Returns in the UK equity market for 2020 were split in two halves, with energy, materials, financials and cyclicals being amongst the worst performing sectors from 1 January to 8 November (the date the Pfizer vaccine was announced) but registering some of the biggest gains for the rest of the year. Of course, we celebrated that value finally had its day in the sun, but we also believe that this rotation toward traditional value stocks is not a flash in the pan and can continue in to 2021. There are at least six reasons why we believe this to be the case:

- 2021 is likely to see some sort of economic recovery based simply on the fact that large sectors of the economy were locked down in 2020 and, although we enter this year with a similar situation, the rollout of the vaccines will make these lockdown events progressively less necessary as we move through the year. In addition, the economy will continue to be aided by massive monetary and fiscal stimulus which should enhance the economic recovery.

- Whilst some workers have been made redundant as a result of lockdown, many more have continued to work but have been spending less and hence saving more, with the Bank of England estimating that this figure is in excess of £100bn. As lockdown ends, there is a possibility that this pent-up spending will be unleashed, leading to a pickup in demand for consumer goods and services.

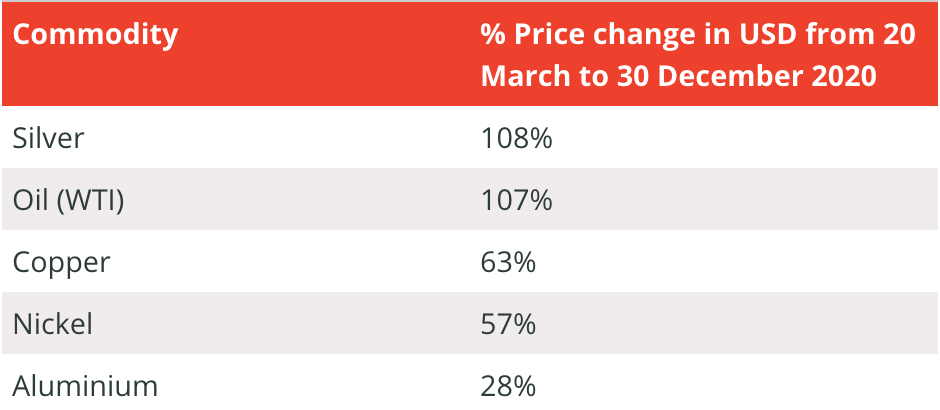

- Demand for raw materials has already returned as Asian economies have begun to grow again. In addition, governments aiming to ‘build back better’ post Covid have all announced large investment programmes in green investment, much of which will increase demand for the raw materials needed for batteries and expansion of the electricity grid, such as copper, lithium, cobalt, nickel. Mining companies such as Anglo American are potential beneficiaries of this.

Measuring the challenge

- An increase in inflation cannot be ruled out but is not priced into markets. Central banks continue to aggressively expand their balance sheets and whilst some of this is finding its way into the real economy, as noted above, the repeated lockdowns mean it is being saved not spent (declining velocity of money as economists would describe it) but this could change post lockdown. Driving inflation up whilst holding interest rates down is known as financial repression and is, of course, the objective of most central banks. This could see a regime change from the previous thirty years of declining inflation and interest rates and would necessitate a very different investment approach to that which has worked in recent years. The losers are likely to be the bond proxies and quality growth companies which are over-owned and over-valued whilst we believe the winners will be traditional value stocks which are under-owned and under-valued.

- Investors are largely aware of the fact that the gap in valuations between value and growth stocks is wider than it has ever been but have been waiting for ‘the catalyst’ for value performance before making any change in allocation. This has duly arrived at the end of the year in the form of the vaccines and Brexit deal.

- Positioning is still very unbalanced. The pain trade in the early part of the year will be the continued underperformance of quality growth that nearly everyone owns. A small amount of re-balancing will only exacerbate this.

We believe the stars are aligned for an improvement in the performance of value stocks in 2021 and beyond. Investors should be mindful of the opportunities being presented to them.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. Information contained in this document should not be viewed as indicative of future results. The value of investments can go down as well as up.

This document is issued by RWC Asset Management LLP (“RWC”), in its capacity as the appointed portfolio manager to the Temple Bar Investment Trust Plc. RWC, is authorised and regulated by the UK Financial Conduct Authority and the US Securities and Exchange Commission.

RWC may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. RWC seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by RWC are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by RWC; or (iv) an offer to enter into any other transaction whatsoever (each a “Transaction”). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party. RWC bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction.