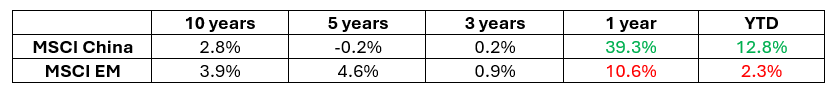

Investors disappointed by returns from Chinese equities might have missed the surge in the MSCI China Index since the beginning of 2024, which has done much to close the performance gap with the rest of the MSCI Emerging Markets Index in recent years.

Recent outperformance has been particularly noticeable.

Recovery in earnings and ROE spur rebound

The Consumer Discretionary and Information Technology sectors have been especially impressive, having climbed 21.8% and 28.6% through 28 February, respectively. The Technology sector has returned 105.4% over the twelve months to 28 February 2025 [1].

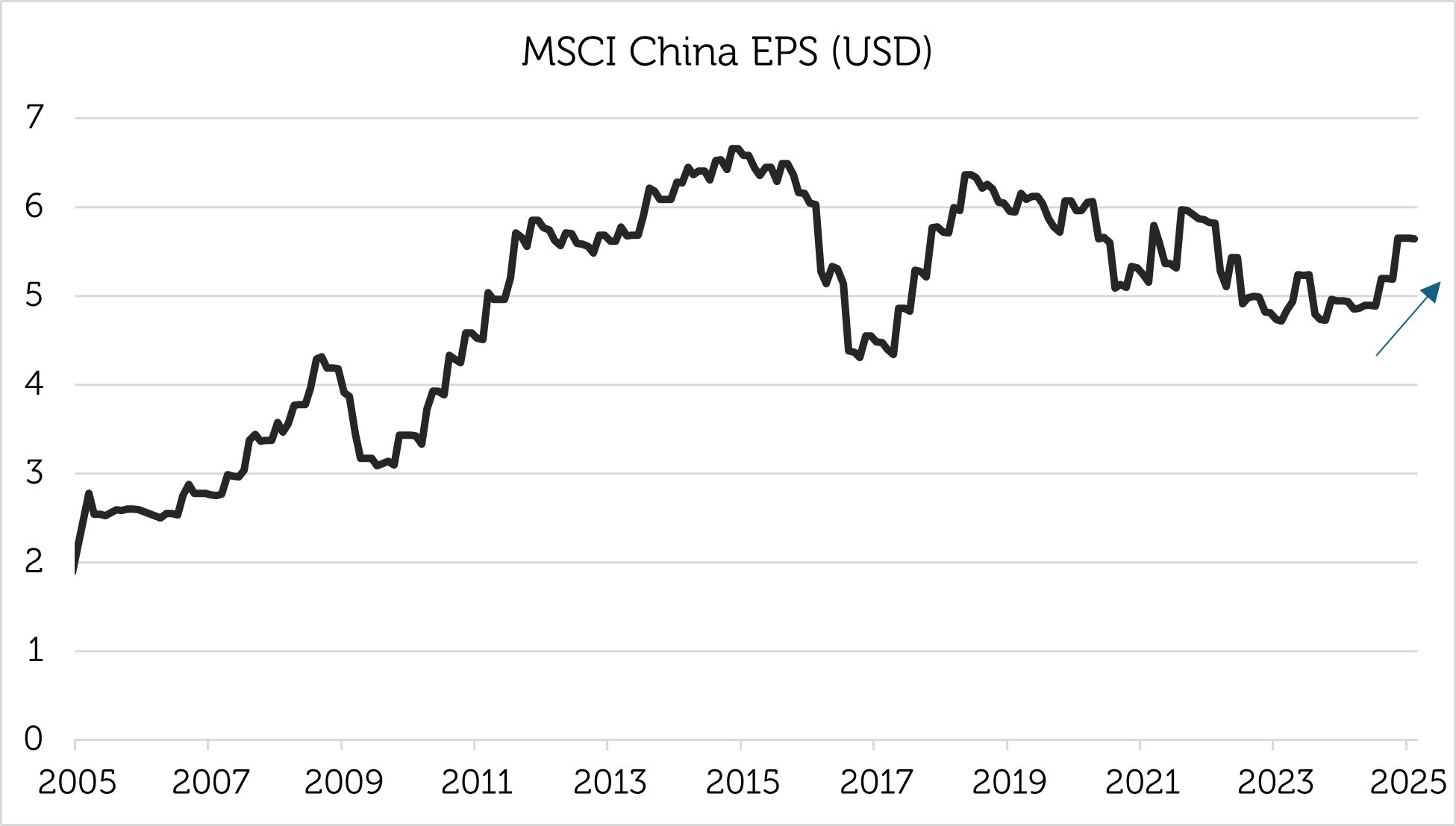

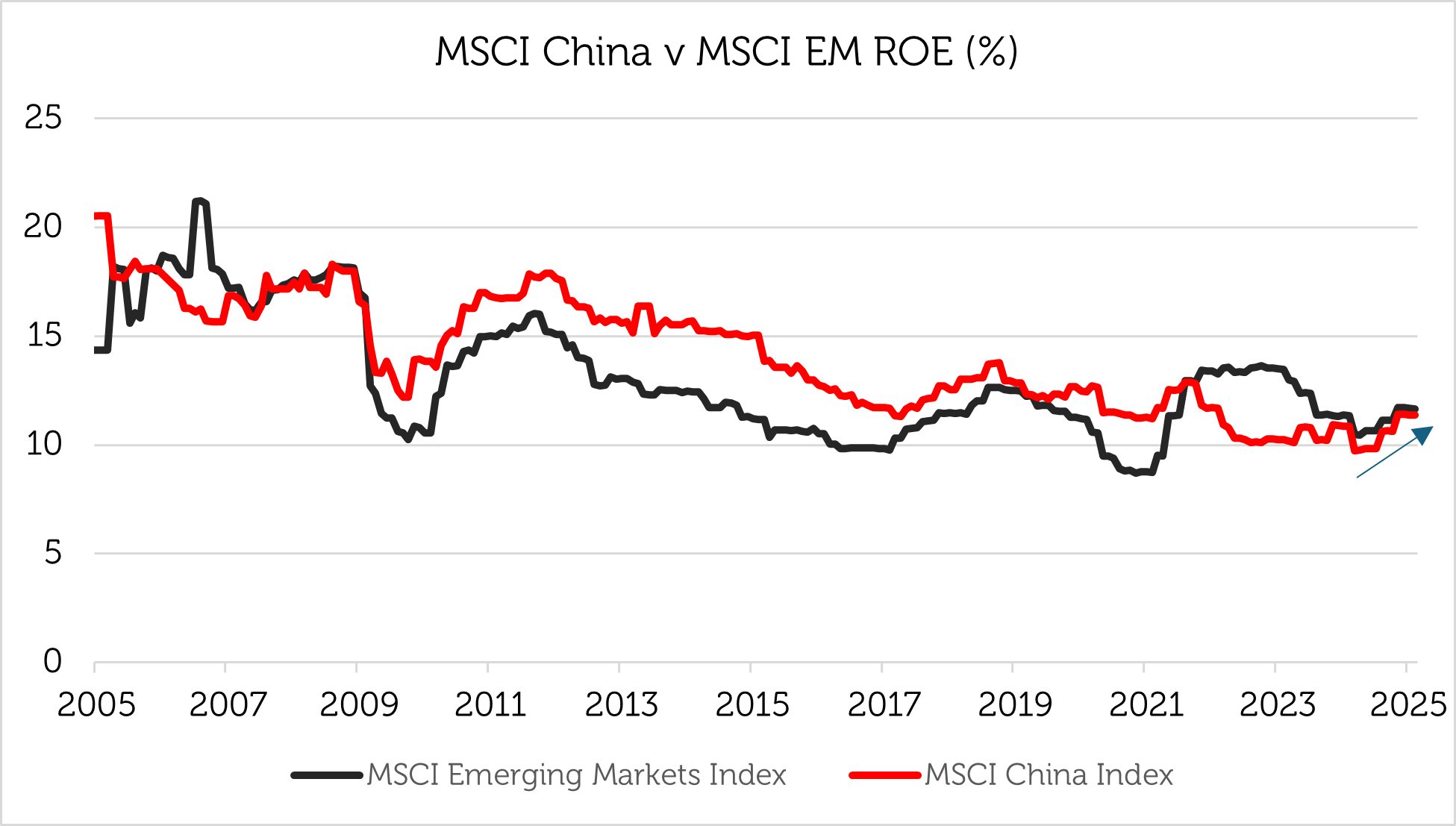

The catalysts for the rebound in Chinese equities have been corporate earnings and ROE recovery in a market with low valuations. MSCI China has been valued at a discount to the broader MSCI Emerging Markets Index since 2022, although it has historically traded roughly on a par with the rest of EM.

