Emerging Markets faced three main headwinds in 2022, namely, China’s zero Covid-19 policy, aggressive monetary policy tightening globally and the Russian invasion of Ukraine. We see two out of those three factors turning into potential tailwinds in 2023. Firstly, China has already started to reopen its economy; therefore, the main question is the impact on the rest of the world. Secondly, we see the Fed pausing hikes at some time in H1 2023 and potentially pivoting to rate cuts in Q4 2023, which could lead to a weaker US dollar. The combination of a dovish Fed and the reopening of China’s economy creates a favourable backdrop for Emerging Market (EM) equities to outperform. Additionally, there are other factors that we think will contribute to the outperformance of EM in 2023:

• Accelerating emerging vs developed real GDP growth differential

• A dollar bear market

• Stronger relative emerging market EPS growth

• Evidence of investor capitulation

• Favourable valuation dynamics

• A global capex recovery post years of structural disinvestment

Looking at the 8 factors in more detail:

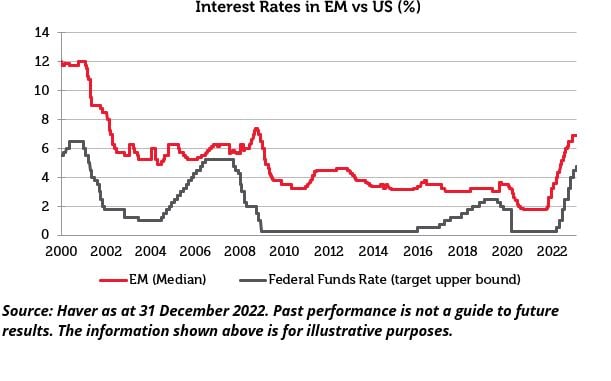

1) A dovish Fed

– As discussed, we believe the Fed will pause rate hikes and then begin to cut rates later this year. Moderating US rates should take the pressure off EM central banks, which have already tightened significantly, remaining ahead of the curve. So far, the only emerging economy central bank with an easing bias is China. Looking forward, we anticipate that countries such as Brazil should also cut rates in 2023.

2) A Relaxation in China’s Covid-19 policy

– China is the world’s second-largest economy and accounts for over one-third of global growth.[1] The prospect of a China reopening is a key catalyst for many EM economies and stock markets in 2023.[2] We anticipate that China’s re-opening will benefit companies across our investment universe. For example, Chinese travel spending was ~$100bn in 2022 but as Covid mobility restrictions are removed, we anticipate this figure could return to pre-Covid levels of ~$250bn in 2023. This spending should impact travel-related companies in China, as well as companies in other countries that are beneficiaries of Chinese tourism, such as Indonesia and Thailand. A faster than expected removal of Covid restrictions continues to support growth sentiment and a rotation back into stocks relying on Chinese consumption and supply chains, as well as having a significant effect on the commodity market.

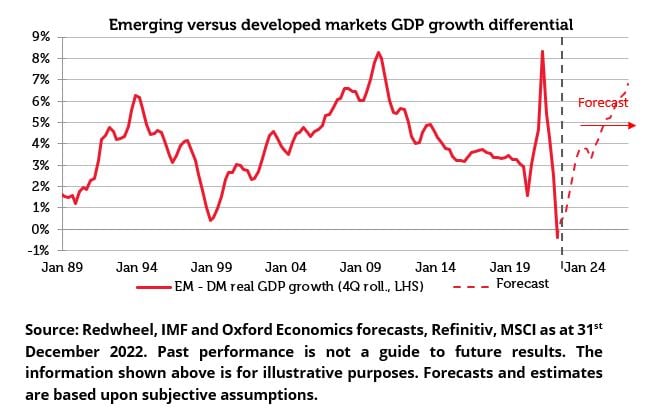

3) Accelerating emerging vs developed real GDP growth differential

– We believe that economic growth is likely to increase in EM during 2023, bolstered by China and LatAm. In contrast, we think Developed Markets (DM) GDP growth is expected to decline close to zero. As a result, the growth differential between EM and DM could widen in 2023 and 2024. This sets a strong backdrop for EM asset prices.

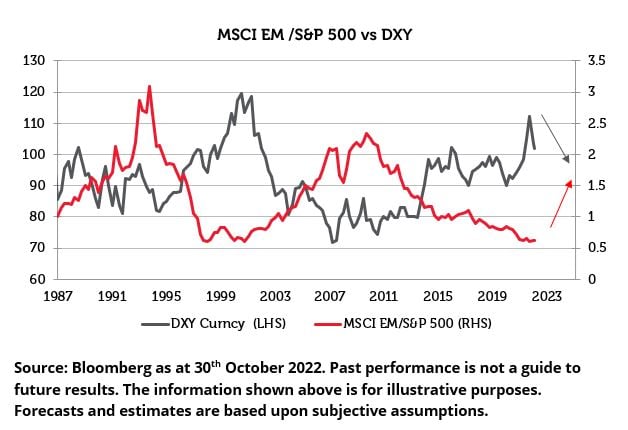

4) Emerging markets will likely benefit from a dollar bear market or a period of dollar weakness

– The interest rate differential moved in favour of US dollar-denominated assets as the Fed raised policy rates more rapidly than its developed market counterparts. On the other hand, China continued to ease monetary policy. The flow of capital to the US accelerated when the Fed signalled an even tighter monetary policy than the markets were expecting in March 2022.

– Going forward, we expect that the Fed’s hawkishness will fade with decelerating inflation in the US due to the lagged effects of monetary tightening. As the Fed begins to become less hawkish and the ECB continues playing catch up on tightening, the interest rate differential should gradually lead to a rotation away from US dollar-denominated assets. This historically has led to EM outperforming the S&P (as seen below).

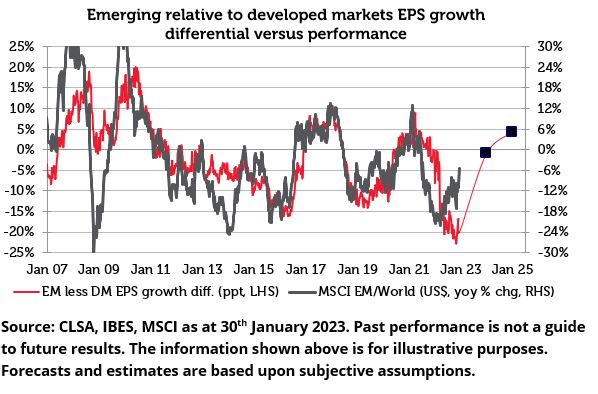

5) Stronger relative emerging market EPS growth

– EM earnings expectations have already been revised to prudent levels. Looking ahead, we anticipate that the lower base should lead to increased growth of corporate earnings within EM. Additionally, there should be more price stability and a chance for favourable market surprises.

6) Evidence of investor capitulation

– After the longest market drawdown in history, investor positioning in EM equities is light. Over the past 13 years, the pace of foreign net selling was only swifter in 2009 and 2020.[3] As news flow surrounding China becomes incrementally more positive, we believe we are at a turning point in investor sentiment towards emerging markets.

7) Favourable valuation dynamics

– Emerging equities are trading on 10.5x P/E ratio, cheaper than the 10-year average of 11.7x. In contrast, US equities trade on a multiple of 29.1x. As a result, current valuations appear attractive in comparison to other markets and in our view offer a great buying opportunity for long-term investors.

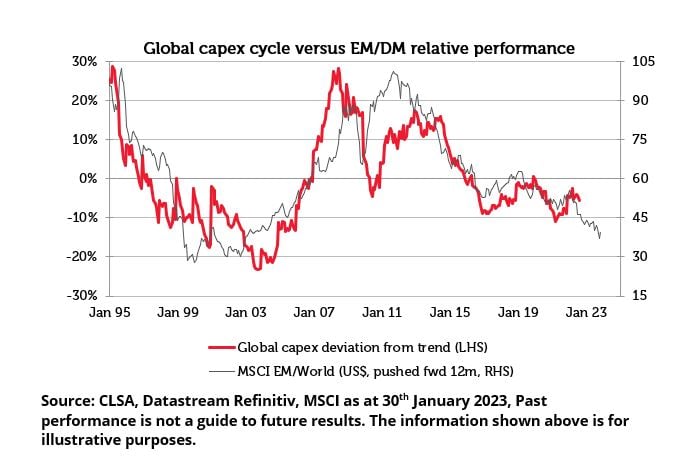

8) A global capex recovery post years of structural disinvestment

– Corporates are recording an early stage—almost involuntary—uptick in investment as the capex depreciation ratio dipped to a record low in 2021. Indeed, for developed equities the ratio fell below parity for 18 months, indicative of depreciating assets not being fully replaced.

– Emerging Markets relative outperformance has historically been a function of the global capex cycle given that the sector composition is heavily skewed towards capex plays.

Regional Outlook

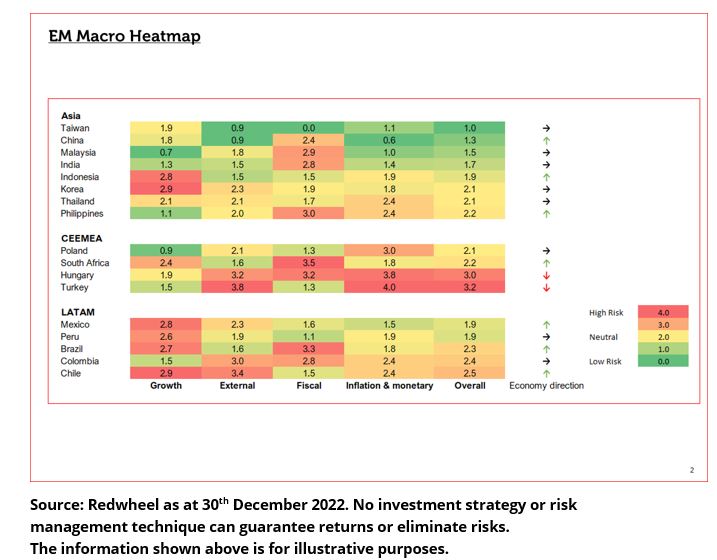

We believe that China is expected to benefit from greater policy impetus following a period of destabilising politics over the past 2 years. This is already evident by several Covid-related policies and increased support for the real estate sector. We see political, economic and covid policies becoming more aligned in the domestic market while external conflicts taper off. This should allow China to continue outperforming going forward. Looking at India, the long-term investment case has strengthened in recent years and we believe the market provides a strong structural growth story. Valuations are expensive, but this comes on the back of strong earnings. External factors, such as crude oil, have turned favourable and domestic indicators continue to be encouraging. South Korea and Taiwan should benefit from a global cyclical recovery and an improvement in prospects for the semiconductor and tech hardware sectors.

