Emerging Market investors are accustomed to crises and volatility. Frontier Markets have undergone in the 2020s a similar experience to emerging markets in the 1990s, a sequence of currency devaluations and market declines. Economic and financial shocks can cause bear markets and portfolio outflows in the short term but typically spur necessary reform and restructuring that result in sustainable long-term recovery.

The parallels between the 1990s and the 2020s – high Fed Funds, devaluations and IMF support

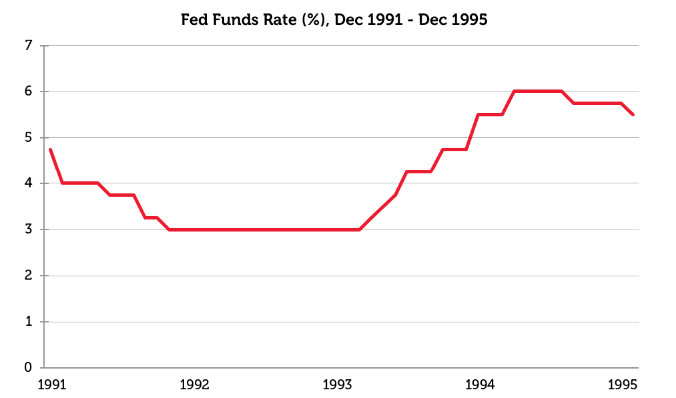

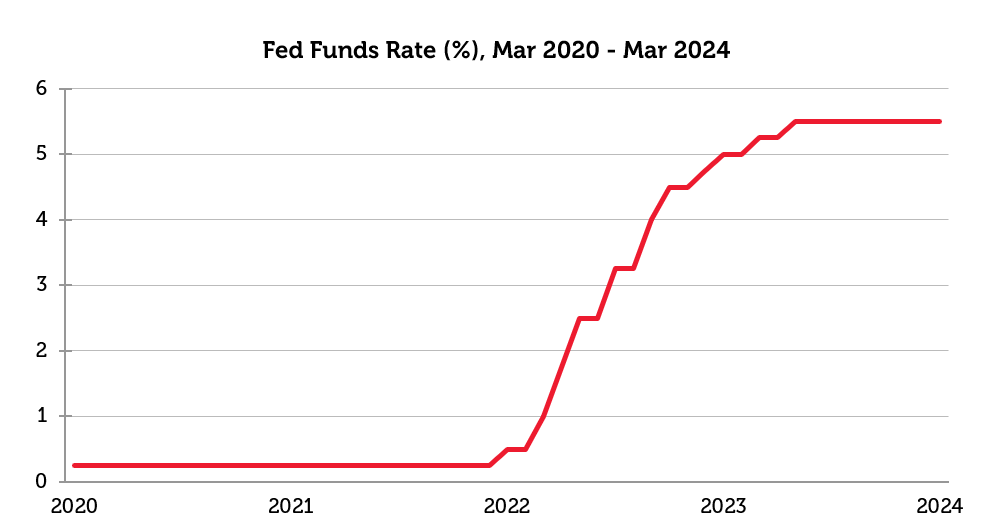

In both the 1990s and the 2020s, the US Federal Reserve raised the Fed Funds Rate aggressively in order to prevent an inflationary surge. Higher US rates drain liquidity from other countries that depend upon borrowing to sustain current account and fiscal deficits, and cause the US dollar to strengthen against foreign currencies, diminishing the ability to service debts. This leads not only to weaker currencies, but also to higher interest rates and lower growth in emerging and frontier markets.

Source: Redwheel, Bloomberg as of 23rd May 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

From 1994 to 1995, the Federal Reserve doubled the Fed Funds Rate from 3.0% to 6.0% and maintained the rate above 5.0% until the late 1990s. Tighter monetary policy and a stronger US dollar put pressure on emerging countries running current account and fiscal deficits, for whom the cost of borrowing rose unsustainably. The Mexican Tequila Crisis that began in December 1994 was sparked by higher interest rates that made the burden of debt impossible to manage, and was followed by the Asia Crisis in 1997 and the Russia Crisis of 1998 whose root causes were similar to Mexico. Fortunately, the IMF provided assistance in exchange for economic reform, which contributed to the bull markets of the 2000s.