Earnings began to recover in the late summer of 2024.

As both earnings growth and ROE have converged with the rest of EM, the valuation discount has narrowed.

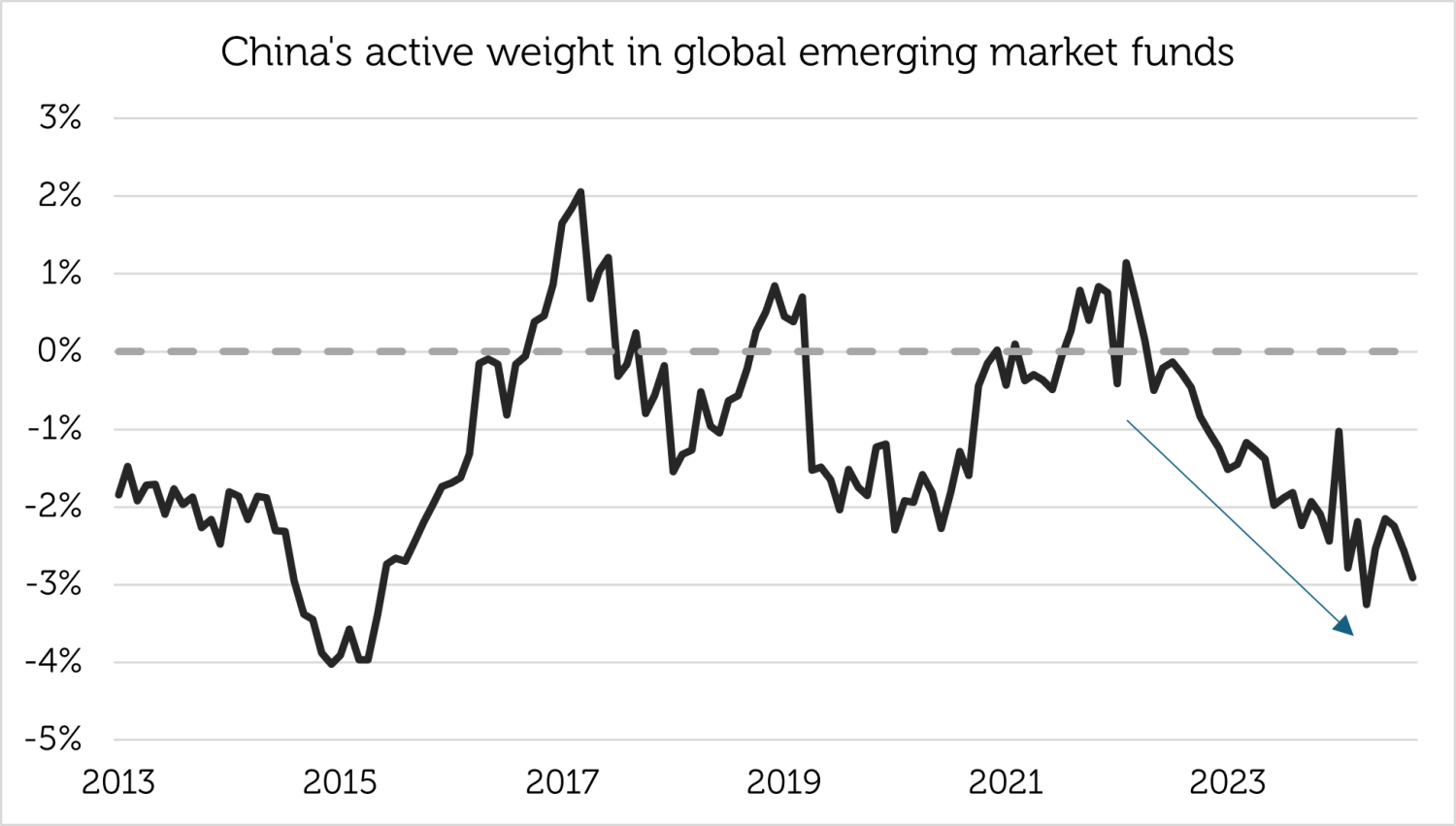

Investors have been underweight a market with improving fundamentals and newsflow

The most significant catalyst for the Chinese equity market was the economic and financial stimulus package announced on 24th September 2024, which included interest rate reductions and a PBOC facility for financial institutions to purchase equities. The strength of support caught investors off-guard as the fund management community has been underweight the Chinese market for several years.

The PBOC’s actions in the autumn of 2024 were followed by a symposium for Chinese entrepreneurs, including Alibaba’s founder, Jack Ma, that was attended by President Xi in February 2025. President Xi encouraged the profit motive with the exhortation that “it is time for private enterprises and private entrepreneurs to show their talents.”[2] His presence at the symposium and explicit reference to private enterprise have been interpreted as an attempt to unleash ‘animal spirits’ that have been suppressed by the Chinese Communist Party’s pursuit of ‘common prosperity’, which emphasizes shared wealth, since 2021.

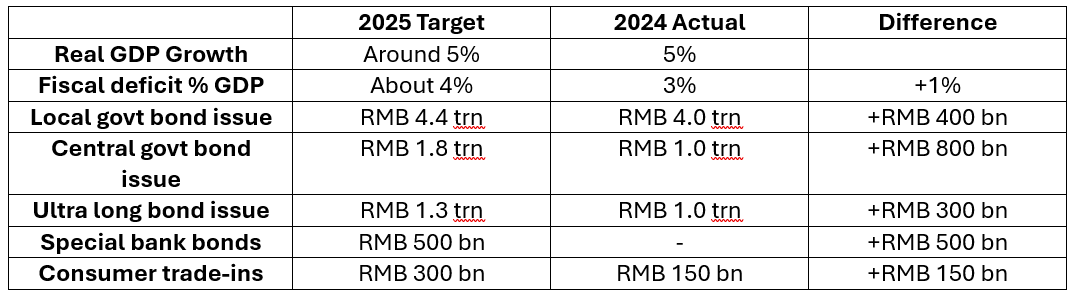

