When markets turn from being a one way, upward only trend to that of heightened volatility it can paralyse investors. It can cause uncertainty, fear and dramatically shortens the time horizon in which many investors think. Attitudes tend to change from consistently investing over time (easy to do when your assets just keep on rising) to fear of immediate loss of wealth (on paper) by mis-timing the entry point, craving certainty that a bottom has been reached and that it is safe to return. For some though the opposite affect occurs, and investors believe that an increase in trading activity is the correct response to increased volatility.

It is these changes in behaviour that can make volatility within markets so dangerous to investors and their long-term return. Let’s look at some evidence.

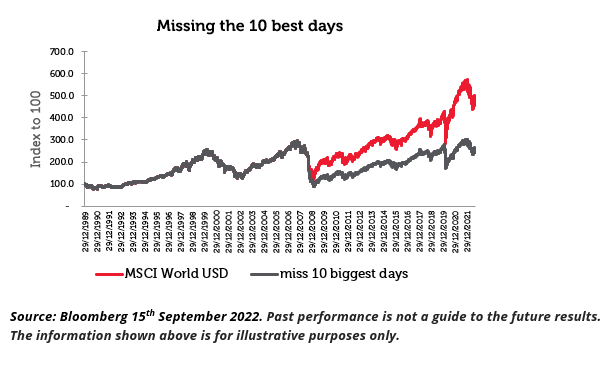

What happens if, through fear of investing or attempting to time markets, you missed the 10 best days returns since 1990 on the MSCI World Index? Your return would be 53% lower, simply from missing 10 days of returns out of 8,534 days. The likelihood of this type of investor behaviour is increased because the ten best days – the 10 largest daily rises in the market – happened to occur during the most volatile times in markets, in 2008 and 2020.

It is a safe assumption that almost no-one could predict when these ten best days would occur. Therefore, by believing you can time the market to not miss them, or that by waiting for some clear sign to jump back in, is fooling yourself.

Unless you take the view that equities as an asset class have ceased to be fit for investment over the long term and that the annualised nominal long-term return of c.8% nominal in USD of the MSCI World since 1970 is no longer repeatable, then you should simply invest in a regular fashion through time, irrespective of short-term volatility. Do not let volatility change your behaviour.

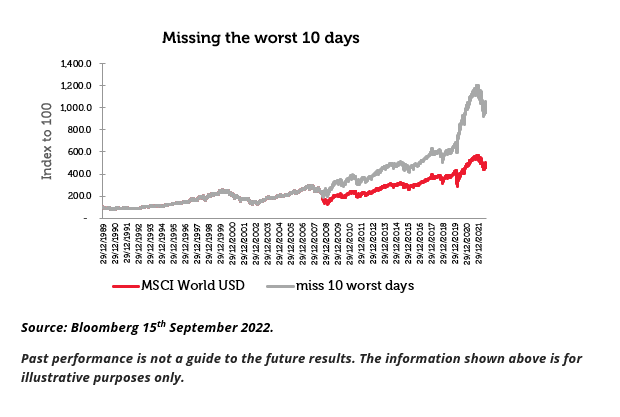

Next, let us look at the risk of losing money. Naturally, the same conclusion on timing holds true. No-one could predict when the worst ten days of the market would be. So, you cannot avoid them altogether. Which is a shame, as they have a profound impact on total return – as shown below, returns would be 211% higher had the worst ten days have been avoided!

Nevertheless, when markets are volatile, and thus the risk of large down days increases, investors can do something to potentially limit the downside. A simple way is to invest in an equity strategy which captures less of the down markets than the up markets. This way, you can continue to invest through time, but mitigate the impact from the violent down days. Investing regularly inthis way allows you to overcome the fear of volatility, knowing you’re dampening down the drawdowns but still participating in the longer-term growth dynamic of equities.

There is a further step that can be taken to help navigate volatility, in addition to investing regularly. That is investing in a strategy that generates a regular dividend. If investing earlier in life and looking for savings growth , then re-investing the regular dividend distribution allows investors to benefit from the compounding of those dividends. This becomes even more powerful in volatile markets, as it means those dividends keep reinvesting even in a falling market, thus creating a larger investment commitment when market eventually turns back up.

Later in life when investors may need to withdraw from savings, then too, a dividend approach helps. By withdrawing natural income instead of having to sell units to fund withdrawals, investors can remain fully invested across the market cycle. This helps avoid sequencing risk, selling units at a low point to then miss out on the recovery in markets by having less capital invested.

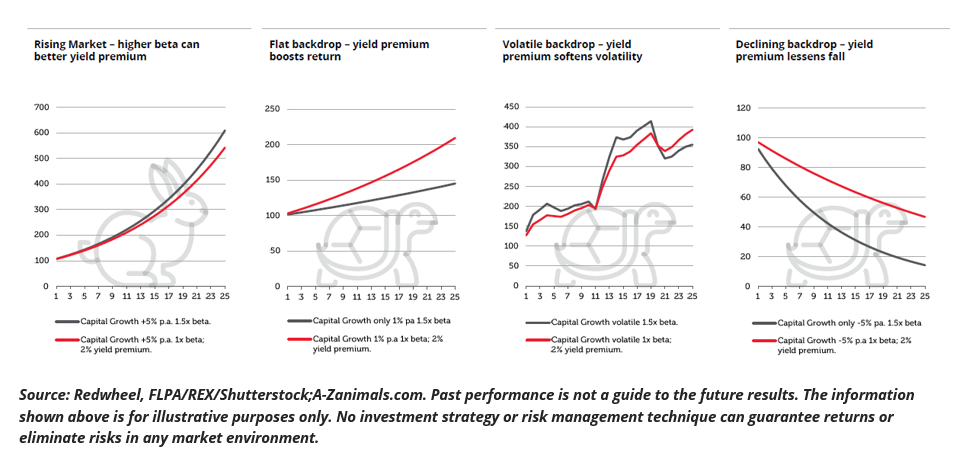

The following exercises, shown in chart form, demonstrates how in anything other than an upward only market, investing in a strategy that compounds a premium dividend yield to the market whilst matching it for capital returns (the tortoise), fares better than a geared play on the market, with a 1.5x beta (the hare). It is an appropriate approach to enable investors to keep investing through volatile times.

The final evidence of whether investors can accurately time investing can be seen by looking at the average return of mutual funds vs. the average return of the investors within those mutual funds. Fees are accounted for to look at the effect of the timing of investing. Ruben Briones at QuantDare looked at the returns of 15,000 mutual funds (across different asset classes) from 2015 to 2022. The average return of the funds was 3.16%. The average return of the investor was 2.63%. The difference is simply poor timing: flows into the funds hit highs with the alone are carved out: the funds return 5.49%; investors return 4.62%. Hadflows simply inversed (done the opposite of the investor) the equity return would have been 7.1%![1]

All the data and maths demonstrate that, as human beings, we are generally not good at timing investment decisions and that these errors become magnified when markets become either euphoric or highly volatile. It is clear that one should simply ignore the noise and keep investing. However, this is hard for most of us to do given our human emotions. So, instead, invest in a manner that can help mitigate the impact of volatility thus allowing one to continue taking the most appropriate action. A global income approach allows investors to do this and saves them from being paralysed by the headlights.

[1] QuantDare – Mutual Fund Returns vs Investor Returns 31st March 2022 by Ruben Briones

Key Information:

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.