Vaccines are among the most impactful medical inventions in history.[i] Globally, vaccines exist to prevent more than 20 life-threatening diseases.[ii] New estimates suggest that global immunisation efforts over the past 50 years have prevented 154 million deaths from diseases like diphtheria, tetanus, pertussis, yellow fever, and measles.[iii]

Despite worldwide immunisation success, the COVID-19 outbreak and resulting vaccination race brought into focus the global prevalence of vaccine hesitancy and appeared to trigger a further decline of trust in vaccinations.[iv] A US survey found that the proportion of surveyed adults who do not think approved vaccines are safe rose by 6% to 16% between 2021 and 2023.[v] Similarly, a survey in Germany shows that public vaccine scepticism increased from 21% in 2022 to 25% in 2024.[vi] As a result of decreasing vaccine uptake and concerns over the prevalence of preventable diseases, the World Health Organisation has declared vaccine hesitancy as one of the top global health challenges.[vii]

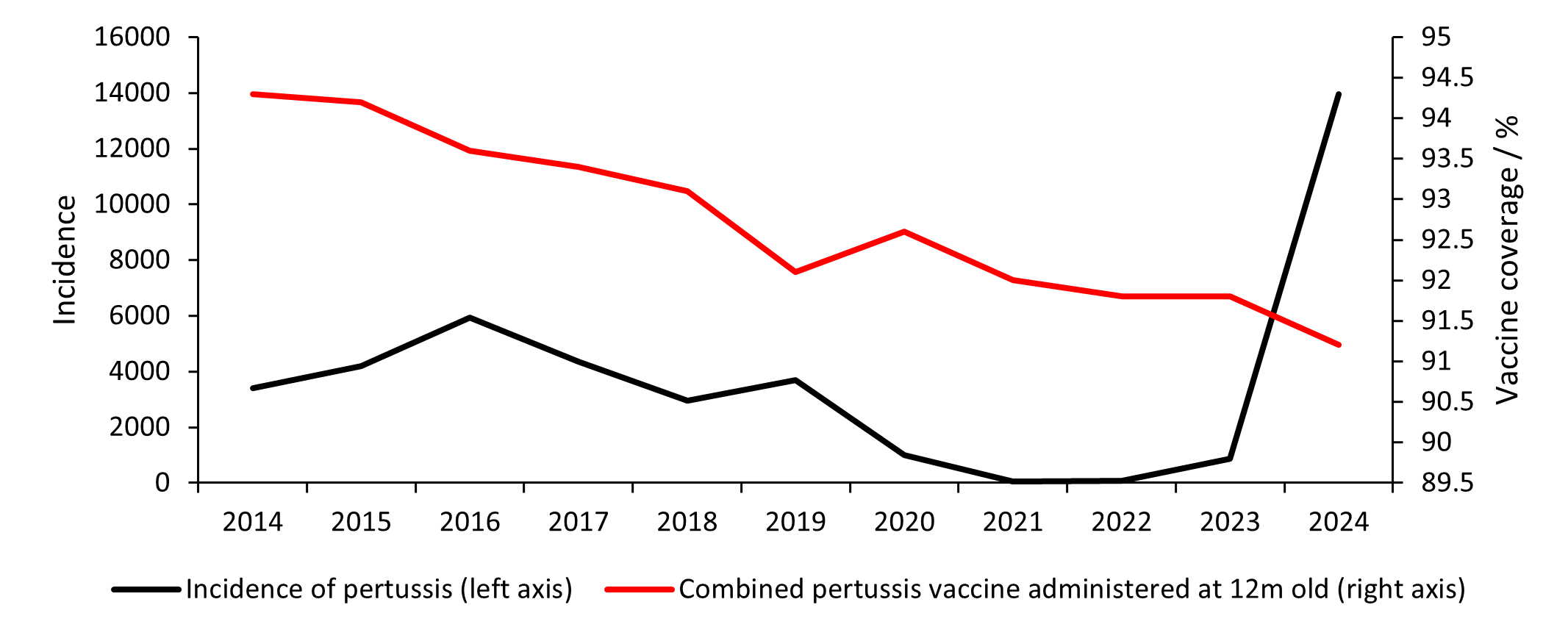

Whooping cough (pertussis) in England shows the concerning effect of increasing vaccine scepticism, declining vaccination rates, and consequent rising incidence of the disease. Although historically associated with lower-income countries where there is greater mistrust of vaccines, Figure 1 demonstrates how growing scepticism can have a marked impact on disease prevalence in higher-income countries too[viii]. In 10 years, the infant pertussis vaccine coverage in England fell from 94% to 91%, meanwhile the maternal pertussis vaccine coverage fell from 75% to 59% from 2017 to 2024[ix]. Incidence of the disease has more than tripled over the same time-period.