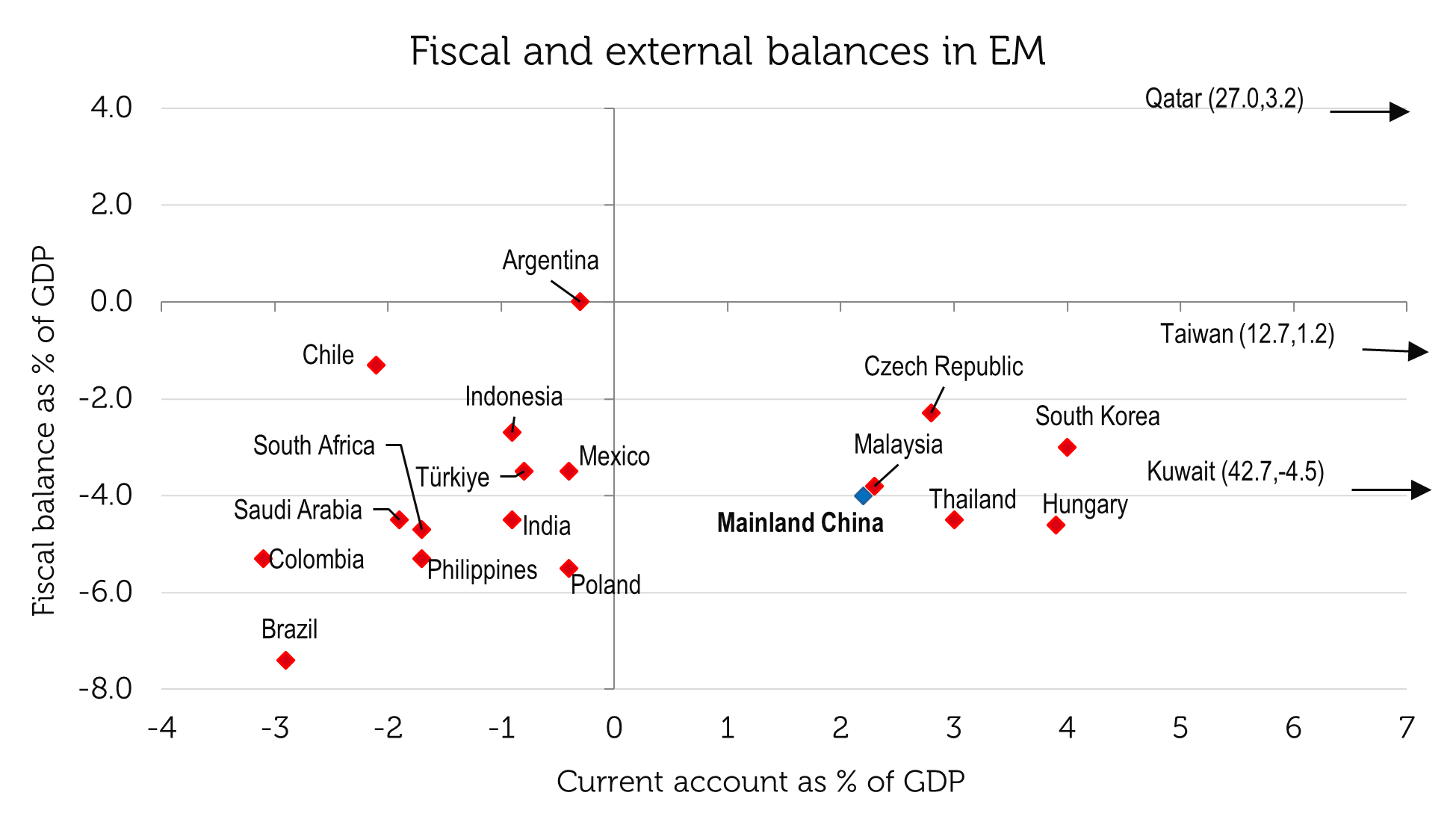

The private sector will continue to be supported by government spending to increase consumption as an engine of economic growth. The meeting of the National People’s Congress in March 2025 endorsed fiscal expansion as a growth driver.

This liquidity injection of over RMB 2.0 trn is made possible by China’s prudent fiscal position and is designed to boost domestic consumption and investment, as well as stabilize the housing market, during the trade war with the United States.

Furthermore, policymakers have taken additional consumer-focused actions. The State Council’s March announcement outlined a 30-point plan to “vigorously boost consumption, expand domestic demand in all directions, improve consumption capacity by increasing income and reducing burdens.”[3] The consumption revival plan prioritizes higher wages, commits to stabilizing the equity and property markets to create a wealth effect, and emphasizes social security. This signals a renewed focus on stimulating consumer spending as an engine of economic growth.

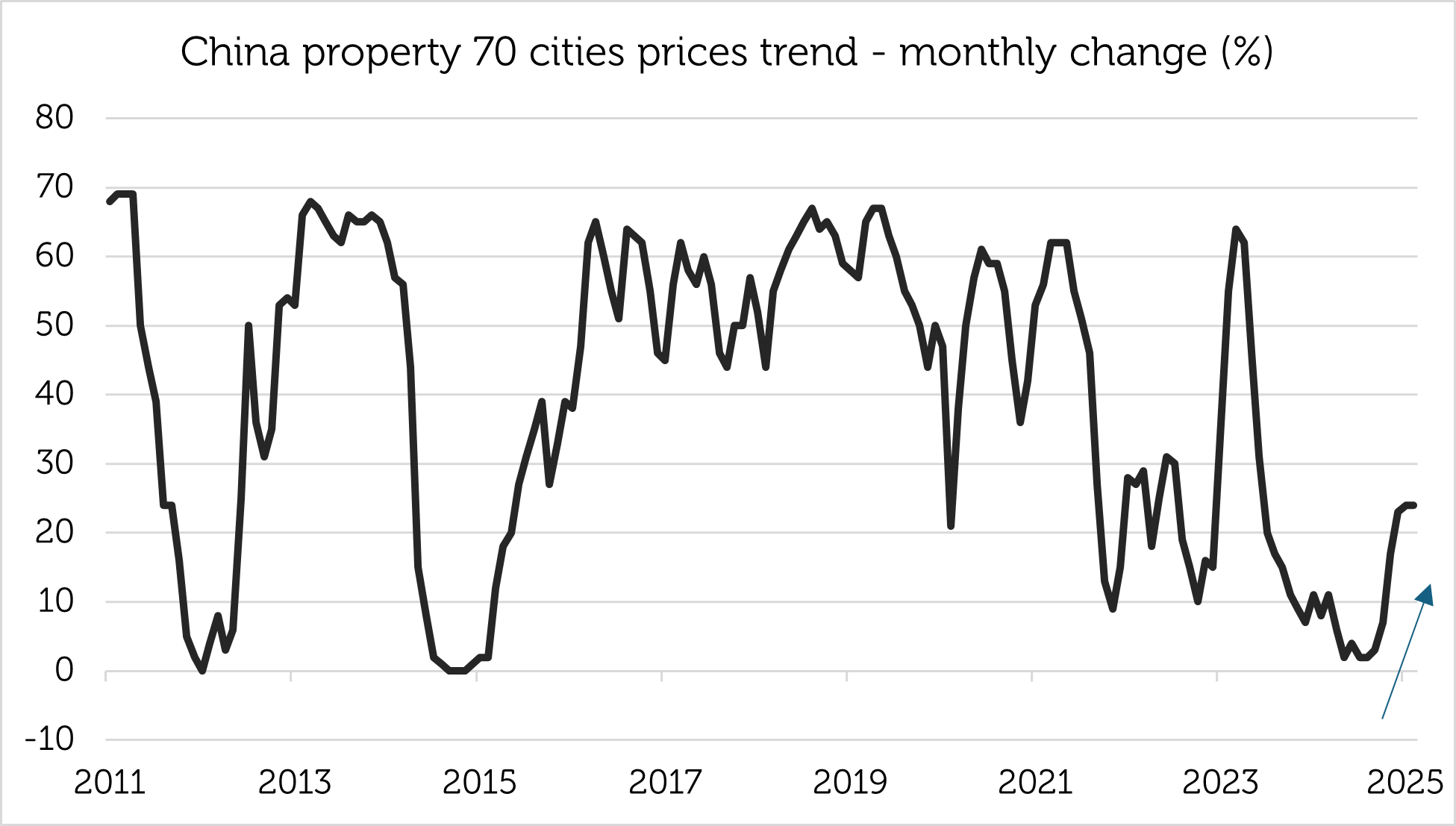

The property market is recovering from its nadir

The residential property market has begun to respond to stimulus measures, with apartment prices beginning to increase as they did in 2012, 2015 and 2023, which might foster consumer confidence that has been recently lacking.

