Since 2020, economic growth within China has been heavily affected by the lingering impact of policy tightening and a pendulum of Covid lockdowns. As a result, 2022 saw the MSCI China index decline 23.5% [1], underperforming the MSCI Emerging Market Index. However, more than ever, we are positive in our stance on China equities, this is partly due to the impactful change seen in Chinese domestic policy and through the reduction of geopolitical tensions between the US & China. Below we review how we think these recent policy changes will look to encourage growth within the market.

Zero Covid Policy Hangover

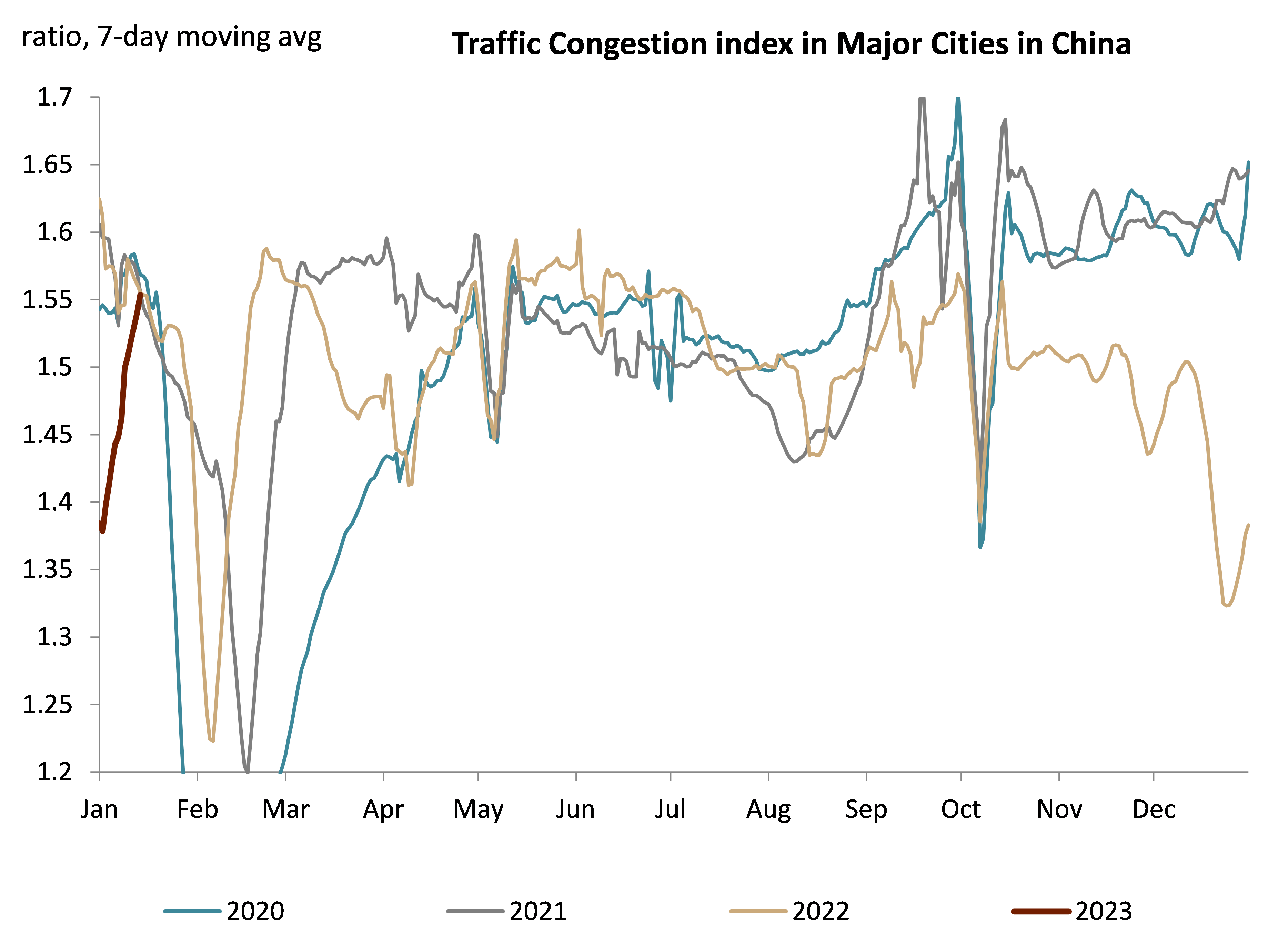

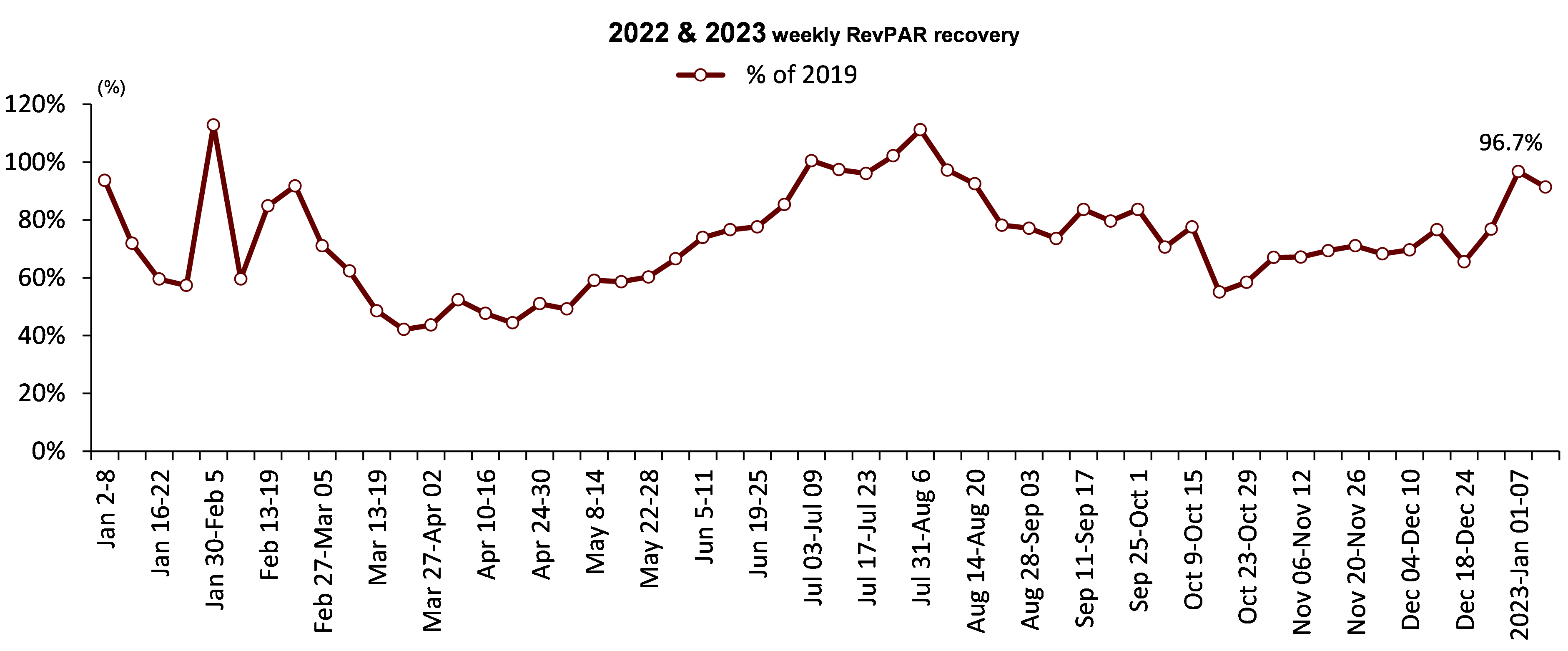

Despite an early recovery from the pandemic in 2020 and 2021, China’s insistence on a zero-Covid policy has deeply damaged its economy. On-and-off lockdowns in major cities, including Shanghai, have hindered business operations and shattered consumer confidence. Meanwhile, rising unemployment rates and mass layoffs in the once red-hot internet sector have led to more pessimism among citizens. As a result, consumer confidence has fallen to a historical low, while household saving rates reached a record high in 2022. Additionally, the country saved 10 trillion RMB [2] in the first six months of the year, which is the FX adjusted equivalent of the Covid relief bill that Biden handed out in 2021. China’s retail sales had practically no growth in 2022, with -11% [3] in April, the worst month since 2018, except for the initial Covid outbreak period. Since the zero-Covid measures were lifted in December 2022, we see that China is quickly opening to the world and, as a result, we potentially expect to see demand for travel (as seen below through an uptick in RevPAR) to be strong, economic activity to recover (as seen below through Traffic Congestion), and consumption to eventually return to a growth trajectory.

China sees traffic jump back to pre-Covid level since reopen

Source: Wind, CICC

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice.

Hotels see fast recovery of RevPAR, indicating strong travel demand

Source: STR, CICC as at 18th January 2023

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part.

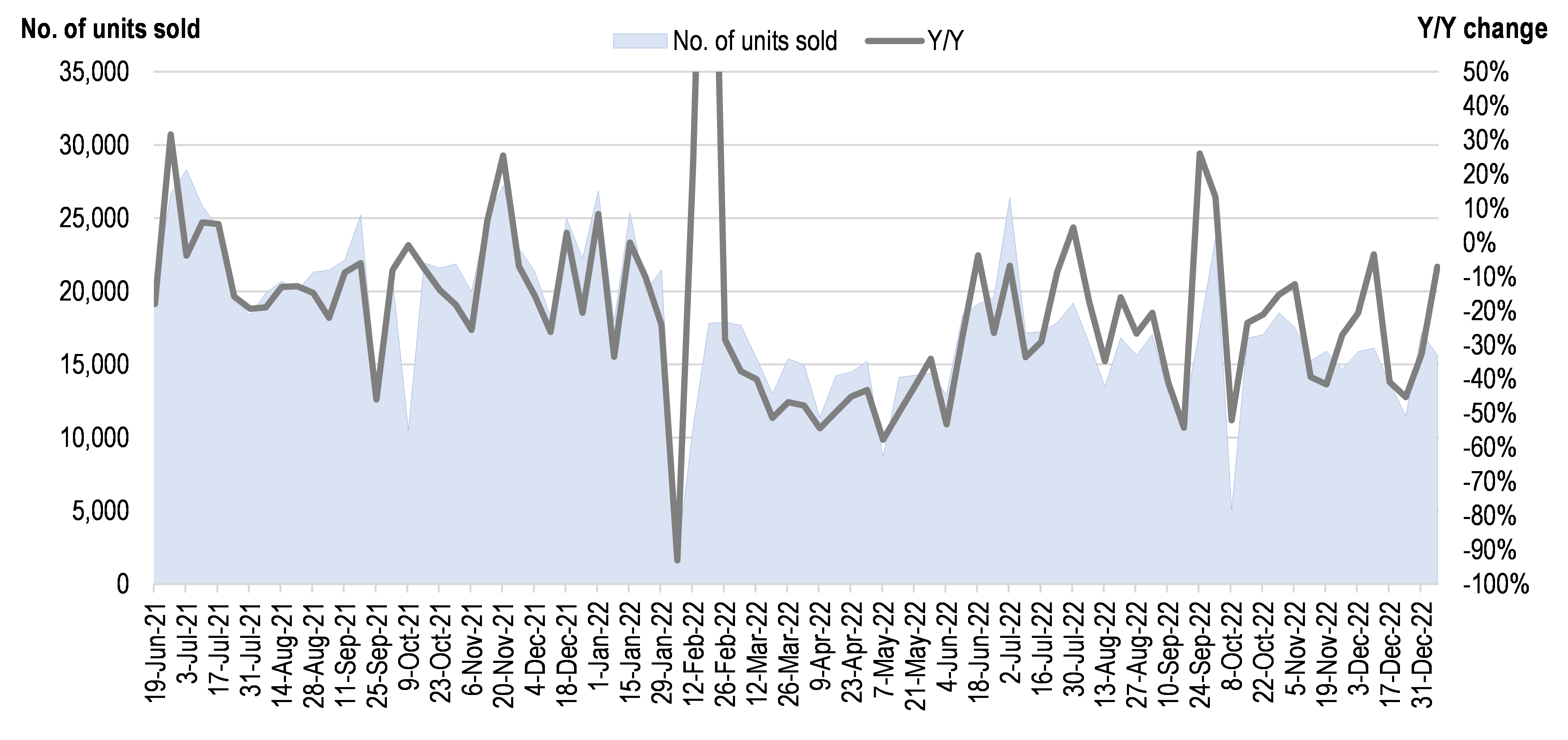

Opportunity in the Property Sector

The real estate sector underwent a rollercoaster ride in 2022 as the recently announced measures signal a U-turn of the policy stance adopted by Beijing in 2016. 2016 saw the authorities unveil a series of steps to try stem rapidly rising home prices. This accumulated in August 2020 as a regulation known as the “three red lines”, which restricted developers’ access to new credit. A number of high-profile bond defaults that started in mid-2021 tipped the entire property sector into financial distress. Over the first 11 months of 2022, land purchases fell around 48% nationally while sales of new homes dropped about 28% and construction completion sank by 19%.[4] Beyond the economic impact, we saw a campaign by homebuyers to halt mortgage payments for units in buildings where developers had stopped construction due to lack of funds, posing a real threat to social stability and, to a lesser extent, bank loan books. Since then, the authorities have fine-tuned the policy to ensure the completion of unfinished projects to stamp out homebuyers’ anger. The China Securities Regulatory Commission provided a ‘saving grace’ by reopening a long-closed door for real estate companies to raise funds through share sales and domestic bond issuance. This new credit stream has allowed many private developers to breathe a sigh of relief. The revival of real estate demand should follow the lifting of Covid restrictions, although we believe it is very unlikely that the property sector will again match the record reached in 2021 of 1.8 trillion square meters sold. A new chapter has arguably begun for the sector and this could bring a new set of winners to the fore. We are actively positioned in this sector, with property companies set to benefit directly from the potential housing market recovery.

China Property: 20 City weekly sales data

Source: Wind, Government websites, JP Morgan, as at 31st December 2022

The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part.

Promise for Domestic Policy

China’s new top governing body has put out several policies to address the economic predicament, from the relaxation of the zero-Covid policy to abundant credit support for property developers; loosening regulation on internet players and the approval of 2-year long Anti Financial’s capital replenishment proposal. Although much was in debate for Xi’s unprecedented third term post the 20th National Party Congress, these supportive measures demonstrate that the leadership has brought economic stability and growth back into focus. When Xi unveiled