Having spent the last few years trying to convince asset allocators that buying UK equities at their cheapest point relative to global equities for fifty years was a better idea than buying global/US equities at their most expensive valuation in financial market history, it seems that there is no valuation low enough for UK equities, nor too high for US equities. Stocks on price to earnings ratios of 5x and dividend yields of 7% are being sold to fund purchases of names such as Nvidia, which is up 190% year to date and valued on 35x revenues.[1]

Many investors seem to be nonchalantly disregarding the mountain of empirical evidence showing that starting valuation and subsequent returns are inversely correlated. Lessons from financial market history also appear to be a distant memory, including the Nifty Fifty collapse, Asian financial crisis, the dot com bust and the Great Financial Crisis. These events are seemingly irrelevant as ‘this time is different’, which echoes sweeping sentiment before these events unfolded. The fact that the great fortunes of investors such as Templeton and Buffett were made by ‘buying when others were despondently selling’ is also evidently irrelevant. Today’s mantra for many seems to be ‘buy what everyone else is buying and completely ignore valuation as it will only hold you back.’

So having been through the five stages of grief, I have finally reached ‘acceptance’ and it is somewhat comforting to know that fabled value investors such as David Einhorn of Greenlight Capital has gone through the same process. In a recent interview with Bloomberg’s Sonali Basak, he stated that “value investing might never come back,”[2]

"The market is still dominated by investors that either will not (index funds), cannot (untrained novice investors) or chose to not (valuation indifferent prof. investors) have valuation as a cornerstone of their investment process."

“I don’t know that it ever comes back. Most of the value investors have been put out of business. It used to be we could buy something at a reasonably low multiple, whatever we thought it was, see the company do somewhat better, benefit from it doing somewhat better, and realize that other investors would see what we saw six months later or a year later and would re-rate the shares so you’d buy something for 10 times earnings... you’d get another 3 points on the multiple and you would make 50% after three years. That isn’t happening anymore because there’s nobody to notice what actually happened to these companies... Nobody knows what anything is worth”

He continued, however, to say that this did not mean that value investing was dead but rather that the source of returns would change. If investors have no interest in buying a company on an earnings yield of 20%, then it is incumbent on the company to buy back their own stock and create value for shareholders that way. As Warren Buffett opined on this subject in Berkshire Hathaway’s 1984 letter to shareholders:

“When companies with outstanding business and comfortable financial positions find their shares selling far below intrinsic value in the marketplace, no alternative action can benefit shareholders as surely as repurchases.”

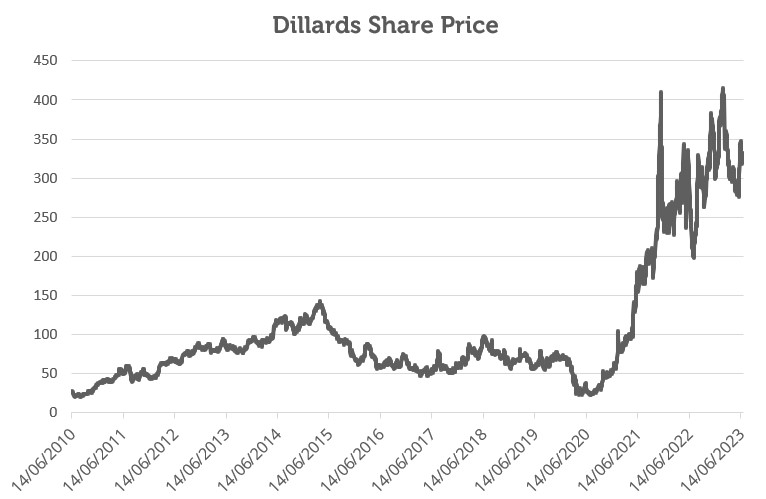

Investors frequently underestimate how powerful this can be. We wrote recently about how an investment in Next had turned £100 in 2001 to £1800 in 2022 as a result of a well-executed share buyback policy. In a similar vein, Einhorn had an investment in a US department store called Dillard’s. The story is written up in the FT article below but can be summarised by the fact that they used to have 100m shares in issue and now have 17m. We used to make the joke about buybacks that eventually “there will be only one share left and it will be worth £4bn” but that is basically what happened here and really explains why the share price went from $20 to $300 in a couple of years. As Einhorn puts it…….

“We were long a retailer called Dillard’s for a number of years. It’s not a great business, but they make some money and they own all of their real estate and it’s pretty unlevered and they were buying back stock. And pretty much you had the employees own the stock and the family own the stock and you got to the point where there’s pretty much no stock left and they really kind of bought it all back and after years and years of the stock underperforming, suddenly it went up 600 per cent. And that is the kind of thing that can happen to some of these other companies that are going to buy back 15, 20, 25 per cent of their stock for the next two or three or four years. Eventually there’s going to be so few shares left and the index funds will have given up or whatnot. And then you’ll have a rerating. The thing is, you just don’t know when that’s going to happen.”[3]

Source: Bloomberg, as at 14th June 2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes.

In light of this, we were very happy to read recently that UK companies themselves have been a “Massive Buyer of UK Equites” – with the current run rate in the region of £200m a day, which is a run rate of £1bn/ week, or £50bn/ year.[4] Imagine if rumours circulated that there was going to be a UK buy programme trade every day for the next year of c £200m – how might the market react?

I have no expectation that this note will change anyone’s mind, and BP will probably continue to be sold on 5x earnings in order to buy Amazon on 85x earnings. But UK companies are not patiently waiting for investors to realise their value, and through increasing buybacks, we could see some ‘do a Dillard’s’. Unfortunately, at that point, it will be too late to allocate back to the UK, and investors who have been paying record valuations for US equities will be left hoping that this time really is different.

Sources:

[1] Bloomberg, as at 30th June 2023, CNBC, as at 30th June 2023

[2] Bloomberg, as at 11th October 2022

[3] https://www.ft.com/content/60cbe9c0-ce7c-42f5-9b49-642e7b879c26

[4] Redburn, RNS Announcements

Key Information

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor’s investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only.