A similar trend can be detected with measles, where misguided concerns over a link with autism in children have led to declining vaccination rates[x]. 2023 saw a 20% rise in global cases compared to 2022[xi], while nearly 60 countries experienced outbreaks in the past year. Globally, only 83% of children received a first dose of the measles vaccine in 2023 and only 74% received the recommended second dose, despite national coverage of 95% or greater being necessary to prevent outbreaks of the contagious disease.[xii]

During the COVID-19 pandemic it was found that antivaccine messages from authority figures were a common reason for vaccine hesitancy.[xiii] Now that President-elect Donald Trump has nominated Robert F Kennedy Jnr. (RFK Jnr.) – who has been skeptical of vaccines in the past – to head up the Health and Human Services Department, there are increasing concerns of an even greater erosion of people’s willingness to get vaccinated in the US.[xiv]

How does this impact investors?

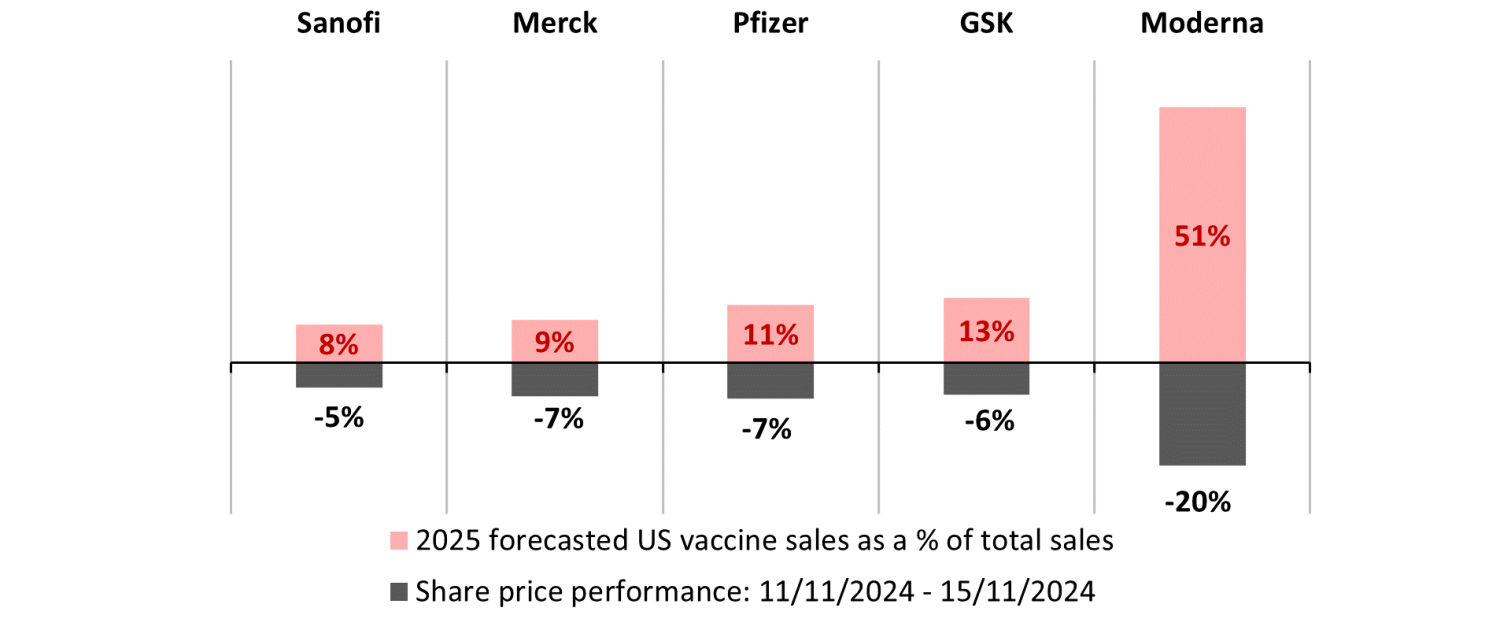

RFK Jnr.’s nomination as Head of Health and Human Services (HHS) precipitated a sharp sell-off in healthcare stocks. Sanofi, Merck, Pfizer, GSK, and Moderna have greater exposures to the US vaccine market and hence were punished most by the market in the week of his nomination.

Although there is very little clarity over the shape of future US health policy, there is a presumption in the investment community that RFK Jnr.’s vaccine stance may lead to larger and longer clinical trials, stricter labels for approved products, lower vaccination rates, and therefore lower revenues for vaccine makers.

Further, with Republican control of both chambers of Congress and the White House, a hawkish health department could seek to repeal the National Childhood Vaccine Injury Act of 1986 which protects vaccine makers from litigation due to injury. An increase in lawsuits – even if not successful – may increase costs for manufacturers.

Ultimately, if significant legislative changes were to occur then investing in vaccine makers could be riskier.

However, whilst commentators have focussed largely on RFK Jnr.’s more harmful rhetoric, not all news has been entirely negative. RFK Jnr. has stated that vaccines were ‘not going to be taken away from anybody’[xv], while Vivek Ramaswamy – who will co-lead the newly created Department of Government Efficiency (DOGE) – confirmed that the new US healthcare leadership ‘understand innovation is a key part of the solution.’[xvi]

And it is interesting to note that Ramaswamy has made comments suggesting that he wants DOGE to reduce regulatory burden on pharma, biotech and medical device companies that require US Food and Drug Administration (FDA) approval. He recently posted on X, “My #1 issue with FDA is that it erects unnecessary barriers to innovation”, so it could be argued that the FDA under the Trump administration may be supportive of getting treatments to patients more quickly, which would most likely be a net positive for manufacturers.

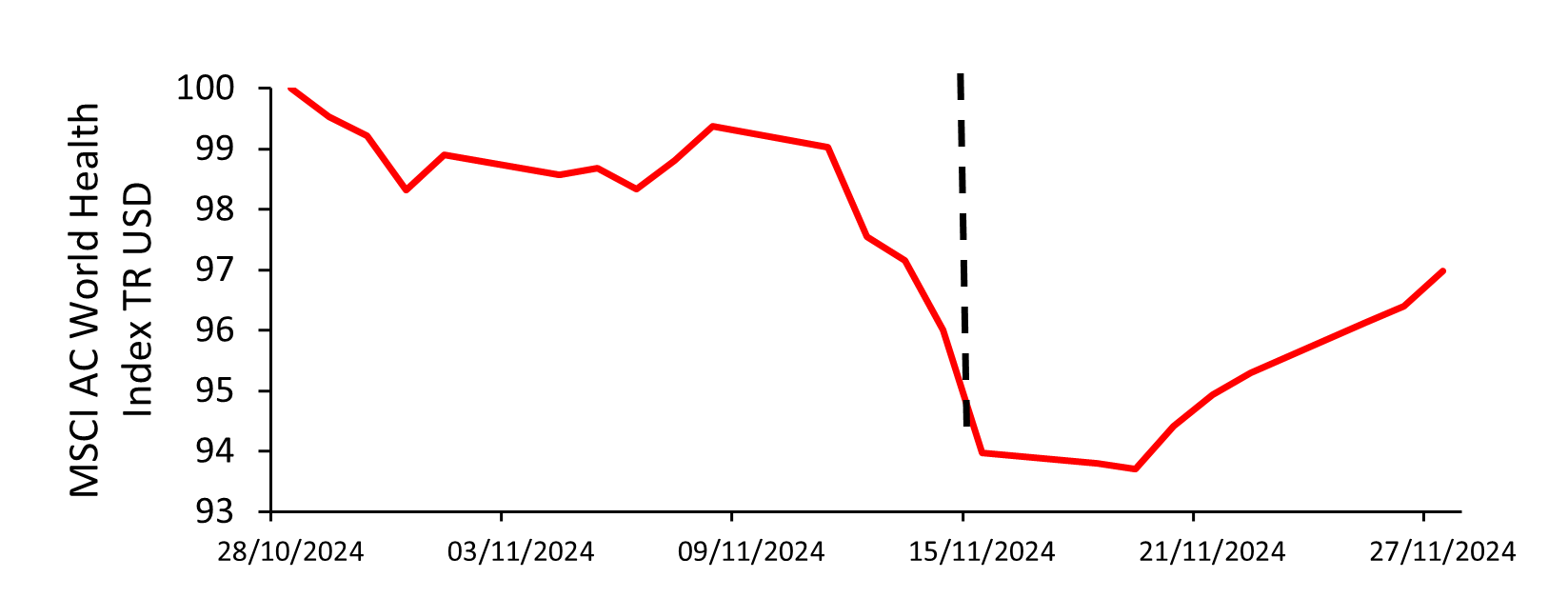

Further, it is our view that despite potential disruption in US healthcare, many treatments will continue to have a life-changing impact on patients’ lives, and hence, best-in-class businesses will keep their competitive advantage. In the week of RFK Jnr.’s nomination, the MSCI AC World Health Index declined by more than 5%[xvii], which included companies with no exposure to vaccines. With that discount, we believe there are significant opportunities for us to invest in these life-changing solutions at compelling valuations.

Sources:

[v] Annenberg Public Policy Center, 2023

[xv] NPR interview, 06/11/2024.

[xvi] Vivek Ramaswamy’s push for FDA changes could boost his wealth – The Washington Post, accessed 27/11/2024.

[xvii] Bloomberg, November 2024

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.