In Latin America, Mexico appears set to benefit from nearshoring due to its close proximity to North America. Brazil, having significantly tightened their monetary policy and will benefit from an easing monetary policy cycle as well as high commodity prices. The Middle East should continue to benefit from elevated energy prices while it diversifies its economy away from oil and broadens its capital markets. South African equities should benefit from our views on US and mainland China, even though the domestic macro trajectory is somewhat anodyne.

For smaller EM and frontier markets (FM), idiosyncratic growth drivers are expected to drive asset prices. Our key themes: Commodities, New Factories of the World and Travel, across the smaller emerging and frontier markets remain intact. We have also seen a fall in prices of soft commodities. This may alleviate pressures on those countries such as the Philippines that are net importers of commodities and may abate food inflation concerns. In addition, a higher oil price is also a tailwind for many FM countries. While oil prices should remain elevated, the rate of change in oil prices should decline. The muted increases should contribute to an overall decline in inflation and allow central banks to cut rates going forward.

Commodities

We believe that the recovery of Chinese demand as a result of its re-opening has the potential to outweigh any weakness in Western demand in the event of a recession. Looking at the oil supply and demand situation, a Chinese recovery to pre-pandemic levels would add 1mbpd to global demand and a full recovery of air travel and jet fuel demand, would add another 1mbpd. Looking at previous global recessions, oil demand has fallen on average by c.1mbpd. Therefore, a Chinese re-opening and economic recovery should have the capacity to more than offset any slowdown. China also accounts for more than half of the global demand for base metals and nearly two-thirds in ferrous metals and bulk commodities. For example, China remains a dominant consumer of copper, another of the strategy’s key commodity exposures. With a clear sequential recovery path now expected for China in 2023, we believe that we are near the trough in the copper cycle due to a return to relatively healthy GDP growth trend. At the same time, 2022 has again demonstrated the supply constraints to the global copper supply which we expect to persist in the years to come.

Long Term Growth Drivers

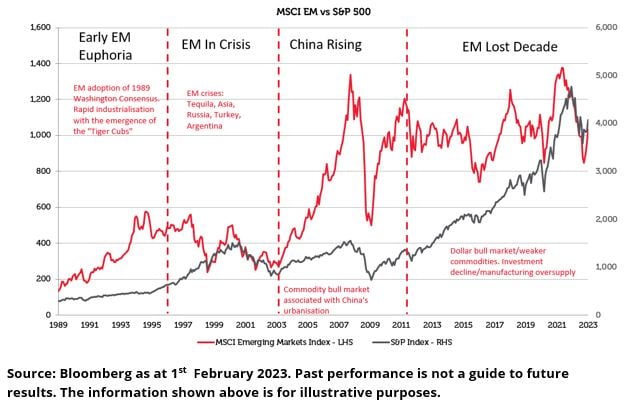

Looking at the longer-term picture, we believe that we are at the cusp of an EM bull market after a “lost” decade in EM. The culmination of the previous 8 factors, though highly supportive for EM equities would ultimately be sufficient to drive a phase of outperformance akin to the 2016/18 episode (26% US$ outperformance over 26m), which albeit welcome at the time, lacked more structural pillars to prolong the rally.

History tells us that longer duration EM outperformance is driven by earnings super-cycles where sustained and superior dollarized EPS growth against the US requires a seismic, underlying shift in the EM investment case. We believe this is coming to fruition as the global economy increasingly separates into two major trading blocs, one broadly aligned to the US and the other to mainland China. We think there will be winners from this de-globalisation and we consider four key themes;

• Supply chain reorientation/Nearshoring

• Energy diversification and independence

• Deployment of EM personal sector savings and new financial hubs

• Secular growth stories (benefitting from independent domestic demand growth, mostly rooted in demographics and infrastructure spending)

The accumulation of these thematic pillars coupled with the previous 8 factors sets up an attractive growth story going forward.

Conclusion

Emerging Markets faced numerous macroeconomic and geopolitical challenges in 2022. Despite the recent obstacles, we believe that the outlook for 2023 is positive and that we are at the cusp of an EM bull market. We expect to see a moderation in US monetary policy and a reopening of the Chinese economy which should improve sentiment and allow EM equity multiples to rerate from currently depressed levels. As a result, we believe EM equities are in a robust position to outperform developed markets and deliver high absolute returns.

Sources:

[1] World Bank as at December 2022

[2] Goldman Sachs, Redwhee; and Haver as at 11 December 2022

[3] CLSA, National Stock Exchange, WFE

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.