculator is trying to guess where shares prices are going in the next few weeks and hence is playing the Keynesian Beauty Contest i.e. seeking to anticipate how others will feel about these stocks in a few weeks’ time. The problem is that sentiment can be a fickle mistress and can change quickly and unpredictably.

‘The most realistic distinction between the investor and speculator is found in their attitude toward stock-market movements. The speculator’s primary interest lies in anticipating and profiting from market fluctuations. The investor’s primary interest lies in acquiring and holding suitable securities at suitable prices.’

Source: Benjamin Graham, ‘The Intelligent Investor’

5. How do you feel about doing what everyone else is doing but later?

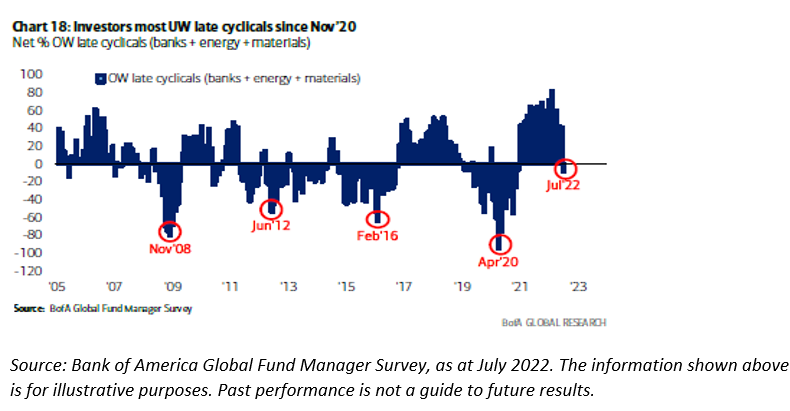

As the charts below show, positioning towards defensives and away from cyclicals is already at extreme levels. Does following the crowd, but with a lag, usually create good investment returns? For anyone unsure about the answer to this, I would strongly recommend reading the latest letter from Source: Howard Marks ‘I Beg to Differ’, July 2022

6. What does the gap in valuation between cyclicals and defensives look like right now?

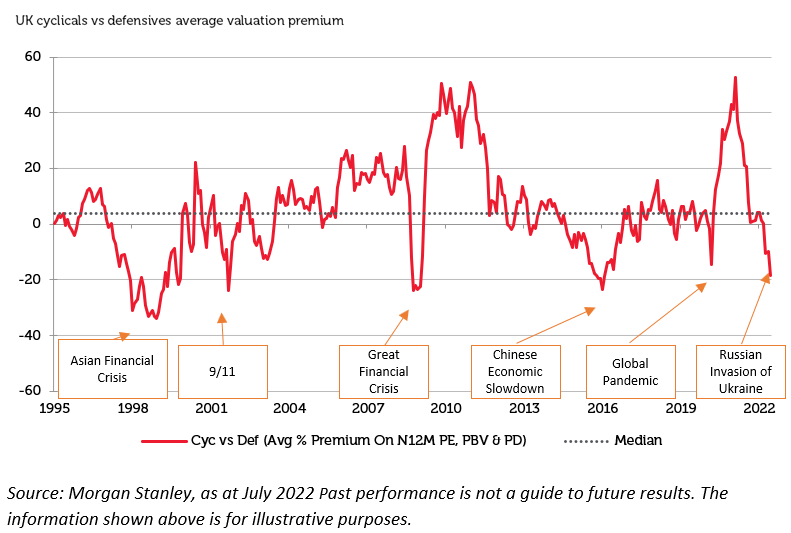

As the chart below shows, the spread between the valuation of cyclicals and defensives is at the same level as during the financial crisis. I remember those selling cyclicals causing the share price of Next to fall from £25 to £10 in 2008, only for it to rebound to £20 within a year and £60 within 5 years. The same can be said of 2020 when those panicking out of NatWest Group pushed the share price down to 90p only to watch it rebound to 250p within a year. On every one of these occasions, the most profitable course of action was to be buying cyclicals which subsequently performed as the economy recovered and risk aversion declined. A sale of cyclicals now would seem to be a bet that ‘this time is different’.

7. Does buying lowly valued stocks improve or reduce the chances of making satisfactory long run returns?

Incredibly, in a market still characterised by high valuations relative to their historical averages, there may still be pockets of outstanding value. We can go into the market today and buy stocks on mid-single digit price-to-earnings ratios and 4-7% dividend yields (see table below) and yet it seems most people would rather sell these stocks than buy them. The fact that the proceeds are invariably being put into consumer staple stocks on mid-twenties price-to-earnings ratios is likely to compound the error in the long run.

‘It is largely the fluctuations which throw up the bargains and the uncertainty due to the fluctuations which prevents other people from taking advantage of them.’

Source: John Maynard Keynes General Theory of Employment, Interest and Money 1936

Conclusion

Rather than form a long-term view of the valuation of many businesses quoted in the stock market, and take advantage of the fact that the recent panic has created an opportunity to buy them for less than they are potentially worth, it seems that many are allowing price action to influence their own behaviour. The institutional imperative, and a desire not to look too different from ones competitors, seems to be driving many investment decisions rather than a desire to take the best course of action for underlying investors. Many asset allocators seem incapable of stomaching any fluctuations in a company’s profitability or volatility in share prices and therefore stability, which is much sought after, has become over-valued whilst volatility is undervalued. Since we are not unduly concerned about variation in short term profits nor share price volatility, we regard this as a very attractive investment opportunity.

The future is never clear, and you pay a very high price in the stock market for a cheery consensus. Uncertainty is the friend of the buyer of long-term values.

We understand that owning or buying cyclicals today feels uncomfortable and yet it is our experience that only by feeling uncomfortable can you expect to make superior returns. As another very talented investor once said to me “Some of my greatest investments made me feel physically sick at the time I put them on”.

In his latest memo, Howard Marks makes the same point as follows:

‘Most great investments begin in discomfort. The things most people feel good about – investments where the underlying premise is widely accepted, the recent performance has been positive, and the outlook is rosy – are unlikely to be available at bargain prices. Rather, bargains are usually found among things that are controversial, that people are pessimistic about, and that have been performing badly of late.’

We realise that this course of action is unlikely to be popular in the short term and that articulating an investment strategy of buying ‘wonderful businesses’ is the easier route to asset raising, but the fact that we have always been willing to go contrary to perceived wisdom has been one of the key reasons behind our long-term returns. We see no reason why that should change now.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.