The most recent tightening cycle, which is still underway, has been even more severe since the COVID-19 pandemic, with the Fed Funds Rate climbing from just above 0% in 2022 to nearly 5.5% today. History has repeated itself, with several small emerging and frontier markets suffering currency devaluations, debt restructurings and gaining IMF assistance to restore economic health. Cheap currencies, low market valuations and the catalyst of IMF aid conditional on free market reforms should catalyse economic and financial recovery just as happened after the financial crises of the 1990s.

Source: Redwheel, Bloomberg as of 23rd May 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

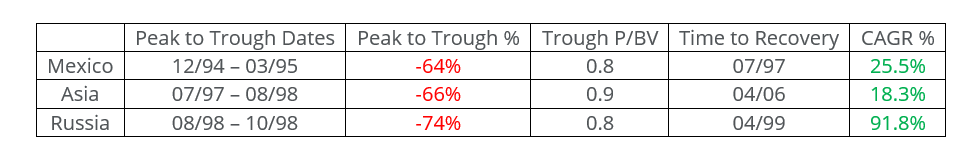

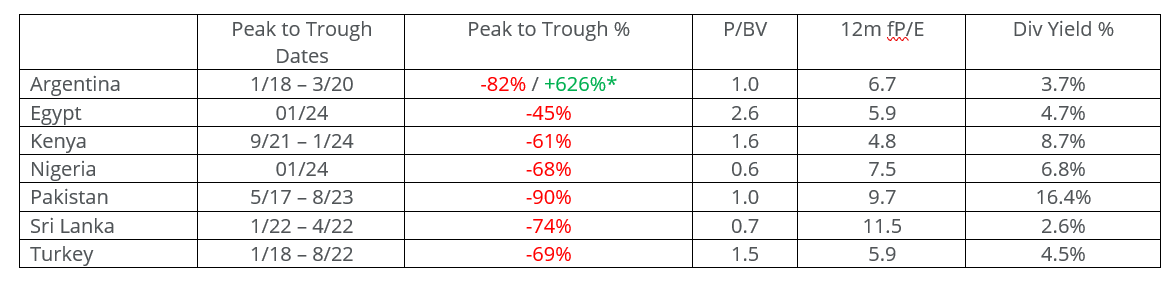

In each financial crisis of the 1990s, currency devaluations were followed by IMF financial support and structural economic reforms. The short-term adjustment is always painful, because the conditions for IMF bailouts usually include trade liberalisation, balanced budgets, removal of price controls, privatisations, and favourable market access for foreign investors. This recipe causes immediate austerity but can lead to rapid economic and financial recovery. As illustrated in the table below, equity investors in key frontier markets were able to profit from cheap currencies and depressed equity market valuations that produced bull markets once economic growth resumed.

Source: Redwheel, Bloomberg as of 23rd May 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results. P/BV stands for price to book ratio. CAGR stands for compound annual growth rate. Peak to Trough refers to the drawdown that coincided with a period of concerted economic and policy change. Time to Recovery is the date when market levels returned to the prior peak. Peak to Trough % refers to market performance in USD.

Frontier Markets have just experienced their own version of the events of the 1990s and have the same potential to benefit from economic liberalisation and reform that has historically resulted in equity bull markets. Argentina, Bangladesh, Egypt, Kenya, Nigeria, Pakistan, Sri Lanka and Turkey are modern-day facsimiles of Mexico, Indonesia, Korea, Malaysia, Philippines, Thailand and Russia.

What has happened on the Frontier? IMF support follows the 1990s playbook

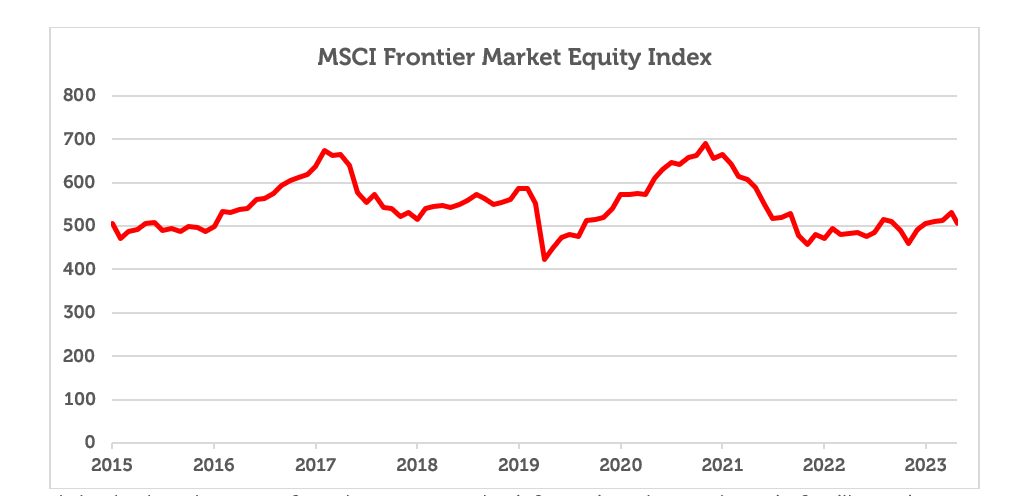

Since the COVID-19 pandemic in 2020, several frontier countries have suffered economic and financial crises that have led to currency devaluations and equity market losses, just like emerging markets in the mid-1990s. Like the broad MSCI Emerging Markets Index starting in late 1994 until late 1995, the MSCI Frontier Market Index has lost about a quarter of its value from the most recent peak in late 2021.

Source: Redwheel, Bloomberg as of 23rd May 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

The reasons for currency devaluation are also very similar, which is to make exports more competitive and encourage greater foreign direct investment by making domestic assets more attractive to foreign investors. The IMF has the blueprint for reform. All countries except Nigeria and Turkey have accepted IMF assistance in exchange for implementing technocratic measures to foster macroeconomic stability, which include reducing government spending to control public debt, balancing the budget by removing subsidies and cutting expenses, allowing currencies to float freely, liberalising trade, raising interest rates to control inflation, and privatising state-owned companies.

Frontier markets are cheap, and Argentina has already regained investor confidence

As with emerging markets in the 1990s, frontier markets are taking advantage of IMF bailouts after suffering economic and financial crises have become somewhat cheap. The table below shows that markets have fallen significantly over recent timeframes; valuation multiples are low and dividend yields are high. This represents a potential opportunity for long term investors.

Source: Redwheel, Bloomberg as of 23rd May 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results. Peak to Trough refers to a drawdown that coincided with a period of concerted economic and policy change. Peak to Trough % refers to market performance in USD. *Argentina (62.5% CAGR) declined and then recovered since the trough

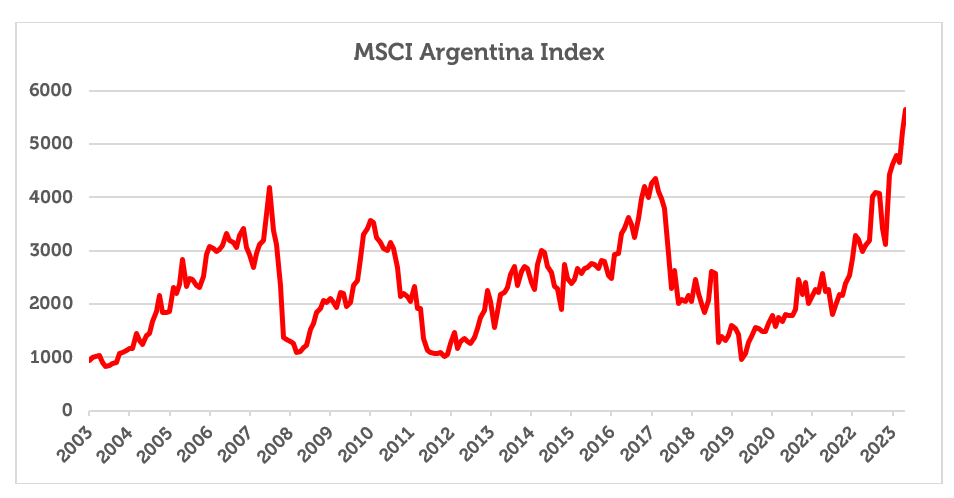

Reform and restructuring, with backing from the IMF, has already resulted in success for Argentina. The MSCI Argentina Index has risen approximately five-fold in USD terms from its lows in 2020, even after accounting for the devaluation of the Argentine peso.

Source: Redwheel, Bloomberg as of 23rd May 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results.

The market confidence in the reform programme of President Milei, with backing from the IMF, is shown in market performance whose rebound from the lows is just as strong as the recoveries from crises in the 1990s. We believe that other markets with cheap valuations, following the same economic orthodoxy, should be comparably recognised and rewarded by equity investors.

Frontier opportunities abound with good growth at attractive valuations

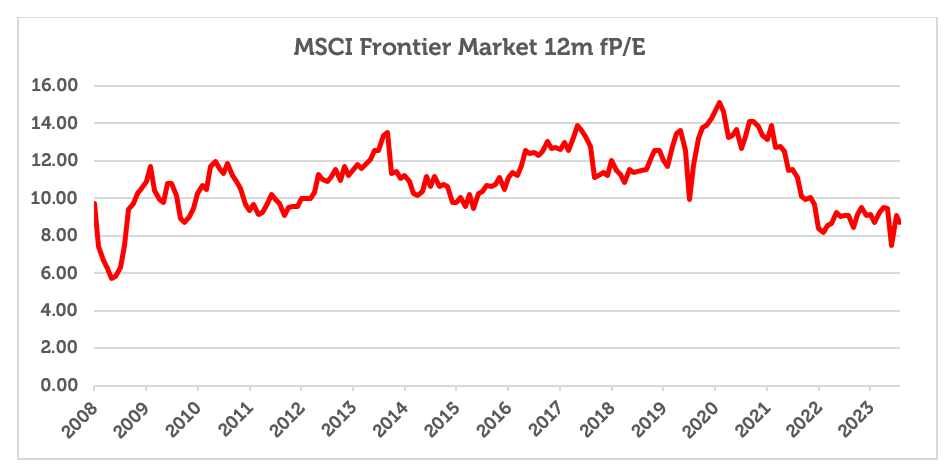

Although reform-minded countries may present the most significant potential for gains, other markets in the MSCI Frontier Markets Index also offer opportunities for growth at attractive valuations and the benefit of diversification.

Source: Redwheel, Bloomberg as of 23rd May 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results. Uses 12-month forward consensus estimates.

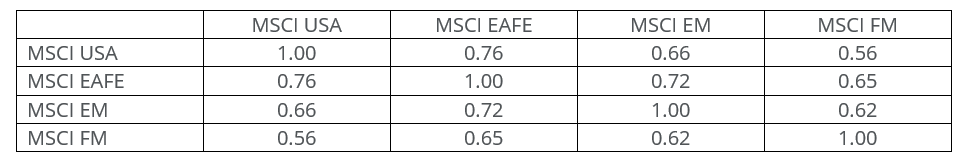

The forward P/E multiple has fallen to nearly its lowest level since the COVID-19 pandemic in 2020, even though earnings, profitability and dividends have recovered from that dip. Furthermore, the low correlation of frontier markets with other global equity indices, indicated in the table below, enhances diversification and makes allocations even more valuable in global equity portfolios.

Source: Bloomberg, Redwheel as of 23rd May, 2024. The information shown above is for illustrative purposes.

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.