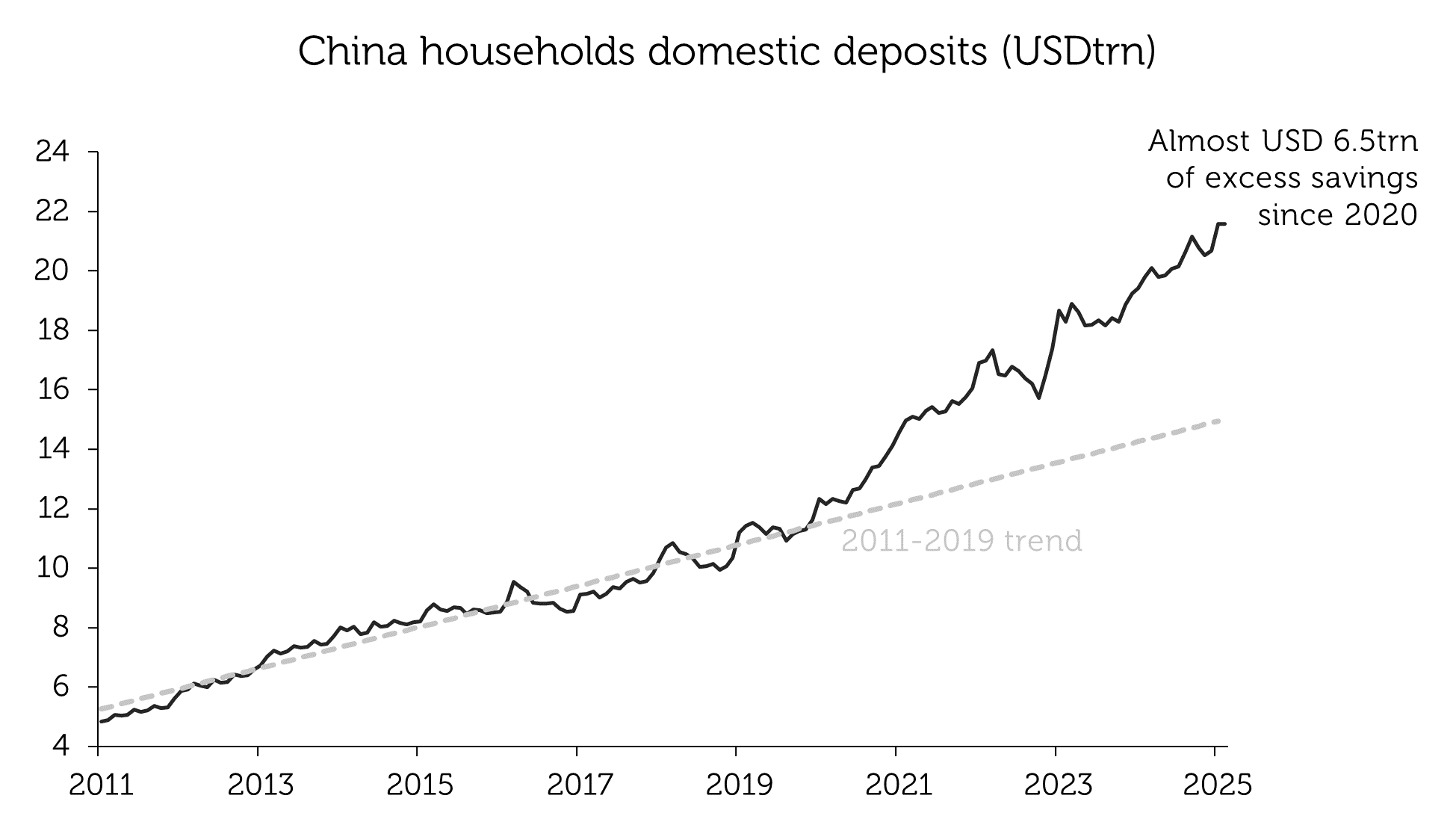

Any rebound in confidence will likely have the effect of catalyzing the move from precautionary savings to consumption and the purchase of financial assets, including equities.

DeepSeek inspires domestic confidence and pride

With the 2.3% dividend yield of Chinese equities exceeding the deposit rate of 1.5%[4], cash could shift from deposits to the stock market.

The catalyst for the equity market in 2025 has been DeepSeek, a Chinese AI company, releasing advanced AI models that use less computing power and are cheaper to operate compared to US peers. This breakthrough showcased China’s growing AI capabilities to counter US sanctions. It also reinforced China’s strategic autonomy in technology by reshaping the global AI landscape.

This breakthrough resulted in the market looking beyond opportunities in Redwheel’s theme of Tech Enablers & AI to other parts of the market that can take advantage of generative AI breakthroughs to enhance their underlying businesses. For China, this has been most prominent for internet companies in our Digital Content and New Commerce themes that focus on consumer internet and e-commerce platforms.

At the start of the year, Chinese equities traded at a forward P/E multiple of 10.3, which was a discount to the MSCI Emerging Markets Index and regional peers, including ASEAN markets, India and Taiwan. The MSCI China Index has re-rated to 12.1 times forward earnings, which is still an 8% discount to the MSCI Emerging Markets Index at 13.2 times forward earnings4. As economic and financial fundamentals continue to improve, global investors should increase allocations to the largest stock market in the emerging markets universe.

Sources:

[1] Bloomberg, 28 February 2025

[2] Bloomberg, February 2025

[3] Bloomberg, March 2025

[4] Source: Bloomberg, 28 February 2025

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to the future. The prices of investments and income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.