the new government stacked with his loyalists, the market was overthrown by the pessimism that China would second economic growth under the new leadership. Our view was, however, that a cohesive and integral government would streamline and execute policies much better from top to bottom. Moreover, we believe apparatchiks would be more committed to policy-making and implementation after the new leadership is formed. Therefore, policy setting in 2023 looks promising.

Geopolitical Tensions

Geopolitical dynamics have taken center stage in 2022. Global events such as the Russian war on Ukraine took a toll and the concern of sanctions on China flustered the equity market. US-China relations also experienced multiple obstacles throughout the year. The US House of Representatives passed the America Competes Act, an extensive piece of legislation aiming to strengthen the US’s competitive edge over China. The US Securities and Exchange Commission (SEC) put a number of Chinese companies on the provisional list of issuers under the Holding Foreign Company Accountable Act (HFCAA), pointing to delisting risk by 2023. Additionally, we saw tensions heighten before house speaker Pelosi’s high-profile visit to Taiwan, which prompted a three-day military drill.

Nevertheless, these tensions quickly eased off, to the market’s surprise. The US Public Company Accounting Oversight Board (PCAOB) reached an agreement with the China Securities Regulatory Commission and Ministry of Finance to gain access to audits of Chinese companies listed on the US exchange. They were eventually granted uncensored access to investigate audit firms in China, potentially saving hundreds of Chinese companies from forced delisting. In addition, the newly appointed Chinese Foreign Minister, Qin Gang, is widely seen as an effort by Beijing to stabilize relations between the world powers. After an eventful 2022, we think the US-China relationship will enter a relatively quiet period with less dramatic interactions. Since the Trump Administration, we believe that US-China relations have been deteriorating and the effect of this has created negative economic impacts on both sides. Nevertheless, we expect both nations to compete and coexist well in the future, which should impact China equities in a positive way.

All in all, we see political, economic and Covid policies aligned in the domestic market and external conflicts taper in the international market. The outlook for 2023 appears positive for China equities. We see opportunities in China’s consumption, property and internet sectors, not only will this be in part due to cyclical recovery, there is great opportunity for intrinsic sustainable growth.

Sources:

[1] Bloomberg 18th January 2023

[2] National Bureau of Statistics of China (NBS)

[3] National Bureau of Statistics of China (NBS)

[4] National Bureau of Statistics of China (NBS)

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.